|

市場調查報告書

商品編碼

1687328

馬達:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Electric Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

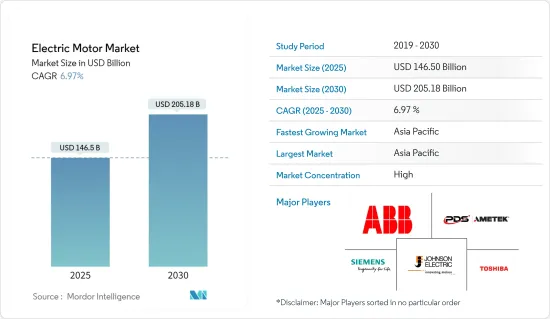

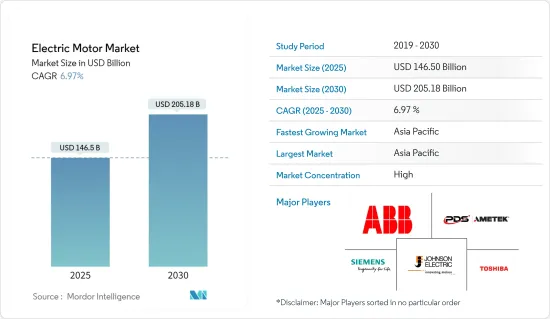

馬達市場規模預計在 2025 年為 1,465 億美元,預計到 2030 年將達到 2051.8 億美元,預測期內(2025-2030 年)的複合年成長率為 6.97%。

主要亮點

- 從中期來看,馬達在住宅應用中的使用增加、電動車的普及以及各種工業流程自動化程度的提高等因素預計將推動馬達市場的發展。

- 另一方面,惡劣的營運條件導致的使用壽命縮短以及原料價格波動等市場限制預計將阻礙市場成長。

- 然而,馬達技術的進步為市場帶來了巨大的機會。例如,軸流和輪內發電等新興技術越來越受歡迎。軸向馬達技術具有許多優勢,包括更高的功率和扭矩密度以及易於整合到各種應用中的薄餅式設計。

- 由於目前工業領域的進步,預計亞太地區將在預測期內成為市場的王牌。

馬達市場趨勢

汽車產業的成長

- 由於人們擴大轉向使用電動車作為清潔的交通方式,預計汽車產業在預測期內將顯著成長。

- 隨著中國、美國、日本、韓國和歐洲的電動車銷售快速成長,馬達的需求預計將呈指數級成長。由於各國政府推出的推廣電動車的獎勵、普通購車者環保意識的增強以及燃料價格的上漲,全球電動車銷售量呈指數級成長。

- 其他因素包括電動車的營業成本低於傳統內燃機汽車 (ICE),以及中國和歐盟政府宣布將在 2035 年前禁止 ICE 出行。

- 一些政府已採取舉措增加電動車的銷售量。政府也為製造商提供補貼和機會,以建立內部電池和馬達製造工廠。中國、印度、法國、英國等國都宣布計畫在2040年前逐步淘汰汽油和柴油車。例如,歐盟於2022年10月宣布,將從2035年起禁止在歐盟成員國銷售新的內燃機汽車。

- 據聯邦汽車運輸局稱,近年來,德國新註冊的電動車數量大幅增加。 2022年迄今,印度已註冊470,559輛新電動車,與前一年同期比較成長32.19%。

- 預計這些發展將在預測期內加速工業領域對馬達的需求。

亞太地區預計將主導市場成長

- 亞太地區是馬達產業的最佳舉辦地,由於工業部門的快速成長,預計未來幾年該地區仍將保持主導地位。該地區的汽車、化工、化肥和石化等行業正在穩步成長,預計將為全球馬達製造商提供巨大的成長機會。

- 中國一直是全球製造業的驅動力。中國在鋼鐵、化工、電力和水泥工業領域居世界領先地位,在石化和精製工業領域也主要企業。在中國,多個新的工業計劃正在排隊等待加入該國的工業組合。

- 近期,中國政府核准了一個有外國公司參與的新煉油廠計劃。 2022年1月,由阿美主導的合資企業做出最終投資決定,在中國東北地區開發大型綜合煉油和石化計畫。新的綜合大樓將建在盤鎮市。預計該項目將於 2024 年運作,產能為 30 萬桶/天。

- 印度是世界第二大粗鋼生產國,並且仍在成長。 2023年4月,新日本製鐵株式會社(NSC)宣布計畫在印度奧裡薩邦建立世界上最大的鋼鐵廠。投資金額約1.02億印度盧比。該公司已與 LN Mittal 領導的安賽樂米塔爾 (Arcelor Mittal) 合作在奧裡薩邦開展業務。

- 2023年1月,新日鐵和安賽樂米塔爾的合資企業AMNS印度公司獲得奧裡薩邦政府核准,將在該國建設一項價值46.8億美元的鋼鐵廠計劃。該工廠的年生產量約為700萬噸。

- 這些發展將在未來幾年對馬達市場產生巨大影響。

馬達產業概況

馬達市場比較分散。市場的主要企業(不分先後順序)包括 ABB 有限公司、AMETEK 公司、德昌電機控股有限公司、西門子股份公司和東芝公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 2028 年市場規模與需求預測(美元)

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 住宅馬達的使用增加

- 電動車日益普及

- 限制因素

- 原物料價格波動

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場區隔

- 依馬達類型

- AC

- DC

- 按電壓

- 小於1kV

- 1kV至6kV之間

- 6kV以上

- 按應用

- 住宅

- 商業的

- 車

- 工業的

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 北美洲

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- ABB Ltd.

