|

市場調查報告書

商品編碼

1687344

雷射:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Lasers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

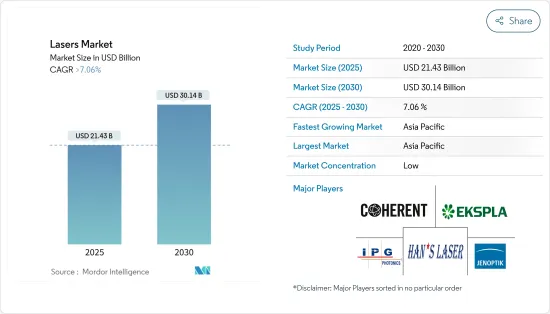

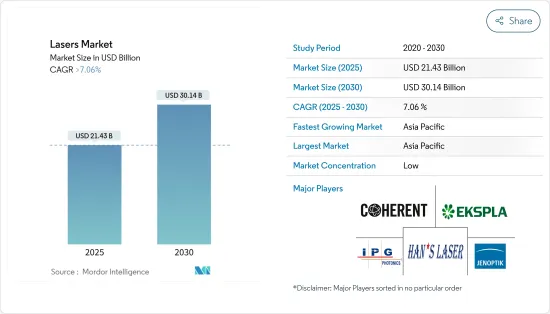

預計 2025 年雷射市場規模為 214.3 億美元,到 2030 年將達到 301.4 億美元,預測期內(2025-2030 年)的複合年成長率將超過 7.06%。

主要亮點

- 快速發展的電子產業依靠雷射技術來確保零件和組件製造的精確性、小型化和複雜性。雷射以非接觸式和高精度的方式切割、標記和構造電子元件。這減少了材料浪費並最大限度地減少了潛在的損害。在處理電子設備中的敏感材料和複雜設計時,這種能力尤其重要。

- 此外,雷射技術對於電子領域的微電子和元件製造至關重要。該技術有利於設備小型化,確保高生產產量比率,並實現現代電子產品不可或缺的複雜電路設計。

- 對創新電子設備的需求不斷成長、電動車普及率激增以及人工智慧在各個領域的廣泛融合等因素正在推動晶片設計和製造市場的發展。這種勢頭正在為雷射市場創造成長機會。

- 然而,小型企業和新興企業往往受到預算緊張的限制,並且由於雷射打標機所需的高額初始投資而面臨挑戰。這些機器的初始成本很高,取決於雷射的位置、所需的功率、標記區域的大小以及附加功能。因此,高昂的前期成本可能會阻礙市場成長。

- 人工智慧增強型雷射系統的採用使得焊接過程中的即時品質監控成為可能,從而改變了市場。這項技術創新將降低生產成本並提高產品質量,從而支持預測期內的整體市場成長。

雷射市場趨勢

雷射感測器是電子和航空領域的新前沿

- 電子產品製造商擴大將雷射感測器用於各種應用。這包括確保產品公差、簡化分類流程和增強零件識別系統。雷射感測器可測量壓力感測器中的隔膜位移、檢查印刷電路基板的特性以及測量助聽器組件中的外殼輪廓。電子製造中越來越流行的感測器類型包括共焦感測器、共焦位移感測器、三角測量感測器和雷射多普勒感測器 (LDS)。

- 例如,2024 年 1 月,基恩士擴展了其 CL-3000 系列共焦位移感測器。共焦位移感測器以其高精度的距離測量而聞名,在自動化品管中發揮著至關重要的作用。感測器透過分析反射光的強度來測量到物體的距離。為了實現這一點,感測器會發射雷射,然後分裂光束。

- 航空業不斷突破技術界限,要求無與倫比的精度和解析度。飛行時間等技術利用遠距雷射距離感測器來測量光的傳輸時間,並利用光的恆定速度來確定距離。此外,航空業越來越依賴高解析度系統,凸顯了雷射雷達系統日益成長的重要性。同時,無人機的發展正在推動航空應用的快速成長。

