|

市場調查報告書

商品編碼

1687375

超高性能混凝土(UHPC):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Ultra High Performance Concrete (UHPC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

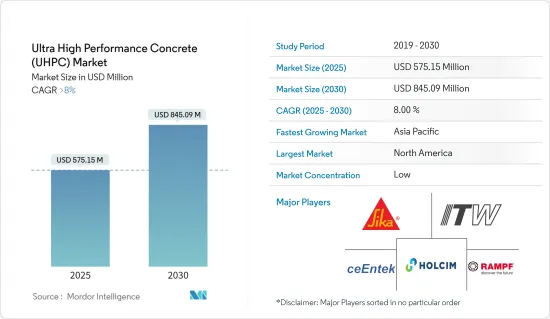

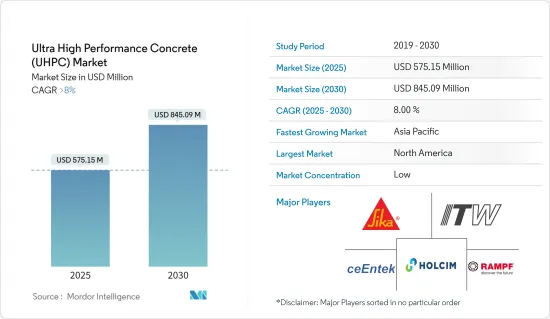

超高性能混凝土市場規模預計在 2025 年為 5.7515 億美元,預計到 2030 年將達到 8.4509 億美元,預測期內(2025-2030 年)的複合年成長率將超過 8%。

新冠疫情對超高性能混凝土市場產生了負面影響。生產設施的關閉和短期停工對多種應用造成了重大損害,並限制了超高性能混凝土的消耗。儘管如此,由於主要終端用戶類別的持續努力,市場仍將繼續保持其發展勢頭,預計 2020 年及以後將取得適度進展。

推動市場發展的關鍵因素是全球建設活動的增加以及超高性能混凝土的益處日益增加。

與傳統混凝土相比,UHPC 的材料成本較高,預計將嚴重阻礙市場成長。

預製建築中使用超高性能混凝土的趨勢日益成長,這可能是未來的驅動力。

預計預測期內北美將主導全球市場。然而,由於建設活動的增加,預計亞太地區在預測期內的複合年成長率最高。

超高性能混凝土(UHPC)市場趨勢

漿體滲透纖維混凝土(SIFCON)席捲市場

- 泥漿浸漬纖維混凝土(SIFCON)是一種最近開發的建築材料。 SIFCON 是一種特殊類型的纖維混凝土,纖維含量高。基質由水泥漿或流體水泥砂漿組成。

- 此複合材料用於承受爆炸載荷的結構、預力混凝土樑的修復、安全儲存等。

- 總體而言,與普通纖維增強混凝土(FRC)相比,SIFCON 在兩個方面有所不同:纖維含量和製造方法。一般FRC的纖維含量為體積1-3%,而SIFCON的纖維含量為5-20%。此外,與 FRC 中使用的普通混凝土不同,SIFCON 的基質由水泥漿或流體水泥砂漿組成。

- 從這些方面來看,SIFCON的製造方法與FRC的製造方法有顯著差異。在 FRC 中,纖維被添加到濕或乾的混凝土混合物中,而 SIFCON 則是透過將水泥漿倒入模板中預先鋪設的密集纖維床中來製備的。

- 最近,人們對在防爆外殼和安全櫃中使用 SIFCON 的興趣日益濃厚。 SIFCON具有高抗衝擊性和高能量吸收性。

- 目前正在進行各種研究來觀察 SIFCON 的其他特性,例如添加不同體積比的鋼纖維的效果。這些研究將有助於未來找到更適合SIFCON的應用。

- 預計所有這些因素將在預測期內迅速推動市場發展。

北美佔據市場主導地位

- 北美佔據全球市場佔有率的主導地位。美國在北美建設產業中佔有很大的佔有率。除美國外,加拿大和墨西哥也是建築業投資的主要貢獻者。

- 根據美國人口普查局的數據,2022 年私人建築業投資為 14,342 億美元,比 2021 年的 12,795 億美元成長 11.7%。 2022年住宅建築支出為8,991億美元,較2021年的7,937億美元成長13.3%;住宅建築支出為5,301億美元,較2021年的4,858億美元下降9.1%。

