|

市場調查報告書

商品編碼

1687109

電纜管理:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030 年)Cable Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

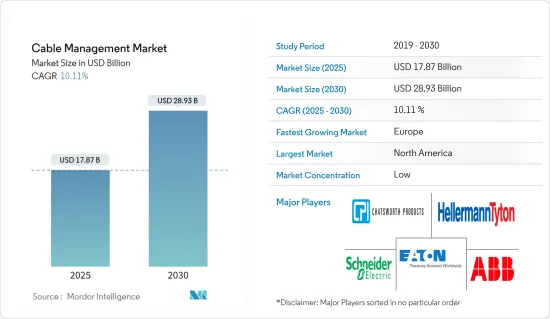

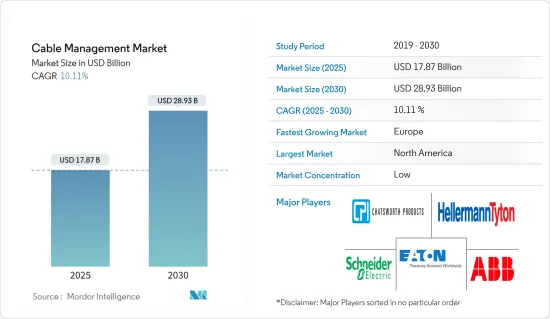

電纜管理市場規模預計在 2025 年為 178.7 億美元,預計到 2030 年將達到 289.3 億美元,預測期內(2025-2030 年)的複合年成長率為 10.11%。

關鍵亮點

- 推動電纜管理產品需求的主要趨勢之一是 IT 領域的快速成長以及機構和企業對高效能資料通訊電纜的日益依賴。

- 據許多主要製造商稱,對管道和其他系統的大部分需求是用於資料通訊。因此,製造商正在設計更新的產品和系統修改,這些產品和修改遠遠超出了這些系統的原始功能。

- 此外,電網、地下電網、可再生能源電網、太陽能發電廠和風力發電機對能夠承受持續陽光、火焰和極端溫度的纜線連接器和熱縮材料的需求不斷成長,預計將在整個預測期內支持市場成長。

- 此外,隨著全球各行業向工業4.0邁進,通訊已成為支撐各領域發展的關鍵因素之一。與通訊、地下電纜管理、電纜密封和聲學領域的其他常見產品一樣,架空電纜管理系統由於其成本效益、供電和配電範圍廣,已成為最受歡迎的解決方案之一。

- 此外,原料價格波動以及隨著消費者和企業對更高性能電纜的需求增加,室內無線網路佈線的安裝和維護可能變得具有挑戰性,這可能會阻礙成長。除此之外,許多現代辦公室面臨的一個常見問題是電纜管理不善和設計過時。海量資料和電力需求意味著需要大量的電纜和電線,使用電纜配線架和梯子等過時的方法來管理它們通常是不可能的。除了容量問題之外,平衡營運效率和空間美觀度的問題也日益嚴重。

- 相反,電纜管理在創造視覺上令人愉悅和整潔的工作環境、維持基本功能以及保護設備免受因雜亂無章的電纜而造成的氣流阻塞方面的重要性日益增加,為市場的成長創造了巨大的機會。

電纜管理市場趨勢

IT和通訊領域可望推動市場成長

- 眾所周知,電訊設備非常敏感,尤其是保持連接正常運作所需的網路和電纜。因此,用於管理和組織電纜的設備必須能夠控制它們而不會造成損害。

- 電纜傳輸著我們所需的資料,照亮城市、實現雲端運算並為數十億台設備供電。因此,電纜管理對於有效控制滿足商業和住宅客戶需求以及 5G 等新興技術所需的光纖部署至關重要。

- 此外,據Viavi Solutions稱,到2022年5月,全球72個國家的約1947個城市將推出5G網路。中國最多,有356個城市,其次是美國,有296個,菲律賓有98個。

- 此外,根據印度電訊監管局 (TRAI) 的數據,截至 2022 年 9 月,Reliance Jio 是印度最大的參與企業,在印度擁有超過 4.19 億通訊用戶,使印度成為全球第二大通訊市場。根據 GSMA Intelligence 預測,到 2023 年初,印度的蜂巢行動連線將達到 11 億。此外,到 2023 年 1 月,印度的行動連線將佔其總人口的 77.0%。此外,據 Ericcsion 稱,到 2029 年,該地區的行動電話用戶總數預計將成長到 12.7 億。

預計歐洲將實現強勁成長

- 隨著電纜在各行業的應用越來越廣泛,對電纜管理解決方案的需求也日益增加。該地區對有線網路和設施的需求正在大幅成長。此外,大容量網路的部署增加了各行業佈線安裝的複雜性。因此,對電纜管理的需求變得突出,從而推動了該地區的電纜管理市場的發展。

