|

市場調查報告書

商品編碼

1687322

碳複合材料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Carbon Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

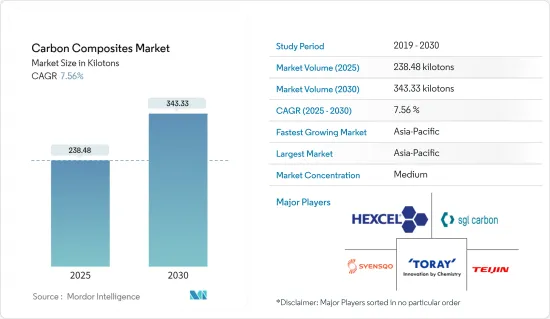

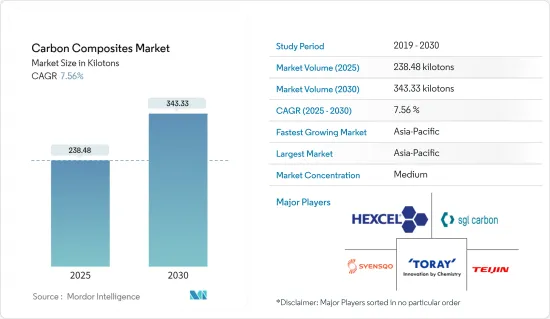

碳複合材料市場規模預計在 2025 年為 238.48 千噸,預計在 2030 年達到 343.33 千噸,預測期內(2025-2030 年)的複合年成長率為 7.56%。

COVID-19 對碳複合材料產業產生了負面影響。全球封鎖和嚴格的政府監管導致大多數生產基地關閉,造成了毀滅性的打擊。儘管如此,自 2021 年以來,業務一直在復甦,預計未來幾年將顯著上升。

主要亮點

- 推動市場發展的首要因素是航太和國防工業的需求不斷增加以及風力發電領域的需求不斷增加。

- 然而,其製造成本高於其他複合材料,且替代品的存在阻礙了市場成長。

- 然而,碳複合材料在 3D 列印中的應用日益廣泛,以及對燃料電池電動車 (FCEV) 的需求不斷增加,提供了市場機會。

- 亞太地區貢獻了最高的市場佔有率,預計在預測期內將佔據市場主導地位。

碳複合材料市場趨勢

航太和國防應用佔市場主導地位

- 航太和國防部門作為主要的最終用戶,佔據碳複合材料市場的主導地位。從歷史上看,航太製造依賴鋁、鋼和鈦等金屬,這些金屬約佔飛機重量的 70%。最近,碳複合材料由於其重量輕、耐用、絕緣和吸收雷達波的特性,其使用量激增。

- 碳複合材料由聚合物基質中的碳纖維組成,具有防鏽、防腐蝕等特點,可降低維護成本。

- 這些材料具有很高的強度重量比,使飛機更輕,燃燒更少的燃料,並允許它們在更長的飛行中搭載更多的乘客。

- 主要的航太應用包括夾子、夾板、支架、肋骨、支柱、縱梁、機翼前緣和特殊部件。

- 在航太工業中,它也被考慮用於機翼抗扭箱和機身面板等大型結構。碳複合材料也用於飛彈防禦、地面防禦和軍事海上應用。

- 例如,波音 787 夢幻飛機採用連續壓縮成型 (CCM) 製程製造的複合材料天花板導軌。

- 由於技術的快速進步和創新,航太業正在經歷飛機製造的激增。波音公司 2023 年至 2042 年的商業性展望強調,國際運輸量和國內航空旅客數量正在恢復並恢復到疫情前的水準。綜合這些因素,波音公司預計到 2042 年全球對新商用噴射機的需求將達到 48,575 架。

- 2023年,波音交付528架飛機,獲得1,314份新訂單。波音公司實現了交付至少 375 架單通道飛機的修訂目標,但在 2022 年交付了396 架窄體737噴射機,未達到其最初 400-450 架的目標。

- 同時,空中巴士公佈,2023年將向全球87家客戶交付735架民航機,與前一年同期比較成長11%。此外,空中巴士民航機部門在年內獲得了2,319份新訂單,顯示出強勁而積極的市場前景。

- 2023年,北約31個成員國軍費總合達1,3,410億美元,佔全球軍費開支的55%。由於北約成員國計畫增加國防預算,目標是將國防支出佔國內生產總值) 的 2%,歐洲國防市場預計將大幅成長。