- 例如,2024年3月,JOUAV發布了其最新的專為無人機設計的LiDAR感測器JoLiDAR-1000。此次公告增強了 JOUAV 的高性能、低成本 LiDAR 感測器產品組合,以進一步推進民用無人機 (UAV) 的應用,包括 GIS、測量和精密電力線檢查。

- 因此,受雷射感測器需求不斷成長和技術創新的推動,各個終端用途領域的強勁進步預計將在預測期內推動市場成長。

亞太地區成長強勁

- 中國引領全球雷射市場很大程度上得益於其強大的基礎設施、成熟的工業生態系統以及對技術改進的不懈關注。該市場因其對汽車、家電、製造業和可再生能源行業的重大貢獻而聞名。隨著自動化數位化的提高,在「中國製造2025」等重要措施的支持下,中國對基於雷射的解決方案的需求預計將快速成長。

- 印度製造業在各種措施和優惠政策的推動下蓬勃發展。 「印度製造」計畫已將印度定位為全球製造地,並為該國經濟贏得了國際讚譽。該計劃旨在提高國內製造能力、吸引外國投資並在全國創造就業機會。 2024年,印度將成為世界第五大製造業國家,反映出其在全球製造業領域的影響力日益增強。

- 日本與先進工業、醫療和技術生態系統的緊密融合使其成為全球雷射市場的傑出參與企業。日本在全球製造業中,特別是在汽車、醫療保健和電子產業中的關鍵作用證明了其重要性。日本以其精密工程和技術創新而聞名,繼續成為全球雷射產業的重要市場。

- 面對勞動成本上升和製造業就業減少的問題,韓國擴大將基於雷射的機器人納入生產過程。這種轉變不僅將取代傳統勞動力,還將提高製造效率和生產力。因此,韓國已成為機器人密度的全球領導者,並展示了其對工業自動化和技術進步的承諾。

- 亞太地區其他雷射市場正在經歷強勁成長。這種快速成長很大程度上歸功於該地區的電子和汽車製造基礎以及不斷成長的消費者購買力。此外,隨著智慧型手機的普及和商業的數位化不斷提高,對各種雷射應用的需求也在不斷成長,尤其是在蓬勃發展的家電和汽車領域。其他亞太地區包括印尼、新加坡和澳洲。

雷射行業概況

市場由大型供應商和較小的區域參與者構成,每個參與者都迎合自己的客戶群。這些供應商依靠研究、創新和產品開發作為其主要成長策略來增加其在市場上的佔有率。

市場資本密集的特徵意味著小型企業面臨較高的退出壁壘,往往導致被大公司收購。再加上企業集中度適中,加劇了競爭公司之間的競爭。

隨著市場進入以收購和合併為標誌的整合階段,顯著的發展已經出現。此外,市場的主要企業正在擴大其區域影響力,並與生態系統合作夥伴合作,深入研究超快雷射的新應用。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 電子產業對雷射系統的需求不斷成長

- 工業 4.0 和智慧製造實務的採用率不斷提高

- 限制因素

- 高資本投入

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按類型

- 光纖雷射

- 二極體雷射

- CO/CO2雷射

- 固體雷射

- 其他

- 按應用

- 通訊

- 材料加工

- 醫療和化妝品

- 光刻

- 研究與開發

- 軍事和國防

- 感應器

- 展示

- 其他用途(標記、光學儲存、印刷)

- 按地區

- 亞洲

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 澳洲和紐西蘭

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 南美洲

- 中東

- 亞洲

第6章競爭格局

- 公司簡介

- Coherent Corp.

- EKSPLA

- Hans Laser Technology Industry Group Co., Ltd.

- IPG Photonics Corporation

- Jenoptik AG

- Keyence Corporation

- Lumentum Holdings Inc.

- Lumibird SA

- Maxphotonics Co., Ltd.

- nLIGHT, Inc.

- Novanta, Inc.

