|

市場調查報告書

商品編碼

1687128

光學塗裝-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Optical Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

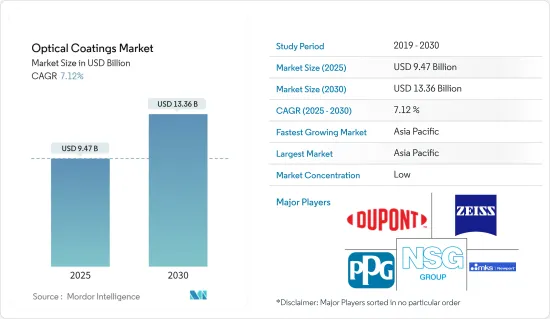

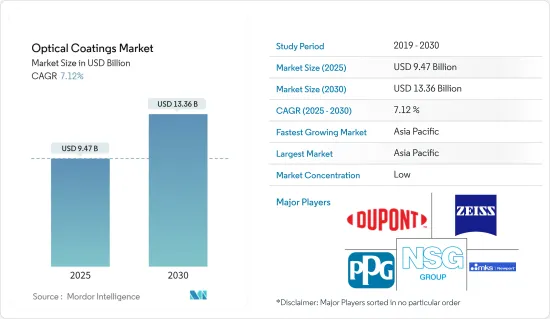

光學塗料市場規模預計在 2025 年為 94.7 億美元,預計到 2030 年將達到 133.6 億美元,預測期內(2025-2030 年)的複合年成長率為 7.12%。

關鍵亮點

- 短期內,太陽能電池產業對光學塗層的需求不斷成長以及光學塗層製程的技術進步預計將推動市場發展。

- 預計光學塗層的高成本和一些限制特性將阻礙市場成長。

- 即將到來的電動車需求可能會在未來幾年為市場創造機會。

- 預計亞太地區將主導市場,並可能在預測期內實現最高的複合年成長率。

光學鍍膜市場趨勢

預計電子半導體領域將佔據市場主導地位。

- 光學塗層在電子應用中發揮著至關重要的作用,確保光線無縫穿過光學表面。隨著對智慧型手機、平板電腦和穿戴式裝置等尖端電子設備的需求激增,對優質光學塗層的需求也隨之成長。這些塗層不僅提高了電子顯示器的性能,而且使其更加耐用。

- 透明導電塗層也用於電子顯示器。消費性電子產品需求的不斷成長推動了這個突出的市場。隨著設備變得越來越小、越來越緊湊,對專業光學塗層的需求也隨之增加。這些塗層可以專業地控制熱量、減少眩光並提高小型部件的光學清晰度。

- 半導體產業優先考慮精確、高性能的光學塗層。這些塗層是光刻製程的必需品,是半導體製造的關鍵步驟,可以提高半導體裝置的效率和品質。物聯網在各個領域的影響力日益增強,推動了半導體需求的激增,從而促進了光學塗層市場的發展。

- 例如,根據日本電子情報技術產業協會(JEITA)的資料,預計2023年日本電子產業的產值將接近10.7兆日圓(約760億美元)。包括家用電子電器、工業設備和無數電子元件在內的電子產業預計到2024年將達到3.68兆美元,與前一年同期比較成長9%。

- 世界半導體貿易統計組織2023年12月31日報告稱,預計2023年全球半導體市場規模為5268.9億美元,2024年成長16.0%。

- 根據ZVEI 2024年7月發布的資料,預計2023年德國電子和數位領域的銷售額將達到2,380億歐元(2,592.8億美元),與前一年同期比較強勁成長10%。

- 鑑於這些動態,市場在不久的將來可能會出現重大波動。

亞太地區可望主導市場

- 預計預測期內亞太地區將引領光學塗料市場。中國、日本、印度和韓國等主要國家正經歷電子、半導體、航太和國防等各領域對光學塗層的需求激增。

- 中國民航局2024年7月12日發布的資料顯示,2024年上半年旅客運輸量超過3.5億美元,較去年同期成長23.5%,比2019年同期成長9%。

- 此外,2023 年 12 月的《航空 A2Z》報告強調,中國正在採購 17 架國產飛機(中國商飛),並計劃在未來兩年內交付,這進一步加強了對光學塗層的需求。

- 根據印度品牌資產基金會(IBEF)的數據,到2024年,印度將在可再生能源、風能和太陽能發電能力方面位居全球第四。根據《2023年印度太陽能市場年度更新》,預計到2023年12月底,印度的累積太陽能光電發電能力將達到約135GW,到2025年3月將達到約170GW。

