|

市場調查報告書

商品編碼

1686652

ICF(絕緣泡棉模板):市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Insulated Concrete Form (ICF) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

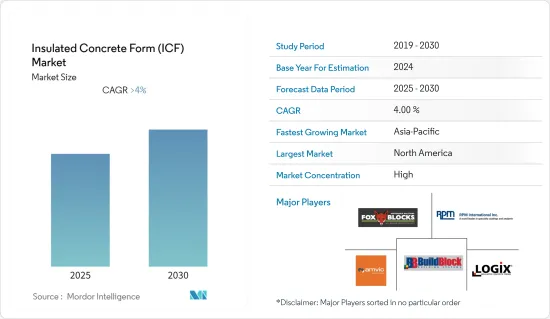

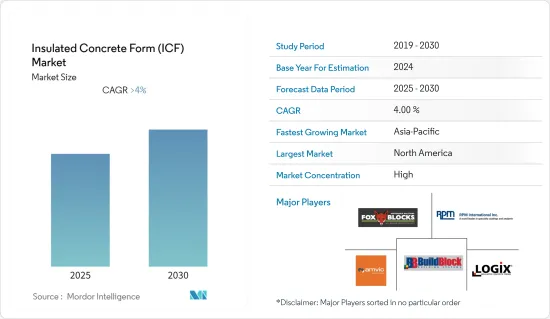

預測期內,ICF(絕緣泡棉模板)市場預計將以超過 4% 的複合年成長率成長。

2020 年,市場受到了新冠疫情的負面影響。全國範圍的封鎖擾亂了供應鏈,為遏制病毒傳播,建築工程和其他活動被迫暫停,對市場產生了不利影響。然而,由於預測期內建築建設活動的增加,預計市場將穩定成長。

主要亮點

- 對節能建築的需求、高層建築建設的增加、災害應變能力的提高以及建造時間的縮短是推動市場成長的一些因素。

- 預計 ICF 的高成本將抑制市場成長。

- 在預測期內,ICF 在製造商和消費者中的普及度和認知度不斷提高,以及 EPS 在建設產業中的作用日益增強,可能會為市場成長帶來機會。

- 北美佔據全球 ICF 市場的最大佔有率,而亞太地區可能在預測期內佔據市場主導地位。

ICF 市場趨勢

住宅市場佔據主導地位

- 隨著建築規範對能源效率的要求越來越高,住宅領域的 ICF 建築數量也隨之增加。

- 例如,加拿大新的能源法規要求住宅建築中要有連續的地下隔熱層。

- 與其他替代品相比,ICF泡沫價格更便宜,但效率相似,這推動了需求,尤其是在加拿大和美國的住宅領域。

- 據美國和加拿大這兩個最大市場的經銷商和建築商稱,大多數 ICF住宅偏向豪華客製化住宅,住宅透過計劃數量來推動需求。

- 在住宅領域,多用戶住宅貢獻了最大的市場成長。此外,地下室建設仍佔ICF住宅工程的很大一部分。

- 根據美國人口普查局的數據,2022 年 7 月美國住宅建築業成長 14%,達到 9,297 億美元,而 2021 年 7 月為 8,155 億美元。這表明改造市場正在成長,因為老舊住宅通常需要添加新功能並修理和更換舊零件。該國住宅上漲也鼓勵住宅在住宅維修上花費更多。

- 印度政府正在積極推動住宅建設,旨在為約 13 億人提供住宅。未來七年,住宅領域的投資預計將達到 1.3 兆美元,將建造 6,000 萬套住宅。預計到 2024 年,該國經濟適用住宅數量將增加 70% 左右。

- 加拿大政府的各種計劃,例如加拿大新建計劃(NBCP)和經濟適用住房舉措(AHI),正在支持該行業的發展。過去幾年,住宅和商業領域一直保持穩定成長。例如,Wellington-sur-le-Bassin 公寓大樓計劃將在魁北克省蒙特婁建造一座 25 層樓的公寓大樓,為該地區提供更好的住宅選擇。該工程預計於 2024年終完工。

- 在德國,建設公司受益於房地產需求飆升和建築投資增加。歐洲中央銀行(ECB)的超低利率、不斷成長的城市人口和不斷增加的移民都助長了建築業的熱潮。德國政府已宣佈建設計畫約150萬套住宅的計畫。待批住宅建築許可證數量已增至40多萬份,標誌著該行業的成長。

