|

市場調查報告書

商品編碼

1687141

覆晶技術-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Flip Chip Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

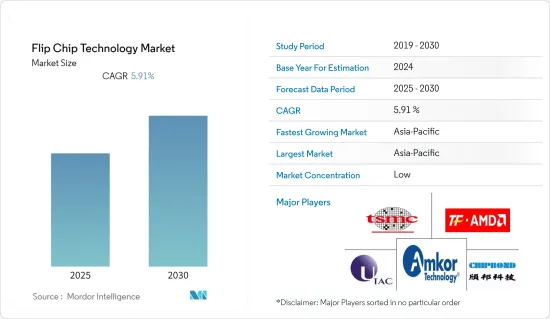

預計覆晶技術市場在預測期內的複合年成長率將達到 5.91%

關鍵亮點

- 覆晶在可靠性、尺寸、靈活性、性能和成本方面比其他封裝方法更具優勢。與其他包裝手法相比,可靠性、尺寸、靈活性、效能和成本等關鍵優勢是推動覆晶市場成長的因素。此外,預計在預測期內,覆晶原料、設備和服務的供應將有利地推動市場發展。

- 此外,與競爭方法相比,市場成長受到許多優勢的推動,包括更小的尺寸、更高的性能和更大的 I/O 靈活性。預計行動、無線、消費性應用、網路、伺服器和資料中心等高效能應用領域對覆晶的需求將會成長。除了 3D 整合和莫耳方法之外,覆晶還是關鍵推動因素之一,有助於實現先進的 SoC(系統晶片)。

- MMIC(單晶微波積體電路)的強勁成長正在推動市場不斷擴大,因為 MMIC 是在微波頻率(300 MHz 至 300 GHz)下工作的設備。這些設備通常執行微波混頻、功率放大、低雜訊放大和高頻開關等功能。

- 晶圓級封裝和嵌入式晶粒是覆晶市場中發展最快的技術。此外,一些知名供應商正在增加對這些技術的投資,以擴大其影響力。

- 例如,2021 年 3 月,三星電子與 Marvell 合作開發了一種新的系統晶片,可提供增強的 5G 網路效能。新發布的晶片將用於三星的Massive MIMO,預計到2021年第二季將在Tier 1通訊業者中佔有一席之地。同樣,聯發科公司於2020年11月簽署了一項協議,以約8,500萬美元的價格收購英特爾Enpirion的電源管理晶片資產。

- COVID-19 對市場成長產生了嚴重影響。這是由於消費者購買行為從家用電子電器產品和汽車等奢侈品轉向食品等必需品。供應鏈也受到影響,導致市場成長放緩。

覆晶技術市場趨勢

軍事和國防工業推動市場成長

- 現代軍事和國防環境需要成熟、可靠且可擴展的技術。感測器是一項關鍵技術,因為它們為整個國防生態系統提供解決方案,包括複雜的控制、測量、監控和執行。

- 軍事要求將組件冷卻至 50 K,因此開發了一種基於銦微泵的技術。軍事系統中感測器數量的不斷增加推動了軍事運算平台對覆晶技術的需求。

- 對於任何雷達來說,包裝和組裝都是成功實施的關鍵。隨著雷達應用變得越來越普遍,成本變得非常重要。毫米波汽車雷達和無人機正在解決成本和封裝問題。單晶片雷達和多通道T/R模組正在變得可行。

- 例如,已經開發出用於 76-84 GHz 範圍的汽車雷達應用的 SiGe 發射/接收相位陣列晶片。此晶片採用可控崩壞晶片連接 (C4) 凸塊製程覆晶到低成本印刷電路基板,在發射和接收鏈之間提供 50 dB 的隔離。這項成就代表了能夠同時進行發射和接收操作的毫米波段高性能 FMCW 雷達的複雜性的最新水平。

- 由於軍事應用對複雜性、性能、引腳數、功耗和成本的要求不斷提高,隨著 GPS 和雷達應用的部署,封裝產業正向高性能封裝發展,如用於軍事和國防應用的覆晶和晶圓級扇出型封裝。在這些類型的應用中使用覆晶技術已被許多應用證明是一種可靠的封裝技術,可實現高密度電子產品。

