|

市場調查報告書

商品編碼

1687347

窗膜:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Window Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

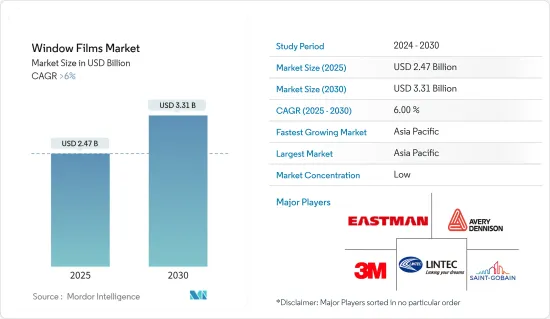

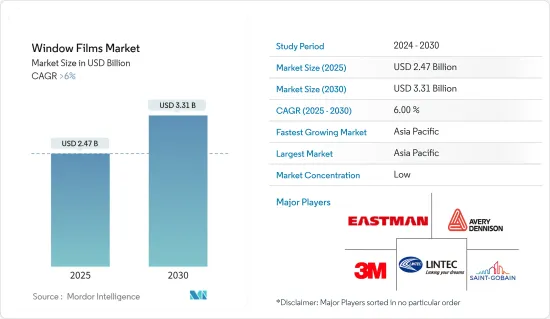

預計 2025 年窗膜市場規模將達到 24.7 億美元,到 2030 年將達到 33.1 億美元,預測期內(2025-2030 年)的複合年成長率將超過 6%。

2020 年新冠疫情對建設產業產生了負面影響。由於物流和原料短缺,該行業面臨挑戰。這也對窗膜市場產生了負面影響。然而,疫情過後汽車業產銷激增,推動了市場的成長和復甦。

主要亮點

- 從中期來看,消費者對減少碳足跡的關注度不斷提高以及對安全的日益關注是推動市場成長的關鍵因素。

- 然而,窗膜的應用需要一定的技術專業知識,需要改進技術和應用問題才能擴大窗膜市場的成長。此外,智慧玻璃市場的成長可能會阻礙窗膜市場的發展。

- 此外,人們對紫外線 (UV) 防護的興趣日益濃厚,預計將為該行業提供新的成長機會。

- 預計亞太地區將主導市場,並在預測期內實現最高的年成長率。

窗膜市場趨勢

建築業佔據市場主導地位

- 窗膜用於建築業以控制陽光。它反射太陽的熱量並有助於維持建築物內的舒適溫度。

- 在建築領域,窗膜有各種用途,包括裝飾膜、紫外線 (UV) 阻隔防窺膜膜、防眩防塗鴉、防塗鴉膜、隔熱膜以及安全膜。預計到 2030 年,全球建築業規模將達到 8 兆美元,主要由印度、中國和美國等國家推動。

- 中國正經歷建築業的繁榮。中國擁有全球最大的建築市場,佔全球建築投資總額的20%。預計到2030年,建築支出將接近13兆美元。

- 根據國家統計局的數據,中國建設產業商務活動指數(BASI)從2023年11月的55.9上升至12月的56.9。 BASI 得分高於 50 表示行業成長,2023 年 10 月的 BASI 得分為 53.5。

- 根據印度工業和國內貿易促進部的數據,2022 年流入印度建築開發領域的外國直接投資 (FDI) 股權價值為 1.25 億美元。 2022年美國私人建築支出成長,幾乎是公共部門建築支出的四倍。美國在建設產業佔有重要佔有率,2022 年的年度支出超過 17.93 億美元。

- 根據美國人口普查局(USCB)的數據,2023年12月的建築支出經季節性已調整的後年化率預計為2.096兆美元,比11月修訂後的2.0783兆美元高出0.9%。此外,預計2023年建築價值將達到19,787億美元,比2022年的18,487億美元高出7.0%。

- 因此,預計上述發展將在未來幾年推動建設產業對窗膜的需求。

亞太地區佔市場主導地位

- 預計亞太地區將主導市場,其中中國和印度佔最大佔有率。中國是該地區GDP最高的國家。中國是成長最快的經濟體之一,目前是世界上最大的生產國之一。該國的製造業對該國的經濟貢獻巨大。中國是亞太地區建設業大國之一,工業和建設業約佔GDP的50%。

