|

市場調查報告書

商品編碼

1687373

熱塑性複合材料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Thermoplastic Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

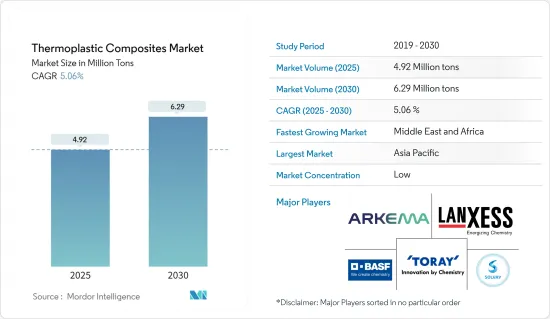

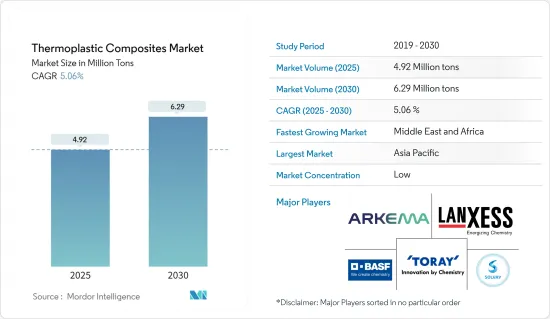

預計 2025 年熱塑性複合材料市場規模為 492 萬噸,到 2030 年將達到 629 萬噸,預測期內(2025-2030 年)的複合年成長率為 5.06%。

新冠疫情迫使全球汽車製造商、風力發電機製造商和飛機製造商停工,並抑制了 2020 年對複合材料的需求。疫情影響了複合材料產業的幾乎方面,從產品需求到勞動力發展,甚至加速或減緩了疫情爆發時已經出現的趨勢。我們的客戶和我們自己的公司暫時停產,降低了生產水平,需求的下降對所有生產過程產生了重大影響。

主要亮點

- 從中期來看,建設產業需求的增加以及航太和國防應用投資的增加是推動市場發展的關鍵因素。

- 另一方面,汽車產業的衰退和新冠疫情的負面影響可能會抑制市場成長。

- 亞太地區貢獻了最高的市場佔有率,預計在預測期內將佔據市場主導地位。

熱塑性複合材料市場趨勢

汽車產業佔市場主導地位

- 汽車是熱塑性複合材料的主要終端用戶產業。生產更輕、二氧化碳排放更低的汽車的需求不斷成長,推動了汽車產業對熱塑性複合材料的需求。

- 熱塑性複合材料以其高韌性和輕質特性而聞名。汽車產業將玻璃纖維氈熱塑性塑膠用於各種用途。

- 熱塑性複合材料在汽車工業的應用包括座椅框架、電池托盤、保險桿梁、貨物地板、前端、氣門蓋、戶定板和引擎下蓋。

- 根據國際汽車製造商組織(OICA)的預測,2022年全球汽車產量將超過85,016,728輛,與前一年同期比較成長6%,這表明由於基於熱塑性複合材料的汽車零件生產,對熱塑性複合材料的需求將增加。

- 此外,預計2022年美國汽車產量與前一年同期比較增加10%。加拿大、墨西哥和美國的汽車產量均成長10%,分別達到1,228,735輛、3,509,072輛和10,060,339輛。在南美洲,哥倫比亞的產量與去年同期相比增幅最大,成長了26%,達到51,455輛。阿根廷的產量也強勁成長了24%,達到536,893輛。

- 此外,美國汽車製造商宣布將在 2022 年向國內電動車製造投資 130 億美元。豐田宣布將向其位於卡羅來納州的製造工廠投資 25 億美元。本田和 LG Energy Solution 宣布成立 44 億美元的合資企業,投資電動車和電池製造。這些因素預計將增加汽車產量,從而使熱塑性複合材料市場受益。

- 在歐洲,德國是主要的汽車製造國之一。根據德國工業協會(VDA)數據顯示,2023年3月德國汽車產量為441,990輛,較去年同期成長67%。

- 因此,考慮到世界各地汽車的成長趨勢和產量,汽車產業可能會主導市場,從而導致預測期內對熱塑性複合材料的需求增加。

中國主導亞太地區

- 在亞太地區,中國是最大的熱塑性複合材料生產國和消費國,其次是印度和日本。

- 由於印度在生產各種、品質精確的產品以滿足產業需求方面具有優勢,因此該國汽車產業對熱塑性複合材料的需求很高。中國是全球產銷最大的汽車市場。 2022年,儘管受到新冠疫情爆發、結構性晶片短缺、地區地緣政治衝突等諸多負面因素的影響,中國汽車市場仍實現了正成長。