- AMETEK Inc.

- Regal Rexnord Corporation

- Robert Bosch GmbH

- Johnson Electric Holdings Limited

- Siemens AG

- Rockwell Automation

- TECO-Westinghouse Motor Company

- Toshiba Corp.

- Weg SA

- Nidec Corporation

- Hitachi Ltd.

第7章 市場機會與未來趨勢

- 馬達技術進步

簡介目錄

Product Code: 61333

The Electric Motor Market size is estimated at USD 146.50 billion in 2025, and is expected to reach USD 205.18 billion by 2030, at a CAGR of 6.97% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing residential usage of the electric motor, increasing adoption of electric vehicles, and increasing automation in various industrial processes, are expected to drive the electric motor market.

- On the other hand, the restraints like the life expectancy of these assets due to harsh operating conditions and fluctuating prices of raw materials are expected to hamper the market growth.

- Nevertheless, the technological developments for the advancement of electric motor technology create tremendous opportunities for the market. For example, emerging technologies like axial flux, in-wheel, etc., are gaining popularity. Axial flux motor technology offers numerous benefits like increased power and torque density and a pancake form factor ideal for integration in various scenarios.

- The Asia-Pacific region is expected to ace the market during the forecast period due to the progress in the industrial sector currently witnessed.

Electric Motors Market Trends

Automotive Segment to Witness Growth

- The automotive segment is estimated to witness significant growth during the forecast period owing to the increasing transition towards electric vehicles as a cleaner source of transportation.

- The demand for electric motors is expected to increase exponentially, owing to the rapid growth of electric vehicle sales across China, the United States, Japan, South Korea, and Europe. Electric vehicle sales are rising exponentially worldwide due to government incentives offered by various Governments to promote electromobility, increasing environmental consciousness amongst general car buyers, and rising fuel prices.

- It is also due to lower operating costs provided by electric vehicles than traditional internal combustion engine (ICE) vehicles and announcements by the governments of China and the EU to ban ICE mobility by 2035.

- The government across several countries is adopting initiatives to increase the sales of electric vehicles. The government also provides subsidies and opportunities for manufacturers to install battery and motor manufacturing plants in-house. Countries such as China, India, France, and the United Kingdom have announced plans to phase out the petrol and diesel vehicles industry entirely before 2040. For instance, in October 2022, European Union announced the ban on selling new ICE vehicles from 2035 in EU member states.

- According to Federal Motor Transport Authority, Germany has seen a significant increase in the number of new electric cars registered in recent years. So far, in 2022, 470,559 new electric cars have been registered, representing a growth of 32.19% compared with the previous year's figures.

- Such developments are expected to accelerate the demand for electric motors in the industrial sector during the forecast period.

Asia-Pacific Expected to Dominate the Market Growth

- Asia-Pacific is the best host for the electric motors industry and is expected to continue its dominance in the coming years on account of rapid growth in the industrial sector. Industries such as automotive, chemical, fertilizers, and petrochemical are witnessing steady growth in the region, which is expected to offer tremendous growth opportunities for the global electric motor players.

- China has been instrumental in driving the manufacturing sector globally. The country is the global leader in the steel, chemical, power, and cement industries, among the top players in the petrochemical and refining industries. Several new industrial projects are queued up in the country to get added to the national industry portfolio.

- Recently, the Chinese government approved new refinery projects with foreign companies' participation. In January 2022, an Aramco-led joint venture took the final investment decision to develop a major integrated refinery and petrochemical complex in Northeast China. The new complex will be located in Panjin City. It is expected to be operational by 2024, with a capacity of 300,000 BPD.

- India is the second-largest producer of crude steel at the global level, and the progress is still on. In April 2023, Nippon Steel Corporation (NSC) announced its plan to set up the world's largest steel plant facility in Odisha, India. The company will invest around INR 1.02 lakh crore. The company already has a presence in Odisha with LN Mittal-led Arcelor Mittal.

- In January 2023, AMNS India, a joint venture between Nippon Steel and Arcelor Mittal, received approval for a USD 4.68 billion steel plant project from the government of Odisha. The annual production capacity of the plant will be around 7 million tons.

- Such developments will likely overwhelmingly impact the electric motor market in the coming years.

Electric Motors Industry Overview

The electric motor market is fragmented. Some of the major companies in the market (not in any particular order) include ABB Ltd. AMETEK Inc., Johnson Electric Holdings Limited, Siemens AG, and Toshiba Corp., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Residential Usage of the Electric Motor

- 4.5.1.2 Rising Adoption of Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 Fluctuating Prices of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Motor Type

- 5.1.1 AC

- 5.1.2 DC

- 5.2 Voltage

- 5.2.1 Less than 1 kV

- 5.2.2 Between 1kV-6kV

- 5.2.3 Higher than 6 kV

- 5.3 Application

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Automotive

- 5.3.4 Industrial

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd.

- 6.3.2 AMETEK Inc.

- 6.3.3 Regal Rexnord Corporation

- 6.3.4 Robert Bosch GmbH

- 6.3.5 Johnson Electric Holdings Limited

- 6.3.6 Siemens AG

- 6.3.7 Rockwell Automation

- 6.3.8 TECO-Westinghouse Motor Company

- 6.3.9 Toshiba Corp.

- 6.3.10 Weg SA

- 6.3.11 Nidec Corporation

- 6.3.12 Hitachi Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Developments for the Advancement of Electric Motor

02-2729-4219

+886-2-2729-4219