|

市場調查報告書

商品編碼

1687333

敞篷車車頂系統:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Convertible Roof System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

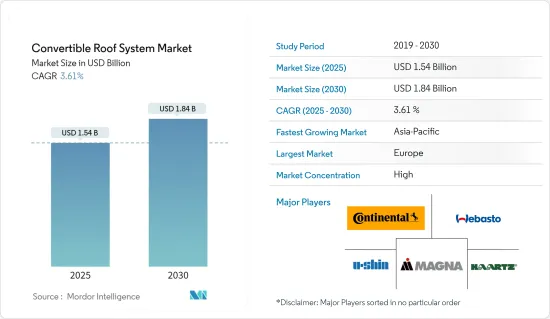

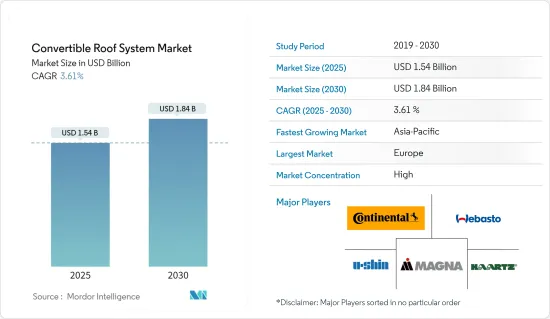

敞篷車車頂系統市場規模預計在 2025 年為 15.4 億美元,預計到 2030 年將達到 18.4 億美元,預測期內(2025-2030 年)的複合年成長率為 3.61%。

新冠疫情對汽車產業的影響是不可避免的,導致汽車製造廠因疫情而關閉。然而,由於對豪華車的需求不斷增加,預計市場將恢復成長動能。預計新興市場中SUV滲透率的提高將進一步推動市場發展。

在全球範圍內,玻璃技術不斷進步,對舒適性、安全性和便利性的需求不斷增加,對汽車錶面美觀度的要求也越來越高。此外,材料技術的創新和新興經濟體對敞篷車車頂系統不斷成長的客戶需求正在推動全球敞篷車車頂系統市場的發展。

敞篷車車頂系統市場趨勢

汽車製造商加大敞篷車車頂系統的投資

研究市場正在進行持續的評估和創新,以提高易用性和舒適度。

例如,汽車製造商正在為其汽車添加一些增強功能。多家公司正在推出配備更好的電子和感測器技術的產品系列,讓乘客可以購買可自訂的汽車並減少用戶的工作量。

2021年7月,偉巴斯特在Start-Ups Autobahn展會上展示了與多家新興企業合作開發的多項創新技術。該公司展示了一種用於汽車車頂的整合式動態照明概念,該概念由其與薄型、軟性 LED 照明和智慧表面解決方案專家 designLED 共同開發。兩家公司已經完成了由輕質瓦片製成的敞篷車車頂原型。

豪華車銷售的成長也是推動敞篷車車頂系統市場成長的因素之一。預計預測期內亞太地區將佔據豪華車銷量的大部分,其中中國、日本和印度等主要汽車市場預計將佔據主導地位。

大多數主要奢侈品牌都將中國視為其成長率最快的市場。中國是全球最大的汽車市場,對德國豪華汽車品牌來說至關重要。儘管過去兩年汽車行業經歷了下滑,但梅賽德斯·奔馳、寶馬和奧迪等德國豪華汽車製造商在 2020 年仍創下了銷售紀錄。 2020年,賓士銷量與前一年同期比較成長22.4%,BMW、Audi等其他汽車製造商的銷量分別成長15.4%和10.6%。

儘管受到新冠疫情影響,2020年前11個月中國豪華車銷量仍突破300萬輛,較去年同期成長9.3%。在中國整體汽車市場面臨下行壓力的背景下,這也標誌著高階品牌連續第三年實現成長。

