|

市場調查報告書

商品編碼

1686628

錫:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Tin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

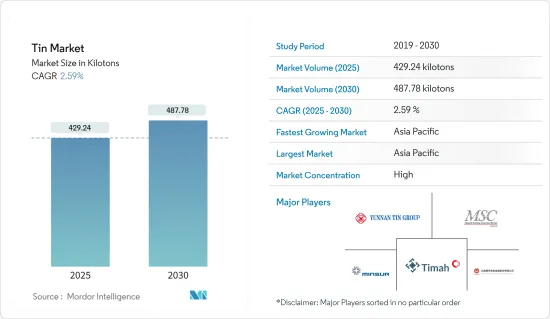

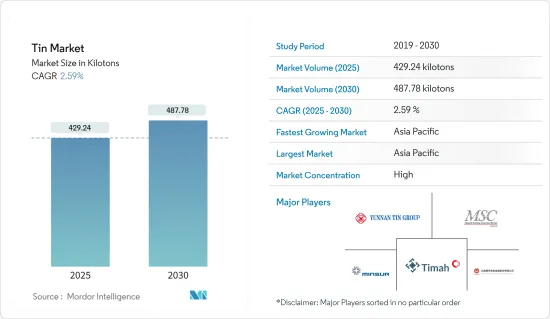

2025 年錫市場規模預計為 429.24 千噸,預計 2030 年將達到 487.78 千噸,預測期內(2025-2030 年)的複合年成長率為 2.59%。

主要亮點

- 預計預測期內電動車市場需求的激增以及電氣和電子行業的不斷成長的應用將推動市場的發展。

- 在容器等金屬產品的生產中,鋁和無錫鋼等替代品的存在阻礙了市場的成長。

- 預計未來幾年錫回收重點的轉變將為市場創造機會。

- 預計亞太地區將主導市場並在預測期內呈現最高的複合年成長率。

錫市場趨勢

電子產業主導市場成長

- 錫在電子工業中用作焊料,通常具有各種純度以及與鉛和銦的合金。所有錫產量中約有50-70%用於電子電氣行業的各種產品,例如行動電話、平板電腦、電腦、手錶和其他家用電子電器。

- 例如,根據日本電子情報技術產業協會(JEITA)的數據,2023年全球電子和IT產業產值估計為33,826億美元,與與前一年同期比較年相比,年比負3%的複合年成長率。不過,預計2024年將成長9%,達到36,868億美元。

- 全球範圍內,智慧型手機的需求大幅成長。根據TelefonaktiebolagetLM Ericsson預測,2023年智慧型手機用戶數將達到69.7億,較2022年成長約5.3%。此外,預計2029年智慧型手機用戶數將達到80.6億,進而推動電子應用領域錫消費量的增加。

- 此外,亞太地區對電子產品的需求主要由中國、印度和日本所推動。由於人事費用低廉且政策靈活,中國對電子製造商來說是一個強勁且利潤豐厚的市場。根據中國國家統計局預測,2023年全國電子製造業與前一年同期比較增加價值額3.4%。

- 德國的電子產業是歐洲最大的。根據ZVEI預測,2023年德國電子和數位產業的銷售額將達到2,420億歐元(2,619.4億美元),與2022年相比,複合年成長率為7.56%。此外,2022年電子數位產業的產出與2021年相比,複合年成長率為1.4%。

- 因此,由於上述因素,錫在電子工業中的使用量日益增加。

亞太地區佔市場主導地位

- 亞太地區佔據錫市場主導地位。中國是世界上最大的錫生產國和消費國之一。

- 作為錫市場和汽車行業的主要貢獻者之一,該行業正在因產品的演變而不斷發展。由於人們對國內污染加劇導致的環境問題的擔憂日益增加,中國正致力於製造能夠確保燃油效率並最大限度減少排放氣體的產品。

- 錫與其他金屬一起用於汽車的多種用途,包括燃料箱、密封劑、電線、散熱器、座墊、接縫和焊接、緊固件、螺絲、螺母、螺栓和屋頂材料。

- 亞太地區是全球最有價值汽車製造商的所在地。中國、印度、日本和韓國等新興經濟體一直努力透過加強製造基礎和發展高效的供應鏈來提高盈利。

- 按年銷量和製造產量計算,中國仍然是世界上最大的汽車市場。根據OICA預測,2023年中國汽車產量將達3,016萬輛,年均成長率達16%左右。

- 根據印度汽車工業協會(SIAM)預測,2022-2023會計年度(2022年4月至2023年3月)該國汽車產業產量總合將達到2,599,318,867輛,較2021-2022會計年度成長約12.55%。根據OICA預測,2023會計年度的汽車產量將創歷史新高,較2022會計年度成長33%。

