|

市場調查報告書

商品編碼

1686625

亞太電池:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Asia-Pacific Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

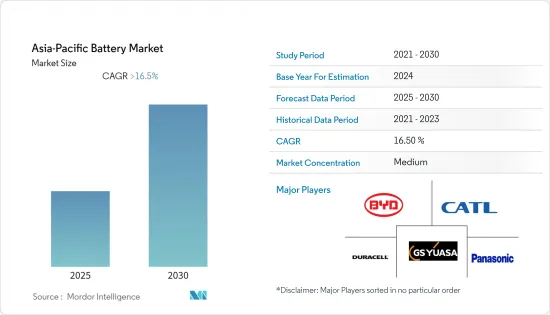

預計預測期內亞太電池市場的複合年成長率將超過 16.5%。

2020年市場受到新冠疫情的不利影響,目前市場已恢復至疫情前的水準。

主要亮點

- 從中期來看,鋰離子電池價格下降、電動車快速普及、可再生能源領域的成長以及家用電器銷售成長等因素預計將推動市場發展。

- 另一方面,原料供需不匹配可能會在未來幾年抑制市場成長。

- 然而,隨著該地區對新車的需求不斷增加,汽車電池領域預計將成為電池市場成長最快的領域。預計未來幾年該領域將成為鋰離子電池的主要終端用戶。將可再生能源納入國家電網的計畫預計將為未來鋰離子電池製造商和供應商創造重大商機。

- 在政府鼓勵製造業發展的政策層面的支持下,印度很可能在亞太電池市場中見證顯著成長。

亞太電池市場趨勢

汽車電池產業將經歷顯著成長

- 預計未來汽車產業將成為鋰離子電池的主要終端用戶領域之一。電動車的廣泛應用預計將為鋰離子電池行業的成長提供巨大推動力。

- 目前,世界各地銷售的車輛類型多樣,混合動力和電氣化程度不斷提高,包括混合動力電動車 (HEV)、插電式混合動力電動車和電動車 (EV)。

- 電動車在已開發經濟體和新興經濟體中越來越受歡迎。中國的電動車銷量居世界首位,印度等新興經濟體正在改造其公共交通基礎設施以適應電動車。

- 在當前的市場情勢下,政策支持對於加速電動車的普及發揮關鍵作用。政策支持將為消費者提供有吸引力的汽車,降低投資者的風險,並鼓勵製造商大規模開發電動車,從而促進市場發展。

- 電池價格下降和技術進步預計將為市場帶來具有價格競爭力的電動車,從而創造對電池技術的需求。

- 全球電動車電池生產集中在亞太地區,中國、日本和韓國公司在該領域佔據主導地位,並在歐洲建廠以捍衛其主導地位。截至2021年,中國是最大的電動車市場,銷量約330萬輛。該國也正在努力降低空氣污染水平,預計將進一步促進汽車電池產業的發展。

- 印度政府已採取多項舉措來推廣電動車。 「印度快速採用和製造(混合動力和)電動車(FAME)」計畫第二階段於 2019 年 4 月啟動,為期三年。該計劃的主要目標是鼓勵更快地採用電動和混合動力汽車汽車,並透過獎勵購買電動車和創建電動車必要的充電基礎設施來促進汽車電池產業的發展。

- FAME印度計畫(於2019年4月啟動)原定於2022年結束。然而,經主管機關核准,聯邦政府於2021年6月決定將FAME印度第二階段計畫延長兩年,至2024年3月。 2021年第一季,聯邦政府增加了電動二輪車和三輪車的激勵措施,以鼓勵更廣泛的採用。據一些行業專家稱,由於過去兩年電動車銷售一直低迷,政府希望利用專門用於 FAME 計劃的資金。

- 因此,隨著電動車的普及,汽車電池產業可能會經歷強勁成長。

印度經濟快速成長

- 亞太地區擁有多個發展中經濟體,自然資源和人力資源豐富。基於政府對製造業的政策支持,印度預計將在未來幾年成為電池企業的主要投資熱點。

- 印度市場受到人口成長、都市化、電子設備價格下降、新智慧技術的採用和可負擔的網路存取的推動。此外,新款智慧型手機更換舊款智慧型手機也有望成為市場成長的推動力。

- 通訊服務滲透率的不斷提高將為印度通訊市場的成長提供機會。因此,隨著用戶的增加,預計該國對通訊塔的需求將會增加,從而進一步增加對備用所需電池的需求。

- 印度是世界上二氧化碳排放排名前五的國家之一。為了緩解空氣污染問題,政府一直帶頭實施有利於電動車普及的政策。

- 政府已明確表示,計劃設立電動車充電站的企業可能不需要獲得交通部頒發的授權或執照。印度政府也設定了一個雄心勃勃的目標,從 2030 年起銷售的所有新車都將實現純電動化。預計這些努力將提振該國對電池的需求。

