|

市場調查報告書

商品編碼

1687190

拉丁美洲泡殼包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Latin America Blister Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

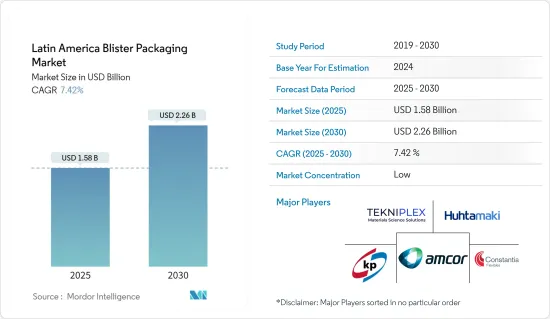

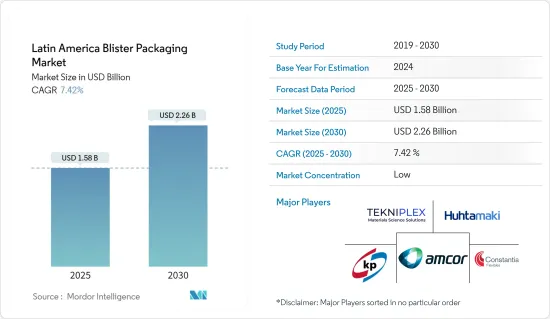

預計 2025 年拉丁美洲泡殼包裝市場規模為 15.8 億美元,到 2030 年將達到 22.6 億美元,預測期內(2025-2030 年)的複合年成長率為 7.42%。

主要亮點

- 製藥業是泡殼包裝的最大終端用戶,佔有相當大的市場佔有率。如此高的佔有率是因為泡殼包裝在製藥行業中具有許多優勢,例如提高產品保護、易於分銷、單位劑量包裝和產品識別。

- 泡殼包裝的創新,例如透過外包裝密封部署的無線射頻識別(RFID)標籤,因其有可能在整個供應鏈中提供個人化的安全性而變得越來越受歡迎。泡殼包裝可保護小型醫療設備和藥品免受氧氣、異味和濕氣的影響,並延長其保存期限。服藥依從性差是一個普遍存在的問題,會導致慢性疾病併發症和醫療成本增加。在預測期內,泡殼包裝方法可能會得到更廣泛的推薦,以解決藥物依從性問題。

- 泡殼包裝現在採用了更多的奈米技術。奈米技術提高了屏障保護能力並使包裝更輕。拉丁美洲的製藥公司是該技術的主要用戶之一,因為它們需要更好地保護其產品免受潮濕、氧氣和其他氣體的影響。

- 泡殼包裝是小單位包裝輕量產品的理想選擇。此外,由於它適合零售用途,因此不適合處理重物。這些限制阻礙了當前終端用戶產業在重型應用中採用和應用泡殼包裝,從而限制了成長機會。因此,這種包裝類型的成長是漸進的、有機的。

拉丁美洲泡殼包裝市場的趨勢

製藥業是成長最快的終端用戶產業

- 製藥業對泡殼包裝解決方案提出了許多要求,包括環境隔離、成本效益、高水準保護、易於操作和維持藥效。這些包裝特別適合滿足嚴格的法規,並且因其保護性能、成本效益、適應性以及製藥和包裝行業的要求而受到高度重視。

- 當藥品採用泡殼包裝時,消費者可以追蹤他們的藥物和劑量,從而提高用藥依從性。泡殼包裝的單位劑量特性降低了錯誤劑量的風險。藥物錠劑、膠囊和錠劑通常以單位劑量的形式採用泡殼包裝。與其他藥品包裝技術相比,單位劑量泡殼包裝的主要優勢在於,可以保證每劑產品/包裝的完整性(包括保存期限),並且能夠通過在每個劑量上方列印星期幾來製作依從性包裝或日曆包裝。

- 藥品通常採用泡殼包裝,因為泡殼包裝可以防止氣體和濕氣,並延長保存期限。在高濕度和高溫條件下實現產品穩定性是一項挑戰。泡殼材料可以減輕運輸過程中可能發生的溫度波動。