- 德國、法國等多個地區已開發國家正大力投資基礎建設。隨著各領域投資的激增,該公司也專注於維修和加強現有基礎設施,以提供更好的營運支持,從而推動電纜管理市場的成長。

- 此外,隨著能源需求的激增和電力基礎設施的老化,該地區各國政府正在採取重大舉措,透過採用智慧電網解決方案來實現電網現代化。這種轉變與新的電力分配和交通基礎設施投資日益成長的趨勢相吻合。

- 此外,IT和電訊市場是該地區成長最快的市場之一。由於該行業對高速連接的需求不斷增加,大大小小的公司都主要致力於提供可靠的服務。對於電纜管理解決方案的需求也源自於為支援新服務而安裝的新電纜。作為電纜管理的早期用戶之一,該行業有望影響市場需求。

電纜管理行業概覽

電纜管理市場競爭激烈且分散。市場參與企業包括 ABB 集團公司 Thomas & Betts、施耐德電機 SE、Cooper Industries (Eaton)、Chatsworth Products Inc. 和 HellermannTyton。認知到潛在的需求,這些領先的製造商正在向開發中國家擴張。

2023 年 12 月,Fischer Connectors 用於超高清 (UHD) 的新型高速連接器和電纜組件將在苛刻的環境中提供 18 Gb/s 的音訊/視訊資料傳輸,與 HDMI 2.0 的效能速度相符。這些新的 UHD 解決方案適用於旗艦 Fischer MiniMax 和 Fischer Core 產品線,具有 10,000 次配接次數、360° EMI 保護、從 IP68 到氣密性和可滅菌性的密封性能以及三種鎖定機制。

2023 年 1 月,Houdson Group 宣布與 Wibe Group 建立新的夥伴關係,為腐蝕性和危險環境提供電纜管理解決方案。此次合作將使 Wibe 電纜梯和 Mita 玻璃增強聚合物 (GRP) 密封產品透過Hudson Group 的新部門 Milton 在英國分銷。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響

第5章市場動態

- 市場促進因素

- 可再生能源商業化的需求

- 數位化和互聯解決方案的採用日益增多

- 市場限制

- 原物料價格不穩定

第6章市場區隔

- 按產品

- 電纜配線架

- 電纜電氣管槽

- 電纜管道

- 纜線連接器和密封接頭

- 電纜托架

- 電纜接頭

- 接線盒/分配盒

- 其他產品(紮線帶、蓋子、緊固件、夾子)

- 按最終用戶產業

- 資訊科技/通訊

- 建造

- 能源公共產業

- 製造業

- 商業

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區(拉丁美洲、中東和非洲)

第7章競爭格局

- 公司簡介

- ABB Ltd.

- Schneider Electric SE

- Cooper Industries(Eaton)

- Chatsworth Products Inc

- HellermannTyton

- Panduit Corporation

- Prsymian SP

- Legrand SA

- Leviton Manufacturing Co. Inc.

- Atkore International Holdings

- Enduro Composites SP(Creative Composites Group)

第8章投資分析

第9章:市場的未來

The Cable Management Market size is estimated at USD 17.87 billion in 2025, and is expected to reach USD 28.93 billion by 2030, at a CAGR of 10.11% during the forecast period (2025-2030).

Key Highlights

- One of the major trends driving the need for cable management products is the IT sector's rapid growth and the growing reliance of institutions and businesses on high-performance data & communication cabling.

- Many leading manufacturers report that most of their demands for raceways and other systems are for data & communication applications. As a result, manufacturers are designing newer products and system modifications, taking these systems well above their origins.

- Additionally, the growing need for cable connectors and heat shrinks in power networks, underground power networks, renewable energy networks, solar plants, and wind turbines are expected to support the market's growth throughout the forecast period, owing to their resistance to continuous sunlight, flames, and severe temperatures.

- Moreover, as industries around the globe are moving toward Industry 4.0, telecommunication has been turning out to be one of the key factors supporting every sector's development. Like other commonplace products in telecommunications, underground cable management, and cable sealing and acoustics, overhead cable management systems have been some of the most popular solutions for their cost-effectiveness, power supply, and distribution range.

- Moreover, the surge in high volatile raw material prices and cable installations for in-building wireless networks can be unmanageable to install and challenging to maintain as rising consumer and business demand for higher-performance cables might hamper the growth. In addition to this, common problems many modern offices have been facing are cable mismanagement and outdated design as oftentimes, with a significantly large number of cables and wires serving massive data and power needs, management has become untenable with antiquated methods such as cable trays or ladders. In addition to this capacity problem, there's also a rising issue of balancing operational efficiency with the aesthetics of a space.

- On the contrary, its rising importance in creating a visually pleasing and clean work environment, as well as the maintenance of basic functionality and protection of the devices from clogged airflow due to messy and disorganized cables, is creating significant opportunities for the studied market to grow.