- 在各個 ICF 組織的宣傳和促銷宣傳活動的推動下,住宅領域的 ICF 市場預計將在預測期內成長。

亞太地區可望主導市場

- 在亞太地區,中國是GDP最大的經濟體。中國實際GDP預計在2020年將成長2.2%,2021年將成長8.1%,主要歸功於疫情後消費支出的復甦。此外,國際貨幣基金組織預測2022年GDP成長率為3.2%。

- 亞太地區有數個大型住宅計劃正在籌備中,包括日本的濱松町芝浦一丁目重建項目和香港的 Loha Park住宅開發項目第 11 期。

- 為了遏制中國主要城市日益嚴重的溫室氣體問題,中國綠建築業預計到 2030 年將成長 5% 至 28%,帶來 12.9 兆美元的投資機會。

- 住房與城市發展部下屬的中國住宅保障局宣布將投入房屋建設資金,在全國40個城市建設650萬套「更綠色、更聰明、更安全」的保障性住宅住宅,以緩解住宅短缺問題。

- 在日本,芝浦一丁目綜合用途開發案是一個耗資 5 億美元的建設計劃,旨在為東京港區提供商業、住宅和休閒設施。預計 2030 年第四季完工。

- 因此,預計所有上述趨勢將在預測期內共同影響日本的 ICF(絕緣泡棉模板)(ICF)消費量。

ICF(絕緣泡棉範本)產業概況

ICF(絕緣泡棉模板)市場本質上是整合的,少數大型參與者佔據相當大的市場佔有率。市場的主要企業(不分先後順序)包括 RPM International Inc、Amvic Inc、Logix Build Solutions Ltd、Build Block 和 Fox Blocks。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 節能高層建築的需求不斷增加

- 加強災害防範

- 縮短施工工期

- 限制因素

- 成本高

- 其他限制因素

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 依材料類型

- 聚苯乙烯泡沫塑膠

- 聚氨酯泡棉

- 水泥黏合木纖維

- 水泥黏結聚苯乙烯珠

- 按應用

- 住宅

- 商業的

- 設施

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Airlite Plastics Company

- Amvic Inc.

- BASF SE

- Beco Products Ltd

- BuildBlock Building Systems LLC

- Durisol UK

- Fox Blocks

- LiteForm

- Logix Build Solutions Ltd

- Mikey Block Co.

- Quad-Lock Building Systems

- PFB Corporation

- Polycrete International

- RASTRA

- RPM International Inc.

- Sismo

- Sunbloc Ltd

第7章 市場機會與未來趨勢

- 製造商和消費者對 ICF 的認可度和認知度不斷提高

- EPS 在建築業中的作用日益增強

The Insulated Concrete Form Market is expected to register a CAGR of greater than 4% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Due to nationwide lockdowns causing supply chain disruptions, construction work and other activities were put on hold to curb the spreading of the virus, thereby negatively affecting the market. However, the market is projected to grow steadily, owing to increased building and construction activities during the forecast period.

Key Highlights

- The factors driving the growth of the market studied are the demand for energy-efficient buildings, increased construction of high-rise buildings, increased preparedness toward disasters, and reduced construction time.

- Factors such as the high cost of ICF are expected to restrain the growth of the market studied.

- Increasing promotion and awareness of ICF among manufacturers and consumers and the growing role of EPS in the construction industry are likely to act as opportunities for the growth of the market during the forecast period.

- North America accounted for the highest market share in the ICF market globally, and the Asia-Pacific is likely to dominate the market during the forecast period.

Insulated Concrete Form Market Trends

Residential Segment to Dominate the Market

- The increasing number of building codes that demand energy efficiency has increased the number of ICF constructions in the residential sector.

- For instance, the new energy code in Canada demands continuous below-grade insulations in residential structures.

- The availability of ICF forms at a cheaper rate (compared to other alternatives), which provide similar efficiency, is driving the demand in the residential segment, especially in Canada and the United States.

- According to distributors and installers in the two major markets, the United States and Canada, most ICF home constructions are skewed toward high-end custom homes, and homeowners are driving the demand in terms of the number of projects.

- Multi-family homes contribute to the largest market growth in the residential sector. Furthermore, basement construction still makes up a significant portion of ICF residential construction works.

