|

市場調查報告書

商品編碼

1687321

離子交換樹脂:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Ion Exchange Resin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

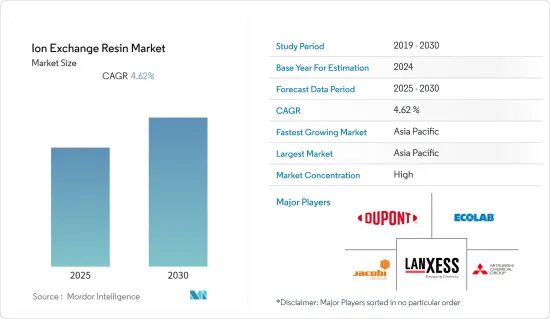

預計預測期內離子交換樹脂市場將以 4.62% 的複合年成長率成長。

市場受到了 COVID-19 的負面影響。疫情導致許多國家採取封鎖措施,以遏止病毒傳播。許多企業和工廠關閉,擾亂了全球供應鏈,影響了全球的生產、交貨時間和產品銷售。目前,市場正在從新冠疫情中復甦並經歷顯著成長。

主要亮點

- 中期推動市場成長的主要因素是水處理行業的成長以及電子和製藥行業對超純水的需求不斷成長。

- 然而,離子交換樹脂的細菌污染可能會阻礙市場成長。

- 預計燃料電池需求的不斷成長將為市場提供成長機會。

- 亞太地區佔據市場主導地位,其中中國和印度是最大的消費國。此外,預計亞太地區在預測期內將實現最快的成長率。

離子交換樹脂市場趨勢

水處理領域正在推動市場

- 離子交換樹脂通常用作水處理劑,去除水中的微量金屬離子、有機化合物和污染物。

- 由於對淡水資源的強勁需求,水處理應用近年來有所增加。在污水處理廠中,水循環利用是一個多步驟的過程。離子交換處理流程通常用於軟化水或海水淡化。它也用於在脫鹼、去離子和消毒等過程中去除水中的其他物質。它們適用於工業和市政應用。

- 近年來,離子交換樹脂在飲用水中的應用越來越多。專用樹脂用於處理各種污染物,包括高氯酸鹽和鈾。

- 還有許多樹脂專門用於去除硝酸鹽和高氯酸鹽,例如強鹼/強陰離子樹脂。還有樹脂珠可用於軟化水。

- 樹脂材料的交換容量是有限的。隨著使用時間的延長,各個替換部位將會變得滿滿的。當離子交換不再可行時,必須重新充電或再生樹脂以使其恢復到原始狀態。用於此目的的物質包括氯化鈉、鹽酸、硫酸和氫氧化鈉。

- 廢再生劑是該過程剩餘的主要物質。這包括所有去除的離子以及總溶解固態含量高的過量再生劑。該再生劑可以在市政污水處理廠進行處理,但排放可能需要監測。

- 離子交換在水處理中的有效性可能會受到礦物結垢、表面堵塞和其他導致樹脂污染的問題的限制。過濾或添加化學物質等預處理步驟有助於減少或防止這些問題。

- 德國擁有歐洲最大的工業污水處理市場,約有3,000座處理廠。每年有超過9.2億立方公尺的工業污水在國內處理後再排放到環境中。

- 由於美國和其他國家的飲料和製藥業對處理水的需求很高,北美用水和污水處理市場也正在快速成長。湖岸污水處理廠擴建計劃4,300 萬美元,涉及在加拿大安大略省開發一座污水處理廠。預計建設將於 2021 年第四季開始,並於 2023 年第二季完工。該計劃旨在解決該地區的污水和污水處理需求。該計劃預計將使加工能力提高70%。

- 由於全球對水處理的需求不斷增加,預計整個預測期內對離子交換樹脂的需求將會成長。

亞太地區佔市場主導地位

- 預計預測期內亞太地區將主導全球離子交換樹脂市場。

- 中國出口離子交換樹脂主要到美國,是世界上最大的出口國。在中國,水處理應用對離子交換樹脂的需求正在快速成長。食品飲料、化學、製藥和電力行業對更純淨、更清潔的樹脂的需求不斷增加,以及公司對技術、研發的投資正在推動市場成長。

- 在亞太地區,中國是最大的用水國。全國有水質淨化廠10113座,處理95%城鎮和30%農村地區的污水。此外,中國計劃在2021年至2025年期間新建或維修8萬公里污水收集管網,增加污水處理能力2,000萬立方公尺/日。