- 此外,美國人口普查局統計數據顯示,2023年12月建築支出(經季節性已調整的年化率)為2.096兆美元,比2023年11月更新的估計值2.0783兆美元高出0.9%。建築支出預計將從 2022 年的 18,487 億美元成長 7.0% 至 2023 年的 19,787 億美元,從而推動市場消費。

- 此外,該國大規模的基礎設施投資預計將促進該國的建築業發展,從而促進市場成長。

- 例如,根據美國運輸部統計,2023年,美國運輸部在國家計劃項目援助計畫下,對公路、橋樑、貨運、港口、鐵路客運和公共交通等9個大型企劃投資約12億美元。

- 據美國公路和運輸建設業協會稱,截至2023年11月30日,美國已承諾提供26億美元的官方公路和橋樑資金,以支持2300多個新計畫。除此之外,中國還在 2022 和 2023 會計年度投資了超過 1,090 億美元,並承諾支持超過 60,000 個新計畫。

- 總體而言,預計上述因素將在預測期內增加對超高性能混凝土的需求。

超高性能混凝土(UHPC)產業概覽

全球超高性能混凝土(UHPC)市場本質上相對分散。主要公司包括 Holcim、Sika AG、Illinois Works Inc.、RAMPF Holding GmbH & Co. KG 和 ceEntek。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 全球建設活動活性化

- 提升超高性能混凝土的優勢

- 限制因素

- 與傳統混凝土相比,材料成本相對較高

- 其他

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按產品

- 泥漿浸漬纖維混凝土(SIFCON)

- 活性粉末混凝土(RPC)

- 緻密增強複合複合材料(CRC)

- 其他

- 按應用

- 道路和橋樑建設

- 建築施工

- 軍事建設

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- ceEntek

- ELO Beton

- Gulf Precast Concrete Co. LLC

- Holcim

- Illinois Tool Works Inc.

- Metrostav

- RAMPF Holding GmbH & Co. KG

- Sika AG

- TAKTL

- UHPC SOLUTIONS North America

第7章 市場機會與未來趨勢

- 預製建築中超高性能混凝土的趨勢日益成長

The Ultra High Performance Concrete Market size is estimated at USD 575.15 million in 2025, and is expected to reach USD 845.09 million by 2030, at a CAGR of greater than 8% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the ultra-high-performance concrete market. Due to the lockdown and brief halts in production facilities, several applications suffered significant damage, limiting the consumption of ultra-high-performance concrete. Nonetheless, beyond 2020, the market developed slowly due to ongoing efforts in the main end-user categories and is likely to continue on its path.

The major factors driving the market studied include the rising construction activities across the world and the increasing benefits of ultra-high-performance concrete.

The high material cost of UHPC, when compared with conventional concrete, is expected to significantly hinder the growth of the market studied.

Growing trends toward the use of ultra-high-performance concrete in prefabricated construction are likely to act as a driving force in the future.

North America is expected to dominate the global market during the forecast period. Meanwhile, Asia-Pacific is expected to register the highest CAGR during the forecast period due to the increasing construction activities across the region.

Ultra High Performance Concrete (UHPC) Market Trends

Slurry-Infiltrated Fibrous Concrete (SIFCON) to Dominate the Market

- Slurry infiltrated fiber concrete (SIFCON) is a recently developed construction material. SIFCON could be considered a special type of fiber concrete with high fiber content. The matrix consists of cement slurry or flowing cement mortar.

- This composite material is used for structures subjected to blast loading, repair of pre-stressed concrete beams, and safe vaults.