- 近日,領先的創新射頻解決方案提供商 Qorvo 獲得了一份為期三年的額外契約,以進一步開發其 GaN 上銅柱覆晶技術。美國國防部 (DoD) 的這個項目將建立一個高產量比率的國內代工廠,以完善銅倒裝組裝工藝,從而能夠在空間受限的相位陣列雷達系統和其他國防電子設備中進行垂直晶粒堆疊。

中國佔有很大的市場佔有率

- 預計預測期內中國包裝產業將實現潛在成長。對 IC 元件的強勁需求正在推動具有更高整合度和 I/O 連接的先進封裝解決方案的擴展。

- 中國政府的「中國製造2025」舉措旨在2030年將半導體產業產值提升至3,050億美元,滿足80%的國內需求。隨著技術戰爭的激烈進行,中國正在加強其晶片產業。美國貿易戰以及中國企業可能被切斷與美國技術的聯繫(包括華為等大公司)的威脅正在推動中國半導體產業的發展。

- 覆晶市場包括凸塊加工和組裝,中國參與企業正在加大凸塊加工產能,尤其是 12' 銅柱的產能。超過90%的先進封裝公司都具備對300mm晶圓進行凸塊加工的能力。 2019年,中國電子企業江蘇長電科技股份有限公司(JCET)開始晶圓凸塊大量生產。該公司新的 12 吋晶圓凸塊生產線已投入量產。目前,該產品已批量出貨給長電科技在中國的客戶,另有幾家設備製造商也具備出貨該生產線的資格。

- 由於新冠疫情爆發,中國所有製造業和地區都因長期停工而受到影響,覆晶技術市場也因此受到影響。此外,中國測試和封裝公司繼續獲得高階封裝技術(例如覆晶和凸塊)和更先進(例如扇入、扇出、2.5D內插器、SiP)處理方面的能力。

- 在技術發展和併購的推動下,長電科技、天盛科技和通富微電子等中國服務供應商預計今年將以兩位數的成長率超越行業平均水平。

覆晶技術產業概況

由於汽車、工業和家用電子電器領域的終端用戶數量不斷增加,覆晶技術市場變得分散。預計預測期內市場將經歷中等至穩定的成長。市場現有參與企業正試圖透過適應 5G通訊、高性能資料中心和小型電子設備等新技術來保持競爭力。近期市場發展趨勢如下:

- 2021 年 11 月-領先的半導體封裝和測試服務供應商 Amkor Technology Inc (NASDAQ: AMKR) 計劃在越南北寧建造一座最先進的智慧工廠。新工廠的第一階段將專注於為全球領先的半導體和電子產品製造商提供先進封裝(SiP)組裝和測試解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 穿戴式裝置需求不斷成長

- MMIC(單晶微波積體電路)應用強勁成長

- 市場問題

- 技術成本上升

第6章 技術簡介

第7章市場區隔

- 透過晶圓凸塊工藝

- 銅柱

- 錫鉛共晶焊料

- 無鉛焊料

- 金釘凸塊

- 依封裝技術

- BGA(2.1D/2.5D/3D)

- CSP

- 依產品(僅定性分析)

- 記憶

- 發光二極體

- CMOS影像感測器

- SoC

- GPU

- CPU

- 按最終用戶

- 軍事和國防

- 醫療保健

- 工業領域

- 車

- 消費性電子產品

- 通訊部分

- 按地區

- 中國

- 台灣

- 美國

- 韓國

- 馬來西亞

- 新加坡

- 日本

第8章競爭格局

- 公司簡介

- Amkor Technology Inc.

- UTAC Holdings Ltd

- Taiwan Semiconductor Manufacturing Company Limited

- Chipbond Technology Corporation

- TF AMD Microlectronics Sdn Bhd

- Jiangsu Changjiang Electronics Technology Co. Ltd

- Powertech Technology Inc.