亞太地區成為豪華汽車主要市場

敞篷車車頂系統的整體市場佔有率主要由歐洲佔據。然而,預計亞太地區在預測期內將以顯著的複合年成長率成長。

預計可轉換市場在預測期內將會成長。美國、加拿大、法國、英國、德國、西班牙以及中東和亞太地區的其他國家的豪華車銷售正在成長。美國是世界上最大的汽車市場之一,擁有超過13家主要汽車製造商。

隨著中國乘用車年均產量達到 800 萬輛,以及豪華車和高檔車的日益普及,該國敞篷車車頂產業的前景看好。敞篷車車頂系統產業嚴重依賴豪華和高檔汽車的銷售,而豪華和高檔汽車的銷售取決於人口的人均收入水平。

此外,中國和德國是汽車領域技術進步的主要中心,這將導致豪華車市場大幅擴張。年輕人口的成長也促進了亞太地區豪華車銷售的成長。印度也是豪華汽車的重要市場。印度政府也舉措來重振該國的豪華車銷售,例如降低商品及服務稅、進口關稅、(豪華)車輛登記稅,並支持銀行/非銀行金融公司為經銷商和客戶提供更容易的貸款,從而幫助擴大市場並促進整個行業的發展。

敞篷車車頂系統產業概覽

敞篷車車頂系統市場主要由 Webasto、Magna International、Haartz Corporation、U-Shin Ltd 和 Continental AG 等公司主導。公司正在透過推出新產品和創新來擴大業務。

例如,2021年7月,偉巴斯特宣布新款BMW4係將搭載偉巴斯特敞篷車車頂。車輛行駛時,只需按一下按鈕,車頂即可在 18 秒內開啟。在一個平滑的運動中,四個屋頂元素相互重疊。同時,頂蓋向後擺動,並將車頂元件存放在下面。

2020年12月,偉巴斯特為改款Stingray開發了自訂的全新兩件式可伸縮硬頂(RHT),車頂總合安裝有六台馬達,取代了液壓系統。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 依屋頂系統元件

- 屋頂材料

- 聚氯乙烯(PVC)

- 碳纖維

- 其他

- 車頂驅動系統(馬達)

- 其他(支撐架等)

- 屋頂材料

- 按屋頂類型

- 硬頂

- 軟頂

- 按車輛類型

- 掀背車

- SUV

- 轎車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 澳洲

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Webasto Group

- Magna International

- Valmet Corp.

- Haartz Corporation

- Continental AG

- Hoerbiger Holding

- U-Shin Ltd

- GAHH LLC

- Aisin Seiki

第7章 市場機會與未來趨勢

The Convertible Roof System Market size is estimated at USD 1.54 billion in 2025, and is expected to reach USD 1.84 billion by 2030, at a CAGR of 3.61% during the forecast period (2025-2030).

The impact of the COVID-19 pandemic on the automotive sector was inevitable with the shut down of automotive manufacturing units due to the pandemic-resultant lockdowns. However, the market is expected to regain its momentum owing to the rise in demand for luxury automobiles. The market's developments will be further aided by the rising penetration of SUVs in emerging markets.

Technological advancements in glass, increased demand for comfort, safety, and convenience features, and increased desire for the high aesthetic appeal of the surface in vehicles is being witnessed across the world. Furthermore, innovations in material technology and growing customer desire for convertible roof systems in emerging countries are driving the global convertible roof system market.

Convertible Roof System Market Trends

Auto Manufacturers Increasing Investments in Convertible Roof Systems

Consistent evaluations and innovations have been undertaken to improve ease and comfort in the market studied. For instance,

Automobile manufacturers are incorporating several enhanced features in their vehicles. Several companies are launching product line-ups with better electronics and sensor technologies, which allow passengers to purchase customizable vehicles and reduce users' effort. For instance,

o In July 2021, Webasto announced multiple innovations developed in collaboration with several startups at the Startup Autobahn exhibition. The company showcased an integrated dynamic lighting concept for automotive roofs developed with designLED, a specialist in thin and flexible LED lighting and smart surface solutions. The two companies completed a prototype for a convertible roof element with light tiles.

