|

市場調查報告書

商品編碼

1687335

國防領域的衛星通訊:市場佔有率分析、產業趨勢和統計數據、成長預測(2025-2030 年)Satellite Communication In The Defense Sector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

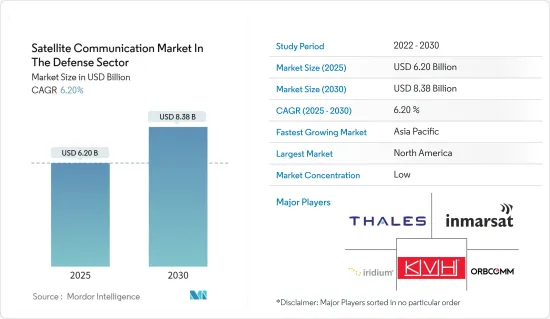

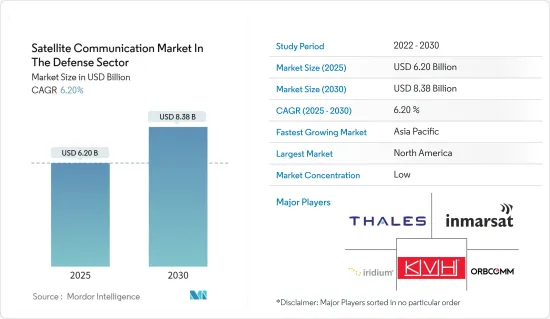

預計國防衛星通訊市場將從 2025 年的 62 億美元成長到 2030 年的 83.8 億美元,預測期間(2025-2030 年)的複合年成長率為 6.2%。

衛星通訊在國防工業中有多種應用,包括擴大寬頻覆蓋範圍、建構5G通訊系統、整合和整合多種有線和無線技術、地球觀測、國防、安全和監視。

主要亮點

- 在飛機上使用智慧型手機的國防相關人員可以利用機上連接存取網路。海事人員可以從船員獲取最新海事資訊中受益,包括海圖更新、引擎監控和天氣路線廣播。背包設備必須快速可靠地部署,以支援惡劣和緊急條件下的連接。

- 有人指控網路攻擊和實體海盜行為之間存在聯繫,據稱海盜可以進入航運公司的系統來識別載有貴重貨物且船上保護措施較差的船隻。因此,需要設計具有機密通訊管道等功能的強大安全系統。

- 軍事和國防工業的首要任務是軍事通訊的隱私和安全。透過標準介面傳輸的基於 IP 的資料(例如情境察覺視訊和遠端感測器資料)數量不斷成長,推動了對資料網路安全性的更高需求。此外,隨著地面、空中和太空的網路資源面臨各種威脅,保護軍用衛星免受網路攻擊變得越來越重要。軍事通訊資料和網路基礎設施至關重要,安全漏洞可能會危及平民的安全。

- 2024年2月,泰雷茲宣布將為德國F126護衛艦提供SurfSAT-L衛星通訊解決方案。該系統的舊版本已在全球多個國家的海軍服役,而現代化系統即使在困難的操作條件下也能提供更好的連接。

- 然而,由於發射衛星和傳輸資料的敏感性,網路安全是衛星通訊的一個主要問題。挑戰在於網路安全威脅可能帶來的負面影響,因為漏洞對於任務至關重要。面臨網路安全威脅的任務關鍵漏洞包括發射系統、通訊、遙測、追蹤和指揮以及任務完成。衛星通訊在衛星整個生命週期中過度依賴安全網路能力是一個嚴重的問題,阻礙了其廣泛通訊。

衛星通訊市場趨勢

遙感探測領域可望佔據主要市場佔有率

- 遙感探測透過提供多種類型的資料為國防、軍事和航太領域提供支援。為了避免與冰山等障礙物相撞而沉沒,海上船舶利用風浪資訊、航線分析、船舶進場、GPS等遙感探測技術。每天有許多衛星繞地球運行,收集有助於定位失蹤或被摧毀的飛機資料。根據 celestrak.org 的數據,到 2023 年,全球軌道上將有約 26,673 顆衛星。

- 遙感探測多年來一直被用作監測方法。第一次世界大戰之前,遠端感測器的使用方式是將其安裝在熱氣球上並飛越目標城市。遙感探測是由具有廣泛功能的專用衛星進行的。例子包括光學衛星、雷達成像衛星、紫外線和紅外線成像衛星以及訊號攔截通訊。

- 遙感探測比傳統的監視形式具有顯著的優勢,因為它可以提供可見光以外波長的高解析度影像。這些資料可用於追蹤敵人的動向、做出戰略決策和評估戰術性威脅。

- 現在,人們對更好的連接和更高解析度影像的要求比以往任何時候都高。由於科學技術的快速發展和軍事活動對軍用衛星技術的依賴,這超出了軍用衛星技術的能力。目前,作為世界最大軍隊的美國軍方主要依靠商業衛星能力用於軍事目的。 2023 年 10 月,空中巴士公司和美國國防公司諾斯羅普·格魯曼公司宣布簽署合作備忘錄 (MoU),為英國未來的寬頻 SKYNET 軍事衛星通訊計畫發展和促進軍事衛星通訊領域的戰略合作。