- ASE Industrial Holding Ltd(Siliconware Precision Industries Co. Ltd)

第9章投資分析

第10章:市場的未來

The Flip Chip Technology Market is expected to register a CAGR of 5.91% during the forecast period.

Key Highlights

- This leads to rapid growth in this industry among raw material suppliers. Its primary advantages over other packaging methods, namely, reliability, size, flexibility, performance, and cost, are the factors driving the growth of the flip-chip market. The availability of flip-chip raw materials, equipment, and services is further expected to drive the market lucratively during the forecast period.

- Moreover, the growth of the market is attributed to its numerous advantages, such as smaller size, higher- performance, and enhanced I/O flexibility over its competitive methodologies. The demand for flip-chip is expected to rise in mobile and wireless, consumer applications, and other high-performance applications such as networks, servers, and data centers. In terms of 3D integration and more than the Moore approach, the flip-chip is one of the key driving factors and helps enable sophisticated SoC (system on chip).

- Due to the strong growth in MMIC (monolithic microwave IC), the market is growing, as MMICs are devices that operate at microwave frequencies (300 MHz to 300 GHz). These devices typically perform functions such as microwave mixing, power amplification, low-noise amplification, and high-frequency switching.

- Fan-out wafer-level packaging and embedded die are some of the fastest emerging technologies for the flip-chip market. Also, some of the prominent vendors are increasing their investment in these technologies, thereby expanding their scope.

- For instance, in March 2021, Samsung Electronics partnered with Marvell to jointly develop a novel system-on-a-chip to offer enhanced 5G network performance. The newly launched chip finds usage in Samsung's massive MIMO and is anticipated to see its presence among Tier One operators by Q2 2021. Similarly, Mediatek, Inc., in November 2020, inked an acquisition deal of approximately USD 85 million to purchase the power management chip assets of Intel Enpirion.

- COVID-19 has severely affected the market growth. This is due to the shifting of consumer purchasing behavior towards essential goods such as groceries from luxury goods such as consumer electronics and vehicles. The supply chain was also affected, thus slowing down the market growth.

Flip Chip Technology Market Trends

The Military and Defense Industry to Drive the Market Growth

- Modern military and defense environments require proven, reliable, and scalable technologies. Sensors are a critical part of the technologies, as these provide solutions to the whole defense ecosystem, including complex controls, measurements, monitoring, and execution.

- For military requirements, the need to cool components down to 50 K has led to the development of a technology based on indium micropumps. The sensor content of military systems continues to grow, thereby driving requirements for flip chip technology in military computing platforms.

- For any radar, packaging and assembly are the keys to a successful implementation. As radar applications proliferate, cost becomes critical. For millimeter-wave automotive and UAV, cost and packaging are being addressed. Single-chip radars and multi-channel T/R modules are becoming feasible.

- For example, a SiGe transmit-receive phased-array chip for automotive radar applications at 76 to 84 GHz has been developed. The chip uses a controlled collapse chip connection (C4) bumping process and is flip-chipped onto a low-cost printed circuit board, achieving 50 dB isolation between the transmit and receive chains. This work represents state-of-the-art complexity for a high-performance FMCW radar at millimeter-wave frequencies, with simultaneous transmit and receive operation.

- Due to the increasing complexities and higher performance, pin count, power, and cost requirements of military applications, the packaging industry is moving toward high-performance packages, such as flip-chip or wafer-level fan-out packaging, for military and defense by deploying GPS and radar applications. The use of flip-chip technology for this type of application has proven itself, in many applications, to be a reliable packaging technology to achieve high-density electronics.

- Recently, Qorvo, a leading provider of innovative RF solutions, was awarded a three-year contract further to advance the development of copper-pillar-on-GaN flip-chip technology. This Department of Defense (DoD) program will create a high-yield domestic foundry to mature the copper flip assembly process, which enables vertical die stacking in space-constrained phased array radar systems and other defense electronics.

China Occupies the Significant Market Share

- The packaging industry in China is expected to register potential growth during the forecast period. There is a strong demand for IC components, which has expanded the deployment of advanced packaging solutions that offer higher levels of integration and higher numbers of I/O connections.

