|

市場調查報告書

商品編碼

1687323

輪胎加固材料:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Tire Reinforcement Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

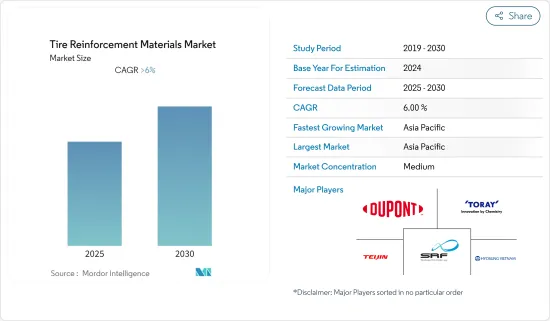

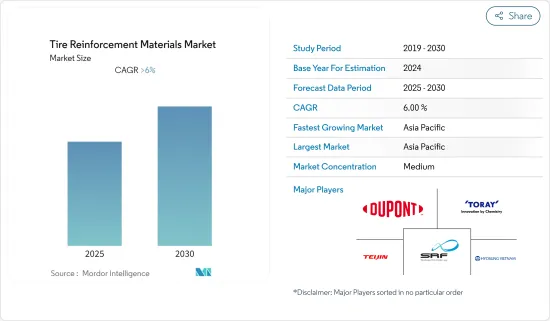

預計預測期內輪胎加固市場複合年成長率將超過 6%。

由於全球汽車產量的增加,2021 年輪胎加固材料經歷了成長。根據 OICA資料,2021 年全球整體汽車產量與 2020 年相比小幅成長了 3%。由於工業應用的增加和汽車行業的成長,預計未來幾年市場將會成長。

主要亮點

- 3D 列印和智慧輪胎的發展預計會阻礙市場的發展。

- 亞太地區佔全球市場主導地位,其中中國、印度等國家消費量最大。

輪胎加強材料市場趨勢

簾線輪胎迅速佔領市場

- 輪胎簾布是一種工業,經向採用高強度紗線,緯向採用阻力可忽略不計的紗線製造,用於將經線固定到位。

- 輪胎簾布塗層織物由於其可控變形、高強度和耐磨性等特性,是最常用的類型。

- 輪胎簾布通常用作卡車、巴士和非公路車輛 (OTR) 斜交輪胎的加固材料。

- 根據OICA的最新統計數據,2021年全球整體汽車銷量達到82,684,788輛,而2020年為78,774,320輛。

- 輪胎簾布簾子佈還包括各種編織增強材料,例如聚酯輪胎簾布簾子佈、尼龍輪胎簾布輪胎簾布包布(包括吸濕排汗和非吸濕排汗胎圈包布)。

- 預測期內,輪胎簾布簾子佈的需求預計會增加。

亞太地區佔市場主導地位

- 預計預測期內亞太地區將主導輪胎加固市場,這主要歸因於印度和中國的汽車產量快速成長。

- 2021年亞洲、大洋洲和中東地區總合售出42,663,736輛汽車,較2020年成長5.8%。

- 隨著新產品的推出、借貸利率的下降以及個人行動領域的持續發展勢頭,該行業可能會在未來幾年快速發展。

- 此外,加大研發投入和注重設備升級預計將推動日本汽車市場的發展。

- 因此,預測期內輪胎加固市場可能會擴大。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 全球汽車使用量增加

- 其他促進因素

- 限制因素

- 輪胎製造的環境問題

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 材料

- 鋼

- 聚酯纖維

- 尼龍

- 人造絲

- 芳香聚醯胺

- 其他材料

- 科技

- 拉絲

- 熔融紡絲

- 溶液紡絲

- 類型

- 輪胎簾布簾子佈

- 輪胎輪胎邊緣鋼絲

- 應用

- 汽車汽車胎體

- 帶束層

- 完帶層

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率/排名分析

- 主要企業策略

- 公司簡介

- Bekaert

- Century Enka Limited.

- CORDENKA GmbH & Co. KG

- Dupont

- FORMOSA TAFFETA CO. LTD

- Glanzstoff Industries

- HYOSUNG

- Jiangsu Taiji Industry New Materials Co. Ltd

- Jiangsu Xingda Steel Tire Cord Co. Ltd

- Kolon Industries Inc.