- 預計該國的人口趨勢將繼續刺激住宅的成長。家庭收入水準的提高加上農村人口向都市區的轉移預計將繼續推動中國住宅建築業的需求。公共和私營部門對經濟適用住宅的日益關注預計將推動住宅建築行業的成長。

- 印度是建設產業最大的市場,房地產和城市發展產業正在崛起。據印度品牌股權基金會 (IBEF) 稱,預計到 2030 年,印度房地產行業的規模將達到 1 兆美元,到 2025 年將國內生產總值) 貢獻約 13%。預計這將增加對窗膜的需求並促進該地區的市場發展。

- 在建築需求強勁的同時,印度的汽車產業也正在崛起。例如,根據印度汽車工業協會(SIAM)的數據,預計2023年乘用車產量將從2022年的365萬輛增加至458萬輛,成長率為25.5%。此外,2023年全國摩托車銷量超過1,586萬輛。

- 此外,OICA表示,中國汽車產量將在2023年達到3,016萬輛,年增率為10.6%。

- 牛津經濟研究院也預測,到2037年,中國、美國和印度將佔全球建築工程的51%。這意味著這兩個亞太國家在全球範圍內的建築量龐大,這可能會在預測期內大幅推動對窗膜的需求。

- 由於這些因素,預計該地區的窗膜市場在預測期內將穩定成長。

窗膜行業概況

全球窗膜市場較為分散,排名前兩家的公司佔據了全球市場的大部分佔有率。市場的主要企業(不分先後順序)包括伊士曼化學公司、3M、艾利丹尼森公司、聖戈班和琳得科公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 對安全和防盜窗膜的需求不斷增加

- 人們對減少碳足跡的興趣日益濃厚

- 限制因素

- 技術、保固和施工問題

- 智慧玻璃市場成長

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按類型

- 陽光調節/防紫外線膜

- 裝飾膜

- 安全防護膜

- 防窺膜

- 隔熱膜

- 其他

- 按最終用戶產業

- 車

- 建築與施工

- 住宅

- 商業的

- 基礎設施和設施

- 海洋

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 越南

- 馬來西亞

- 印尼

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 土耳其

- 北歐的

- 西班牙

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 卡達

- 奈及利亞

- 阿拉伯聯合大公國

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Armolan Greece

- Avery Dennison Corporation

- Eastman Chemical Company

- HYOSUNG CHEMICAL

- Johnson Window Films Inc.

- LINTEC Corporation

- NEXFIL

- Rayno Window Film

- Saint-Gobain

- TORAY INDUSTRIES INC.

第7章 市場機會與未來趨勢

- 人們對紫外線防護的興趣日益濃厚

The Window Films Market size is estimated at USD 2.47 billion in 2025, and is expected to reach USD 3.31 billion by 2030, at a CAGR of greater than 6% during the forecast period (2025-2030).

The COVID-19 pandemic in 2020 adversely affected the construction industry. The industry faced challenges due to logistics and raw materials' unavailability. This also negatively impacted the window films market. However, the automotive industry's upsurge in production and sales post-pandemic propelled the market's growth and recovery.

Key Highlights

- Over the medium term, the major factors driving the market's growth are increasing emphasis on reducing carbon footprint and increasing safety and security concerns among consumers.

- However, some technical expertise is required to install window films, and the technicality and installation issues need to be improved to increase the growth of the window film market. Also, the growth in the smart glass market may cause hindrances to the window film market.

- Also, the growing concern for ultraviolet (UV) protection is projected to create new growth opportunities for the industry.

- Asia-Pacific is expected to dominate the market and will likely witness the highest annual growth rate during the forecast period.

Window Films Market Trends

The Building and Construction Segment to Dominate the Market

- Window films are utilized in the construction industry for solar control. They can reflect solar radiation heat and maintain a comfortable temperature inside buildings. Window films are used in the construction sector for solar control due to their ability to reflect the heat from solar radiation and maintain a comfortable ambiance in terms of the temperature inside the structure or building.

- In the construction segment, window films, such as decorative, ultraviolet (UV) block, privacy, anti-glare, anti-graffiti, insulating films, and safety and security films, are used. The global construction industry is expected to reach USD 8 trillion by 2030, primarily driven by countries like India, China, and the United States.

- China is amid a construction mega-boom. The country has the largest building construction market in the world, making up 20% of all construction investment globally. The country is expected to spend nearly USD 13 trillion on buildings by 2030.

