|

市場調查報告書

商品編碼

1687233

穿戴式慣性感測器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Wearable Inertial Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

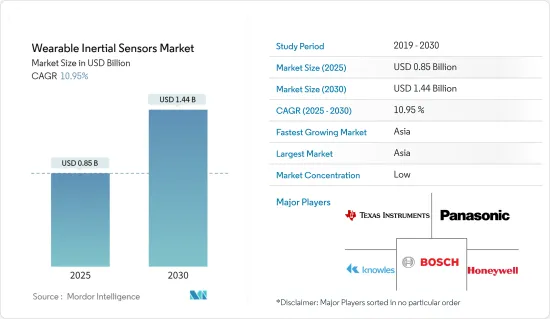

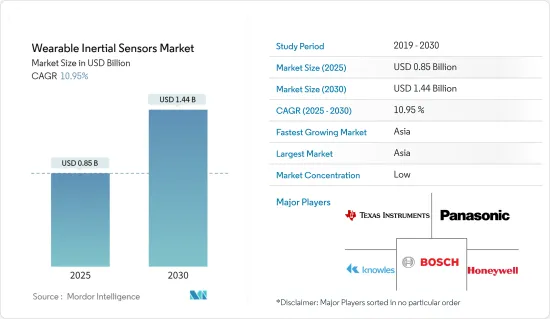

穿戴式慣性感測器市場規模預計在 2025 年為 8.5 億美元,預計到 2030 年將達到 14.4 億美元,預測期內(2025-2030 年)的複合年成長率為 10.95%。

穿戴式慣性感測器,也稱為慣性測量單元 (IMU),是一種使用一個或多個加速計、陀螺儀和磁力計測量運動相關參數的電子設備。這些感測器體積小、重量輕,個人可以輕鬆佩戴以追蹤日常活動中的動作。

主要亮點

- 穿戴式慣性感測器,包括陀螺儀、加速計和地磁感測器,在過去十年中取得了重大發展。由於其性能、小型化和成本下降,穿戴式慣性感測器正在整合到許多日常生活產品中,例如智慧型手機和智慧型手錶。

- 穿戴式慣性感測器具有廣泛的應用範圍。例如,活動監測和健身追蹤在消費市場被廣泛採用。基於穿戴式慣性感測器訊號資料的各種醫療應用也正在開發中,包括跌倒風險評估、跌倒檢測和帕金森氏症的早期檢測。根據帕金森基金會統計,2016 年,全球約有 100 萬人患有帕金森氏症。預計到 2030 年這一數字將增加到約 180 萬。這些發展正在推動所研究市場的需求。

- 全球都市化的加速顯著增加了對先進且美觀的消費性電子產品的需求,這些產品可以更好地滿足消費者的需求,例如便攜性、一機多種功能、緊湊性和時間安排。此外,近年來,由於可支配收入的增加和數位解決方案的普及率不斷提高,全球相當一部分千禧世代已成為各種穿戴式裝置的早期採用者,包括智慧型手錶。

- 隨著蘋果、三星和 Fitbit 等大多數穿戴式裝置供應商都整合了可提供即時健康更新的先進健康監測功能,穿戴式裝置在老年人群中的採用率進一步激增。考慮到對醫療穿戴式裝置的需求不斷成長,新參與企業不斷透過推出創新解決方案在研究產業中展現自己的存在,這也對研究市場的成長產生了積極影響。

- 然而,穿戴式產品的高成本和全部區域嚴格的監管合規性對研究市場構成了挑戰。此外,由於缺乏全球通用標準而導致的互通性問題也有望成為限制調查市場成長的主要因素之一。

穿戴式慣性感測器市場趨勢

消費性電子產品將大幅成長

- 慣性穿戴式感測器技術是一種新興趨勢,它將消費性電子產品融入日常活動中,並且可以佩戴在身體的任何部位,適應不斷變化的生活方式。消費性電子產業穿戴慣性感測器的趨勢受到網路連線等因素的驅動。根據國際電信聯盟預測,2023年全球網路用戶數將達54億。