- IBEF也強調,在政府支持和良好經濟狀況的推動下,可再生能源產業已成為具有吸引力的投資磁鐵。印度致力於自給自足,滿足其能源需求,預計到 2040 年將達到 15,820 TWh。

- 根據日本電子情報技術產業協會(JEITA)的報告,2023年電子元件及設備為日本電子產業貢獻了約6.97兆日圓(約470億美元),總產值約為10.7兆日圓(約760億美元)。

- 鑑於這些動態,預計亞太光學塗料市場在預測期內將實現穩定成長。

光學鍍膜產業概況

光學塗裝市場本質上是高度分散的。該市場的主要企業(不分先後順序)包括杜邦、蔡司國際、紐波特公司、PPG工業公司和日本板硝子。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 太陽能電池產業需求不斷成長

- 光學鍍膜製程的技術進步

- 限制因素

- 光學鍍膜成本高且具有一些限制特性

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 依產品類型

- 光學濾光片鍍膜

- 抗反射膜

- 透明導電塗層

- 鏡面塗層(高反射率)

- 分光鏡鍍膜

- 其他產品類型(溫控塗料)

- 依技術

- 化學沉澱

- 離子束濺鍍

- 等離子濺鍍

- 原子層沉澱

- 亞波長結構表面

- 按最終用戶產業

- 航太與國防

- 電子和半導體

- 通訊

- 醫療保健

- 太陽的

- 車

- 其他最終用戶產業(軍事/國防、醫療)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- 3M

- Abrisa Technologies

- AccuCoat inc.

- Artemis Optical Ltd

- Edmund Optics Inc.

- DuPont

- Inrad Optics

- Materion Corporation

- Newport Corporation

- Nippon Sheet Glass Co. Ltd

- Optical Coatings Technologies

- PPG Industries Inc.

- Quantum Coating Inc.

- Reynard Corporation

- SIGMAKOKI CO. LTD

- Schott AG

- Zeiss International

- Zygo

第7章 市場機會與未來趨勢

- 未來電動車的需求

簡介目錄

Product Code: 55454

The Optical Coatings Market size is estimated at USD 9.47 billion in 2025, and is expected to reach USD 13.36 billion by 2030, at a CAGR of 7.12% during the forecast period (2025-2030).

Key Highlights

- Over the short term, increasing demand for optical coatings from the solar industry and technological advancements in the optical coatings process are expected to drive the market.

- High costs and some limiting properties of optical coatings are expected to hinder the market's growth.

- The upcoming demand for electric vehicles is likely to create opportunities for the market in the coming years.

- Asia-Pacific is expected to dominate the market and is likely to witness the highest CAGR during the forecast period.

Optical Coatings Market Trends

The Electronics and Semiconductors Segment is Expected to Dominate the Market

- Optical coatings play a pivotal role in electronic applications, ensuring light seamlessly passes through optical surfaces. With the surging demand for cutting-edge electronic devices such as smartphones, tablets, and wearables, the appetite for premium optical coatings has surged. These coatings not only bolster the performance of electronic displays but also enhance their durability.

- Transparent conductive coatings find their place in electronic displays as well. The market in focus is buoyed by the relentless growth in demand for consumer electronics. As devices shrink in size and become more compact, the need for adept optical coatings grows. These coatings adeptly manage heat, mitigate glare, and elevate the optical clarity of smaller components.

- The semiconductor industry prioritizes precise, high-performance optical coatings. Integral to photolithography-a cornerstone of semiconductor fabrication-these coatings amplify the efficiency and quality of semiconductor devices. With the rising influence of IoT across diverse sectors, semiconductor demand has surged, subsequently propelling the optical coatings market.

- For instance, data from the Japan Electronics and Information Technology Industries Association (JEITA) highlighted that in 2023, Japan's electronics sector achieved a production value nearing JPY 10.7 trillion Japanese (~USD 76 billion). Encompassing consumer electronics, industrial equipment, and myriad electronic components, the industry is projected to touch USD 3.68 trillion by 2024, marking a commendable 9% Y-o-Y growth.

