|

市場調查報告書

商品編碼

1687346

氨:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Ammonia - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

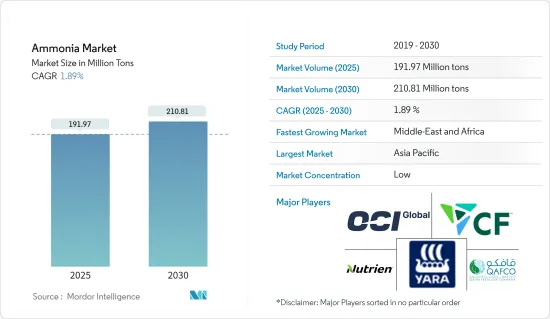

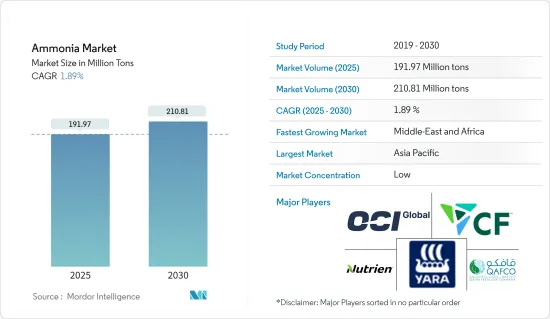

預計2025年氨市場規模為1.9197億噸,2030年將達2.1081億噸,預測期間(2025-2030年)複合年成長率為1.89%。

在 COVID-19 疫情期間,全球氨市場受到負面影響,農業、紡織、採礦業和其他終端用戶產業受到嚴重影響。然而,行業內製藥業的成長正在改善,預計這將有助於市場發展。目前,氨市場正在從疫情中復甦並經歷強勁成長。

主要亮點

- 短期內,預化肥行業的大量使用和炸藥製造中氨的使用量的增加將在預測期內推動市場成長。

- 然而,濃氨的危害可能會阻礙市場成長。

- 然而,預計 2024 年至 2029 年期間氨作為冷媒的使用和綠色氨的日益普及將為市場帶來機會。

- 預計亞太地區將佔據市場主導地位,並在 2024 年至 2029 年期間實現最高的複合年成長率。

氨市場趨勢

農業可望主導市場

- 據世界經濟論壇稱,氨對農業和全球食品供應鏈至關重要。氨也被視為未來能源來源。

- 氨與大氣中的氮結合,吸收的氮用於作物的主要養分,然後用於生產氮肥。氨作為肥料生產中不可或缺的原料,可以改善作物健康,並長期維持並提高土壤肥力。

- 根據聯合國預測,世界人口將持續成長,到2050年將達到90億。屆時,預計相同土地面積上的糧食生產需求將增加60%。實現糧食安全需要以可負擔的價格獲得充足的、營養豐富的食物。這可以透過使用最佳化肥料來實現。

- 此外,美國是三大肥料成分的主要進口國之一。主要肥料成分生產國為中國、俄羅斯、加拿大和摩洛哥。 2023年3月,美國農業部(USDA)宣布了前兩輪新津貼計劃,旨在創新擴大47個州和兩個地區的國內化肥生產能力。美國也宣布,已收到來自350多家獨立公司的30億美元申請,凸顯國內化肥產業的強勁復甦。

- 此外,美國農業部宣布首輪津貼2900萬美元。這些津貼可能有助於獨立公司增加美國製造的化肥的產量並促進良性競爭。

- 2023年3月,CBH集團宣布開設新的奎那那化肥廠,將為西澳的糧食種植者帶來巨大利益。該計劃標誌著 CBH 液體肥料業務的開始,並將使其顆粒肥料生產能力提高 15,000。新設施的儲存容量為 32,000 噸尿素硝酸銨 (UAN) 和 55,000 噸顆粒散裝肥料。

- 因此,預計所有上述因素將在 2024-2029 年期間推動農業產業對氨的需求。

亞太地區預計將主導市場

- 由於中國、印度和日本等國家氨消費量龐大,亞太地區在氨市場佔據主導地位。

- 中國是世界上最大的氨生產國和消費國。根據美國地質調查局 (USGS) 的數據,2023 年美國生產了 4,300 萬噸氨。由於氨在農業領域(包括化肥、紡織、製藥和採礦)的用途日益廣泛,美國對氨的需求也在增加。

