|

市場調查報告書

商品編碼

1686619

穿戴式溫度感測器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Wearable Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

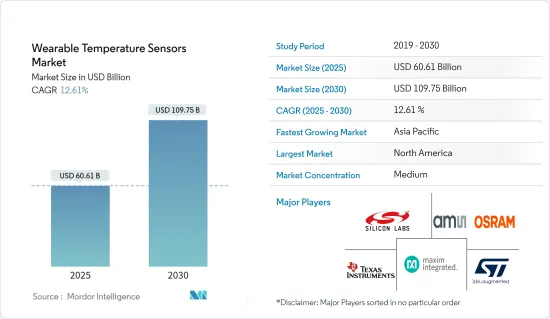

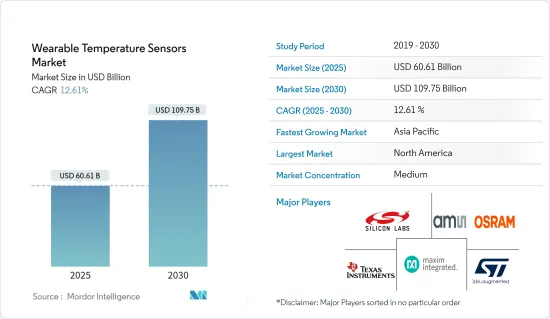

穿戴式溫度感測器市場規模預計在 2025 年為 606.1 億美元,預計到 2030 年將達到 1,097.5 億美元,預測期內(2025-2030 年)的複合年成長率為 12.61%。

穿戴式溫度感測器是一種單獨使用來測量人體體溫的可攜式感測器。這些感測器將被整合到穿戴式裝置中或直接安裝到人體上,以監測心率、體溫和脈搏率。穿戴式感測器在醫療保健和診斷行業中越來越受歡迎,因為該行業的幾個參數(血壓、心率和體溫)都至關重要。

主要亮點

- 消費性電子產品的支出也刺激了穿戴式裝置的成長。由於都市化和人口成長而導致的生活方式的改變導致了人們對健康和安全意識的增強。這是刺激健身追蹤器、耳戴式裝置和智慧型手錶等穿戴式裝置成長的主要因素。

- 智慧生活的快速發展和連網設備的增加預計將推動穿戴式溫度感測器市場的發展。這些穿戴式溫度感測器正在提高各個年齡層的健身和健康意識,從而推動穿戴式感測器的發展。

- 穿戴式感測器設備也正在成為運動產業的重要組成部分,因為它們可以幫助運動員堅持日常訓練並提供有關其被編程監測的參數的重要資訊。此外,由更小、更智慧、更低成本的感測器組成的先進穿戴式裝置的出現,以及人工智慧和物聯網的日益普及,預計將進一步確保穿戴式裝置市場的成長,預計這將對穿戴式溫度感測器市場產生積極影響。

- 隨著消費者對智慧型穿戴裝置的追求日益成長,設備價格也隨之上漲,零件成本也不斷增加,限制了市場普及。智慧型手錶和健身追蹤器價格低廉,吸引了大量消費者的注意。然而,隨著該技術變得越來越普及,其他設備如鞋類、眼鏡產品和內衣產品的價格較高且採用率較低。

穿戴式溫度感測器市場趨勢

醫療保健預計將成為所有終端用戶領域中成長最快的領域

- 穿戴式溫度感測器廣泛用於醫療保健領域,以即時監測體溫。例如,檢測發燒、持續監測患者以及追蹤患有某些疾病的個人的體溫變化。

- 穿戴式溫度感測器可以持續監測個人的體溫,並有助於及早發現異常的體溫變化。這些即時資料對於及時干預至關重要,尤其是在感染疾病和慢性疾病方面。穿戴式感測器還提供了一種非侵入性且便捷的方式來追蹤健康參數,提高了患者的舒適度和對監測通訊協定的依從性。

- 這些感測器正在成為一種遠端健康監測的新技術,用於估計呼吸頻率、血氧水平和體溫等生命徵象,並檢測生理和生化標記。穿戴式溫度感測器為包括 COVID-19 在內的多種疾病的非侵入性和早期診斷提供了巨大潛力。

- 預計預測期內老年人口的增加和穿戴式裝置在醫療保健領域的好處的增加將推動市場擴張。根據人口問題研究所的數據,大約 25% 的人口年齡在 15 歲以下,10% 的人口年齡在 65 歲以上。