- 在「十四五」規劃中,中國發布了廢水再利用的新指南,要求提高廢水再利用的比例。到2025年,25%的廢棄物必須回收。

- 此外,印度是世界上最大的水消耗國之一,每年需要約 7,400 億立方公尺的水來滿足其需求。然而,地下水的枯竭和用水需求的增加增加了該國對處理水的依賴。

- 在韓國,2023 年 2 月,SK offplant Co. 宣布透過在地化生產超純水核心技術,擴大其在水產業的投資組合。該公司已與專門從事膜製造和加工的韓國公司Sepratek簽署了研發協議,投資其超純水(UPW)核心技術。

- 預計上述因素將在預測期內推動亞太地區對離子交換樹脂的需求。

離子交換樹脂產業概況

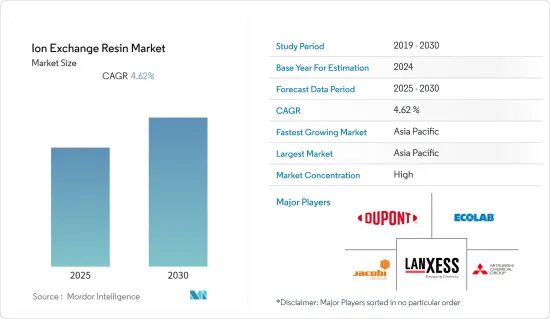

離子交換樹脂市場正在整合,主要企業佔據全球市場佔有率。市場上一些知名的參與者包括杜邦、朗盛、藝康、三菱化學公司和雅可比碳集團。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 電子和製藥業對超純水的需求不斷增加

- 污水處理產業的成長

- 其他促進因素

- 限制因素

- 離子交換樹脂的細菌污染

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按類型

- 通用樹脂

- 特殊樹脂

- 按應用

- 製藥

- 飲食

- 水處理

- 採礦和冶金

- 化學處理

- 力量

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Anhui Samsung Resin Co. Ltd

- Bio-rad Laboratories Inc.

- Doshion Polyscience Pvt. Ltd

- Dupont

- Ecolab

- Eichrom Technologies Llc

- Evoqua Water Technologies Llc

- Ion Exchange(India)Ltd

- Jacobi Carbons Group

- Lanxess

- Mitsubishi Chemical Corporation

- Novasep

- Protech Water India

- Pure Resin Co. Ltd

- Resintech Inc.

- Samyang Corporation

- Sunresin New Materials Co. Ltd

- Suqing Group

- Suzhou Bojie Resin Technology Co. Ltd

- Thermax Limited

第7章 市場機會與未來趨勢

- 燃料電池需求不斷成長

The Ion Exchange Resin Market is expected to register a CAGR of 4.62% during the forecast period.

The market was negatively impacted due to COVID-19. Owing to the pandemic, several countries worldwide went into lockdown to curb the spread of the virus. The shutdown of numerous companies and factories disrupted worldwide supply networks and harmed global production, delivery schedules, and product sales. Currently, the market recovered from the COVID-19 pandemic and is increasing significantly.

Key Highlights

- Over the medium term, the major factors driving the market's growth are the growing water treatment industry and the increasing demand for ultra-pure water from the electronics or pharmaceutical industry.

- Conversely, bacterial contamination caused by ion exchange resins will likely hinder the studied market's growth.

- Growing demand for fuel cells is expected to offer growth opportunities to the market studied.

- Asia-Pacific dominated the market, with the largest consumption coming from China and India. Also, Asia-Pacific will likely register the fastest growth rate during the forecast period.

Ion Exchange Resin Market Trends

Water Treatment Segment to Drive the Market

- Ion exchange resins are commonly used as a water treatment agent to remove trace metal ions, organic compounds, and pollutants from water.

- Water treatment applications are increasing lately, owing to the strong demand for freshwater resources. Water recycling is a multi-stage process in wastewater treatment plants. The ion exchange treatment process is commonly used for water softening or demineralization. It is also used for removing other substances from water in processes such as de-alkalization, de-ionization, and disinfection. These are used for both industrial and municipal purposes.

- Recently, ion exchange resins is increasingly used to create drinking water. Specialized resins are designed to treat various contaminants, including perchlorate and uranium.

- Many resins, such as strong base/strong anion resin, are designed to remove nitrates and perchlorate. There are also resin beads that can be used for water softening.

- Resin materials contain a finite exchange capacity. Each of the individual exchange sites will become full with prolonged use. When it is impossible to exchange ions, the resin must be recharged or regenerated to restore it to its initial condition. The substances used for this include sodium chloride, hydrochloric acid, sulfuric acid, or sodium hydroxide.

