|

市場調查報告書

商品編碼

1687270

全球分散式阻斷服務 (DDoS) 防護 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global Distributed Denial of Service (DDoS) Protection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

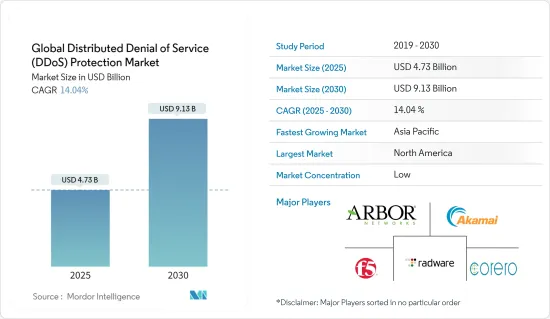

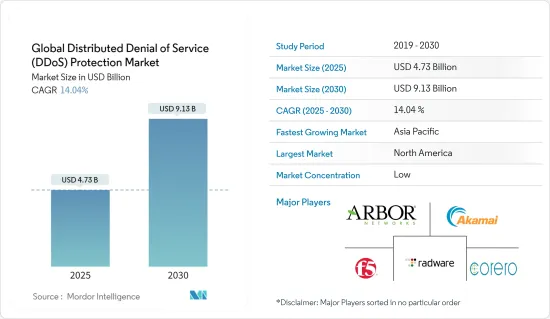

預計 2025 年全球分散式阻斷服務保護市場規模為 47.3 億美元,到 2030 年將達到 91.3 億美元,預測期內(2025-2030 年)的複合年成長率為 14.04%。

隨著新冠疫情的到來,勞動力幾乎全部轉移到了網路上。世界各地的人們在網路上工作、學習和購物的次數比以往任何時候都多。這也反映在最近 DDoS 攻擊的目標上,最受攻擊的資源是醫療保健組織、送貨服務、遊戲和教育平台的網站。

關鍵亮點

- 網路攻擊的驚人成長預計將成為採用 DDoS 防護解決方案的主要驅動力。此類攻擊的威脅源自於犯罪者能夠輕鬆獲得易於使用的工具,並且全面了解勒索的利潤潛力。這些攻擊直接針對商業系統和個人,可能導致巨大的經濟和人身損失。

- 企業對 DDoS 保護的要求至關重要,因為無法應對攻擊可能會影響收益、生產力、聲譽和用戶忠誠度。據Cloudflare稱,DDoS攻擊造成的經濟負擔巨大,每小時DDoS攻擊將給組織帶來約10萬美元的損失,這進一步增加了對DDoS防護解決方案的需求。

- 此外,據 Cloudflare 稱,DDoS 攻擊的頻率和複雜程度正在急劇上升。繼第一季到第二季加倍之後,觀察到的網路層攻擊總數在第三季再次加倍,與第一季COVID-19 之前的水平相比增加了四倍。我們也發現攻擊媒介比以往任何時候都多。雖然 SYN、RST 和 UDP泛光仍然佔據主導地位,但我們已經看到針對特定通訊協定的攻擊爆炸式成長,包括 mDNS、Memcached 和 Jenkins DoS 攻擊。

- 據思科稱,到預測期中期,即2021年,流量超過1Gigabit每秒的DDoS攻擊數量預計將成長到310萬次,比2016年成長2.5倍。近年來,這些攻擊變得更加頻繁和嚴重。

- 此外,從國家分佈來看,美國是遭受L3/4 DDoS攻擊最多的國家,其次是德國和澳洲。依地區分類,前三大市場分別為北美(美國、加拿大)、歐洲(德國、俄羅斯等)、中東(阿拉伯聯合大公國、科威特)、亞太地區、大洋洲(澳洲、泰國、日本)。