- 藥品泡殼包裝主要有兩種類型:第一種類型的蓋子由透明塑膠或塑膠、紙和箔的複合材料製成,腔體由透明熱成型塑膠製成。第二種型腔是由於冷拉而產生的,箔片是兩種腹板的重要組成部分。 PVC、PCTFE、PVDC、用於較不敏感產品的熱成型泡殼和用於敏感活性藥物原料藥(API) 的 Alu-Alu 冷成型泡殼是製藥業泡殼包裝中可用的部分解決方案。

- 由於創新包裝技術的使用日益廣泛且該地區對藥品的需求日益成長,拉丁美洲已成為藥品泡殼包裝的成長市場。預計未來幾年該地區將經歷顯著的成長。這是由不斷上漲的醫療成本和對特殊藥物的需求所推動的。

- 根據美國商務部的數據,2023 年墨西哥的藥品銷售額約為 108.3 億美元,而 2018 年為 100.3 億美元。隨著製藥業的發展,對泡殼包裝等有效包裝解決方案的需求也隨之成長。泡殼包裝通常用於錠劑和膠囊的單位劑量包裝,提供對藥品非常重要的保護和劑量準確性。

巴西可望佔據主要市場佔有率

- 同時,巴西政府努力改善商業環境,以相對廉價的生產能力維持巴西的穩定成長,吸引各行各業的大公司在巴西設立工廠。這使得這些公司能夠同時服務國內市場和北美市場。因此,由於國內產量的增加,該地區對泡殼包裝的需求預計將大幅快速發展。

- 有幾種塑膠聚合物用於製造泡殼包裝,包括 PVC、PVDC、PCTFE 和 COP。 PVC 是最常用的泡殼包裝材料,有時也稱為聚氯乙烯。它的最大優點就是成本低。在巴西,政府上週稍早宣布降低聚丙烯進口稅的措施已取得成效。進口材料的提案、報價和交易增加。

- 根據巴西經濟部消息,巴西政府自8月5日至2023年8月4日期間,暫時將懸浮法聚氯乙烯和聚丙烯共聚物(PPC)的進口關稅從11.2%下調至4.4%。所有產品均不受進口配額限制。對於聚丙烯共聚物,考慮了 HS 代碼為 3902.3000 的產品。 HS 編號 3904.1010 的產品視為懸浮 PVC。屬於 HS 編碼 3901.4000 且密度低於 0.94 的乙烯和 α-烯烴共聚物產品的進口關稅也從 11.2% 降至 3.3%。

- 巴西對醫療產品的需求不斷成長,推動了製藥和醫療保健領域對泡殼包裝的需求激增。對於藥品生產企業來說,遵守藥品包裝標準至關重要,這增加了對泡殼包裝等包裝技術的需求。

- 根據美國商務部國際貿易管理局的數據,巴西是拉丁美洲最大的醫藥和醫療保健市場,其醫療保健支出佔國內生產毛額的9.1%。該地區最大的贏家是當地的私人實驗室,突顯了隨著固態劑型的增加,該地區對藥品泡殼包裝供應商的需求不斷擴大。

- 根據 IQVIA 的數據,預計拉丁美洲在 2023 年至 2027 年期間的複合年成長率將達到 22%。與其他地區相比,拉丁美洲的醫藥市場成長率最高。隨著醫藥市場的成長,符合法規要求的包裝的需求也在成長。泡殼包裝以防止篡改、安全和無污染的包裝而聞名,使其成為滿足嚴格的藥品法規的首選。

拉丁美洲泡殼包裝產業概況

拉丁美洲泡殼包裝市場較為分散,主要參與者包括 Amcor Group GmbH、Tekni-Plex Inc.、Constantia Flexibles Group GmbH、Klockner Pentaplast Group 和 West Rock Company。市場參與者正在採用夥伴關係、創新和收購等策略來改善其產品供應並獲得永續的競爭優勢。

2024 年 1 月,TekniPlex Healthcare 與 Alpek Polyester 合作,宣布推出「世界上第一款」由消費後回收材料製成的藥用級 PET泡殼膜。這款創新薄膜由 30% 的消費後回收單體製成,將在 Pharmapack 2024 上亮相。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

第5章 市場動態

- 市場促進因素

- 老齡人口增加和疾病流行

- 小型化和相對低成本等產品創新

- 市場挑戰

- 法規的動態性質和缺乏處理重負荷的能力

第6章 市場細分

- 按工藝

- 熱成型

- 冷成型

- 按材質

- 塑膠薄膜

- 紙和紙板

- 鋁

- 按最終用戶產業

- 消費品

- 藥品

- 按國家

- 巴西

- 墨西哥

第7章 競爭格局

- 公司簡介

- Amcor Group GmbH

- Tekni-Plex Inc.