- 感測器(尤其是壓力感測器和激活器)的不斷進步和小型化也正在擴大消費性電子產業穿戴式慣性感測器市場的範圍。隨著感測器的生物相容性不斷增強,其在醫療保健和健身活動中的應用也顯著成長。因此,近年來穿戴式設備的銷售量大幅成長。根據思科預測,連網穿戴裝置的數量將從 2020 年的 8.35 億台成長到 2022 年的 11.05 億台,在醫療保健應用方面前景看好。許多公司正在投資開發先進的微電子機械系統(MEMS)和數位感測器,其尺寸將不斷縮小以涵蓋廣泛的市場應用。

- 電子機械感測器 (MEMS) 和加速計用於電子穩定控制和安全氣囊展開。隨著技術的進步,慣性測量單元或 IMU(MEMS加速計和 MEMS 陀螺儀的組合)已被開發用於穿戴式設備,並受到日常家用電子電器的影響,例如全球定位系統 (GPS) 和慣性測量單元(由加速計、陀螺儀和地磁儀組成)感測器。因此,健身追蹤穿戴式裝置完全圍繞著這些感測器運轉。

- 例如,Nintendo Switch Nintendo Labo Joy-con 具有加速計和陀螺儀的預設感應器。透過將Joy-con與紙板結合,我們創造了一個具有遊戲功能的人工智慧穿戴式機器人。這是任天堂透過簡化、自訂的穿戴式科技創造身臨其境型的體驗,打破與未來幾代人(通常更精通科技)障礙的方式。

- 加速計是穿戴式裝置中使用的動作感測器。重力、線性等加速度品牌顯示了其感應能力。同時,它的測量能力允許對測量資料進行編程以用於各種目的。例如,跑步者可以獲得最大速度輸出和加速度。此外,加速計可以像智慧型手錶和腕帶一樣追蹤睡眠模式,從而推動消費性電子領域對穿戴式動作感測器的需求。

亞太地區佔市場主導地位

- 由於穿戴式裝置和數位技術的普及度不斷提高以及消費者群體龐大,預計亞太地區在預測期內將顯著成長。考慮到這種前景, OEM也對 IMU(慣性測量單元)和 MEMS 技術的擴展提供了大力支持,以增強新開發產品的採用。此外,由於中國大陸、台灣等地區的崛起,電子產業的發展也促進了市場的成長。

- 穿戴式慣性感測器市場已成為中國最大、成長最快的市場之一。智慧型手錶、健身追蹤器、虛擬實境 (VR) 耳機和動態捕捉服都使用穿戴式慣性感測器,即可偵測移動和方向的感測器。中國穿戴式慣性感測器市場的快速成長主要得益於中國對穿戴式科技的接受度不斷提高,以及人口健康意識的不斷增強。

- 穿戴式科技的日益普及以及對健康和健身測量的需求不斷成長,都推動了近年來印度穿戴式慣性感測器市場的大幅成長。加速計、陀螺儀和磁力計等穿戴式慣性感測器對於為穿戴式裝置提供運動和方向資訊至關重要,受到國內消費者、運動員和醫療專業人士的歡迎。

- 技術熟練的環境和重視便利和創新的社會正在推動日本穿戴式慣性感測器市場的持續成長。穿戴式慣性感測器應用於醫療保健、體育、娛樂和遊戲產業等多個領域。由於人口老化和對健康和福祉的高度關注,日本正在加速使用帶有慣性感測器的穿戴式設備進行一般健康監測和增強。

- 由於韓國民眾精通科技且對穿戴式科技的高度興趣,韓國穿戴式慣性感測器市場近年來迅速擴張。智慧型手錶、健身帶、虛擬實境耳機和其他穿戴式醫療設備都在一定程度上配備了穿戴式慣性感測器。人們對娛樂、健康和健身的關注度不斷提高以及先進技術的採用導致韓國市場對這些產品的需求增加。

- 亞太地區其他地區(包括新加坡、澳洲、馬來西亞和其他對亞太地區穿戴式感測器需求敏感的國家)的慣性感測器市場在過去幾年中一直穩步成長,這得益於人們對健身和健康的興趣日益濃厚、人口老齡化日益嚴重以及技術和醫療保健領域的進步。

