|

市場調查報告書

商品編碼

1687379

北美蒸發冷卻:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)NA Evaporative Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

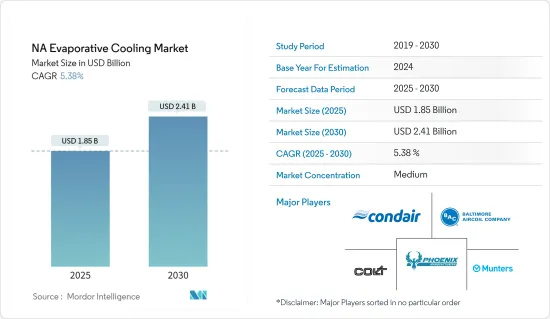

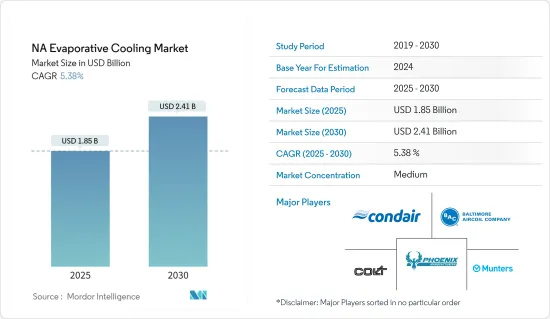

北美蒸發冷卻市場規模預計在 2025 年為 18.5 億美元,預計到 2030 年將達到 24.1 億美元,預測期內(2025-2030 年)的複合年成長率為 5.38%。

主要亮點

- 北美正大力推動永續能源管理。因此,傳統空調不是一個可行的選擇。這一關鍵因素推動了蒸發冷卻的普及,使其成為冷卻大型開放空間和區域的最有效選擇。

- 在該地區,尤其是美國,已經實施了各種政府標準,透過蒸發冷卻技術實現商業和工業部門的高效能源利用。因此,加拿大自然資源部正在考慮提高蒸發冷卻產品的最低能源性能標準 (MEPS),以使其與美國此類產品的 MEPS 保持一致。蒸發冷卻是傳統冷卻技術的一種更可取的替代方案,因為它利用了透過蒸發水來降低空氣溫度的自然過程。

- 除了多功能(它們可用於開放環境中的冷卻、空氣淨化和通風)之外,蒸發冷卻器還為最終用戶提供了幾個關鍵優勢,包括成本效益、節能、低維護和操作要求。因此,由於永續能源法規的發展,技術進步及其相對於傳統冷卻技術的優勢正在推動該地區的市場研究。

- 美國的另一個關鍵促進因素是資料中心擴大採用蒸發冷卻器。由於數位內容、巨量資料和電子商務的採用,該國對資料中心的需求正在快速成長。必須始終保持這些設施正常運轉,特別是對於在該領域營運的跨國公司而言。除了可靠性之外,該行業還在尋求各種節能解決方案,以幫助降低營運成本和資料中心營運的碳排放。

- 然而,蒸發冷卻技術對外部氣候的依賴可能是一個限制整體市場成長的主要問題。

- 新冠疫情的突然爆發導致多個國家採取了嚴格的封鎖措施,造成許多製造工廠暫時關閉,從而導致蒸發冷卻系統的需求波動。在後 COVID-19 時代,預計市場將在整個預測期內享有充足的成長機會,尤其是由於該地區對資料中心的需求不斷增加。

北美蒸發冷卻市場趨勢

商業部門預計將大幅成長

- 商業機構面臨維持最佳氣候條件的巨大壓力,特別是為了保護客戶和員工的健康和福祉。醫院、電影院、機場、飯店、購物中心等商業場所通常會根據其通風和冷卻需求同時採用空調和蒸發冷卻器。

- 此外,蒸發式空氣冷卻器主要用於商業場所,作為空調的替代品。除此之外,由於空調的安裝成本相當高,越來越多的中小型企業採用空調作為替代方案,預計這也將推動市場發展。

- 近期資料中心營運需求的激增使得 HVAC 公司必須為資料中心提供經濟高效的解決方案。資料中心解決方案供應商正在尋找能夠減少整體排放的可靠解決方案,這極大地推動了市場成長。