- According to the United States Census Bureau, the residential construction industry in the United States was valued at USD 929.7 billion in July 2022, compared to USD 815.5 billion in July 2021, registering a growth of 14%. Aging houses signal a growing remodeling market, as old structures normally need to add new amenities or repair/replace old components. Rising home prices in the country have also encouraged homeowners to spend more on home improvements.

- The Indian government has been actively boosting housing construction, as it aims to provide homes to about 1.3 billion people. The country is likely to witness ~USD 1.3 trillion of investment in the housing sector over the next seven years, and to witness the construction of 60 million new homes in the country. The availability of affordable housing in the country is expected to rise by around 70% by 2024.

- Various government projects in Canada, such as New Building Canada Plan (NBCP) and Affordable Housing Initiative (AHI), support the sector's growth. The residential and commercial sectors have been witnessing steady growth in the past few years. For instance, the Wellington Sur Le Bassin Condominium Tower project involves the construction of a 25-story condominium tower in Montreal, Quebec, for providing better residential facilities in the region. The construction work is projected to be complete by the end of 2024.

- In Germany, construction companies are benefiting from the soaring demand for real estate and increased investments in buildings. The upswing in construction has been encouraged by the European Central Bank's ultra-low interest rates, a growing urban population, and high immigration. The German government announced plans to construct around 1.5 million housing units. The overhang of pending residential building permits increased to more than 400,000, suggesting the growth of the sector.

- With the growing awareness and promotional campaigns held by various ICF organizations, the market for ICF in the residential sector is expected to grow over the forecast period.

Asia Pacific region is Expected to Dominate the Market

- In the Asia-Pacific, China is the largest economy in terms of GDP. China's real GDP grew by 2.2% in 2020 and by 8.1% in 2021, primarily driven by the consumer spending rebound post-pandemic. Furthermore, as per IMF forecasts, the country's GDP was estimated to grow by 3.2% in 2022.

- Major residential projects are coming up in the Asia-Pacific, such as Hamamatsucho Shibaura 1 Chome Redevelopment in Japan, Lohas Park Residential Development Phase XI in Hong Kong, etc.

- To contain the growing greenhouse gas predicaments in the country's major cities, the country's green building sector is expected to increase from 5% to 28% by 2030, representing a USD 12.9 trillion investment opportunity.

- The Housing Security Department of the Ministry of Housing and Urban Development in China announced the investment in residential construction to build 6.5 million affordable rental units that will be 'greener, smarter and safer' to reduce the housing pressure in 40 cities across China.

- In Japan, Shibaura 1-Chome Mixed-Use Complex is a construction project with an allotted budget of USD 500 million, which aims at providing commercial, residential, and leisure facilities in Minato City, Tokyo Japan. It is expected to be completed by the fourth quarter of 2030.

- Hence, all the abovementioned trends are projected to collectively influence the consumption of insulated concrete form (ICF) in the country over the forecast period.

Insulated Concrete Form Industry Overview

The insulated concrete form market is consolidated in nature, with few major companies holding a significant share of the market. The major companies in the market (Not in any particular order) include RPM International Inc, Amvic Inc., Logix Build Solutions Ltd, Build Block, and Fox Blocks, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Hi-rise Energy-efficient Buildings

- 4.1.2 Increasing Preparedness Toward Disasters

- 4.1.3 Reduced Construction Time

- 4.2 Restraints

- 4.2.1 High Cost Association

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Material Type

- 5.1.1 Polystyrene Foam

- 5.1.2 Polyurethane Foam

- 5.1.3 Cement-bonded Wood Fiber

- 5.1.4 Cement-bonded Polystyrene Beads

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Institutional

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Rest of the Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Airlite Plastics Company

- 6.4.2 Amvic Inc.

- 6.4.3 BASF SE

- 6.4.4 Beco Products Ltd

- 6.4.5 BuildBlock Building Systems LLC

- 6.4.6 Durisol UK

- 6.4.7 Fox Blocks

- 6.4.8 LiteForm

- 6.4.9 Logix Build Solutions Ltd

- 6.4.10 Mikey Block Co.

- 6.4.11 Quad-Lock Building Systems

- 6.4.12 PFB Corporation

- 6.4.13 Polycrete International

- 6.4.14 RASTRA

- 6.4.15 RPM International Inc.

- 6.4.16 Sismo

- 6.4.17 Sunbloc Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Promotion and Awareness of ICF Among Manufacturers and Consumers

- 7.2 Growing Role of EPS in Construction