|

市場調查報告書

商品編碼

1687144

燃料電池-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Fuel Cell - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

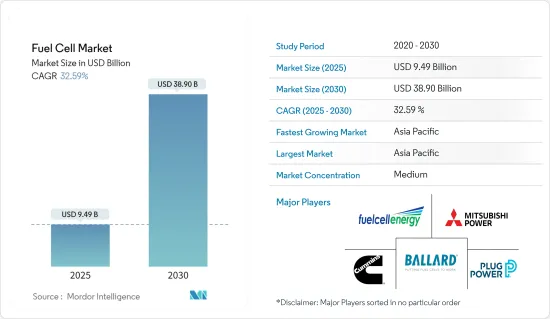

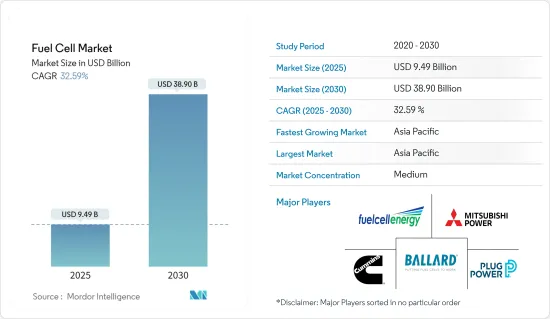

燃料電池市場規模預計在 2025 年為 94.9 億美元,預計到 2030 年將達到 389 億美元,預測期內(2025-2030 年)的複合年成長率為 32.59%。

關鍵亮點

- 從中期來看,預計綠色和藍氫生產成本的下降以及汽車行業需求的增加將在預測期內推動市場發展。

- 然而,來自替代能源的競爭和高昂的資本成本預計將阻礙市場成長。

- 分散式發電是固體氧化物燃料電池的潛在市場,預計由於技術創新的進步,市場將顯著成長。預計這一因素將為未來市場創造許多機會。

- 預計亞太地區將主導燃料電池市場,大部分需求來自中國、印度、日本和韓國等國家。

燃料電池市場趨勢

汽車應用佔據市場主導地位

- 近年來,由於燃料電池系統具有高性能、更短的加油時間和更長的行駛里程,燃料電池汽車行業的利潤越來越豐厚。當談到汽車採用燃料電池技術時,減少水排放、降低排放氣體百分比以及卓越的功率和扭矩起著關鍵作用。

- 在傳統車輛中,燃料電池技術的續航里程可達 300 英里以上。與電池電動車相比,重型電池重量的減輕將在預測期內推動市場成長。

- 此外,政府減少環境污染的法規正在推動燃料電池在汽車領域的應用。各國正加緊研發和投資燃料電池技術,以改善公共運輸,同時減少有害排放氣體。例如,韓國政府計劃在2030年用燃料電池公車取代約26,000輛CNG公車。

- 此外,由於在物流和建築領域的使用日益增多,堆高機和卡車等物料輸送車輛預計在預測期內將顯著成長。燃料電池由於其效率更高、石油消費量更少,主要用於取代小型車輛和倉庫堆高機的內燃機。

- 此外,甲醇燃料電池卡車將燃料儲存在可加油的車載油箱中,減少了加油時間,使遠距運輸更加可行。主要汽車製造商正在開發採用燃料電池技術的 8 級車輛。

- 在亞太地區,強力的獎勵和政府政策預計將推動燃料電池電動車的普及。預計這將提高消費者的接受度,並增加尋求建立全球燃料電池加氣站網路的公司的私人投資。

- 未來五年,主要目標商標產品製造商(OEM)預計將在亞太市場推出約 20 款燃料電池汽車車型。預計亞洲OEM憑藉其先發優勢將在預測期內主導市場。例如,到2030年,豐田預計將銷售165,000輛燃料電池電動車,而現代預計將銷售148,000輛燃料電池電動車。

- 日本在採用替代燃料技術方面處於領先地位。日本政府和當地OEM(目標商標產品製造商)致力於電動動力傳動系統的全球標準化。同時,日本政府也鼓勵大規模部署和採用氫燃料技術用於交通運輸應用。日本政府設定的目標是到2025年實現20萬輛燃料電池汽車的上市。