- 未來幾年推動國防衛星通訊市場成長的主要因素是人工智慧在地球監視衛星通訊的應用。此外,遙感探測和監測應用的需求不斷成長以及政府建立間諜衛星網路的計劃也有望推動市場需求。推動市場發展的因素包括海上安全風險的增加、國防領域投資的增加以及對全球政治不穩定日益成長的擔憂。

亞太地區預計將佔據主要市場佔有率

- 該地區正在進行大量創新和研發投資,以加強國防機構的衛星通訊。例如,日本政府已核准2023年10.17兆日圓(660億美元)的國防費用,這筆資金也將用於購買新的國防設備。

- 2024 年 2 月,印度陸軍撥款約 2,500 億盧比(29.933 億美元)用於滿足其國防需求。這包括建立監視衛星星系和加強安全通訊網路。

- 國防衛星服務透過提供可靠、安全的寬頻服務來支援軍隊,實現陸、海、空的全球互通性,從而提高作戰效率和任務成功的可能性。

- 此外,衛星通訊的軍事應用比傳統應用需要更高的安全標準。因此,軍事衛星通訊提供者一直在努力改進其解決方案,以滿足軍事和國防工業不斷成長的需求。這些要求包括增強衛星通訊能力,包括頻寬頻率、全球廣播和個人通訊服務。

- 2024年7月,日本將利用新型H3火箭發射改良型地球觀測衛星ALOS-4。先進陸地觀測衛星-4的主要任務是地球觀測,重點在於災害應變、測繪以及火山爆發、地震活動和地殼運動等監測活動。此外,它還配備了國防部開發的紅外線感測器,可以監視飛彈發射等軍事行動。

衛星通訊產業概況

國防領域的衛星通訊市場較為分散,既有全球性企業,也有規模較小的企業。主要參與企業包括泰雷茲集團、國際海事衛星組織通訊公司、銥星通訊公司、KVH 工業公司和 Orbcomm 公司。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 評估宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 海上威脅日益增加,海上安全政策不明確

- 軍事和國防衛星通訊解決方案需求不斷成長

- 市場限制

- 衛星通訊面臨的網路安全威脅

- 依賴高成本的衛星設備

第6章市場區隔

- 按類型

- 地面設施

- 服務

- 按應用

- 監視和追蹤

- 遙感探測

- 災害復原

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Thales Group

- Inmarsat Communications

- Iridium Communications Inc.

- KVH Industries Inc.

- Orbcomm Inc.

- Cobham PLC

- Thuraya Telecommunications Company(Al Yah Satellite Communications Company PJSC)

- ViaSat Inc.

- ST Engineering iDirect

- L3Harris Technologies Inc.

第8章投資分析

第9章:市場的未來

The Satellite Communication Market In The Defense is expected to grow from USD 6.20 billion in 2025 to USD 8.38 billion by 2030, at a CAGR of 6.2% during the forecast period (2025-2030).

Satellite communication is being used for many applications across the defense industry, including for extending broadband coverage, setting up 5G communications systems, integration and convergence of diverse wired and wireless technologies, earth observation, defense, security, and surveillance applications.

Key Highlights

- Defense personnel using a smartphone in the air can benefit from in-flight connectivity to access the internet. Ship personnel may benefit from crew connectivity with the latest maritime information, such as chart updates, engine monitoring, and weather routing broadcasts. The backpack terminals must be quickly and reliably deployed to support connectivity in harsh and emergent conditions.

- There have been accusations of linkages between cyberattacks and physical piracy, with pirates allegedly accessing the systems of shipping corporations to identify ships carrying valuable cargo with low onboard protection. As a result, the need to design a solid security system with features like a secret communication channel has arisen.

- The military and defense industry's main priority is the privacy and security of military communications. The need for enhanced data network security is driven by the increasing volume of IP-based data, including situational awareness video and remote sensor data provided across standard interfaces. Furthermore, as cyber resources on the ground, air, and space are subject to diverse threats, safeguarding military satellites from cyberattacks has become increasingly important. Security breaches could threaten citizen safety because military communication data and network infrastructure are vital.

- In February 2024, Thales announced to supply SurfSAT-L satellite communication solutions for F126 German frigates. This modernized system, previous versions of which have been in service with multiple navies worldwide, would ensure improved connectivity even under difficult operational conditions.