- 在印度,超過50%的通訊塔位於每天停電超過8小時的地方。通訊業者必須維持 99.5% 的運轉率,否則將面臨處罰。因此,該塔嚴重依賴柴油發電機。電訊業正在轉向可再生能源,特別是太陽能,以及電池儲存系統,以減少溫室氣體排放。

- 因此,2020年2月,印度通訊部指示通訊服務供應商使用可再生能源解決方案和節能技術,從而推動印度電池市場的發展。

- 因此,由於這些因素,預計印度在預測期內將在亞太電池市場中呈現顯著成長。

亞太電池產業概況

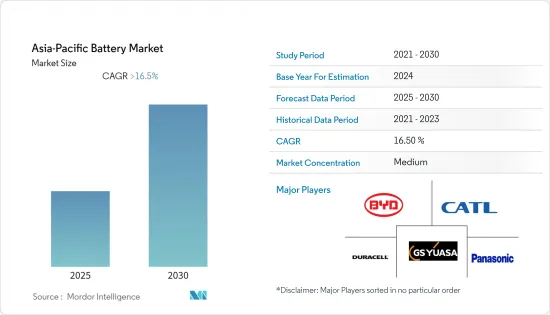

亞太電池市場需要更加緊密地團結起來。主要公司包括(排名不分先後)寧德時代、比亞迪、金霸王、GS湯淺、Panasonic Corporation。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 2027 年市場規模與需求預測

- 2027年電池/原料價格趨勢及各主要技術類型預測

- 2020年前主要電池技術及主要國家進出口分析

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場區隔

- 類型

- 一次電池

- 二次電池

- 科技

- 鉛酸電池

- 鋰離子電池

- 其他技術

- 應用

- 汽車電池(HEV、PHEV、EV)

- 工業電池(原動機、固定式(電信、UPS、能源儲存系統(ESS)))

- 可攜式電池(消費性電子產品)

- 其他用途

- 地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- BYD Co. Ltd

- Contemporary Amperex Technology Co. Limited

- Duracell Inc.

- EnerSys

- GS Yuasa Corporation

- Clarios International Inc.

- LG Chem Ltd

- Panasonic Corporation

- Saft Groupe SA

- Samsung SDI Co. Ltd

- Tesla Inc.

- TianJin Lishen Battery Joint-Stock Co. Ltd

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 53366

The Asia-Pacific Battery Market is expected to register a CAGR of greater than 16.5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors including lithium-ion battery prices decline, rapid adoption of electric vehicles, growing renewable sector, and increased sale of consumer electronics are expected to drive the market.

- On the other hand, the demand-supply mismatch of raw materials is likely to restrain the market's growth in the coming years.

- Nevertheless, The automotive batteries segment is expected to be the fastest-growing segment in the battery market due to the increasing demand for new vehicles produced in the region. The segment is expected to be the leading end-user for lithium-ion batteries in the coming years. Plans to integrate renewable energy with the national grids in respective countries are expected to create a significant opportunity for lithium-ion battery manufacturers and suppliers in the future.

- India is likely to experience significant growth in the Asia-Pacific battery market based on policy-level support from the government encouraging the manufacturing sector.

Asia Pacific Battery Market Trends

Automotive Battery Segment to Witness Significant Growth

- The automotive sector is anticipated to be one of the major end-user segments for lithium-ion batteries in the future. The penetration of electric vehicles will likely provide a massive impetus for the lithium-ion battery industry's growth.

- Different vehicle types are now available globally, featuring increasing degrees of hybridization and electrification, such as Hybrid Electric Vehicles (HEVs), plug-in hybrid electric vehicles, and Electric Vehicles (EVs).

- In developed and developing economies, the adoption of electric vehicles is increasing at a high rate. China is leading in global EV sales, and other developing economies like India are transforming their public transportation infrastructure for EVs.

- In the current market scenario, policy support plays a crucial role in driving the adoption of electric vehicles. Policy support enables market growth by making vehicles appealing to consumers, reducing risks for investors, and encouraging manufacturers to develop electric vehicles on a large scale.