- Constantia Flexibles Group GmbH

- Klockner Pentaplast Group

- West Rock Company

- Huhtamaki Oyj

- Honeywell International Inc.

- Sonoco Products Company

第8章投資分析

第9章 市場機會與展望

The Latin America Blister Packaging Market size is estimated at USD 1.58 billion in 2025, and is expected to reach USD 2.26 billion by 2030, at a CAGR of 7.42% during the forecast period (2025-2030).

Key Highlights

- The pharmaceutical industry is the largest end-user of blister packaging and has a significant market share. This high share is due to the many advantages of blister packaging in the pharmaceutical industry, including improved product protection, ease of distribution, unit dosage packaging, and product identification.

- Innovative technology in blister packs, such as radio frequency identification (RFID) tags deployed using seals on the outside packaging, is increasingly used due to the potential to provide individualized security throughout the supply chain. Blister packs protect compact medical devices and pharmaceuticals from oxygen, odors, and moisture, extending shelf life. Inadequate medication adherence is a pervasive problem that leads to chronic disease complications and increased healthcare costs. Packaging methods using blister packs may be widely recommended to address drug adherence issues during the forecast period.

- Blister packaging is now using more nanotechnology. Nanotechnology improves barrier protection and makes the packaging lighter. Pharmaceutical businesses in Latin America, which need better protection for their products against moisture, oxygen, and other gases, are among the primary users of this technology.

- Blister packaging is best suited for lightweight products packaged in small units. It is also suited for retail handling, making it not a preferred choice in heavy goods handling. Such limitations have hindered the adoption and application of blister packaging for heavy goods, even in the current end-user industry applications, limiting growth opportunities. Therefore, the growth of this type of packaging has been gradual and organic.

Latin America Blister Packaging Market Trends

The Pharmaceutical Segment to be the Fastest-growing End-user Industry

- The pharmaceutical sector poses different demands for blister packaging solutions concerning insulation from external surroundings, cost-effectiveness, high levels of protection, and ease of handling and retaining the effectiveness of the medicine. These packs are uniquely suited to meet stringent regulations and are highly valued for their protective properties, cost-effectiveness, adaptability, and pharmaceutical and packaging industry requirements.

- Adherence is improved when medicines are blister packaged because consumers can track their medications and dosage. The unit dosage feature of blisters reduces the risk of incorrect dosing. Pharmaceutical pills, capsules, or tablets are frequently packaged in blister packs as unit doses. The main benefits of unit-dose blister packs over other packaging techniques for pharmaceutical products are the assurance of product/packaging integrity (including shelf life) of each dose and the capacity to produce a compliance pack or calendar pack by printing the days of the week above each dose.

- Drugs are typically packaged in blister packs because they are more protected from gas and moisture, giving them a longer shelf life. Product stability is challenging to achieve in situations of high humidity and temperature. Blistering materials can mitigate temperature swings that can happen during shipping.

- For pharma packaging, there are primarily two types of blister packing. The lid of the first type is made of clear plastic or a composite material made of plastic, paper, and foil, while the cavity is made of clear thermoformed plastic. The second type's cavity is caused by cold stretching, and foil is a crucial component of both webs. PVC, PCTFE, PVDC, and thermoform blisters for less sensitive products or Alu-Alu cold-form blisters for more sensitive active pharmaceutical ingredients (APIs) are a few solutions available in blister packaging for the pharmaceutical industry.

- Latin America is a growing market for pharmaceutical blister packaging due to the increased use of creative packaging techniques and a rising need for medications in the region. The region is predicted to have significant growth in the following years. This results from rising medical expenses and the demand for specialty medications.