- 根據中國工業協會預測,中國是全球最大的汽車生產基地,預計2022年汽車總產量將達到2,700萬輛,較上年的2,600萬輛成長3.4%。

- 官方資料顯示,受生產和投資穩健成長的支撐,中國電子產業在2022年實現穩定成長。根據工業信部統計,2021年前三個月,製造業主要企業增加價值增加價值額增7.6%,成長率高增加價值額全部工業4個百分點。因此,電子產品需求的大幅成長正在支撐該產業對熱塑性複合材料的需求。

- 根據國際貿易組織的統計,中國是全球最大的建築市場,擁有全球最高的都市化。根據美國建築師協會(AIA)上海分會的資料,到2025年,中國預計將建造一個相當於10個紐約市的城市。

- 中國政府正在採取措施緊縮經濟。中國的「十四五」規劃包括一項由政府主導的計劃,將數位技術應用於建築和施工過程。預計到2025年,建築業將佔全國GDP的6%,中國建築業在振興經濟、穩定就業方面發揮越來越重要的作用。

- 根據航太公司空中巴士公司2023年4月發布的新聞稿,未來20年,中國航空運輸量預計將以每年5.3%的速度成長,遠高於全球3.6%的平均值。這意味著到 2041 年全球將需要 8,420 架客機和貨機,佔未來 20 年全球所需新飛機總數(約 39,500 架)的 20% 以上。

- 因此,由於上述原因,中國很可能在預測期內推動亞太地區的市場成長。

熱塑性複合材料產業概況

全球熱塑性複合材料市場本質上是部分分散的,有幾家公司在全球和區域層面開展業務。市場的主要企業包括朗盛、索爾維、BASF、東麗工業公司和阿科瑪公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 汽車產業需求增加

- 建設產業支出增加

- 限制因素

- 熱塑性複合材料成型的高成本且挑戰大

- 其他

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 依樹脂類型

- 聚丙烯(PP)

- 聚醯胺(PA)

- 聚醚醚酮(PEEK)

- 其他

- 依纖維類型

- 玻璃纖維

- 碳纖維

- 其他

- 依產品類型

- 短纖維熱塑性塑膠(SFT)

- 長纖維熱塑性塑膠(LFT)

- 連續纖維熱塑性塑膠(CFT)

- 玻璃纖維氈熱塑性塑膠 (GMT)

- 按最終用戶產業

- 航太與國防

- 電氣和電子

- 車

- 建築學

- 醫療保健

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Arkema SA

- AVANCO Group

- Avient Corporation

- BASF SE

- Celanese Corporation

- Daicel Corporation

- DSM

- Hexcel Corporation

- LANXESS

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Group Corporation

- SABIC

- SGL Carbon

- Solvay

- TechnoCompound GmbH

- Toray Industries Inc.

第7章 市場機會與未來趨勢

- 醫療保健領域的廣泛應用

- 航太和國防工業的需求不斷成長

The Thermoplastic Composites Market size is estimated at 4.92 million tons in 2025, and is expected to reach 6.29 million tons by 2030, at a CAGR of 5.06% during the forecast period (2025-2030).

The COVID-19 pandemic, on a global scale, has forced automakers, wind turbine manufacturers, and aircraft manufacturers to shut down their operations, lowering the demand for composites in 2020. The pandemic impacted almost every aspect of the composites industry, from product demand to workforce development to the acceleration or deceleration of trends that were already underway when it struck. Customers and their own temporary production stop reduced the production levels, and demand reductions have all had a significant impact on production processes.

Key Highlights

- In the medium term, the major factors driving the market studied are the increasing demand from the construction industry and increasing investments in aerospace and defense applications.

- On the flip side, the declining automotive industry and the negative impact of the COVID-19 pandemic are likely to restrain the market growth.

- Asia-Pacific accounted for the highest market share, and the region is likely to dominate the market during the forecast period.

Thermoplastic Composites Market Trends

Automotive Industry to Dominate the Market

- Automotive is the major end-user industry of thermoplastic composites. The growing demand for producing lightweight and low CO2 emission vehicles is driving the demand for thermoplastic composites in the automotive industry.

- Thermoplastic composites are known for their high toughness and lightweight characteristics. Automotive industries highly adopt glass mat thermoplastics for various uses.

- The application areas of these composites in the automotive industry include seat frames, battery trays, bumper beams, load floors, front ends, valve covers, rocker panels, and under-engine covers.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), more than 85,016,728 motor vehicles were manufactured worldwide in 2022, an increase of 6% from a year earlier, indicating an increased demand for thermoplastic composites from thermoplastic composite-based automotive part manufacturing.

- Additionally, America's automotive production grew by 10% Y-o-Y in 2022. Canada, Mexico, and the United States saw a production increase of 10%, with motor vehicle production reaching 12,28,735 units, 35,09,072 units, and 1,00,60,339 units, respectively. In the South American region, Colombia saw the greatest rise in Y-o-Y production, reaching 51,455 units, an increase of 26%. Argentina also saw a massive 24% increase, with production reaching 5,36,893 units.