- 因此,由於上述因素,航太和國防領域預計將佔據市場主導地位。

亞太地區佔市場主導地位

- 亞太地區在全球碳複合材料市場佔有最高佔有率。碳複合材料的需求大多來自航太和國防、汽車以及體育和休閒休閒。

- 碳複合材料因其高強度重量比、耐腐蝕性和易加工性而在汽車行業有著巨大的需求。由於其重量輕但強度高,有助於降低燃料消耗,因此在各種汽車應用中,它擴大取代金屬。

- 根據國際貿易管理局(ITA)的數據,中國是世界第二大民用航太市場。中國民航局估計,航空業可望將國內客運量恢復到疫情爆發前的約85%水準。

- 2023年4月,空中巴士公司與天津富眾投資有限公司、中國航空工業Group Limited簽署了新的合作協議,以擴大A320系列飛機的組裝。此次擴建包括在空中巴士天津工廠增加第二條組裝。該協議支持空中巴士到 2026 年透過其全球生產網路每月生產 75 架飛機的總體目標。

- 根據中國工業協會最新發布的資料,預計2023年全國汽車產量將超過3,016萬輛,與前一年同期比較增加11.6%。 2023年,全國乘用車銷量3,009萬輛,與前一年同期比較成長12%。

- 此外,中國政府預測,到2025年電動車普及率將達20%。如此大規模的投資預計將推動中國汽車產業的發展,並對市場產生積極影響。

- 預計所有上述因素都將在未來幾年推動碳複合材料市場的發展。預計亞太地區將在預測期內佔據市場主導地位。

碳複合材料產業概況

全球碳複合材料市場因其性質而部分分散。主要企業(排名不分先後)包括東麗工業公司、Syensqo、赫氏公司、帝人株式會社和西格里碳素股份有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 航太和國防工業的需求不斷成長

- 風力發電產業需求不斷成長

- 限制因素

- 與其他複合材料相比製造成本較高

- 替代方案的可用性

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按矩陣

- 混合

- 金屬

- 陶瓷製品

- 碳

- 聚合物

- 熱固性

- 熱塑性塑膠

- 按工藝

- 預浸料提升工藝

- 拉擠纏繞

- 濕層壓灌注工藝

- 壓制和注射工藝

- 其他

- 按應用

- 航太與國防

- 車

- 風力發電機

- 運動休閒

- 土木工程

- 海洋

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Carbon Composites Inc.

- China Composites Group Corporation Ltd

- Epsilon Composite

- Hexcel Corporation

- Mitsubishi Chemical Corporation

- Nippon Carbon Co. Ltd

- Plasan

- Rockman

- SGL Carbon

- Syensqo

- Teijin Limited

- Toray Industries Inc.

第7章 市場機會與未來趨勢

- 擴大碳複合材料在3D列印的應用

- 燃料電池電動車(FCEV)需求不斷成長

The Carbon Composites Market size is estimated at 238.48 kilotons in 2025, and is expected to reach 343.33 kilotons by 2030, at a CAGR of 7.56% during the forecast period (2025-2030).

COVID-19 had a negative impact on the carbon composites sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business has been recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- The major factors driving the market are increasing demand from the aerospace and defense industry and increasing demand from the wind energy sector.

- However, the high cost of manufacturing in comparison to other composites and the presence of substitutes are hindering the market growth.

- Nevertheless, the growing adoption of carbon composites in 3D printing and increasing demand from fuel cell electric vehicles (FCEVs) will be the market opportunities.

- The Asia-Pacific region accounts for the highest market share and is expected to dominate the market during the forecast period.

Carbon Composites Market Trends

Aerospace and defense applications to dominate the market

- The aerospace and defense sectors dominate the carbon composite market as its primary end-users. Historically, aerospace manufacturing relied on metals like aluminum, steel, and titanium, which made up about 70% of an aircraft's weight. Recently, the use of carbon composites has surged due to their weight reduction, resistance, insulation, and radar absorption properties.

- Carbon composites, made of carbon fibers in a polymer matrix, reduce maintenance costs by resisting rust and corrosion.

- With superior strength-to-weight ratios, these materials lighten aircraft, reducing fuel consumption and allowing longer flights with more passengers.

- Key aerospace applications include clips, cleats, brackets, ribs, struts, stringers, wing leading edges, and specialized parts.

- The aerospace sector is also exploring their use in larger structures like wing torsion boxes and fuselage panels. Carbon composites are used in missile defense, ground defense, and military marine applications.

- Industry leaders like Boeing use various carbon fiber-based composite parts in their aircraft, such as the Boeing 787 Dreamliner, which features composite ceiling rails made using continuous compression molding (CCM) processes.

- The aerospace industry is witnessing a surge in aircraft manufacturing, driven by swift technological advancements and innovations. Boeing's Commercial Outlook for 2023-2042 highlights a rebound in international traffic and domestic air travel, returning to pre-pandemic levels. Owing to these factors, Boeing forecasts global demand for 48,575 new commercial jets by 2042.