亞太地區可望強勁成長

- 亞太地區的很大一部分將歸因於不斷成長的醫療保健應用領域。預計中國、韓國和印度等新興經濟體的需求不斷成長,將大幅促進該地區對此類穿戴式溫度感測器的需求。

- 預計預測期內亞太地區將顯著成長。支持這一成長的關鍵因素是增加對醫療基礎設施、研究和研發中心、政府計劃和有利於醫療設備和器械市場的政策的投資。

- 由於慢性病發病率不斷上升以及人們對醫療感測器認知的不斷提高,亞太地區的市場佔有率預計將擴大。這些地區穿戴式溫度感測器市場的成長歸因於近年來對醫療感測器發展的日益重視、醫療保健基礎設施的加強以及疾病的早期發現。

- 隨著人口老化,該地區在醫療設備和設施領域的技術創新一直具有空間,為外國公司提供了投資機會。例如,2023 年 7 月,Boat 宣布發布一款具有健康和健身追蹤功能的智慧戒指。該戒指配備了一系列健康感測器,包括溫度測量、心率追蹤、睡眠監測和女性月經週期映射。

穿戴式溫度感測器產業概況

穿戴式溫度感測器市場正走向半固體。該市場的一些全球主要企業包括 Silicon Laboratories Inc.、Maxim Integrated Products Inc.、STMicroelectronics NV、Texas Instruments Inc. 和 AMS-OSRAM AG。這些公司透過專注於市場擴張、收購、產品發布和技術升級來不斷擴大業務。

- 2024 年 2 月 GreenTEG 和 WITHINGS 之間的合作可望徹底改變健康監測。此次合作將把 GreenTEG 專為體溫監測而設計的尖端感測器 CALERA 整合到最新的 WITHINGS Scanwatch NOVA 中。

- 2024 年 2 月領先的感測器製造商 Sensirion 透露了將其位於匈牙利德布勒森的生產工廠擴建 5,000平方公尺的計劃。此舉將增強 Sensirion 的生產能力,特別是在感測器模組領域。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈/供應鏈分析

- 評估宏觀經濟因素和新冠肺炎疫情對市場的影響

第5章 市場動態

- 市場促進因素

- 提高各年齡層的健康意識

- 穿戴式裝置的技術進步

- 市場挑戰

- 產品成本高

第6章 市場細分

- 按應用

- 貼身衣物

- 眼鏡產品

- 鞋類

- 腕錶

- 其他用途

- 按行業

- 衛生保健

- 運動/健身

- 產業

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Silicon Laboratories Inc.

- Maxim Integrated Products Inc.

- STMicroelectronics NV

- Texas Instruments Inc.

- AMS-OSRAM AG

- Melexis

- Analog Devices Inc.

- GreenTEG

- TE Cnnectivity Ltd

- Sensirion AG

第8章投資分析

第9章:市場的未來

The Wearable Temperature Sensors Market size is estimated at USD 60.61 billion in 2025, and is expected to reach USD 109.75 billion by 2030, at a CAGR of 12.61% during the forecast period (2025-2030).

Wearable temperature sensors are portable sensors that are used independently to measure human temperature. These sensors are directly integrated into wearable devices or the human body to monitor heart rate, body temperature, and pulse rate. Wearable sensors have gained popularity in the healthcare and diagnosis industry, where several parameters are of vital importance, namely blood pressure, heart rate, and body temperature.

Key Highlights

- Spending on consumer electronic products is also stimulating the growth of wearable devices. The increasing urbanization and changing lifestyle of the growing population have increased health and safety awareness. This is a major factor stimulating the growth of wearable devices, such as fitness trackers, earwear, and smartwatches.

- The rapidly increasing trend of smart living and the growing number of connected devices are expected to enhance the wearable temperature sensors market. These wearable temperature sensors increase awareness regarding fitness and health in people of all age groups, driving the growth of wearable sensors.

- Also, wearable sensor devices have emerged as a significant part of the sports industry since they help athletes stick to their daily routines and provide important information about the parameters they are programmed to monitor. Moreover, the advent of advanced wearable devices that comprise smaller, smarter, and low-cost sensors, together with the growing adoption of AI and IoT, is further projected to ensure the growth of the wearable devices market, which is anticipated to create a positive impact on the wearable temperature sensors market.

- With the growing propensity of consumers toward smart wearables, the prices of devices are also soaring along with the growing cost of components, which limits adoption in the market. Smartwatches and fitness trackers have low-cost segments that drive significant attention from consumers. However, with the proliferation of technology, other devices such as footwear, eyewear, and body wear products are highly priced and have lower adoption rates.