穿戴式慣性感測器產業概況

預計對研發、夥伴關係和聯盟的投資將成為該市場供應商的策略重點的一部分。此外,對技術創新和透過策略聯盟進行市場擴張的投資預計也將成為該市場供應商的關注重點。對於在市場上營運的規模較大的供應商來說,他們獲得分銷管道和客戶群的機會更高。除此之外,供應商越來越注重透過合作和收購來擴大其在市場上的能力。總體而言,競爭對手之間的敵意預計會很高。市場的主要供應商包括德州儀器公司、松下公司、博世感測器公司、樓氏電子和霍尼韋爾國際公司。

2023 年 1 月,Quadric 與 Osram 建立合作夥伴關係,開發整合感測模組,將尖端的 Mira 系列可見光和紅外線光 CMOS 感測器與 Quadric 尖端的 Chimera GPNPU 處理器結合。整合的超低功耗模組使穿戴式科技中新型智慧感應成為可能。

2022年12月,Analog Devices, Inc.與奧勒岡健康與科學大學(OHSU)合作開發了智慧型手錶,以應對青少年日益嚴重的心理健康危機。作為這項全球首創、獨一無二的計劃合作的一部分,俄勒岡健康與科學大學 (OHSU) 將利用 ADI 的創新技術和產品來應對日益嚴重的全球精神健康危機,拯救、改善和豐富人們的生活。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 新冠疫情和宏觀經濟趨勢對該產業的影響

- 技術簡介

第5章 市場動態

- 市場促進因素

- 增強健康意識

- 穿戴健身監測器的需求不斷增加

- 科技快速進步

- 市場限制

- 安全問題

- 設備高成本

第6章 市場細分

- 依產品類型

- 智慧型手錶

- 健身帶/活動追蹤器

- 智慧穿戴

- 運動裝備

- 其他

- 按最終用戶

- 衛生保健

- 運動與健身

- 家電

- 娛樂與媒體

- 政府及公共工程

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 亞洲

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 以色列

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 北美洲

第7章 競爭格局

- 公司簡介

- Texas Instruments Incorporated

- Panasonic Corporation

- Bosch Sensortec GmbH

- Knowles Electronics

- Honeywell International Inc.

- TE Connectivity Ltd

- Analog Devices Inc

- General Electric Co.

- AMS osram AG

- STMicroelectronics NV

- Infineon Technologies AG

- NXP Semiconductors NV

- InvenSense, Inc.(TDK Corporation)

第8章投資分析

第9章 市場機會與未來趨勢

The Wearable Inertial Sensors Market size is estimated at USD 0.85 billion in 2025, and is expected to reach USD 1.44 billion by 2030, at a CAGR of 10.95% during the forecast period (2025-2030).

Wearable inertial sensors, also known as inertial measurement units (IMUs), are electronic devices designed to measure motion-related parameters using one or more accelerometers, gyroscopes, and magnetometers. These sensors are small, lightweight, and can be effortlessly worn by individuals to track their movements during daily activities.

Key Highlights

- Wearable inertial sensors, including gyroscopes, accelerometers, and magnetometers, have developed considerably during the last decade. Through performance, miniaturization, and cost drop, wearable inertial sensors have been integrated into several daily life products, such as smartphones and smartwatches.

- The fields of application of wearable inertial sensors are numerous. For instance, activity monitoring and fitness tracking are widely employed in the consumer market. Various medical applications based on signal data from wearable inertial sensors have been developed, including fall risk assessment, fall detection, and early identification of Parkinson's disease. According to the Parkinson's Foundation, in 2016, the estimated number of Parkinson's disease patients was around 1 million. This number is predicted to increase to approximately 1.8 million by 2030. Such developments raise the demand for the market studied.

- The rising urbanization across the globe has significantly driven the demand for advanced, aesthetically appealing consumer electronic products that can better serve the consumers' requirements, such as portability, multiple features in one device, and compact and time schedules. Moreover, in recent years, a sizable number of millennials globally has been quick to adopt wearables of different types, including smartwatches, owing to the increased disposable income and the growing penetration of digital solutions.