- 北美是汽車燃料電池的第二大市場,主要由美國主導。嚴格的排放標準、技術製造商的存在以及稅額扣抵等獎勵正在推動該國汽車領域燃料電池系統的市場成長。根據國際能源總署(IEA)的數據,截至2022年,全球共有15,200輛燃料電池汽車投入營運。

- 美國知名汽車製造商和目標商標產品製造商的存在也是預計鼓勵美國大規模採用燃料電池商用車的關鍵因素。現代汽車計劃在2030年建成商用和乘用車燃料電池系統近50萬套的生產能力,預計投資額為64億美元。

- 因此,由於技術創新不斷增加以及私人企業不斷進入,預計車輛應用將佔據市場主導地位。

亞太地區佔市場主導地位

- 由於中國、日本、印度和韓國等國家的政府對使用清潔能源採取了優惠政策,亞太地區是燃料電池最有前景的區域市場之一。

- 中國是燃料電池領域最具潛力的國家之一,原因如下:在國家和地方政府的豐厚補貼以及地方政府為鼓勵廣泛使用氫動力汽車(主要是為了減少污染)而訂定的獎勵計劃的支持下,中國的氫燃料電池產業正在獲得發展動力。

- 除了潛在的龐大市場之外,中國還擁有許多生產燃料電池的國內公司。因此,該國存在需求和國內供應,進一步推動了市場成長。

- 隨著政府越來越重視利用清潔能源技術向低碳經濟轉型,中國的燃料電池市場潛力巨大。

- 中國也正在見證超大規模平台的崛起,因此需要為中國超大規模平台提供資料中心服務。中國每100人就有50名網路用戶,顯示其連接生態系統具有巨大的發展和擴展空間。資料中心很可能成為該國燃料電池技術的主要消費者。

- 到 2022 年,Elcogen 將把固體氧化物燃料電池(SOFC) 和堆疊技術融入其 Convion C60 動力裝置,以高效能產生熱量和電力。該計劃為未來類似大規模的計劃提供了一個模板,預計這些項目將使企業能夠有效地生產熱能和電力,同時減少碳排放。

- 在印度,政府正在支持氫氣各個方面的研究、開發和示範計劃,包括氫氣的生產、儲存和作為發電燃料的使用,這可能會為該國的燃料電池市場創造機會。

- 此外,2023 年 1 月,印度政府宣布了國家綠色氫能任務,初始資金為 24 億美元,其中包括 21 億美元用於 SIGHT 計劃、7 億美元用於先導計畫、5000 萬美元用於研發以及 4000 萬美元用於其他任務組件。

- 此外,該國的綠色氫氣生產能力預計將達到每年至少 500 萬噸,相應增加其可再生能源產能約 125 吉瓦。預計2030年目標將吸引超過8,000億印度盧比的投資,到2030年將避免近5,000萬噸二氧化碳排放。

- 日本90%以上的能源消耗需求依賴進口海外資源。因此,日本對石化燃料的依賴程度很高,是世界上碳排放強度第五大的國家。然而,近年來,日本正經歷一個重大轉折點,即擺脫石化燃料,轉向可再生能源。日本一直致力於改革其能源政策和體系,並專注於可再生能源和清潔氫能。

- 日本於 2015 年實施了最成功的燃料電池商業化計畫之一—ENE-FARM 計畫。該計劃已安裝了超過 12 萬個住宅燃料電池系統。日本透過其 ENE-FARM 計畫繼續在小型燃料電池系統的開發和部署方面保持領先地位,該計畫為購買住宅熱電聯產燃料電池系統提供補貼。

- 因此,預計在預測期內,政府支持舉措以及在交通運輸和其他應用中採用燃料電池技術的努力等因素將推動該地區的燃料電池市場發展。

燃料電池產業概況

燃料電池市場比較分散。該市場的主要企業(不分先後順序)包括 Ballard Power Systems Inc.、FuelCell Energy Inc.、三菱電力有限公司、Plug Power Inc. 和康明斯公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 至2028年的市場規模及需求預測(單位:美元)

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 綠氫和藍氫生產成本下降

- 汽車產業需求增加

- 限制因素

- 競爭性替代能源

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 應用

- 車載

- 非車輛

- 科技

- 固體電解質燃料電池(PEMFC)

- 固體氧化物燃料電池(SOFC)

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 中國

- 韓國

- 日本

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 北美洲

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Ballard Power Systems Inc.

- Horizon Fuel Cell Technologies Pte. Ltd.