- 中國約佔全球整體面積的7%,養活了全球22%的人口。該國是多種作物的最大生產國,包括水稻、棉花和馬鈴薯。因此,大規模的農業活動導致用作肥料的氨的需求激增。

- 此外,印度是嚴重依賴農業的經濟體之一。超過55%的人口仍以農業為生。據化肥部稱,2023會計年度的尿素產量將達到約2,800萬噸,而上年度的產量為2,572萬噸。印度的尿素產量正在上升。

- 紡織業也受益於氨的功能。液態氨在鞣製上的使用十分廣泛,就像染料在紡織品染色中的使用一樣。液氨在合成纖維的發展中扮演重要角色。氨溶液可以使織物著色達到幾乎任何顏色。

- 日本在紡織品生產方面有著悠久的傳統,是最大的技術紡織品生產國之一。為了在充斥著來自中國和其他新興國家的廉價紡織產品的全球市場中保持競爭力,日本紡織業正在轉型成為專門生產技術先進的智慧紡織產品的產業。合成蜘蛛絲和穿戴式健康監測器等創新是日本紡織業差異化努力的一部分。

- 此外,根據印度品牌股權基金會的數據,2023年4月至2023年10月,印度紡織品和服裝出口(包括手工藝品)額為211.5億美元。預計到 2025-26 年將達到 1900 億美元。

- 因此,預計所有上述因素將導致 2024-2029 年期間氨市場需求增加。

合成氨產業展望

氨市場高度分散。主要參與者(不分先後順序)包括 CF Industries Holdings Inc.、Yara、Nutrien Ltd.、OCI 和卡達化肥公司 (QAFCO)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 肥料工業中的多種應用

- 火藥製造的使用增加

- 限制因素

- 濃縮形式的危險

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按類型

- 液體

- 氣體

- 按最終用戶產業

- 農業

- 纖維

- 礦業

- 製藥

- 《冷凍》

- 其他終端用戶產業(食品和飲料、橡膠、水處理、石油、紙漿和造紙業)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- BASF SE

- CF Industries Holdings Inc.

- Chambal Fertilisers and Chemicals Limited

- CSBP

- Eurochem Group

- Group DF(Ostchem)

- IFFCO

- Jsc Togliattiazot

- Koch Fertilizer LLC

- Nutrien Ltd

- OCI

- PT Pupuk Sriwidjaja Palembang(Pusri)

- Qatar Fertiliser Company(QAFCO)

- Rashtriya Chemicals And Fertilizers Limited

- SABIC

- Yara

第7章 市場機會與未來趨勢

- 使用氨作為冷媒

- 擴大綠色氨的應用

The Ammonia Market size is estimated at 191.97 million tons in 2025, and is expected to reach 210.81 million tons by 2030, at a CAGR of 1.89% during the forecast period (2025-2030).

During the COVID-19 pandemic, there was a negative impact on the ammonia market globally as agriculture, textile, mining, and other end-user industries were significantly affected. However, growth in the pharmaceutical segment is improving in the industry, and this is expected to assist in market development. Currently, the ammonia market has recovered from the pandemic and is growing significantly.

Key Highlights

- In the short term, abundant use in the fertilizer industry and ammonia's increasing usage for the production of explosives are projected to fuel the market's growth during the forecast period.

- However, the hazardous effects of ammonia in its concentrated form are likely to hinder the growth of the market.

- Nevertheless, the use of ammonia as a refrigerant and the growing adoption of green ammonia are likely to act as opportunities for the market between 2024 and 2029.

- Asia-Pacific is expected to dominate the market and is likely to witness the highest CAGR from 2024 to 2029.

Ammonia Market Trends

The Agriculture Industry is Expected to Dominate the Market

- According to the World Economic Forum, ammonia is vital in agriculture and the global food supply chain. Ammonia has also been recognized as a future energy source for clean hydrogen.

- Ammonia binds nitrogen from the atmosphere and produces the primary crop nutrients using the absorbed nitrogen, which is then used to produce nitrogen fertilizers. As an essential raw material for fertilizer production, ammonia improves crop health and, in the long run, maintains and even increases soil fertility.

- According to the United Nations, the world population continues to grow and will reach 9 billion by 2050. By then, on the same land area, the demand for food production is expected to increase by 60%. Achieving food security requires the availability of sufficient, nutritious food at affordable prices. This can be achieved through the use of optimized fertilizers.

- Additionally, the United States is among the top importers of the three major fertilizer ingredients. Major producers of the main fertilizer components include China, Russia, Canada, and Morocco. In March 2023, the US Department of Agriculture (USDA) announced the first two rounds of a new grant program to expand innovative production for domestic fertilizer production capacity in 47 states and two territories. The USDA further announced that it received USD 3 billion in applications from more than 350 independent companies, thus highlighting significant recovery in the country's fertilizer industry.