- 典型的資料中心通常需要大約 0.5-50MW 的冷卻能力,但 ASHRAE 指南的最新變更已將允許的動作溫度提高到 27°C。這是資料中心對蒸發式空氣冷卻器整體需求的主要促進因素。此外,這些產品不使用冷媒或氟碳化合物,最大限度地減少了最終用戶應用的碳排放。

- 根據美國人口普查局的數據,今年商業建築投資達到約1,150億美元。美國最初建造的商業建築大多為倉庫和私人辦公室。同時,去年的總額約為 945.5 億美元,顯示商業建築領域顯著成長。該地區商業建築行業的成長預計將成倍地推動市場成長。

直接冷卻預計將占主導地位

- 直接蒸發式空氣冷卻是最古老、最簡單、最廣泛使用的蒸發式空氣冷卻類型。該系統的風扇透過潮濕的海綿狀墊片吸入熱空氣,然後將產生的冷空氣直接或透過管道分佈到室內空間。隨著空氣中的熱量蒸發水分,溫暖乾燥的空氣變成涼爽潮濕的空氣。

- 直接蒸發冷卻系統主要適用於需要去除大量熱負荷的應用,也可以為此目的使用外部空氣。主要應用包括對舒適度要求較低的住宅、商用廚房和倉庫。因此,系統需求取決於最終使用者及其指定的操作性能要求。

- 此外,直接蒸發冷卻(DEC)通常是資料中心冷卻最節能的方法,因為外部空氣透過蒸發直接冷卻並用於調節內部氣候。因此,區域資料中心總數的增加預計將倍增市場成長。

- 根據Cloudscene的數據,截至2022年1月,美國共有2,701個資料中心,德國則位居第二,擁有487個資料中心。就資料中心總數而言,英國排名第三,擁有456個資料中心,中國位居第三,擁有443個資料中心。預計美國大量資料中心的存在將在整個預測期內加速市場成長。

- 例如,ST Engineering宣布將於2022年7月推出其新型Airbitat DC冷卻系統,標誌著其進入資料中心冷卻市場。 Airbitat 直流冷卻系統是該公司城市環境解決方案 (UES) 業務的一項創新,為熱帶地區的資料中心提供強大的預冷功能,與傳統的冷卻器系統相比,每年可實現 20% 以上的淨節能。

北美蒸發冷卻產業概況

北美蒸發冷卻市場處於半靜態狀態。市場競爭激烈,許多全球大公司都進入該市場。從市場佔有率來看,目前市場主要被幾家大公司佔據。這些佔據了絕對市場佔有率的大公司正致力於擴大海外基本客群。這些公司正在利用策略合作計劃來最大限度地提高市場佔有率並提高盈利。

- 2023 年 11 月,美卓宣布推出增強型蒸發冷卻水塔。這種創新的解決方案透過蒸發有效地冷卻了熱的外爐氣體。該塔通常與高溫靜電除塵設備或袋式除塵器配合使用,可有效將氣體溫度從約 600-700°C 降低至約 200-350°C。值得注意的是,塔在乾狀態下運行,任何添加的水都會蒸發。塔內小液滴的快速蒸發大大減少了所需的停留時間和長度,並確保了完全蒸發。

- 2023 年 3 月,總部位於鳳凰城的蒸發冷卻系統製造商 Air2O 獲得 EREN 集團 1,410 萬美元的投資。該投資將用於加強供應鏈物流、營運和勞動力。事實證明,這項創新解決方案能夠幫助資料中心實現低於 1.1 的 PUE。此外,我們也成功開發並獲得專利的智慧控制系統,可適應不同應用不斷變化的外部和內部氣候條件。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 買家的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 價值鏈/供應鏈分析

- 評估宏觀經濟因素對產業的影響

第5章市場動態

- 市場促進因素

- 資料中心採用蒸發冷卻器

- 對經濟高效的冷卻解決方案的需求

- 市場限制

- 對外部氣候的依賴

第6章市場區隔

- 按冷卻方式

- 直接冷卻

- 間接

- 兩階段

- 按應用

- 住宅

- 工業的

- 商業的

- 對於牲畜

- 其他

- 按國家

- 美國

- 加拿大

第7章競爭格局

- 公司簡介

- Condair Group AG

- Baltimore Aircoil Company Inc.(BAC)

- Munters Group AB

- Colt Group

- Phoenix Manufacturing Inc.