- Falling battery prices and improving technology are expected to bring price-competitive electric vehicles to the market, creating demand for battery technologies.

- The global production of batteries for electric vehicles is concentrated in Asia-Pacific, with Chinese, Japanese, and South Korean companies dominating the sector and building factories in Europe to conserve their supremacy. As of 2021, China was the largest market for electric vehicles, as the country accounted for approximately 3300000 vehicles sold. The country is also making efforts to reduce air pollution levels, which is further expected to push the automotive battery segment.

- The Indian government has taken several initiatives to promote electric vehicles. In April 2019, Phase II of the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) India scheme was implemented for three years. The scheme's main objective is to promote faster adoption of electric and hybrid vehicles by providing an incentive for the purchase of electric vehicles and creating necessary charging infrastructure for electric vehicles, thereby boosting the automotive battery segment.

- The FAME India Scheme (which started in April 2019) was supposed to end by 2022. However, with the approval of competent authorities, the union government, in June 2021, decided that the FAME India Phase II Scheme will be extended for two years, i.e., up to March 2024. In Q1 of 2021, the union government increased incentives on electric two- and three-wheelers to help boost broad-based adoption. According to some industry experts, the government wanted to utilize the funds earmarked for the FAME scheme, with the sale of EVs remaining muted for the past two years.

- Thus, the automotive battery sector will likely witness significant growth with the increasing adoption of electric vehicles.

India to Witness Significant Growth

- Asia-Pacific has multiple growing economies with substantial natural and human resources. India is expected to become a major investment hotspot for battery companies in the coming years, based on the policy-level support from the governments encouraging the manufacturing sector.

- The Indian market is driven by increasing population, urbanization, declining cost of electronic items, the introduction of new smart technologies, and availability of the internet at a cheaper cost. Replacement of older smartphones with newer ones is also expected to drive the market's growth.

- The increasing penetration of telecommunication services provides an opportunity for the growth of the telecommunication market in India. Therefore, with the increase in subscribers, the requirement for telecommunication towers in the country is expected to increase, further fostering the demand for batteries required for backup purposes.

- India is among the top five emitters of CO2 in the world. To mitigate the problem of air pollution, the government has taken the initiative to implement policies favorable to increase the EV fleet count on the road.

- The government has clarified that entities planning to set up EV charging stations may not require licensing from the ministry. The Indian government also set an ambitious target of new vehicles sold after 2030 to be fully electric. Such initiatives are expected to drive the demand for batteries in the country.

- India has more than 50% of telecom towers located in sites that face outages for 8 hours a day or more. The telecom industry players must maintain an uptime of 99.5% or face penalties. As a result, the towers are heavily dependent on diesel generators. The telecom industry is moving toward renewable sources, particularly solar, in tandem with battery energy storage systems to reduce greenhouse emissions.

- To this effect, in February 2020, the Indian Department of Telecommunications issued directions to the telecom service providers to use renewable energy solutions and energy-efficient technologies, thereby boosting the Indian battery market.

- Hence, due to such factors, India is expected to witness significant growth in the Asia-Pacific battery market during the forecast period.

Asia Pacific Battery Industry Overview

The Asia-Pacific Battery Market could be more cohesive. Some major players include (not in particular order) Contemporary Amperex Technology Co. Limited, BYD Co. Ltd, Duracell Inc., GS Yuasa Corporation, and Panasonic Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Battery/Raw Material Price Trends and Forecast, by Major Technology Type, till 2027

- 4.4 Import and Export Analysis, by Major Battery Technology and Major Country, in USD million, till 2020

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary Battery

- 5.1.2 Secondary Battery

- 5.2 Technology

- 5.2.1 Lead-acid Battery

- 5.2.2 Lithium-ion Battery

- 5.2.3 Other Technologies

- 5.3 Application

- 5.3.1 Automotive Batteries (HEV, PHEV, and EV)

- 5.3.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, and Energy Storage Systems (ESS))

- 5.3.3 Portable Batteries (Consumer Electronics)

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 India

- 5.4.2 China

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 Duracell Inc.

- 6.3.4 EnerSys

- 6.3.5 GS Yuasa Corporation

- 6.3.6 Clarios International Inc.

- 6.3.7 LG Chem Ltd

- 6.3.8 Panasonic Corporation

- 6.3.9 Saft Groupe SA

- 6.3.10 Samsung SDI Co. Ltd

- 6.3.11 Tesla Inc.

- 6.3.12 TianJin Lishen Battery Joint-Stock Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219