- TRUMPF SE+Co. KG

- Wuhan Raycus Fiber Laser Technologies Co. Ltd

- 併購、合資、合作與協議

- 市場佔有率分析

- 主要企業策略

第7章 市場機會與未來趨勢

- LiDAR技術

The Lasers Market size is estimated at USD 21.43 billion in 2025, and is expected to reach USD 30.14 billion by 2030, at a CAGR of greater than 7.06% during the forecast period (2025-2030).

Key Highlights

- The rapidly evolving electronics industry relies on laser technology to ensure precision, miniaturization, and complexity in manufacturing components and assemblies. Lasers cut, mark, and structure electronic parts using a non-contact and highly accurate approach. This reduces material waste and minimizes potential damage. Such capabilities are especially crucial when handling sensitive materials and intricate designs in electronic devices.

- Additionally, laser technology is crucial in producing microelectronics and components in the electronics sector. This technology facilitates the miniaturization of devices, guarantees high production yields, and allows for intricate circuit designs vital to contemporary electronics.

- Factors such as the rising demand for innovative electronics, the surge in electric vehicle adoption, and the widespread integration of artificial intelligence across various sectors drive the chip design and fabrication market. This momentum is creating growth opportunities for the laser market.

- However, small businesses and startups, often constrained by tight budgets, face challenges due to the high initial investment required for laser marking machines. These machines have a significant upfront cost, influenced by laser placement, power requirements, marking area size, and added functionalities. As a result, this steep initial expense could stifle market growth.

- The market has been transformed by adopting AI-enhanced laser systems, enabling real-time quality monitoring during welding. This innovation reduces production costs and enhances product quality, supporting the overall market growth during the forecast period.

Laser Market Trends

Laser Sensors to be the New Frontier in Electronics and Aviation

- Electronic manufacturers are increasingly turning to laser sensors for a variety of applications. These include ensuring product tolerances, streamlining sorting processes, and enhancing part recognition systems. Laser sensors measure diaphragm displacement in pressure transducers, inspect features on printed circuit boards, and gauge housing profiles for hearing aid assemblies. Among the types of sensors gaining traction in electronic manufacturing are confocal sensors, confocal displacement sensors, triangulation sensors, and Laser Doppler Sensors (LDS).

- For instance, in January 2024, 'Keyence expanded its CL-3000 Series of Confocal Displacement Sensors. Confocal displacement sensors, known for their high-precision distance measurements, play a pivotal role in automated quality control. These sensors gauge the distance to an object by analyzing the intensity of reflected light. To achieve this, the sensor emits a laser light and subsequently splits the beam.

- The aviation sector consistently pushes technological boundaries, demanding unparalleled accuracy and resolution. Technologies like Time-of-Flight leverage long-range laser distance sensors, measuring light's transit time and employing the constant speed of light to determine distances. Moreover, the aviation industry's growing reliance on high-resolution systems underscores the rising significance of LiDAR systems. Meanwhile, the evolution of unmanned aerial vehicles (UAVs) is witnessing a surge in aerial applications.

- For instance, in March 2024, JOUAV unveiled its newest LiDAR sensor, the JoLiDAR-1000, designed specifically for drones. This launch bolsters JOUAV's already impressive range of high-performance, budget-friendly LiDAR sensors, furthering the evolution of civilian unmanned aerial vehicle (UAV) uses, including GIS, surveying, and meticulous power line inspections.

- As a result, robust advancements across diverse end-use sectors are poised to propel market growth during the forecast period, driven by increasing demand and innovation for laser-based sensors.

Asia Pacific to Register Major Growth

- China leads the world laser market in large part because of its strong infrastructure, established industrial ecosystem, and relentless focus on technological improvements. The market is distinguished by its substantial contributions to the automobile, consumer electronics, manufacturing, and renewable energy industries. As automation and digitalization increase, China's need for laser-based solutions is anticipated to develop rapidly, supported by major initiatives like "Made in China 2025".

- India's manufacturing sector is witnessing rapid growth, driven by various initiatives and favorable policies. The 'Make in India' initiative has positioned the nation as a global manufacturing hub, garnering international acclaim for its economy. This program aims to boost domestic manufacturing capabilities, attract foreign investments, and create employment opportunities across the country. In 2024, India ascended to become the world's fifth-largest manufacturing nation, reflecting its growing prominence in the global manufacturing landscape.