- Toshiba Energy Systems & Solutions Corporation

- FuelCell Energy Inc.

- Plug Power Inc.

- Nuvera Fuel Cells LLC

- Intelligent Energy Limited

- SFC Energy AG

- Mitsubishi Power Ltd.

- Cummins Inc.

第7章 市場機會與未來趨勢

- 分散式發電是固體氧化物燃料電池的潛在市場

簡介目錄

Product Code: 55634

The Fuel Cell Market size is estimated at USD 9.49 billion in 2025, and is expected to reach USD 38.90 billion by 2030, at a CAGR of 32.59% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, falling costs of green and blue hydrogen generation and rising demand from the automotive sector are expected to drive the market during the forecast period.

- On the other hand, competition for alternative energy sources and high capital costs are expected to hinder the growth of the market.

- Nevertheless, the distributed generation as a potential market for solid oxide fuel cells are expected to grow significantly in the market due to the increasing innovation. This factor is expected to create several opportunities for the market in the future.

- Asia-Pacific is expected to dominate the fuel cell market, with the majority of the demand coming from countries such as China, India, Japan, and South Korea.

Fuel Cell Market Trends

Vehicular Application to Dominate the Market

- The fuel cell-based automotive industry has become more lucrative in recent years due to the higher performance, reduced refueling time, and long range offered by the systems. The exhaust in terms of water, a decline in the proportion of emissions, and superior power and torque output play a significant role in terms of the adoption of fuel cell technologies for automobiles.

- On a traditional vehicle, the fuel cell technology provides a driving range of over 300 miles. It reduces the weight of carrying heavy batteries compared to battery electric vehicles, thereby boosting the market's growth over the forecast period.

- Furthermore, government regulations for reducing environmental pollution encourage the adoption of fuel cells in the automotive sector. The countries are focusing on R&D and investing in fuel cell technology to improve their public transportation while reducing harmful emissions. For instance, the South Korean government plans to replace around 26,000 CNG buses with fuel-cell buses by 2030.

- Also, material-handling vehicles, such as forklifts, trucks, etc., are expected to witness significant growth over the forecast period due to their increased usage in the logistics and construction sectors. Fuel cells are used as replacements for internal combustion engines in light-duty vehicles and warehouse forklifts, primarily to improve efficiency and reduce oil consumption.

- Furthermore, in methanol fuel cell trucks, the fuel is stored in refillable onboard tanks to reduce the refueling time, thereby providing feasibility for long routes. The major automobile manufacturers are developing Class 8 vehicles that operate on fuel cell technology.

- In the Asia-Pacific region, the adoption of fuel-cell electric vehicles is expected to be driven by strong incentives and government policies. This is expected to boost consumer acceptance and increase private investments by companies seeking to establish global fuel cell network refueling stations.

- Over the next five years, leading original equipment manufacturers (OEMs) are expected to launch approximately 20 fuel cell vehicle models in the Asia-Pacific market. Asian OEMs, with a first-mover advantage, are expected to dominate the market during the forecast period. For instance, the unit sales of Toyota fuel cell electric vehicles are estimated at 165,000 and those of Hyundai fuel cell electric vehicles at 148,000 by 2030.

- Japan is at the forefront in terms of the adoption of alternative fuel technologies. The Japanese government and the local original equipment manufacturers (OEMs) focus on standardizing electrified powertrains globally. Meanwhile, the Japanese government also encouraged hydrogen fuel technology for large-scale deployments and transport applications. The country has set a target of having 200,000 FCVs on the road by 2025.

- North America is the second-largest market for vehicular fuel cells, mainly dominated by the United States. Stringent emission norms, the presence of technology producers, incentives in the form of tax credits, etc., drive the market growth for fuel cell systems in the vehicular segment of the country. According to International Energy Agency (IEA), as of 2022, 15.2 thousand of total fuel cell vehicle was in circulation.

- The presence of some of the most prominent automotive manufacturers and original equipment manufacturers in the country is another major factor expected to propel the large-scale adoption of fuel cell commercial vehicles in the United States. Hyundai plans to build a production capacity of nearly 500k fuel cell systems for commercial and passenger vehicles by 2030 at an estimated cost of USD 6.4 billion.

- Hence, vehicular applications are expected to dominate the market due to increasing technological innovation and rising private player involvement.