- Wearables are further witnessing a surge in adoption among the older age population, as most wearable device providers, including Apple, Samsung, and Fitbit, are integrating advanced health-monitoring features that keep them updated about their health status in real time. Considering the growing demand for healthcare wearables, new players are continuously marking their presence in the studied industry by launching innovative solutions, which are also positively impacting the growth of the market studied.

- However, the high cost of wearable products and stringent regulatory compliances across developed regions are challenging the studied market. Furthermore, interoperability concerns owing to the lack of common global standards are also anticipated to remain among the major factors restraining the growth of the studied market.

Wearable Inertial Sensors Market Trends

Consumer Electronics to Witness Significant Growth

- Inertial wearable sensors technology, an emerging trend, integrates consumer electronics into daily activities and addresses the changing lifestyles with the ability to be worn on any part of the body. The trend of wearable inertial sensors in the consumer electronics industry is driven by the factors such as internet connectivity As per ITU, the approximate global internet user count reached 5.4 billion in 2023. and enhanced data exchange capabilities, enabling seamless communication between devices and networks.

- The growing advancement and reduction in the size of sensors, especially pressure sensors and activators, also exp anded the scope of the wearables inertial sensor market in the consumer electronics industry. As sensors become increasingly bio-compatible, their use for healthcare and fitness activities has also significantly increased. This has led to a significant increase in wearable devices sold over the past few years. According to Cisco, the growth in connected wearable devices, from 835 million devices in 2020 to 1.105 billion in 2022, holds great promise, specifically for healthcare applications. Many compa nies are investing in developing advanced Microelectromechanical systems (MEMS) and digital sensors, further decreasing their sizes and covering a wide range of market applications.

- The micro-electro-mechanical sensors (MEMS) and accelerometers are used for electronic stability control and airbag deployment. Inertial Measurement Units or IMU (they are a combination of MEMS Accelerometer and MEMS Gyroscope) have been developed for wearables as technology has advanced and are influenced by the impact of consumer electronic devices being used daily, such as global positioning system (GPS) or inertial measuring unit (composed of accelerometer, gyroscope, and magnetometer) sensors. This has helped fitness-tracking wearables revolve around these sensors exclusively.

- For instance, Nintendo Switch Labo edition Joy-cons possess default sensors in the accelerometer and gyroscope, usually in electronics consumer wearables. Joy-cons and cardboard combine to build artificial wearables, such as robots, to apply to a gaming function. It is usually Nintendo's way of breaking barriers for future generations (who are more involved with technology at younger ages) in immersive experiences with simplified custom wearable tech.

- Accelerometers are motion sensors, used in wearables. Their brand of acceleration, such as gravity and linear, demonstrates their sensing capabilities. Meanwhile, their measuring ability enables the programming of measured data for different purposes. For instance, a user who runs can access their top speed output and acceleration. Further, accelerometers can track sleep patterns like smartwatches and wristbands, thus driving the demand for wearable motion sensors in the consumer electronics segment.

Asia Pacific to Dominate the Market

- The Asia Pacific region is expected to witness notable growth during the forecast period owing to a large consumer base with a growing penetration of wearable devices and digital technologies. Considering the prospects, OEMs are also creating considerable support toward the enlargement of IMUs (inertial measurement units) and MEMS technology further to enhance the penetration of the newly developed products. Furthermore, the evolution of the electronics industry, owing to the emergence of countries such as China, Taiwan, etc., also contributes to the growth of the studied market.

- The market for wearable inertial sensors has become one of the largest and fastest-growing in China. Smartwatches, fitness trackers, virtual reality (VR) headsets, and motion-capture suits all use wearable inertial sensors, which are sensors that can detect motion and direction. The rapid growth of the wearable inertial sensor market in China has been primarily fueled by the country's rising acceptance of wearable technology and its expanding population of health-conscious individuals.

- The growing popularity of wearable technology and rising demand for measuring one's health and fitness have both contributed to the enormous rise of the wearable inertial sensors market in India in recent years. Wearable inertial sensors, such as accelerometers, gyroscopes, and magnetometers, are essential for giving wearable devices information about motion and orientation, which makes them popular for customers, athletes, and healthcare professionals in the nation.