- The Chinese government's initiative of 'Made in China 2025' aims to make its semiconductor industry reach USD 305 billion in output by 2030 and meet 80% of domestic demand. China is ramping up its chip industry amid a brewing tech war. The United States-China trade war and the threat that Chinese firms could be cut off from American technology(as major firms like Huawei) are boosting China's push for its semiconductor industry.

- The flip-chip market includes bumping and assembly, and there is enormous ramping of bumping capacity by Chinese players, particularly in the 12' Cu pillar. More than 90% of advanced packaging players have 300 mm wafer bumping capability. In 2019, Chinese electronics company Jiangsu Changjiang Electronics Technology (JCET) started high-volume wafer bumping. The company has moved into volume production with its new 12-inch wafer bumping line. Production volumes are already being shipped to China-based JCET customers, with several additional device manufacturers qualifying the line for shipments.

- Due to the COVID-19 pandemic, all the manufacturing industries and bases are affected in China due to the long-lasting shutdown in the country, thereby affecting the flip-chip technology market. Moreover, the Chinese testing and packaging companies continue to gain processing capacity for high-end packaging technologies (e.g., flip-chip and bumping) and more advanced (e.g., fan-in, fan-out, 2.5D interposer, and SiP).

- Owing to the progress in both technology development and merger and acquisitions, Chinese service providers, such as JCET, TSHT, and TFME, are projected to rise above the industry's average in their revenue performances this year with double-digit growth rates.

Flip Chip Technology Industry Overview

The flip chip technology market is fragmented due to the growing number of end users in automotive, industrial, and consumer electronics. The market is expected to grow at a fair steady rate over the forecast period. The existing players in the market are striving to maintain a competitive edge by catering to newer technologies, such as 5G telecommunication, high-performance data centers, compact electronic devices, etc. Some of the recent developments in the market are -

- November 2021 - Amkor Technology Inc. (NASDAQ: AMKR), a leading provider of semiconductor packaging and test services, planned to build a state-of-the-art smart factory in Bac Ninh, Vietnam. The first phase of the new factory would focus on providing advanced system in package (SiP) assembly and test solutions to the leading global semiconductor and electronic manufacturing companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Wearable Devices

- 5.1.2 Strong Growth in MMIC (Monolithic Microwave IC) Applications

- 5.2 Market Challenge

- 5.2.1 Higher Costs Associated with the Technology

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 By Wafer Bumping Process

- 7.1.1 Copper Pillar

- 7.1.2 Tin-Lead Eutectic Solder

- 7.1.3 Lead Free Solder

- 7.1.4 Gold Stud Bumping

- 7.2 By Packaging Technology

- 7.2.1 BGA (2.1D/2.5D/3D)

- 7.2.2 CSP

- 7.3 By Product (Only Qualitative Analysis)

- 7.3.1 Memory

- 7.3.2 Light Emitting Diode

- 7.3.3 CMOS Image Sensor

- 7.3.4 SoC

- 7.3.5 GPU

- 7.3.6 CPU

- 7.4 By End User

- 7.4.1 Military and Defense

- 7.4.2 Medical and Healthcare

- 7.4.3 Industrial Sector

- 7.4.4 Automotive

- 7.4.5 Consumer Electronics

- 7.4.6 Telecommunications

- 7.5 By Geography

- 7.5.1 China

- 7.5.2 Taiwan

- 7.5.3 United States

- 7.5.4 South Korea

- 7.5.5 Malaysia

- 7.5.6 Singapore

- 7.5.7 Japan

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Amkor Technology Inc.

- 8.1.2 UTAC Holdings Ltd

- 8.1.3 Taiwan Semiconductor Manufacturing Company Limited

- 8.1.4 Chipbond Technology Corporation

- 8.1.5 TF AMD Microlectronics Sdn Bhd

- 8.1.6 Jiangsu Changjiang Electronics Technology Co. Ltd

- 8.1.7 Powertech Technology Inc.

- 8.1.8 ASE Industrial Holding Ltd (Siliconware Precision Industries Co. Ltd)