- 通訊產業是 2021 年第一季DDoS 攻擊最嚴重的產業。據 Cloudflare 稱,應用層攻擊呈上升趨勢,其中旨在破壞 HTTP 伺服器處理請求能力的攻擊是一個主要問題。勒索軟體類型的 DDoS 攻擊也繼續成為 2021 年第一季的一大挑戰。

分散式阻斷服務 (DDoS) 防護市場趨勢

案例複雜的 DDoS 攻擊正在推動市場

- 各行各業的 DDoS 攻擊案例急劇增加,破壞了重要的組織服務並給各企業造成了數百萬美元的損失,導致新興經濟體更加關注強大的保護解決方案。

- 針對暴露的網路基礎架構(如串聯路由器和其他網路伺服器)的網路層攻擊對資料中心產生了重大影響,而相當一部分 IT 和通訊供應商則在資料中心業務。根據 Cloudflare 的數據,同步標誌 (SYN) 資料包泛光攻擊仍然是最常見的攻擊類型,約佔 2021 年 1 月網路層攻擊的 44%。已發現的其他攻擊包括重置標誌 (RST) 封包、用戶資料通訊協定(UDP) 和網域名稱系統放大攻擊。這些發展使得 DDoS 保護對於這些產業的供應商至關重要。

- 5G 的頻寬增加和低延遲預計將進一步增加攻擊的數量和嚴重性。根據 Corero 的研究,5G 更寬的頻寬將允許先進的殭屍網路利用盡可能多的行動電話和物聯網設備來消滅其目標。

- 此外,隨著新冠疫情導致遠端辦公的出現,個人運算設備並不總是受到保護,這使得從不安全的在家工作環境訪問公司網路時更容易受到攻擊,從而導致由殭屍網路驅動的 DDoS 攻擊增加。

- 隨著全球各地企業的發展,新的進階持續性威脅使關鍵服務面臨風險。這促使組織部署更好的 DDoS 解決方案來保護其端點和網路免受潛在攻擊。

預計北美將佔很大佔有率

- 由於先進技術的採用日益增多以及網路安全解決方案的嚴格實施,北美預計將佔據很大的市場佔有率。滿足嚴格的法規和合規性要求的需求推動了該地區終端用戶行業對先進安全系統的需求,從而推動了市場成長。

- 該地區還遭遇了大量的 DDoS 攻擊,並且這些攻擊在多個終端用戶行業中可能會增加,進一步推動對 DDoS 防護解決方案的需求。此外,該地區,尤其是美國,網路攻擊正在激增。該地區的數字龐大,主要是由於連網設備數量的快速成長。

- 此外,在美國,消費者正在使用公共雲端將他們的個人資訊預先加載到多個行動應用程式上,使銀行業務、購物和通訊更加便捷。在過去幾年中,該地區的企業見證了 DDoS 攻擊的增加,導致對保護解決方案的認知大大提高。此外,根據白宮經濟顧問委員會的數據,美國經濟每年因有害網路活動損失約 570 億美元至 1,090 億美元。

- 此外,Atlas VPN 估計,光是 2020 年 3 月,美國就發生了超過 175,000 次 DDoS 攻擊。攻擊者試圖破壞美國衛生與公眾服務部網站。其主要目的似乎是剝奪公民獲取 COVID-19 疫情官方資料和防護措施的權利。

- 美國政府也簽署立法,成立網路安全和基礎設施安全局(CISA),以加強國家抵禦網路攻擊的能力。該機構與聯邦政府合作,提供網路安全工具、事件回應服務和評估能力,以保護支援合作機構關鍵業務的政府網路。因此,新舊企業都可以投資於專為產業設計的正確保護套件,開闢新的途徑。

- 隨著各公司推出獨立的 5G 網路,他們可能需要安全合作夥伴來確保他們的網路和針對攻擊的安全性在威脅發生之前就已牢固建立。例如,2021年4月,DISH Network Corporation選擇Allot Ltd為其美國的基於雲端原生OpenRAN的5G網路提供端對端用戶平面保護(UPP),以抵禦DDoS和殭屍網路攻擊。