- Japan's technologically proficient environment and a society that values convenience and innovation has propelled consistent growth in the wearable inertial sensor market there. Wearable inertial sensors have several uses in the healthcare, sports, entertainment, and gaming industries, among other fields. The use of wearables with inertial sensors for monitoring and enhancing general well-being has been accelerated by Japan's aging population and a strong focus on health and wellbeing.

- Due to the nation's tech-savvy population and keen interest in wearable technology, the South Korean Wearable Inertial Sensors Market has rapidly expanded in recent years. Smartwatches, fitness bands, virtual reality headsets, and other wearable medical equipment all feature wearable inertial sensors to some extent. Due to the rising emphasis on entertainment, health, and fitness and the adoption of advanced technologies, the demand for these gadgets has increased in the South Korean market.

- The Rest of Asia Pacific's inertial sensor market, which includes nations like Singapore, Australia, Malaysia, and others perceiving demand for wearable sensors in the Rest of Asia Pacific, has been steadily increasing over the past few years, driven by a growing interest in fitness and wellness, a rising aging population, as well as advancements in technology and healthcare.

Wearable Inertial Sensors Industry Overview

Investments in research and development, along with partnerships and alliances, are expected to be some of the strategic focus of vendors operating in the market. In addition to this, investment into technological innovations and market expansions via strategic alliances are expected to be focal points for the vendors in the market. Access to distribution channels and the deep clientele is significantly higher for large vendors operating in the market. In addition to this, vendors tend to focus on expanding their capabilities in the market via partnerships and acquisitions. Overall, the competitive rivalry is expected to be high among the vendors. Some of the major vendors in the market are Texas Instruments Incorporated, Panasonic Corporation, Bosch Sensortec GmbH, Knowles Electronics, Honeywell International Inc., etc.

In January 2023, Quadric and OSRAM established a collaborative partnership to create integrated sensing modules that combine the cutting-edge Mira Family of CMOS sensors for visible and infrared light with Quadric's cutting-edge Chimera GPNPU processors. The integrated ultra-low power modules will make it possible for wearable technology to use new types of smart sensing.

In December 2022 , Analog Devices Inc. collaborated with Oregon Health & Science University (OHSU) to develop a smartwatch that detects vital mental health indicators to help address the rising mental health crisis in teens. As per the collaboration on the first and one-of-a-kind project, OHSU would leverage ADI's innovative technology and products for the burgeoning worldwide mental health crisis to save, improve, and enrich human lives.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 and Macro Economic Trends on the Industry

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing health awareness

- 5.1.2 Growing Demand for Wearable Fitness Monitors

- 5.1.3 Rapid Technology Advancements

- 5.2 Market Restraints

- 5.2.1 Security concerns

- 5.2.2 High cost of the devices

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Smart Watches

- 6.1.2 Fitness Bands/Activity Tracker

- 6.1.3 Smart Clothing

- 6.1.4 Sports Gear

- 6.1.5 Others

- 6.2 By End-user Type

- 6.2.1 Healthcare

- 6.2.2 Sports and Fitness

- 6.2.3 Consumer electronics

- 6.2.4 Entertainment and Media

- 6.2.5 Government and Public Utilities

- 6.2.6 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Australia and New Zealand

- 6.3.4 Middle East and Africa

- 6.3.4.1 United Arab Emirates

- 6.3.4.2 Saudi Arabia

- 6.3.4.3 Israel

- 6.3.5 Latin America

- 6.3.5.1 Brazil

- 6.3.5.2 Argentina

- 6.3.5.3 Mexico

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Texas Instruments Incorporated

- 7.1.2 Panasonic Corporation

- 7.1.3 Bosch Sensortec GmbH

- 7.1.4 Knowles Electronics

- 7.1.5 Honeywell International Inc.

- 7.1.6 TE Connectivity Ltd

- 7.1.7 Analog Devices Inc

- 7.1.8 General Electric Co.

- 7.1.9 AMS osram AG

- 7.1.10 STMicroelectronics NV

- 7.1.11 Infineon Technologies AG

- 7.1.12 NXP Semiconductors NV

- 7.1.13 InvenSense, Inc. (TDK Corporation)