- According to the National Bureau of Statistics (NBS), in China, the construction industry's business activity index (BASI) rose to 56.9 as of December 2023 from 55.9 in November 2023. The BASI score above 50 indicates growth in the industry, and the October 2023 BASI score was 53.5.

- According to the Department for Promotion of Industry and Internal Trade of India, the foreign direct investment (FDI) equity inflow for the construction development sector in India was worth USD 125 million in 2022. The United States' spending on private construction grew in 2022 and was nearly four times larger than construction spending in the public sector. The United States holds a significant share of the construction industry, which recorded an annual expenditure of over USD 1,793 million in 2022.

- According to the US Census Bureau (USCB), construction spending in December 2023 was estimated at a seasonally adjusted annual rate of USD 2,096.0 billion, 0.9% above the revised November estimate of USD 2,078.3 billion. Moreover, the construction value was USD 1,978.7 billion in 2023, 7.0%higher than the USD 1,848.7 billion spent in 2022.

- Therefore, the aforementioned developments are expected to drive the demand for window films in the construction industry through the years to come.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the market, with China and India accounting for the largest share. China has the largest GDP in the region. China is one of the fastest emerging economies, and it has become one of the biggest production houses in the world today. The country's manufacturing sector is one of the major contributors to the country's economy. China is one of the major countries in Asia-Pacific with ample construction activities, with the industrial and construction industries accounting for approximately 50% of the GDP.

- Demographics in the country are expected to continue to spur growth in residential construction. Rising household income levels combined with the population migrating from rural to urban areas are expected to continue to drive demand for the residential construction segment in the country. Increased focus on affordable housing by both the public and private sectors will drive growth in the residential construction segment.

- India is the largest market for the construction industry, with an increase in the real estate and urban development segment. According to the Indian Brand Equity Foundation (IBEF), the Indian real estate industry will likely reach USD 1 trillion by 2030 and contribute approximately 13% to the country's GDP by 2025. This will increase the demand for the window film market and propel its market in the region.

- Although the demand for construction is good, the automotive industry in India is also increasing. For instance, according to the Society of Indian Automobile Manufacturers (SIAM) India, the passenger vehicle production volume reached 4.58 million in 2023, registering a 25.5% growth over 3.65 million in 2022. Moreover, in 2023, over 15.86 million units of two-wheelers were sold domestically across the country.

- Also, according to OICA, automotive production in China reached 30.16 million in 2023, an annual increase of 10.6%.

- Also, Oxford Economics estimates that China, the United States, and India will account for 51% of all construction work done worldwide by 2037. This means a huge global construction volume will occur in the two Asia-Pacific countries and can significantly grow the demand for window films during the forecast period.

- Due to all such factors, the market for window films in the region is expected to grow steadily during the forecast period.

Window Films Industry Overview

The global window films market is fragmented, with the top two companies holding significant shares in the global market. Some of the major players in the market (not in any particular order) include Eastman Chemical Company, 3M, Avery Dennison Corporation, Saint-Gobain, and Lintec Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Safety and Security Window Films

- 4.1.2 Increasing Emphasis on Reducing Carbon Footprint

- 4.2 Restraints

- 4.2.1 Technical, Warranty, and Installation Issues

- 4.2.2 Growing Smart Glass Market

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Solar Control and UV Blocking Films

- 5.1.2 Decorative Films

- 5.1.3 Safety and Security Films

- 5.1.4 Privacy Films

- 5.1.5 Insulating Films

- 5.1.6 Other Types

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Building and Construction

- 5.2.2.1 Residential

- 5.2.2.2 Commercial

- 5.2.2.3 Infrastructural and Institutional

- 5.2.3 Marine

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Vietnam

- 5.3.1.7 Malaysia

- 5.3.1.8 Indonesia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Turkey

- 5.3.3.7 NORDIC

- 5.3.3.8 Spain

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Qatar

- 5.3.5.4 Nigeria

- 5.3.5.5 United Arab Emirates

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Armolan Greece

- 6.4.3 Avery Dennison Corporation

- 6.4.4 Eastman Chemical Company

- 6.4.5 HYOSUNG CHEMICAL

- 6.4.6 Johnson Window Films Inc.

- 6.4.7 LINTEC Corporation

- 6.4.8 NEXFIL

- 6.4.9 Rayno Window Film

- 6.4.10 Saint-Gobain

- 6.4.11 TORAY INDUSTRIES INC.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Concerns Regarding UV Protection