分散式阻斷服務 (DDoS) 防護產業概覽

DDoS 防護市場由多個參與企業組成,主要是國內和國際的參與者,他們在競爭激烈的市場空間中爭奪關注。該市場還具有產品滲透率高、產品差異化程度中等至高、競爭激烈等特性。市場以產品為中心,技術進步不斷主導市場。創新、研發投資、合作夥伴關係和併購有望成為市場供應商之間的競爭策略的一部分。總體而言,競爭格局非常激烈,預計在預測期內仍將保持這種狀態。

- 2022 年 6 月 - G-Core Labs 與英特爾合作,宣布推出一款獨立解決方案 (eBPF),可緩解 DDoS 攻擊,同時降低對整體延遲的影響。此基於 XDP 的解決方案無需專用 DDoS 保護伺服器角色,並可防止 SYN泛光DDoS 攻擊。

- 2022 年 3 月 - 即時、高效能 DDoS 網路防護解決方案供應商 Corero Network Security 擴展了其針對殭屍網路和地毯式轟炸攻擊的自動防護能力。該公司的使命是透過防止 DDoS 攻擊造成的中斷和停機,使網路成為更安全的商業場所。

- 2022 年 2 月-Radware 以 3,000 萬美元收購 SecurityDAM,並將為Radware收購後的雲端 DDoS 防護服務支付高達 1,250 萬美元的成功費。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

- 研究框架

- 二次研究

- 初步研究

- 資料三角測量與洞察生成

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 複雜 DDoS 攻擊的興起

- 部署經濟高效的雲端基礎和混合的解決方案

- 跨產業的技術擴散與物聯網應用

- 市場問題

- 增加網路和部署的複雜性

第6章 相關使用案例和使用案例

第7章市場區隔

- 成分

- 解決方案

- 服務

- 部署類型

- 雲

- 本地

- 混合

- 公司規模

- 中小型企業

- 大型企業

- 最終用戶產業

- 政府和國防

- 資訊科技/通訊

- 醫療保健

- 零售

- BFSI

- 媒體娛樂

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第8章競爭格局

- 公司簡介

- Arbor Networks Inc.(NetScout Systems Inc.)

- Akamai Technologies Inc.

- F5 Networks Inc.

- Imperva Inc.

- Radware Ltd

- Corero Network Security Inc.

- Neustar Inc.

- Cloudflare Inc.

- Nexusguard Ltd

- Dosarrest Internet Security Ltd

- Verisign Inc.

第9章投資分析

第10章:市場的未來

The Global Distributed Denial of Service Protection Market size is estimated at USD 4.73 billion in 2025, and is expected to reach USD 9.13 billion by 2030, at a CAGR of 14.04% during the forecast period (2025-2030).

With the emergence of the COVID-19 pandemic, working environments have shifted almost entirely to the web. People worldwide have increasingly started working, studying, and shopping online as compared to before. This has also been reflected in the goals of recent DDoS attacks, with the most targeted resources being the websites of medical organizations, delivery services, and gaming and educational platforms.

Key Highlights

- An alarming increase in the number of network attacks is anticipated to be a significant driver for the adoption of DDoS protection solutions. The threat of these attacks is driven by ready access to easy-to-use tools and a more comprehensive criminal understanding of its potential for profit through extortion. These attacks directly target business systems and individuals, which could lead to enormous financial and personal losses.

- The requirement for DDoS protection for enterprises has gained tremendous significance, as failure to deal with the attacks can affect revenue, productivity, reputation, and user loyalty. According to Cloudflare, the financial burden of a DDoS attack is significant, as falling victim to a DDoS attack can cost an organization around USD 100,000 for every hour the attack lasts, further fuelling the demand for DDoS protection solutions.