- Generally, as compared to normal fiber-reinforced concrete (FRC), SIFCON is different in two aspects, i.e., fiber content and the method of production. The fiber content of FRC generally varies from 1% to 3% by volume, but the fiber content of SIFCON varies between 5% and 20%. Also, the matrix of SIFCON consists of cement paste or flowing cement mortar as opposed to regular concrete used in FRC.

- All of these points make the production of SIFCON far different from that of FRC. In FRC, the fibers are added to the wet or dry concrete mix, whereas SIFCON is prepared by infill-treating cement slurry into a bed of fibers preplaced and packed tightly in the molds.

- Recently, interest in using SIFCON in explosion-proof containers and safety cabinets has increased. SIFCON has high impact resistance and high energy absorption.

- Various studies have been carried out to observe the other properties of SIFCON, such as the effect of adding different volumetric ratios of steel fiber. These studies will help find more suitable applications of SIFCON in the future.

- All these factors are expected to rapidly drive the market studied during the forecast period.

North America to Dominate the Market

- North America dominated the global market share. The United States has a significant share of the construction industry in North America. Besides the United States, Canada and Mexico contribute significantly to the investments in the construction sector.

- According to the US Census Bureau, the value of private construction in 2022 stood at USD 1,434.2 billion, 11.7% higher than the USD 1,279.5 billion in 2021. Residential construction spending in 2022 was USD 899.1 billion, up 13.3% from USD 793.7 billion in 2021, while non-residential construction spending amounted to USD 530.1 billion in 2022, down 9.1% from USD 485.8 billion in 2021.

- Furthermore, as per statistics generated by the US Census Bureau, the estimated seasonally adjusted annual rate of construction spending in December 2023 was USD 2,096.0 billion, 0.9% higher than the updated November 2023 estimate of USD 2,078.3 billion. Spending on buildings increased by 7.0% in 2023 to USD 1,978.7 billion from USD 1,848.70 billion in 2022, thereby increasing the consumption of the market studied.

- Moreover, significant infrastructure investments in the country are expected to boost the country's construction sector, thus uplifting the growth of the market studied. For instance,

- According to the US Department of Transportation, in 2023, the US Department of Transport invested around USD 1.2 billion for nine "mega" projects, which include highway, bridge, freight, port, passenger rail, and public transportation, under the National Infrastructure Project Assistance Program.

- According to the American Road & Transportation Builders Association, on November 30, 2023, the United States committed USD 2.6 billion in highway and bridge formula funds to support over 2,300 new projects. This was in addition to over USD 109 billion in investment and over 60,000 new project commitments supported in FY 2022 and FY 2023.

- On the whole, the aforementioned factors are expected to increase the demand for ultra-high-performance concrete during the forecast period.

Ultra High Performance Concrete (UHPC) Industry Overview

The global ultra-high-performance concrete (UHPC) market is relatively fragmented in nature. Some of the major companies are (not in any particular order) Holcim, Sika AG, Illinois Works Inc., RAMPF Holding GmbH & Co. KG, and ceEntek.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Construction Activities Across the Globe

- 4.1.2 Increasing Benefits of Ultra-High-Performance Concrete

- 4.2 Restraints

- 4.2.1 Relatively High Material Cost When Compared with Conventional Concrete

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Slurry-Infiltrated Fibrous Concrete (SIFCON)

- 5.1.2 Reactive Powder Concrete (RPC)

- 5.1.3 Compact Reinforced Composite (CRC)

- 5.1.4 Other Products

- 5.2 Application

- 5.2.1 Roads and Bridge Construction

- 5.2.2 Building Construction

- 5.2.3 Military Construction

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ceEntek

- 6.4.2 ELO Beton

- 6.4.3 Gulf Precast Concrete Co. LLC

- 6.4.4 Holcim

- 6.4.5 Illinois Tool Works Inc.

- 6.4.6 Metrostav

- 6.4.7 RAMPF Holding GmbH & Co. KG

- 6.4.8 Sika AG

- 6.4.9 TAKTL

- 6.4.10 UHPC SOLUTIONS North America

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Trends Toward the Use of Ultra-High-Performance Concrete in Prefabricated Construction