- Delta Cooling Towers Inc.

- SPX Cooling Technologies

- Bonaire Group(Celi Group)

第8章投資分析

第9章市場趨勢與未來機會

The NA Evaporative Cooling Market size is estimated at USD 1.85 billion in 2025, and is expected to reach USD 2.41 billion by 2030, at a CAGR of 5.38% during the forecast period (2025-2030).

Key Highlights

- North American region has been witnessing a surge in the overall number of initiatives for sustainable energy management. Hence, traditional air conditioning is not a feasible option. This crucial factor is boosting the popularity of evaporative cooling, which is becoming the most effective option for cooling large open spaces or areas.

- Various government standards have been implemented within the region, especially in the United States, for efficient energy utilization across commercial and industrial sectors with evaporative cooling techniques. Therefore, Natural Resources Canada is considering a rise in the minimum energy performance standards (MEPS) for evaporative-cooled products to align with the MEPS in the United States for those classes of products. As evaporative cooling utilizes a natural process, namely reducing air temperature by evaporating water on it, they are the preferred alternative over traditional cooling technologies.

- Evaporative coolers offer several key benefits to end users, including cost-effectiveness, energy savings, low maintenance, and operational requirements, besides being multifunctional (can be used in an open environment for cooling, air purification, and ventilation). Thus, owing to favorable regulations for sustainable energy across the region, advancements in technologies and their benefits compared to traditional cooling techniques are significantly driving the market studied.

- The other significant driver for the United States is the rise in the adoption of evaporative coolers in data centers. The demand for data centers is increasing at a rapid pace in the country, with the adoption of digital content, Big Data, and e-commerce. Keeping these facilities constantly functional is mandatory, especially for multinational companies operating in this space. In addition to reliability, the industry is seeking various energy-efficient solutions that have the potential to lower operational costs and reduce carbon emissions from data center operations.

- However, the dependency of evaporative cooling technologies on the external climate could be a major point of concern that can overall limit the growth of the market.

- The sudden COVID-19 pandemic outbreak caused the adoption of strict lockdown laws across several nations, which has mainly led to the temporary closure of many manufacturing facilities and fluctuations in demand for evaporative cooling systems. During the post-COVID-19 scenario, the market is expected to witness ample opportunities for growth throughout the forecast period significantly, especially due to the rise in the demand for the data center within the region.

North America Evaporative Cooling Market Trends

Commercial Sector is Expected to Register a Significant Growth

- Commercial establishments are greatly required to maintain optimal climatic conditions, especially to protect the health and well-being of clients and employees. Commercial entities, such as hospitals, movie theaters, airports, hotels, and malls, among others, generally employ both air conditioners and evaporative coolers depending upon the ventilation and cooling requirements of an enclosure.

- Moreover, evaporative air coolers are majorly used in commercial establishments' facilities as alternatives to air conditioners. Apart from this, the market is anticipated to be driven by the growing adoption of small to medium enterprises instead of air conditioners, as the cost of air conditioning setup can be significantly high.

- Due to the recent surge in demand for data center operations, it has become imperative for HVAC companies to provide cost and energy-efficient solutions for data centers. Data center solution providers are mostly on the lookout for reliable solutions that are able to cut down overall emissions, thereby driving the market's growth considerably.

- A normal data center usually requires about 0.5 to 50MW of cooling capacity, and due to recent changes in ASHRAE guidelines, the permissible operating temperature has been increased to 27°C. This has been a significant driver for the overall demand for evaporative air coolers in data centers. Additionally, these products do not make utilization of any refrigerants or CFCs, which could further minimize the overall carbon footprint for the end-user applications.