- Additionally, as per Cloudflare, DDoS attacks are surging in frequency and sophistication. After doubling from Q1 to Q2, the total number of network layer attacks witnessed in Q3 doubled again, resulting in a 4x increase compared to the pre-COVID-19 levels in the first quarter. The company also witnessed more attack vectors deployed than ever. While SYN, RST, and UDP floods continue to dominate the landscape, the company saw an explosion in protocol-specific attacks such as mDNS, Memcached, and Jenkins DoS attacks.

- As per Cisco, the number of DDoS attacks exceeding 1 gigabit per second of traffic is expected to rise to 3.1 million by the mid-forecast period, i.e., by 2021, which is a 2.5-fold increase from 2016. In recent years, these attacks have increased in frequency and severity.

- Moreover, the United States observed the highest number of L3/4 DDoS attacks under the country-based distribution, followed by Germany and Australia. The top countries affected by region include North America (United States, Canada), Europe (Germany, Russia, among others), the Middle East (UAE, Kuwait), Asia-Pacific, and Oceania (Australia, Thailand, Japan).

- The telecom industry was at the top when DDoS attacks most targeted it during the first quarter of 2021. According to Cloudflare, application-layer attacks are on the rise, and those that aim to disrupt the HTTP server's ability to process requests are reasons for significant concern. Also, ransom DDoS attacks continued to be a significant challenge during the first quarter of 2021.

Distributed Denial of Service (DDoS) Protection Market Trends

Increasing Instances of Sophisticated DDoS Attacks to Drive the Market

- The rapidly rising instances of DDoS attacks across multiple industries, which have disrupted crucial organizational services and the loss of millions of dollars for various companies, have increased the focus on robust protection solutions across emerging economies.

- Network layer attacks that target exposed network infrastructure such as inline routers and other network servers significantly impact data centers where a significant share of IT and telecom vendors operate. According to Cloudflare, about 44% of network layer attacks occurred in January 2021, with synchronizing flag (SYN) packet flood attacks remaining the most common. Other attacks noted included reset flag (RST) packets, user datagram protocol (UDP), and domain name system amplification attacks. Due to such developments, DDoS protection is vital for vendors operating in these industries.

- The increased bandwidth and low latency in 5G are further anticipated to increase the volume and severity of the attacks. According to Corero's study, the higher bandwidth of 5G enables advanced botnets to harness as many mobiles or IoT devices as possible to cripple their targets.

- Further, with the adoption of remote working due to the onset of Covid, corporate networks have become more vulnerable when accessed from unsecured work-from-home environments, as personal computing devices are not always protected, thus causing an increase in Botnet DDoS attacks.

- As businesses worldwide grow, new and advanced persistent threats have exposed critical services to risk. This has encouraged organizations to deploy better DDoS solutions to safeguard their endpoints and networks against potential attacks.

North America is Expected to Hold a Major Share

- The North American region is expected to hold a significant market share, primarily due to the higher adoption of advanced technologies and stricter implementation of cybersecurity solutions. Given the need to meet stringent regulatory and compliance requirements, there is a rising need for advanced security systems among the region's end-user industries that positively boost the market's growth.

- The region also accounts for a significant number of DDoS attacks, which are likely to increase with respect to multiple end-user industries, further driving the demand for DDoS protection solutions. Moreover, cyberattacks in the region, especially in the United States, are increasing rapidly. They are reaching high numbers, primarily owing to the rapidly increasing number of connected devices in the region.

- Also, in the United States, consumers have been using public clouds, and multiple mobile applications are preloaded with personal information for the convenience of banking, shopping, and communication. In the past few years, companies in the region have been witnessing increasing DDoS attacks, which has resulted in tremendous awareness related to protection solutions. Also, according to the White House Council of Economic Advisers, the US economy loses approximately USD 57 billion to USD 109 billion per year to harmful cyber activity.