- Kordsa Teknik Tekstil AS

- Michelin

- SRF Limited

- Teijin Ltd

- Toray Hybrid Cord Inc.

- TOYOBO CO. LTD

第7章 市場機會與未來趨勢

The Tire Reinforcement Materials Market is expected to register a CAGR of greater than 6% during the forecast period.

Tire reinforcement materials had a growth in 2021, with the increase in automotive production across the globe. According to OICA data, automotive production across the world increased by a slight value of 3% in 2021 compared to 2020. In the coming years, with the increase in industrial applications and growth in the automotive industry, the market is expected to grow in the coming years.

Key Highlights

- The development of 3D-printed and smart tires is expected to hinder the market.

- Asia-Pacific dominated the market across the world, with the largest consumption in countries such as China and India.

Tire Reinforcement Materials Market Trends

Tire Cord Fabric to Dominate the Market

- Tire cord fabric is a type of industrial fabric manufactured using high tenacity yarns in the warp direction and yarns of negligible resistance in the weft direction used to hold warn yarns locked in their position.

- Tire cord coated fabrics are the majorly used type due to properties such as controlled deformation, high strength, abrasion resistance, etc.

- Tire cords are often used as reinforcing materials in bias tires for trucks, buses, and off-the-road (OTR) vehicles.

- As per the latest OICA statistics, the overall sales of vehicles across the world amounted to 82,684,788 units in 2021 compared to 78,774,320 units in 2020.

- Tire cord textiles also include a variety of textile reinforcements such as polyester tire cord fabrics, nylon tire cord fabrics, cycle tire cord fabrics, and chafer fabrics for heavy-duty tires and tubeless radial tires, including wicking and non-wicking chafer.

- The demand for tire cord fabric is expected to increase over the forecast period.

Asia-Pacific Dominates the Market

- Asia-Pacific is expected to dominate the market for tire reinforcement materials during the forecast period, majorly owing to the rapidly increasing automotive production in India and China.

- A total of 42663736 units of vehicles were sold in 2021 across Asia, Oceania, and the Middle Eastern regions, registering a 5.8% growth compared to 2020.

- Because of new product introductions, decreased borrowing rates, and sustained momentum in the personal mobility area, the industry is likely to develop rapidly in the coming years.

- Additionally, increasing investments in R&D and focus on the up-gradation of equipment are expected to boost the automotive market in Japan.

- This, in turn, is likely to augment the market for tire reinforcement materials during the forecast period.

Tire Reinforcement Materials Industry Overview

The tire reinforcement materials market is partially consolidated in nature. Some of the major players (not in any particular order) in the market include DuPont, Hyosung, SRF Limited, Teijin Ltd, and Toray Hybrid Cord Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Vehicle Usage Across the Globe

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Environmental Issues in Manufacturing of Tires

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Material

- 5.1.1 Steel

- 5.1.2 Polyester

- 5.1.3 Nylon

- 5.1.4 Rayon

- 5.1.5 Aramid

- 5.1.6 Other Materials

- 5.2 Technology

- 5.2.1 Drawing

- 5.2.2 Melt Spinning

- 5.2.3 Solution Spinning

- 5.3 Type

- 5.3.1 Tire Cord Fabric

- 5.3.2 Tire Bead Wire

- 5.4 Application

- 5.4.1 Automobile Carcasses

- 5.4.2 Belt Ply

- 5.4.3 Cap Ply

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Bekaert

- 6.4.2 Century Enka Limited.

- 6.4.3 CORDENKA GmbH & Co. KG

- 6.4.4 Dupont

- 6.4.5 FORMOSA TAFFETA CO. LTD

- 6.4.6 Glanzstoff Industries

- 6.4.7 HYOSUNG

- 6.4.8 Jiangsu Taiji Industry New Materials Co. Ltd

- 6.4.9 Jiangsu Xingda Steel Tire Cord Co. Ltd

- 6.4.10 Kolon Industries Inc.

- 6.4.11 Kordsa Teknik Tekstil AS

- 6.4.12 Michelin

- 6.4.13 SRF Limited

- 6.4.14 Teijin Ltd

- 6.4.15 Toray Hybrid Cord Inc.

- 6.4.16 TOYOBO CO. LTD