- Japan's strong integration into advanced industrial, medical, and technological ecosystems establishes it as a distinguished participant in the global laser market. Its critical role in global manufacturing, particularly in the automotive, healthcare, and electronics industries, underpins its significance. Renowned for its precision engineering and innovation, Japan remains a vital market within the global laser industry.

- South Korea, facing rising labor wages and a dip in manufacturing employment, is increasingly adopting laser-based robotics in its production processes. This transition not only replaces traditional labor but also enhances efficiency and productivity in manufacturing. As a result, South Korea has emerged as one of the global leaders in robot density, showcasing its commitment to industrial automation and technological advancement.

- Robust growth characterizes the laser market in the Rest of Asia-Pacific region. This surge is primarily attributed to the region's electronics and automobile manufacturing stronghold and rising consumer purchasing power. Furthermore, as smartphone adoption accelerates and businesses digitize, there's a heightened demand for various laser applications, especially in the flourishing consumer electronics and automotive sectors. The Rest of the Asia-Pacific region consists of countries like Indonesia, Singapore, and Australia, under the scope of the study, where the studied market is gaining considerable traction.

Laser Industry Overview

Large vendors and smaller regional players populate the market, each catering to their respective clientele. These vendors emphasize research, innovation, and product development as key growth strategies, bolstering their market presence.

The capital-intensive nature of the market means that smaller companies face heightened exit barriers, often leading to acquisitions by larger firms. This, combined with moderate firm concentration, amplifies the competitive rivalry.

Notable moves have already been made as the market heads towards a consolidation phase marked by acquisitions and mergers. Additionally, major players in the market are expanding their regional footprint and collaborating with ecosystem partners, delving into novel applications for ultrafast lasers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Laser Systems from the Electronics Industry

- 4.1.2 Increasing Adoption of Industry 4.0 and Smart Manufacturing Practices

- 4.2 Restraints

- 4.2.1 High Capital Investment

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Fiber Lasers

- 5.1.2 Diode Lasers

- 5.1.3 CO/CO2 Lasers

- 5.1.4 Solid State Lasers

- 5.1.5 Other Types

- 5.2 Application

- 5.2.1 Communications

- 5.2.2 Materials Processing

- 5.2.3 Medical and Cosmetics

- 5.2.4 Lithography

- 5.2.5 Research and Development

- 5.2.6 Military and Defense

- 5.2.7 Sensors

- 5.2.8 Displays

- 5.2.9 Other Applications (Marking, Optical Storage, Printing)

- 5.3 Geography

- 5.3.1 Asia

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Australia and New Zealand

- 5.3.2 Australia and New Zealand

- 5.3.3 North America

- 5.3.3.1 United States

- 5.3.3.2 Canada

- 5.3.3.3 Mexico

- 5.3.4 Europe

- 5.3.4.1 Germany

- 5.3.4.2 United Kingdom

- 5.3.4.3 France

- 5.3.4.4 Italy

- 5.3.5 South America

- 5.3.6 Middle East

- 5.3.1 Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Coherent Corp.

- 6.1.2 EKSPLA

- 6.1.3 Hans Laser Technology Industry Group Co., Ltd.

- 6.1.4 IPG Photonics Corporation

- 6.1.5 Jenoptik AG

- 6.1.6 Keyence Corporation

- 6.1.7 Lumentum Holdings Inc.

- 6.1.8 Lumibird SA

- 6.1.9 Maxphotonics Co., Ltd.

- 6.1.10 nLIGHT, Inc.

- 6.1.11 Novanta, Inc.

- 6.1.12 TRUMPF SE + Co. KG

- 6.1.13 Wuhan Raycus Fiber Laser Technologies Co. Ltd

- 6.2 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.3 Market Share Analysis

- 6.4 Strategies Adopted by Leading Players

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 LiDAR Technology