- The spent regenerant is the primary substance remaining from the process. It contains not only all the ions removed but also extra regenerations with high total dissolved solids. It can be treated in a municipal wastewater facility, while discharges may require monitoring.

- The efficacy of ion exchange for water treatment can be limited by mineral scaling, surface clogging, and other issues contributing to resin fouling. Pretreatment processes such as filtration or adding chemicals can help reduce or prevent these issues.

- Germany includes Europe's largest industrial wastewater treatment market, with almost 3,000 treatment plants. Over 920 million cubic meters of industrial wastewater are treated annually in the country before being discharged to the outside environment.

- The North American water and wastewater treatment market is also rapidly growing due to the high demand for treated water from the beverage and pharmaceutical industries in countries such as the United States. Expansion of the Lakeshore Wastewater Treatment Plant, a USD 43 million project, entails the development of a wastewater treatment plant in Ontario, Canada. Construction began in Q4 2021 and is expected to complete in Q2 2023. The project aims to address the region's wastewater and sewage needs. The project is expected to increase the capacity by 70%.

- With the increasing need for water treatment globally, the demand for ion exchange resins is projected to grow through the forecast period.

Asia-pacific to Dominate the Market

- Asia-Pacific is expected to dominate the global ion exchange resin market during the forecast period.

- China exports ion exchange resin mainly to the United States and is the largest exporter globally. In China, the demand for ion exchange resins for the applications in water treatment applications is growing at a fast pace. The increasing demand for purer and cleaner resins for usage in food and beverages, chemical, pharmaceutical, and power industries and companies investing in technology and R&D shall augment the market growth.

- In the Asia-Pacific region, China is the largest water consumer country. It contains 10,113 water treatment plants that treat wastewater for 95% of municipalities and 30% of rural areas. Moreover, China plans to build or renovate 80,000 km of sewage collection pipeline networks and increase sewage treatment capacity by 20 million cubic meters/day between 2021-2025.

- In the 14th Five-year Plan, China published new guidelines for wastewater reuse, which mandated increasing the proportion of sewage. It must be treated to reuse standards to 25% by 2025.

- Furthermore, India is among the largest water consumers in the world and needs around 740 billion cubic meters of water per year to meet the demand. However, depleting groundwater and increasing water demand are driving the dependency on water treatment in the country.

- In South Korea, in February 2023, SK Ecoplant Co. announced the expansion of its portfolio in the water industry through localizing core technology to produce ultrapure water. The company signed an R&D agreement with Sepratek, a Korean company specializing in membrane manufacturing and processes, to invest in core technologies for ultrapure water (UPW).

- The above factors are expected to drive the demand for Ion-exchange resins in the Asia-Pacific region during the forecast period.

Ion Exchange Resin Industry Overview

The ion exchange resin market is consolidated, with top players accounting for a major global market share. Some prominent players in the market include DuPont, LANXESS, Ecolab, Mitsubishi Chemical Corporation, and Jacobi Carbons Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand For Ultra Pure Water From Electronics Or Pharmaceutical Industry

- 4.1.2 Growing Wastewater Treatment Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Bacterial Contamination Caused by Ion Exchange Resins

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Commodity Resins

- 5.1.2 Specialty Resins

- 5.2 Application

- 5.2.1 Pharmaceutical

- 5.2.2 Food and Beverage

- 5.2.3 Water Treatment

- 5.2.4 Mining and Metallurgy

- 5.2.5 Chemical Processing

- 5.2.6 Power

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anhui Samsung Resin Co. Ltd

- 6.4.2 Bio-rad Laboratories Inc.

- 6.4.3 Doshion Polyscience Pvt. Ltd

- 6.4.4 Dupont

- 6.4.5 Ecolab

- 6.4.6 Eichrom Technologies Llc

- 6.4.7 Evoqua Water Technologies Llc

- 6.4.8 Ion Exchange (India) Ltd

- 6.4.9 Jacobi Carbons Group

- 6.4.10 Lanxess

- 6.4.11 Mitsubishi Chemical Corporation

- 6.4.12 Novasep

- 6.4.13 Protech Water India

- 6.4.14 Pure Resin Co. Ltd

- 6.4.15 Resintech Inc.

- 6.4.16 Samyang Corporation

- 6.4.17 Sunresin New Materials Co. Ltd

- 6.4.18 Suqing Group

- 6.4.19 Suzhou Bojie Resin Technology Co. Ltd

- 6.4.20 Thermax Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand For Fuel Cells