Asia-Pacific to Dominate the Market

- Asia-Pacific is one of the most promising regional markets for fuel cells on account of the favorable government policies for clean energy usage in countries such as China, Japan, India, and South Korea.

- China is the country with one of the highest potentials for fuel cells due to the following reasons: The hydrogen fuel cell industry in the country has been gaining traction on the back of favorable national and provincial government subsidies and incentive programs from local authorities, mainly to encourage the uptake of hydrogen vehicles to cut pollution.

- Along with the potentially large market, China also has numerous domestic enterprises that manufacture fuel cells. Hence, the demand and the domestic supply are present in the country, further bolstering the growth of the market.

- China has great potential in the fuel cell market as the government is increasingly focusing on ways to utilize clean energy technology in order to switch to a low-carbon economy.

- China has also witnessed a rise in its hyper-scale platforms, owing to which providing data center services for Chinese hyper-scale platforms has become necessary. China has 50 internet users per 100 people, indicating scope for a lot of development and expansion in the connectivity ecosystem. The data centers can become major consumers of fuel cell technology in the country.

- In 2022, Elcogen incorporated solid oxide fuel cell (SOFC) and stack technology into the Convion C60 power unit to generate heat and electricity with high efficiency levels. The project provides a template for future projects of this kind, also at scale, which are expected to enable companies to generate both heat and electricity at high efficiency levels, all while reducing carbon emissions.

- In India, the government has been supporting research, development, and demonstration projects on various aspects of hydrogen, including its production, storage, and use as a fuel for power generation, which is likely to fuel an opportunity for the fuel cell market in the country.

- Further, in January 2023, the government of India announced the National Green Hydrogen Mission with initial funding of USD 2.4 billion, including an outlay of USD 2.1 billion for the SIGHT program, USD 700 million for pilot projects, USD 50 million for R&D, and USD 40 million for other mission components.

- Further, the country's green hydrogen production capacity is likely to reach at least 5 MMT per annum, with an associated renewable energy capacity addition of about N125 GW. The targets by 2030 are likely to bring in over INR 8 lakh crore of investments, and nearly 50 MMT of CO2 emissions are expected to be averted by 2030.

- Japan imports foreign resources to satisfy over 90% of its energy consumption needs. As a result, the heavy reliance on fossil fuels places Japan in fifth place globally in carbon intensity. However, Japan has been undergoing a significant transition in recent years, shifting away from fossil fuels and renewable energy sources. The country has strived to reform its energy policy and systems by focusing on renewable energy and clean hydrogen.

- Japan implemented one of the most successful fuel cell commercialization programs, the Ene-farm program, in 2015. The program led to the deployment of over 120,000 residential fuel cell systems. Japan remains, by far, the leader in developing and deploying small-scale fuel cell systems through the Ene-farm program, which provides subsidies for purchasing residential fuel cell systems for the domestic CHP.

- Therefore, factors such as supportive government policies and efforts to incorporate fuel cell technology in transportation and other applications are expected to drive the region's fuel cell market during the forecast period.

Fuel Cell Industry Overview

The fuel cell market is semi-fragmented. The key players in the market (not in particular order) include Ballard Power Systems Inc., FuelCell Energy Inc., Mitsubishi Power Ltd., Plug Power Inc., and Cummins Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Falling Costs of Green And Blue Hydrogen Generation

- 4.5.1.2 Rising Demand from The Automotive Sector

- 4.5.2 Restraints

- 4.5.2.1 Competition for Alternative Energy Source

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Vehicular

- 5.1.2 Non-vehicular

- 5.2 Technology

- 5.2.1 Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2 Solid Oxide Fuel Cell (SOFC)

- 5.2.3 Other Technologies

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 South Korea

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Ballard Power Systems Inc.

- 6.3.2 Horizon Fuel Cell Technologies Pte. Ltd.

- 6.3.3 Toshiba Energy Systems & Solutions Corporation

- 6.3.4 FuelCell Energy Inc.

- 6.3.5 Plug Power Inc.

- 6.3.6 Nuvera Fuel Cells LLC

- 6.3.7 Intelligent Energy Limited

- 6.3.8 SFC Energy AG

- 6.3.9 Mitsubishi Power Ltd.

- 6.3.10 Cummins Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Distributed Generation as a Potential Market For Solid Oxide Fuel Cells

02-2729-4219

+886-2-2729-4219