- However, cybersecurity has become a major concern in satellite communication, as launching a satellite to transmit data is highly sensitive. The challenge lies in the negative impact that cybersecurity threats can potentially have, as the vulnerabilities are mission-critical. The mission-critical vulnerabilities exposed to cybersecurity threats include the launch systems, communications, telemetry, tracking and command, and mission completion. The over-dependency of satellite communication on secure cyber capabilities across the satellite's lifespan makes it a serious concern, thus hindering its adoption.

Satellite Communication Market Trends

The Remote Sensing Segment is Expected to Hold a Significant Market Share

- Remote sensing aids the defense, military, and aerospace sectors by providing many data types. Navigating ships use remote sensing technology, such as wind-wave information, routing analysis, ship proximity, and GPS, to avoid hitting obstacles like icebergs and sinking. Many satellites orbit the Earth daily, collecting data useful for locating lost or destroyed aircraft. According to celestrak.org, there were around 26,673 orbit satellites globally in 2023.

- Remote sensing has been utilized as a surveillance method for many years. Remote sensors were used before the First World War by connecting them to hot air balloons and flying them over target cities. Remote sensing is carried out by specialized satellites with a wide range of capabilities. Optical satellites, radar imaging satellites, ultraviolet and infrared imagery satellites, and signal-intercepting communication satellites are a few examples.

- Remote sensing offers significant advantages over traditional forms of surveillance in that it can provide high-resolution imagery of light wavelengths other than visible light. This data can be utilized to track enemy movements, make strategic decisions, and assess tactical threats.

- There is now a need for better connection and higher-resolution imaging than before. This is beyond the ability of military-owned satellite technologies due to the fast growth of science and technology and the dependency of military activities on military-owned satellite technologies. Today, the US Military, the world's largest military, mainly relies on commercial satellite capabilities for military purposes. In October 2023, Airbus and US-headquartered defense company Northrop Grumman announced a Memorandum of Understanding (MoU) to develop and foster a strategic collaboration in military satellite communications for the United Kingdom's future wideband SKYNET military satellite communications program.

- A primary factor that could drive the satellite communication market's growth in the defense sector over the next few years is the application of AI in satellite communication for earth-based surveillance. The rising demand for remote sensing and monitoring applications and governments' plans to establish a network of spy satellites are also expected to drive market demand. The increased seaborne security risks, increased defense sector investments, and growing concerns about political instability in many parts of the world are driving the market.

Asia-Pacific is Expected to Hold a Significant Market Share

- The region is witnessing various innovations and investments in research and development to strengthen satellite communication in defense organizations. For instance, the Japanese government approved JPY 10.17 trillion (USD 66 billion) in defense spending in 2023. The funding will also be used to buy new defense equipment.

- In February 2024, the Indian armed forces allocated approximately INR 25,000 crore (USD 2,993.3 million) to fulfill its defense needs. These include establishing a surveillance satellite constellation and bolstering secure communication networks.

- Defense satellite services can assist military departments and boost operational effectiveness and mission success probabilities by offering dependable, secure broadband services that permit global interoperability on land, sea, and air.

- Moreover, military applications for satellite communication demand higher security standards than conventional uses. Military Satcom providers have, therefore, been driven to improve their solutions to meet the constantly rising demands of the military and defense industry. These demands include improving satellite communications capabilities, including bandwidth frequency, global broadcast, and personal communication service.

- In July 2024, Japan launched its upgraded Earth observation satellite, ALOS-4, aboard the new H3 rocket. The primary mission of the Advanced Land Observation Satellite (ALOS-4) is Earth observation, focusing on disaster response, mapmaking, and monitoring activities like volcanic eruptions, seismic shifts, and land movements. Additionally, it features an infrared sensor developed by the Defense Ministry, enabling it to monitor military actions, including missile launches.

Satellite Communication Industry Overview

The satellite communication market in the defense sector is fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Thales Group, Inmarsat Communications, Iridium Communications Inc., KVH Industries Inc., and Orbcomm Inc. Market players are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Seaborne Threats and Ambiguous Maritime Security Policies

- 5.1.2 Rise in Demand for Military and Defense Satellite Communication Solutions

- 5.2 Market Restraints

- 5.2.1 Cybersecurity Threats to Satellite Communication

- 5.2.2 Reliance on High-cost Satellite Equipment

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Ground Equipment

- 6.1.2 Services

- 6.2 By Application

- 6.2.1 Surveillance and Tracking

- 6.2.2 Remote Sensing

- 6.2.3 Disaster Recovery

- 6.2.4 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Thales Group

- 7.1.2 Inmarsat Communications

- 7.1.3 Iridium Communications Inc.

- 7.1.4 KVH Industries Inc.

- 7.1.5 Orbcomm Inc.

- 7.1.6 Cobham PLC

- 7.1.7 Thuraya Telecommunications Company (Al Yah Satellite Communications Company P.J.S.C)

- 7.1.8 ViaSat Inc.

- 7.1.9 ST Engineering iDirect

- 7.1.10 L3Harris Technologies Inc.