- Furthermore, the USDA also announced its first USD 29 million grant offering in the first round. The subsidy will help independent companies increase their production of American-made fertilizers and encourage healthy competition.

- In March 2023, CBH Group announced the opening of its new Kwinana Fertilizer Plant, which will benefit grain farmers in Western Australia significantly. The project marks the start of CBH's liquid fertilizer business, increasing its granular fertilizer production capacity by 15,000. The new facility has 32,000 tons of urea ammonium nitrate (UAN) storage capacity and 55,000 tons of granular bulk fertilizer.

- Therefore, all the aforementioned factors are expected to enhance the demand for ammonia from the agriculture industry between 2024 and 2029.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific dominates the ammonia market owing to large consumption from countries such as China, India, and Japan.

- China is the largest producer and consumer of ammonia in the world. According to the US Geological Survey (USGS), the country produced 43 million metric tons of ammonia in 2023. The demand for ammonia in the country is rising due to increasing applications in the agriculture industry, such as fertilizers, textiles, pharmaceuticals, and mining.

- China accounts for approximately 7% of the overall agricultural acreage globally, thus feeding 22% of the world's population. The country is the largest producer of various crops, including rice, cotton, potatoes, and others. Hence, the demand for ammonia, which is used as a fertilizer, is rapidly increasing owing to the country's large-scale agricultural activities.

- Further, India is one of the economies that are largely dependent on agriculture. Agriculture is still the primary source of livelihood for more than 55% of the population. As per the Department of Fertilizers, in FY2023, about 28 million metric tons of urea were produced in India, which was 25.72 million metric tons in the previous year. Urea production in India presented an increasing trend.

- The textile industry also benefits from ammonia's capabilities. The use of liquid ammonia in tanning is widespread, as is the use of dyes in textile dyeing. Liquid ammonia plays an important role in the development of synthetic fabrics. The solution of ammonia enables fabric coloring to achieve almost any color.

- Japan has a long tradition in textile production and is one of the largest manufacturers of technical textiles. To remain competitive in the global market flooded with cheap textiles from China and other emerging countries, the Japanese textile industry is transforming into an industry that specializes in technological and smart textiles. Innovations such as synthetic spider silk and wearable health monitors are among the efforts to differentiate the Japanese textile industry.

- In addition, according to the Indian Brand Equity Foundation, India's textile and apparel exports (including handicrafts) from April 2023 to October 2023 stood at USD 21.15 billion. The industry is expected to reach USD 190 billion by 2025-26.

- Thus, all the above-mentioned factors are likely to provide the increasing demand for the ammonia market between 2024 and 2029.

Ammonia Industry Oveview

The ammonia market is highly fragmented in nature. The major players (not in any particular order) include CF Industries Holdings Inc., Yara, Nutrien Ltd, OCI, and Qatar Fertiliser Company (QAFCO).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Abundant Use in the Fertilizer Industry

- 4.1.2 Increasing Usage to Produce Explosives

- 4.2 Restraints

- 4.2.1 Hazardous Effects in its Concentrated Form

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Liquid

- 5.1.2 Gas

- 5.2 End-user Industry

- 5.2.1 Agriculture

- 5.2.2 Textiles

- 5.2.3 Mining

- 5.2.4 Pharmaceutical

- 5.2.5 Refrigeration

- 5.2.6 Other End-user Industries (Food and Beverage, Rubber, Water Treatment, Petroleum, and Pulp and Paper Industries)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 CF Industries Holdings Inc.

- 6.4.3 Chambal Fertilisers and Chemicals Limited

- 6.4.4 CSBP

- 6.4.5 Eurochem Group

- 6.4.6 Group DF (Ostchem)

- 6.4.7 IFFCO

- 6.4.8 Jsc Togliattiazot

- 6.4.9 Koch Fertilizer LLC

- 6.4.10 Nutrien Ltd

- 6.4.11 OCI

- 6.4.12 PT Pupuk Sriwidjaja Palembang (Pusri)

- 6.4.13 Qatar Fertiliser Company (QAFCO)

- 6.4.14 Rashtriya Chemicals And Fertilizers Limited

- 6.4.15 SABIC

- 6.4.16 Yara

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use of Ammonia as a Refrigerant

- 7.2 Growing Adoption of Green Ammonia