Increasing luxury car sales is another factor driving the market growth for convertible roof systems. Asia-Pacific is expected to dominate luxury car sales during the forecast period due to major automotive markets such as China, followed by Japan and India.

Most major luxury brands see China as the fastest-growing market in terms of growth rate. China is the largest auto market globally, but it is disproportionately important to German premium car brands. German luxury car manufacturers, i.e., Mercedes-Benz, BMW, and Audi, posted record sales in 2020 despite the industry's decline over the previous two years. In 2020, Mercedes-Benz reported a Y-o-Y increase of 22.4%, while other carmakers like BMW and Audi witnessed increases of 15.4% and 10.6%, respectively.

Despite the COVID-19 pandemic, China's luxury vehicle sales in the first 11 months of 2020 exceeded 3 million units with a Y-o-Y increase of 9.3%. This also marked the third consecutive year for luxury brands to register growth in the wake of downward pressure in China's overall automotive market.

Emergence of Asia-Pacific as Major Market for Luxury Vehicles

Europe dominated the overall share of the convertible roof system market. However, the Asia-Pacific region is expected to record a significant CAGR during the forecast period.

The convertible market is expected to grow over the forecast period. Countries like the US, Canada, France, the UK, Germany, Spain, and others in the Middle East and Asia-Pacific regions are witnessing growth in luxury car sales. The US is one of the largest automotive markets globally and is home to over 13 major auto manufacturers.

With an average production of 8 million passenger vehicle units per annum and the growing popularity of luxury and premium cars with consumers, prospects for the convertible roof industry in the country are high. The convertible roof system industry is highly dependent on the sales of luxury and premium cars, which are, in turn, dependent on the per capita income levels of the population.

Additionally, China and Germany are the major hubs for technological advancements in the automotive sector, leading to a significant expansion of the luxury vehicles market. The growing youth population is yet another contributing factor for the growth of luxury car sales in the APAC region. India is another important market for luxury cars. The Indian government is also taking initiatives to recover the sales of luxury cars in the country by reducing GST, import duties, registration taxes on (luxury) cars, and providing support from banks/NBFCs to offer easy access to loans for dealers and customers, which will help expand the market and boost the overall sector.

Convertible Roof System Industry Overview

The convertible roof system market is majorly dominated by Webasto, Magna International, The Haartz Corporation, U-Shin Ltd, and Continental AG, among others. The companies are expanding their businesses by launching new products and innovations. For instance:

In July 2021, Webasto announced that the new BMW 4 Series features a convertible roof from Webasto. The roof can be opened within 18 seconds while driving at the touch of a button. In a single flowing movement, the four roof elements are stacked on top of each other. At the same time, the top cover opens backward, and the roof elements are stored underneath.

In December 2020, Webasto developed the new, custom-made two-part retractable hard top (RHT) for the re-imagined Stingray, with a total of six electric motors fitted in the roof in place of a hydraulic system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Roof System Components Type

- 5.1.1 Roof Material

- 5.1.1.1 Polyvinyl Chloride (PVC)

- 5.1.1.2 Carbon Fiber

- 5.1.1.3 Other Roof Materials

- 5.1.2 Roof Drive System (Motors)

- 5.1.3 Other Roof System Component Types (Supporting Frames, etc.)

- 5.1.1 Roof Material

- 5.2 Roof Top Type

- 5.2.1 Hard Top

- 5.2.2 Soft Top

- 5.3 Vehicle Type

- 5.3.1 Hatchback

- 5.3.2 SUV

- 5.3.3 Sedan

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 UK

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 Australia

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Webasto Group

- 6.2.2 Magna International

- 6.2.3 Valmet Corp.

- 6.2.4 Haartz Corporation

- 6.2.5 Continental AG

- 6.2.6 Hoerbiger Holding

- 6.2.7 U-Shin Ltd

- 6.2.8 GAHH LLC

- 6.2.9 Aisin Seiki