- 此外,錫的其他主要終端用戶產業包括電氣和電子、重工業和包裝。由於政府的支持和有利的數位化計劃和政策,中國的資訊和通訊技術(ICT)產業在過去十年中迅速發展。

- 因此,預計預測期內該地區的錫市場將穩定成長。

錫行業概況

錫市場高度整合。主要企業(排名不分先後)包括雲南錫業Group Limited、Timah、MINSUR、馬來西亞冶煉公司、雲南誠豐有色金屬等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 電動車需求激增

- 電氣和電子產業的應用日益增多

- 其他促進因素

- 限制因素

- 替代方案的可用性

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

- 定價分析

第5章 市場區隔

- 產品類型

- 金屬

- 合金

- 化合物

- 應用

- 焊接

- 鍍錫

- 化學品

- 其他用途(特殊合金、鉛酸電池)

- 最終用戶產業

- 車

- 電子產品

- 包裝(食品和飲料)

- 玻璃

- 其他最終用戶產業(化學、工具製造、醫療設備)

- 地區

- 生產分析

- 澳洲

- 玻利維亞

- 巴西

- 緬甸

- 中國

- 剛果(金沙薩)

- 印尼

- 馬來西亞

- 秘魯

- 越南

- 其他國家

- 消費分析

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 奧地利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 生產分析

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ArcelorMittal

- Aurubis AG

- Avalon Advanced Materials Inc.

- Indium Corporation

- Jiangxi New Nanshan Technology Co. Ltd

- Malaysia Smelting Corporation Berhad

- MINSUR

- Thailand Smelting and Refining Co. Ltd

- Timah

- Yunnan Chengfeng Non-ferrous Metals Co. Ltd

- YUNNAN TIN COMPANY GROUP LIMITED

第7章 市場機會與未來趨勢

- 轉向錫回收

- 其他機會

簡介目錄

Product Code: 53430

The Tin Market size is estimated at 429.24 kilotons in 2025, and is expected to reach 487.78 kilotons by 2030, at a CAGR of 2.59% during the forecast period (2025-2030).

Key Highlights

- Surging demand from the electric vehicle market and increasing applications in the electrical and electronics industry are expected to drive the market during the forecast period.

- The presence of substitutes like aluminum and tin-free steel for producing metallic products like containers is hindering the market's growth.

- Shifting focus toward recycling tin is expected to create opportunities for the market in the coming years.

- Asia-Pacific is expected to dominate the market and witness the highest CAGR during the forecast period.

Tin Market Trends

The Electronic Segment to Dominate the Market Growth

- Tin is used in the electronics industry as a solder and is often used in various purities and alloys, generally with lead and indium. About 50-70% of the overall tin produced is used in the electronics and electrical industry in various products, such as mobiles, tablets, computers, watches, clocks, and other consumer electronic devices.

- For instance, according to the Japan Electronics and Information Technology Industries Association (JEITA), the global electronics and IT industry's production was estimated at USD 3,382.6 billion in 2023, registering a negative CAGR of 3% Y-o-Y compared to 2022. However, in 2024, it is expected to grow by 9% and reach USD 3,686.8 billion.

- Globally, smartphone demand is increasing significantly. According to TelefonaktiebolagetLM Ericsson, smartphone subscriptions accounted for 6,970 million in 2023, an increase of about 5.3% compared to 2022. Also, the subscription will reach 8,060 million by 2029, enhancing tin consumption from electronics applications.

- Also, the demand for electronics products in Asia-Pacific mainly comes from China, India, and Japan. China is a robust and favorable market for electronics producers, owing to the country's low labor cost and flexible policies. According to the National Bureau of Statistics of China, the annual growth rate of value added in the electronics manufacturing industry in the country increased by 3.4% Y-o-Y in 2023.

- The German electronics industry in Europe is the largest in the region. According to the ZVEI, Germany's electro and digital industry turnover accounted for EUR 242 billion (USD 261.94 billion) in 2023, witnessing a CAGR of 7.56% compared to 2022. Also, in terms of production, the electro and digital industries registered a CAGR of 1.4% in 2022 compared to 2021.

- Hence, due to the factors mentioned above, the use of tin is increasing in the electronics industry.

Asia-Pacific to Dominate the Market

- Asia-Pacific has dominated the tin market. China is one of the largest producers and consumers of tin globally.

- The automotive industry, one of the major contributors to the tin market and the automotive sector, has been shaping up for product evolution. China is focusing on manufacturing products to ensure fuel economy and minimize emissions owing to the growing environmental concerns due to mounting pollution in the country.