- According to the US Department of Commerce, in 2023, Mexico sold around USD 10.83 billion worth of pharmaceutical products, compared with USD 10.03 billion in 2018. As the pharmaceutical industry grows, the need for effective packaging solutions like blister packaging also increases. Blister packaging is commonly used for unit-dose packaging of tablets and capsules, providing protection and dosage accuracy, which are crucial for pharmaceutical products.

Brazil is Expected to Hold Major Market Share

- Many large companies across all industries have established facilities in Brazil due to the government's simultaneous efforts to improve the business environment and maintain Brazil's steady growth in relatively cheap productive capacity. This has enabled these companies to serve both domestic markets and North America. As a result, the demand for blister packaging is anticipated to develop significantly fast in the region due to rising domestic production.

- Several plastic polymers, including PVC, PVDC, PCTFE, and COP, create blister packaging. PVC is the most used blister packing material, sometimes known as polyvinyl chloride. Its key benefit is its cost-effectiveness. Brazil saw results from the government's reduction in PP import taxes, which was announced at the start of the previous week. More proposals, offers, and deals were made for imported material.

- According to the Ministry of Economy, the Brazilian government temporarily lowered import duties on suspension-produced polyvinyl chloride and polypropylene copolymers (PPC) from 11.2% to 4.4% starting on August 5 and lasting until August 4, 2023. The import of either product is not subject to a set quota. Products listed under the HS code 3902.3000 were considered for polypropylene copolymer. The products with the HS number 3904.1010 were considered for suspension-made PVC. Import duties on ethylene and alpha-olefin copolymer products with densities less than 0.94 that fall under the HS code 3901.4000 were also lowered from 11.2% to 3.3%.

- The pharmaceutical and healthcare sectors are witnessing a surge in demand for blister packaging due to Brazil's rising demand for medical products. Following packaging standards for pharmaceutical products is crucial for pharmaceutical producers, which drives the need for packaging techniques like blister packing.

- According to the International Trade Administration, US Department of Commerce, with a 9.1% GDP expenditure on healthcare, Brazil has the largest pharmaceutical and healthcare market in Latin America. The most considerable profits in the region are made by the local private laboratories, which highlights the expanding need for pharmaceutical blister packaging suppliers in the area as the number of solid dosages develops.

- According to IQVIA, Latin America is expected to register a CAGR of 22% from 2023 to 2027. Latin America has the highest pharmaceutical market growth percentage compared with other regions. As the pharmaceutical market grows, so does the need for packaging that complies with regulatory standards. Blister packaging is known for its ability to provide tamper-evident, secure, and contamination-free packaging, making it a preferred choice to meet stringent pharmaceutical regulations.

Latin America Blister Packaging Industry Overview

The Latin American blister packaging market is fragmented, with major players like Amcor Group GmbH, Tekni-Plex Inc., Constantia Flexibles Group GmbH, Klockner Pentaplast Group, and West Rock Company. Market players employ strategies like partnerships, innovations, and acquisitions to improve their product offerings and achieve a sustainable competitive edge.

In January 2024, TekniPlex Healthcare, in collaboration with Alpek Polyester, introduced the 'world's inaugural' pharmaceutical-grade PET blister film featuring post-consumer recycled material. This innovation, highlighting 30% post-consumer recycled monomers, will debut at Pharmapack 2024.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Geriatric Population and Prevalence of Diseases

- 5.1.2 Product Innovations such as Downsizing, Coupled with Relatively Low Costs

- 5.2 Market Challenges

- 5.2.1 Dynamic Nature of Regulations and Inability to Support Heavy Goods

6 MARKET SEGMENTATION

- 6.1 By Process

- 6.1.1 Thermoforming

- 6.1.2 Cold Forming

- 6.2 By Material

- 6.2.1 Plastic Films

- 6.2.2 Paper and Paperboard

- 6.2.3 Aluminum

- 6.3 By End-user Industry

- 6.3.1 Consumer Goods

- 6.3.2 Pharmaceutical

- 6.4 By Country

- 6.4.1 Brazil

- 6.4.2 Mexico

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 Tekni-Plex Inc.

- 7.1.3 Constantia Flexibles Group GmbH

- 7.1.4 Klockner Pentaplast Group

- 7.1.5 West Rock Company

- 7.1.6 Huhtamaki Oyj

- 7.1.7 Honeywell International Inc.

- 7.1.8 Sonoco Products Company