- Moreover, in 2022, US auto manufacturing companies announced a USD 13 billion investment in domestic EV manufacturing, more than triple the investment in 2020. Toyota announced a USD 2.5 billion investment in the Carolina manufacturing facility. Honda and LG Energy Solution announced a USD 4.4 billion joint venture for investments in EV and battery manufacturing. These factors are expected to ascend vehicle production, thereby benefiting the thermoplastic composites market.

- In Europe, Germany is among the key manufacturer of vehicles. According to the German Association of the Automotive Industry (VDA), Germany produced 441,990 units of vehicles in March 2023, a growth of 67% compared to the number of vehicles produced in the month of March in the previous year.

- Thus, considering the growth trends and production of automobiles in different regions worldwide, the automotive industry is likely to dominate the market, which, in turn, is expected to enhance the demand for thermoplastic composites during the forecast period.

China to Dominate the Asia-Pacific Region

- China is the largest manufacturer and consumer of thermoplastic composites in the Asia-Pacific region, followed by India and Japan.

- The use of thermoplastic composites in the automotive sector in the country is in high demand, owing to the advantage of producing a wide range of products that fit the industry's needs with precise quality. China is the world's biggest automobile market in terms of both production and sales. China's automotive market experienced positive growth in 2022 despite the impact of several negative factors, including the occurrence of the COVID-19 pandemic, a structural chip shortage, and local geopolitical conflicts.

- According to the China Association of Automobile Manufacturers (CAAM), China has the largest automotive production base in the world, with a total vehicle production of 27 million units in 2022, registering an increase of 3.4% compared to 26 million units produced in the previous year.

- According to official data, China's electronics sector recorded stable growth in 2022, supporting solid growth in terms of production and investment. According to the Ministry of Industry and Information Technology, the value added of major enterprises in the sector increased by 7.6% over the same period in 2021, exceeding the value added of all industries by 4%. Thus, a significant boost in demand for electronic goods supports the demand for thermoplastic composites from the industry.

- According to the International Trade Organization, China is the world's largest construction market and has the highest rate of urbanization globally. According to data from the American Institute of Architects (AIA) Shanghai, by 2025, China is anticipated to build a city equivalent to 10 New York City's worth of city space since the 1990s.

- The Chinese government is taking steps to tighten the economy. China's 14th Five-Year Plan includes a government-led effort to apply digital technology to the building and construction process. Furthermore, the construction industry is expected to account for 6% of the country's GDP by 2025. China's construction sector plays an increasingly important role in stimulating the economy and stabilizing employment.

- According to aerospace company Airbus' press release in April 2023, over the next 20 years, China's air traffic is projected to grow at an annual rate of 5.3%, well above the global average of 3.6%. This would require 8,420 passengers and freighters by 2041, or more than 20% of the world's need for new aircraft over the next 20 years, around 39,500.

- Hence, due to the reasons mentioned above, China is likely to drive the market's growth in the Asia-Pacific region during the forecast period.

Thermoplastic Composites Industry Overview

The global thermoplastic composites market is partially fragmented in nature, with several companies operating on both global and regional levels. Some of the major companies in the market include LANXESS, Solvay, BASF SE, Toray Industries Inc., and Arkema SA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Automotive Industry

- 4.1.2 Rising Consumption in the Construction Industry

- 4.2 Restraints

- 4.2.1 High Cost of Raw Materials and Challenges to Form Thermoplastic Composites

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Resin Type

- 5.1.1 Polypropylene (PP)

- 5.1.2 Polyamide (PA)

- 5.1.3 Polyetheretherketone (PEEK)

- 5.1.4 Other Resin Types

- 5.2 Fiber Type

- 5.2.1 Glass Fiber

- 5.2.2 Carbon Fiber

- 5.2.3 Other Fiber Types

- 5.3 Product Type

- 5.3.1 Short Fiber Thermoplastic (SFT)

- 5.3.2 Long Fiber Thermoplastic (LFT)

- 5.3.3 Continuous Fiber Thermoplastic (CFT)

- 5.3.4 Glass Mat Thermoplastic (GMT)

- 5.4 End-user Industry

- 5.4.1 Aerospace and Defense

- 5.4.2 Electrical and Electronics

- 5.4.3 Automotive

- 5.4.4 Construction

- 5.4.5 Medical

- 5.4.6 Other End-user Industries

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Rank Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema SA

- 6.4.2 AVANCO Group

- 6.4.3 Avient Corporation

- 6.4.4 BASF SE

- 6.4.5 Celanese Corporation

- 6.4.6 Daicel Corporation

- 6.4.7 DSM

- 6.4.8 Hexcel Corporation

- 6.4.9 LANXESS

- 6.4.10 LyondellBasell Industries Holdings BV

- 6.4.11 Mitsubishi Chemical Group Corporation

- 6.4.12 SABIC

- 6.4.13 SGL Carbon

- 6.4.14 Solvay

- 6.4.15 TechnoCompound GmbH

- 6.4.16 Toray Industries Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Wide Application Scope in the Healthcare Sector

- 7.2 Rising Demand from the Aerospace and Defense Industry