- In 2023, Boeing delivered 528 aircraft and secured 1,314 net new orders, a notable increase from 480 deliveries and 774 net new orders in 2022. While Boeing met its revised goal of delivering at least 375 single-aisle planes, it delivered 396 narrowbody 737 jets in 2022, falling short of its initial target of 400 to 450 jets.

- Airbus, on the other hand, reported delivering 735 commercial aircraft to 87 global customers in 2023, marking an 11% increase from the prior year. Airbus's "Commercial Aircraft" division also secured 2,319 gross new orders in the same year. Indicated a strong positive market outlook.

- In 2023, the 31 NATO members collectively spent USD 1,341 billion, constituting 55% of the global military expenditure. The European defense market is projected to grow substantially as NATO members have aimed to increase the defense budget by targeting spending of 2% of the Gross Domestic Product (GDP).

- Hence, due to the aforementioned factors, the aerospace and defense sector is expected to dominate the market studied.

Asia Pacific to dominate the market

- Asia-Pacific accounts for the highest share of the global carbon composites market. Most of the demand for carbon composites comes from applications in aerospace and defense, automotive, sports and leisure, etc.

- Carbon composites have been witnessing tremendous demand in the automotive industry owing to their high strength-to-weight ratios, corrosion resistivity, and workability features. They have been replacing metals in various automotive applications due to their lightweight but tough features, which contribute to lesser fuel consumption.

- According to the International Trade Administration (ITA), China is the world's second-largest civil aerospace market. The Civil Aviation Administration of China (CAAC) estimates that the aviation sector is expected to recover domestic traffic to approximately 85% of pre-pandemic levels.

- In April 2023, Airbus signed a new cooperation agreement with Tianjin FZ Investment Company Ltd. and Aviation Industry Corp of China Ltd. to expand the final assembly capacity of the A320 Family. This expansion includes adding a second assembly line at Airbus's Tianjin facility. The agreement supports Airbus's overall target of producing 75 aircraft per month by 2026 across its global production network.

- According to the latest data released by the China Association of Automobile Manufacturers (CAAM), car production in the country exceeded 30.16 million units in 2023, an 11.6% increase compared to the previous year. A total of 30.09 million passenger cars were sold in the country in 2023, a 12% increase compared to the previous year.

- Moreover, the Chinese government estimates a 20% penetration rate of electric vehicles by 2025. Such significant investments are projected to propel the country's automotive sector and positively impact the market studied.

- All the above-mentioned factors are expected to drive the market for carbon composites in the coming years. Asia-Pacific is expected to dominate the market studied during the forecast period.

Carbon Composites Industry Overview

The global carbon composites market is partially fragmented in nature. The major players (not in any particular order) include Toray Industries Inc., Syensqo, Hexcel Corporation, Teijin Limited, and SGL Carbon SE, among other companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Aerospace and Defense Industry

- 4.1.2 Increasing Demand from the Wind Energy Sector

- 4.2 Restraints

- 4.2.1 High Cost for Manufacturing in Comparison to Other Composites

- 4.2.2 Presence of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Matrix

- 5.1.1 Hybrid

- 5.1.2 Metal

- 5.1.3 Ceramics

- 5.1.4 Carbon

- 5.1.5 Polymer

- 5.1.5.1 Thermosetting

- 5.1.5.2 Thermoplastic

- 5.2 Process

- 5.2.1 Prepeg Layup Process

- 5.2.2 Pultrusion and Winding

- 5.2.3 Wet Lamination and Infusion Process

- 5.2.4 Press and Injection Processes

- 5.2.5 Other Processes

- 5.3 Application

- 5.3.1 Aerospace and Defense

- 5.3.2 Automotive

- 5.3.3 Wind Turbines

- 5.3.4 Sports and Leisure

- 5.3.5 Civil Engineering

- 5.3.6 Marine Applications

- 5.3.7 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Carbon Composites Inc.

- 6.4.2 China Composites Group Corporation Ltd

- 6.4.3 Epsilon Composite

- 6.4.4 Hexcel Corporation

- 6.4.5 Mitsubishi Chemical Corporation

- 6.4.6 Nippon Carbon Co. Ltd

- 6.4.7 Plasan

- 6.4.8 Rockman

- 6.4.9 SGL Carbon

- 6.4.10 Syensqo

- 6.4.11 Teijin Limited

- 6.4.12 Toray Industries Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Carbon Composites in 3D-Printing

- 7.2 Increasing Demand from Fuel Cell Electric Vehicle (FCEV)