- Moreover, according to Atlas VPN, it was estimated that there were more than 175,000 DDoS attacks in the United States in March 2020 alone. Attackers tried to disable the website of the US Department of Health and Human Services. The primary purpose seemed to deprive the citizens of access to official data regarding the COVID-19 pandemic and the measures being taken against it.

- The US government also signed a law to establish the Cybersecurity and Infrastructure Security Agency (CISA) to enhance the national defense against cyberattacks. The agency works with the federal government to provide cybersecurity tools, incident response services, and assessment capabilities to safeguard the governmental networks that support essential operations of the partner departments and agencies. As a result, it opens new avenues for the new and existing companies to invest in a suitable protection suite designed for the industry.

- Various firms are deploying standalone 5G networks, and they would need security partners to become ingrained in their network and security against attacks well before a threat occurs. For instance, in April 2021, DISH Network Corporation chose Allot Ltd to provide end-to-end User Plane Protection (UPP) against DDoS and botnet attacks on the United States' cloud-native, OpenRAN-based 5G network.

Distributed Denial of Service (DDoS) Protection Industry Overview

The DDoS protection market primarily comprises multiple domestic and international players fighting for attention in a somewhat contested market space. The market is also characterized by growing product penetration, moderate/high product differentiation, and high levels of competition. The market is product-centric, and technological advancements constantly govern it. Innovations, R&D investments, partnerships, and M&As are expected to be part of the competitive strategy among the vendors operating in the market. Overall, the intensity of the competitive rivalry is high, and it is expected to remain the same during the forecast period.

- June 2022 - G-Core Labs, in partnership with Intel, launched a standalone solution (eBPF) providing mitigation of DDoS attacks with a low impact on overall latency. The XDP-based solution removes the need for a dedicated DDoS protection server role and protects against SYN Flood DDoS attacks.

- March 2022 - Corero Network Security, a real-time, high-performance DDoS cyber defense solutions provider, extended its automatic protection against Botnet and Carpet Bomb attacks. The company's mission is to make the internet a safer place to do business by protecting against the disruption and downtime caused by DDoS attacks.

- February 2022 - Radware acquired SecurityDAM for USD 30 million, with contingent payments of up to USD 12.5 million for Radware's cloud DDoS protection service after the deal.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Instances of Sophisticated DDoS Attacks

- 5.1.2 Introduction of Cost-effective Cloud-based and Hybrid Solutions

- 5.1.3 Proliferation of Technology and Adoption of IoT across Various Verticals

- 5.2 Market Challenges

- 5.2.1 Growing Network and Deployment Complexities

6 RELEVANT USE CASES AND CASE STUDIES

7 MARKET SEGMENTATION

- 7.1 Component

- 7.1.1 Solution

- 7.1.2 Service

- 7.2 Deployment Type

- 7.2.1 Cloud

- 7.2.2 On-premise

- 7.2.3 Hybrid

- 7.3 Size of Enterprise

- 7.3.1 Small and Medium Enterprises

- 7.3.2 Large Enterprises

- 7.4 End-user Industry

- 7.4.1 Government and Defense

- 7.4.2 IT and Telecommunication

- 7.4.3 Healthcare

- 7.4.4 Retail

- 7.4.5 BFSI

- 7.4.6 Media and Entertainment

- 7.4.7 Other End-user Industries

- 7.5 Geography

- 7.5.1 North America

- 7.5.2 Europe

- 7.5.3 Asia-Pacific

- 7.5.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Arbor Networks Inc. (NetScout Systems Inc.)

- 8.1.2 Akamai Technologies Inc.

- 8.1.3 F5 Networks Inc.

- 8.1.4 Imperva Inc.

- 8.1.5 Radware Ltd

- 8.1.6 Corero Network Security Inc.

- 8.1.7 Neustar Inc.

- 8.1.8 Cloudflare Inc.

- 8.1.9 Nexusguard Ltd

- 8.1.10 Dosarrest Internet Security Ltd

- 8.1.11 Verisign Inc.