Wearable Temperature Sensors Market Trends

Healthcare is Expected to Register the Fastest Growth Among All End-user Verticals

- Wearable temperature sensors are significantly used in the healthcare sector to monitor body temperature in real time. Examples include fever detection, continuous monitoring of patients, and tracking temperature variations for individuals with certain medical conditions.

- They enable the continuous monitoring of an individual's body temperature, aiding in the early detection of abnormal variations. This real-time data is crucial for timely intervention, especially in infections or chronic conditions. Wearable sensors also provide a non-invasive and convenient way to track health parameters, enhancing patient comfort and compliance with monitoring protocols.

- These sensors are emerging as a new technology for remote health monitoring to detect physiological and biochemical markers by estimating vital signs such as respiratory rate, blood oxygen level, and body temperature; wearable temperature sensors offer immense potential for the non-invasive and early diagnosis of multiple diseases, including COVID-19.

- The growing geriatric population and the increasing number of advantages of wearable devices in healthcare are projected to accelerate the expansion of the market during the forecast period. According to the Population Reference Bureau, about 25% of the population is under 15 years of age, and 10% is over 65 years of age.

Asia-Pacific is Expected to Register Significant Growth

- The major share of the Asia-Pacific region can be attributed to the growth in application areas of the healthcare sector. The escalating demand in the emerging economies of China, South Korea, and India is expected to greatly contribute to the regional demand for such wearable temperature sensors.

- The Asia-Pacific region is expected to witness significant growth during the forecast period. Major factors supporting growth are increasing investments in medical infrastructure, research and innovation centers, government programs, and policies favoring the healthcare equipment and devices markets.

- The Asia-Pacific region is anticipated to experience market share growth due to the increasing prevalence of chronic disorders and the rising awareness of medical sensors among individuals. The growth of the wearable temperature sensors market in these regions is attributed to the increased emphasis on the development of medical sensors in recent years, the enhancement of healthcare infrastructure, and the early detection of diseases.

- Given the region's aging population, there is always room for innovation in the field of medical devices and equipment, which provides opportunities for foreign companies to invest in the country. For instance, in July 2023, Boat announced the release of its smart ring with health and fitness tracking features. The ring has various health sensors, such as measuring the user's body temperature, heart rate tracking, sleep monitoring, female menstrual cycle mapping, etc.

Wearable Temperature Sensors Industry Overview

The wearable temperature sensors market is semi-consolidated. Some of the global key players in this market are Silicon Laboratories Inc., Maxim Integrated Products Inc., STMicroelectronics NV, Texas Instruments Inc., and AMS-OSRAM AG. These firms have been continuously expanding their operations by focusing on market expansions and acquisitions, product launches, and technological upgrades.

- February 2024: GreenTEG's collaboration with WITHINGS is expected to revolutionize health monitoring. The partnership involves integrating GreenTEG's cutting-edge CALERA sensor, designed for core body temperature monitoring, into the latest WITHINGS Scanwatch NOVA.

- February 2024: Sensirion, a leading sensor manufacturer, revealed plans to expand its production facility in Debrecen, Hungary, by an additional 5,000 sq. m. The expansion is set to be executed in two phases, with the first phase slated for completion in Q4 2024 and the second phase expected to be wrapped up by Q1 2025. This move is poised to bolster Sensirion's production capabilities, particularly in the realm of sensor modules.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Assessment of the Impact of Macroeconomic Factors and COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Health Awareness Among all Age Groups

- 5.1.2 Technological Advancement in Wearable Devices

- 5.2 Market Challenges

- 5.2.1 High Product Cost

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Body Wear

- 6.1.2 Eye Wear

- 6.1.3 Foot Wear

- 6.1.4 Wrist Wear

- 6.1.5 Other Applications

- 6.2 By End-user Vertical

- 6.2.1 Healthcare

- 6.2.2 Sports/Fitness

- 6.2.3 Industrial

- 6.2.4 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Silicon Laboratories Inc.

- 7.1.2 Maxim Integrated Products Inc.

- 7.1.3 STMicroelectronics NV

- 7.1.4 Texas Instruments Inc.

- 7.1.5 AMS-OSRAM AG

- 7.1.6 Melexis

- 7.1.7 Analog Devices Inc.

- 7.1.8 GreenTEG

- 7.1.9 TE Cnnectivity Ltd

- 7.1.10 Sensirion AG