- World Semiconductor Trade Statistics reported on December 31, 2023, that the global semiconductor market was valued at USD 526.89 billion in 2023, with a promising 16.0% growth anticipated in 2024.

- Data from ZVEI in July 2024 indicates that Germany's electronic and digital sector achieved a turnover of EUR 238 billion (USD 259.28 billion) in 2023, reflecting a robust 10% growth from the previous year.

- Given these dynamics, the market is poised for significant movements in the foreseeable future.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is likely to lead the optical coatings market during the forecast period. Leading countries such as China, Japan, India, and South Korea are showcasing a surge in demand for optical coatings across various sectors, including electronics, semiconductors, aerospace, and defense.

- Data from the Civil Aviation Administration of China (CAAC) on July 12, 2024, revealed that passenger traffic in the first half of 2024 exceeded USD 350 million, marking a 23.5% Y-o-Y increase and a 9% rise from the same period in 2019.

- Furthermore, a report by Aviation A2Z in December 2023 highlighted that China would acquire 17 domestically manufactured aircraft (COMAC), with deliveries scheduled over the next two years, further bolstering the demand for optical coatings.

- As per the India Brand Equity Foundation (IBEF), India ranks fourth globally in renewable energy, wind power, and solar power capacity in 2024. The Annual 2023 India Solar Market Update noted that by the end of December 2023, India's cumulative solar capacity reached approximately 135 GW, with projections of hitting around 170 GW by March 2025.

- IBEF also highlighted that bolstered by government support and favorable economics, the renewable sector has become a magnet for investors. With an eye on self-sufficiency, India aims to meet its energy demand, which is projected to hit 15,820 TWh by 2040.

- The Japan Electronics and Information Technology Industries Association (JEITA) reported that in 2023, electronic components and devices contributed approximately JPY 6.97 trillion (USD 47 billion) to the nation's electronics industry, which boasted a total production value of around JPY 10.7 trillion (USD 76 billion).

- Given these dynamics, the optical coatings market in Asia-Pacific is set for steady growth during the forecast period.

Optical Coatings Industry Overview

The optical coatings market is highly fragmented in nature. Some of the key players in the market (not in any particular order) include DuPont, Zeiss International, Newport Corporation, PPG Industries Inc., and Nippon Sheet Glass Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Solar Industry

- 4.1.2 Technological Advancements in the Optical Coatings Process

- 4.2 Restraints

- 4.2.1 High Costs and Some Limiting Properties of Optical Coatings

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Product Type

- 5.1.1 Optical Filter Coatings

- 5.1.2 Anti-reflective Coatings

- 5.1.3 Transparent Conductive Coatings

- 5.1.4 Mirror Coatings (High Reflective)

- 5.1.5 Beam Splitter Coatings

- 5.1.6 Other Product Types (Temperature Management Coatings)

- 5.2 By Technology

- 5.2.1 Chemical Vapor Deposition

- 5.2.2 Ion-beam Sputtering

- 5.2.3 Plasma Sputtering

- 5.2.4 Atomic Layer Deposition

- 5.2.5 Sub-wavelength Structured Surfaces

- 5.3 By End-user Industry

- 5.3.1 Aerospace and Defense

- 5.3.2 Electronics and Semiconductors

- 5.3.3 Telecommunications

- 5.3.4 Healthcare

- 5.3.5 Solar

- 5.3.6 Automotive

- 5.3.7 Other End-user Industries (Military and Defense and Medical)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Nordic Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Qatar

- 5.4.5.4 United Arab Emirates

- 5.4.5.5 Nigeria

- 5.4.5.6 Egypt

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Abrisa Technologies

- 6.4.3 AccuCoat inc.

- 6.4.4 Artemis Optical Ltd

- 6.4.5 Edmund Optics Inc.

- 6.4.6 DuPont

- 6.4.7 Inrad Optics

- 6.4.8 Materion Corporation

- 6.4.9 Newport Corporation

- 6.4.10 Nippon Sheet Glass Co. Ltd

- 6.4.11 Optical Coatings Technologies

- 6.4.12 PPG Industries Inc.

- 6.4.13 Quantum Coating Inc.

- 6.4.14 Reynard Corporation

- 6.4.15 SIGMAKOKI CO. LTD

- 6.4.16 Schott AG

- 6.4.17 Zeiss International

- 6.4.18 Zygo

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Upcoming Demand from Electric Vehicles

02-2729-4219

+886-2-2729-4219