- As per US Census Bureau, the value of commercial construction that has been put in place reached a landmark of around USD 115 billion this year. Warehouses and private offices were the most common type of commercial construction started in the United States. In contrast, the total count was around USD 94.55 billion last year, indicating significant growth in the commercial construction sector. This rise in the commercial construction sector within the region is likely to drive the market's growth exponentially.

Direct Cooling is Expected to Hold Major Share

- Direct evaporative air cooling is the oldest, simplest, and most widely used type of evaporative cooling. The fan in the system pulls hot air through a dampened sponge-like pad and distributes the resulting cool air to the interior space either directly or through ducts. Warm, dry air is converted to cool, moist air as the heat in the air evaporates the water.

- Direct evaporative cooling systems are mainly suitable for applications with large heat-load removal needs and those open to using outside air to accomplish this. The major areas of their applications include residential sectors, commercial kitchens, and warehouses where comfort requirements are more relaxed. Hence, the system requirement depends on the end users and the specified operational performance requirements.

- Moreover, Direct evaporative cooling (DEC) is typically the most energy-efficient method to cool a data center, as the outside air is directly cooled through evaporation and is then used to moderate the internal climate. Hence, the rise in the overall count of regional data centers is expected to amplify the market's growth exponentially.

- As per Cloudscene, as of January 2022, the total count of data centers in the United States was 2,701 data centers whereas Germany ranked second with an overall count of 487 data centers. The United Kingdom ranked third among countries in terms of the total number of data centers, with 456, while China recorded 443. This possession of a significant number of data centers in the United States is expected to amplify the market's growth throughout the forecast period.

- For instance, In July 2022, ST Engineering declared the launch of its new Airbitat DC Cooling System, thereby marking its entry into the data center cooling market. The Airbitat DC Cooling System, an innovation by its Urban Environment Solutions (UES) business, delivers powerful pre-cooling for tropical data centers, achieving annual net energy savings of more than 20% over conventional chiller systems alone.

North America Evaporative Cooling Industry Overview

The North American evaporative cooling market is semi-consolidated. The market is competitive and consists of various major global players. Based on market share, few of the major players currently dominate the market. These significant players with prominent shares in the market are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to maximize their market share and increase profitability.

- November 2023: Metso announced the launch of its enhanced evaporative cooling tower. This innovative solution efficiently cools hot furnace off-gases through evaporation. The tower, typically used in conjunction with a hot electrostatic precipitator or bag filter, effectively lowers the gas temperature from approximately 600-700°C to about 200-350°C. It is important to note that the tower operates dryly, meaning all added water evaporates. The rapid evaporation of small droplets in the tower significantly reduces the required retention time and length, ensuring complete evaporation.

- March 2023: Air2O, a Phoenix-based manufacturer of evaporated cooling systems, has received a generous investment of USD 14.1 million from EREN Groupe. This investment will be utilized to enhance our supply chain logistics, operations, and workforce. We are proud to announce that our innovative solutions have proven to achieve a PUE of lower than 1.1 in Data Centers. Furthermore, we have successfully developed and patented intelligent control systems that adapt to changing external and internal climate conditions across various applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of Impact of Macro-economic Factors on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of Evaporative Coolers in Data Centers

- 5.1.2 Demand for Cost-effective Cooling Solution

- 5.2 Market Restraints

- 5.2.1 Dpendency on External Climate

6 MARKET SEGMENTATION

- 6.1 By Cooling

- 6.1.1 Direct

- 6.1.2 Indirect

- 6.1.3 Two-Stage

- 6.2 By Application

- 6.2.1 Residential

- 6.2.2 Industrial

- 6.2.3 Commercial

- 6.2.4 Confinement Farming

- 6.2.5 Other Applications

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Condair Group AG

- 7.1.2 Baltimore Aircoil Company Inc. (BAC)

- 7.1.3 Munters Group AB

- 7.1.4 Colt Group

- 7.1.5 Phoenix Manufacturing Inc.

- 7.1.6 Delta Cooling Towers Inc.

- 7.1.7 SPX Cooling Technologies

- 7.1.8 Bonaire Group (Celi Group)