Cable Management Market Trends

IT & Telecommunication segment is expected to promote market growth

- Telecom equipment is notoriously sensitive, especially the cables needed to maintain networks and connections properly. Owing to that reason, any equipment utilized to manage or organize those cables is required to be able to offer control without the risk of harm.

- Cables carry the data required to light cities, make cloud computing possible, and allow billions of devices to function. Hence, cable management is crucial to effectively control fiber rollouts, which are required to help the needs of business and residential customers, and the rollout of advanced technologies, such as 5G.

- In addition, according to Viavi Solutions, by May 2022, around 1947 cities across 72 countries had 5G networks available worldwide. China had the most cities with 356, followed by the USA with 296, and followed Philipinnes with 98 cities respectively.

- Furthermore, according to TRAI (Telecom Regulatory Authority of India), Reliance Jio was the top player in the country, with a wireless telecom subscriber base of over 419 million around India as of September 2022. and India was the second-largest telecom market worldwide. According to GSMA Intelligence, there were 1.10 billion cellular mobile connections in India at the start of 2023. It also indicates that mobile connections in India were equivalent to 77.0 percent of the total population in January 2023. Further, according to, Ericcsion, Total mobile subscriptions in the region are estimated to grow to 1.27 billion in 2029.

Europe is Expected to Witness Major Growth

- With the raised deployment of cables across multiple industries, the need for cable management solutions is also growing. The expanded demand for networks and facilities with the vast volume of cables has increased drastically in the region. Additionally, deploying high-capacity networks has led to complicated cable installations across different verticals. Thus, the requirement for the management of cables has gained prominence, promoting the region's cable management market.

- Multiple regional developed nations, such as Germany and France, are spending significantly on developing their infrastructure. With these surged investments in various sectors, enterprises also focus on renovating and enhancing their existing infrastructure to build better support for operations, which has been leading to growth in the cable management market.

- Moreover, with the surging energy demand and aging electricity infrastructure, governments across the region are largely moving toward modernizing energy grids by adopting smart grid solutions. Such transformations align with the rising propensity toward adopting new distribution and transportation infrastructure investments.

- Furthermore, one of the fastest-growing markets in the region is IT and telecom. Owing to the industry's rising demand for high-speed connectivity, various small and large businesses mainly concentrate on providing dependable services. The requirement for cable management solutions is also an outcome of the installation of new cables for supporting new services. One of the initial users of cable management, the industry is expected to influence market demand.

Cable Management Industry Overview

The cable management market is competitive and fragmented. ABB group company Thomas & Betts, Schneider Electric SE, Cooper Industries (Eaton), Chatsworth Products Inc., HellermannTyton, and others are some of the prominent participants in the market. After identifying potential needs, these top manufacturers have expanded into developing countries.

December 2023: Fischer Connectors' new high-speed connectors and cable assemblies for Ultra High Definition (UHD) provide audio/video data transfer at 18 Gb/s in demanding environments, matching the performance speed of HDMI 2.0. These new UHD solutions are available in the flagship Fischer MiniMax and Fischer Core product lines with 10,000 mating cycles, 360° EMI protection, different sealing performances from IP68 to hermeticity and sterilization capacities, and three locking mechanisms.

January 2023: The Houdson Group announced the form of a new partnership with Wibe Group to provide specialist cable management solutions for corrosive and hazardous environments. This collaboration is expected to see Wibe cable ladders and Mita Glass Reinforced Polymer (GRP) containment products distributed to the UK through 'Milton,' a new division of the Hudson Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand in Renewable Energy Commercialization

- 5.1.2 Growing Trend of Digitization and Adoption of Connected Solution

- 5.2 Market Restraints

- 5.2.1 Volatile Raw Material Prices

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Cable Trays

- 6.1.2 Cable Raceways

- 6.1.3 Cable Conduits

- 6.1.4 Cable Connectors and Glands

- 6.1.5 Cable Carriers

- 6.1.6 Cable Lugs

- 6.1.7 Junction/Distribution Boxes

- 6.1.8 Other Products (Ties, Covers, Fasteners, Clips)

- 6.2 By End-user Industry

- 6.2.1 IT and Telecommunication

- 6.2.2 Construction

- 6.2.3 Energy and Utility

- 6.2.4 Manufacturing

- 6.2.5 Commercial

- 6.2.6 Other End User Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World (Latin America and Middle East and Africa)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd.

- 7.1.2 Schneider Electric SE

- 7.1.3 Cooper Industries (Eaton)

- 7.1.4 Chatsworth Products Inc

- 7.1.5 HellermannTyton

- 7.1.6 Panduit Corporation

- 7.1.7 Prsymian SP

- 7.1.8 Legrand SA

- 7.1.9 Leviton Manufacturing Co. Inc.

- 7.1.10 Atkore International Holdings

- 7.1.11 Enduro Composites SP (Creative Composites Group)