- Tin, along with other metals, is used in numerous automotive applications, including fuel tanks, sealants, wiring, radiator, seat cushions, seams and welds, fasteners, screws, nuts, bolts, and roofing.

- Asia-Pacific is home to some of the world's most valuable vehicle manufacturers. Developing countries such as China, India, Japan, and South Korea have been working hard to strengthen the manufacturing base and develop efficient supply chains for greater profitability.

- China remains the world's largest automotive market in annual sales and manufacturing output. According to OICA, vehicle production in China reached a total of 30.16 million units in 2023, a double-digit increase of 16% annually.

- According to the Society of Indian Automobile Manufacturers (SIAM), in FY 2022-2023 (April 2022 to March 2023), the country's automotive industry produced a total of 2,59,31,867, an increase of about 12.55% compared to FY 2021-2022. As per OICA, the country registered a record increase of 33% in vehicle production in 2023 compared to 2022.

- In addition, the other major end-user industries for tin include electrical and electronics, heavy engineering, and packaging. China's information and communication technology (ICT) sector has grown rapidly in the past decade, owing to the government's support and favorable digitization plans and policies.

- Therefore, due to all such factors, the market for tin in the region is expected to have steady growth during the forecast period.

Tin Industry Overview

The Tin market is highly consolidated. The major players (not in any particular order) include YUNNAN TIN COMPANY GROUP LIMITED, Timah, MINSUR, Malaysia Smelting Corporation Berhad, and Yunnan Chengfeng Nonferrous Metals Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surging Demand from the Electric Vehicle Market

- 4.1.2 Increasing Applications in the Electrical and the Electronics Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Presence of Subsitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

5 MARKET SEGMENTATION (Market Size by Volume)

- 5.1 Product Type

- 5.1.1 Metal

- 5.1.2 Alloy

- 5.1.3 Compounds

- 5.2 Application

- 5.2.1 Solder

- 5.2.2 Tin Plating

- 5.2.3 Chemicals

- 5.2.4 Other Applications (Specialized Alloys and Lead-acid Batteries)

- 5.3 End-user Industry

- 5.3.1 Automotive

- 5.3.2 Electronics

- 5.3.3 Packaging (Food and Beverage)

- 5.3.4 Glass

- 5.3.5 Other End-user Industries (Chemical, Tool Making, Medical Devices)

- 5.4 Geography

- 5.4.1 Production Analysis

- 5.4.1.1 Australia

- 5.4.1.2 Bolivia

- 5.4.1.3 Brazil

- 5.4.1.4 Burma

- 5.4.1.5 China

- 5.4.1.6 Congo (Kinshasa)

- 5.4.1.7 Indonesia

- 5.4.1.8 Malaysia

- 5.4.1.9 Peru

- 5.4.1.10 Vietnam

- 5.4.1.11 Other Countries

- 5.4.2 Consumption Analysis

- 5.4.2.1 Asia-Pacific

- 5.4.2.1.1 China

- 5.4.2.1.2 India

- 5.4.2.1.3 Japan

- 5.4.2.1.4 South Korea

- 5.4.2.1.5 Rest of Asia-Pacific

- 5.4.2.2 North America

- 5.4.2.2.1 United States

- 5.4.2.2.2 Canada

- 5.4.2.2.3 Mexico

- 5.4.2.3 Europe

- 5.4.2.3.1 Germany

- 5.4.2.3.2 United Kingdom

- 5.4.2.3.3 Italy

- 5.4.2.3.4 France

- 5.4.2.3.5 Austria

- 5.4.2.3.6 Rest of Europe

- 5.4.2.4 South America

- 5.4.2.4.1 Brazil

- 5.4.2.4.2 Argentina

- 5.4.2.4.3 Rest of South America

- 5.4.2.5 Middle East and Africa

- 5.4.2.5.1 South Africa

- 5.4.2.5.2 United Arab Emirates

- 5.4.2.5.3 Rest of Middle East and Africa

- 5.4.1 Production Analysis

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 Aurubis AG

- 6.4.3 Avalon Advanced Materials Inc.

- 6.4.4 Indium Corporation

- 6.4.5 Jiangxi New Nanshan Technology Co. Ltd

- 6.4.6 Malaysia Smelting Corporation Berhad

- 6.4.7 MINSUR

- 6.4.8 Thailand Smelting and Refining Co. Ltd

- 6.4.9 Timah

- 6.4.10 Yunnan Chengfeng Non-ferrous Metals Co. Ltd

- 6.4.11 YUNNAN TIN COMPANY GROUP LIMITED

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus toward Recycling of Tin

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219