|

市場調查報告書

商品編碼

1686607

苯乙烯乙烯丁烯苯乙烯 (SEBS) - 市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Styrene Ethylene Butylene Styrene (SEBS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

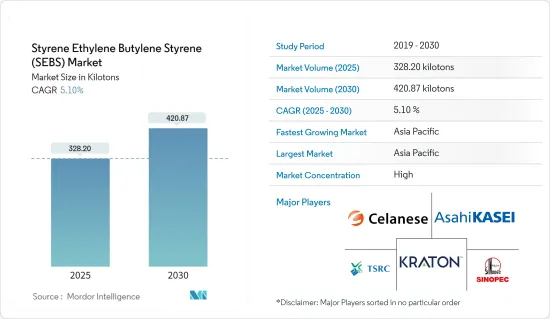

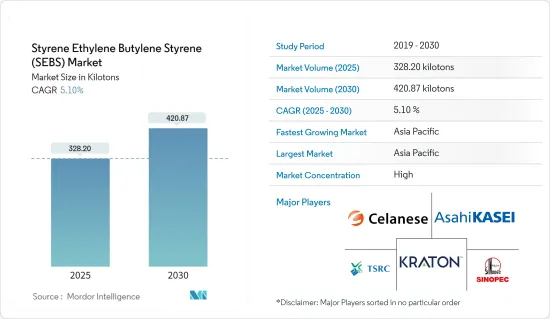

苯乙烯/乙烯/丁烯/苯乙烯市場規模預計在 2025 年為 328.20 千噸,預計在 2030 年達到 420.87 千噸,預測期內(2025-2030 年)的複合年成長率為 5.1%。

由於多個國家實施全國封鎖,嚴格的社交隔離措施影響了黏合劑和密封劑、汽車和塑膠等應用,COVID-19 疫情阻礙了苯乙烯乙烯丁烯苯乙烯 (SEBS) 市場的發展。然而,由於黏合劑和密封劑、汽車和塑膠產業對乙烯、丁烯和苯乙烯的需求不斷增加,即使在放鬆管制後,市場仍錄得顯著的成長率。

主要亮點

- 預計黏合劑產業投資的增加和汽車產業需求的增加將推動乙烯丁烯苯乙烯市場的發展。

- 然而,苯乙烯的危險性質和法規預計會阻礙市場成長。

- 預計其在各種應用中作為 PVC 替代品的出現將在預測期內為市場創造機會。

- 預計亞太地區將主導市場。預計在預測期內其複合年成長率也將達到最高。這是由於黏合劑和密封劑、汽車和塑膠產業對苯乙烯、乙烯、丁烯和苯乙烯的需求不斷增加。

苯乙烯-乙烯-丁烯-苯乙烯 (SEBS) 市場趨勢

汽車產業可望主導市場

- 苯乙烯-乙烯-丁烯-苯乙烯 (SEBS) 因其高強度、優異的紫外線穩定性、熱穩定性和其他物理特性而用於汽車密封條、車窗封裝、玻璃導槽、靜態密封條、汽車內飾件和儀錶面板準備。

- 受人口成長和新興市場富裕程度提高的推動,全球汽車產量預計在不久的將來將超過 1 億輛。根據國際汽車製造商組織(OICA)的預測,2023年全球汽車產量將達到約9,355萬輛,而2022年為8,502萬輛,成長率為10%。這表明汽車產業對 SEBS 的需求增加。 2023年,全球乘用車產量將達到約6,800萬輛,較2022年成長近11%。

- 由於對電動車的需求不斷增加,汽車產業也正在成長。預計電動車銷量到 2027 年將達到 3,100 萬輛,到 2035 年將達到 7,450 萬輛。因此,預計未來幾年對 SEBS 的需求將會成長。

- 中國乘用電動車(EV)市場持續以驚人的速度成長。 2022年電動車銷量與前一年同期比較去年同期成長87%。比亞迪、五菱、奇瑞、長安、廣汽是主導電動車市場的中國品牌,其中本土品牌佔81%。此外,比亞迪計劃在2022年與前一年同期比較市場佔有率年增11%以上,中國市場前10款電動車款中,將有6款是比亞迪品牌。

- 中國政府預測,2025年,電動車產量將達20%。預計這將增加汽車電池的生產和消費,從而推動市場對SEBS的需求。

- 中國是全球最大的汽車生產基地,根據中國工業協會的預測,2023年中國汽車總產量將達到3,016萬輛,較去年的2,700萬輛成長11.7%。

- 預計這些因素將在預測期內推動全球苯乙烯-乙烯-丁烯-苯乙烯 (SEBS) 市場的成長。

亞太地區可望主導市場

- 亞太地區佔據全球 SEBS 市場的主導地位。印度、中國、日本和韓國等國家建設活動的增加,增加了該地區對黏合劑、密封劑和電氣產品的需求,進一步導致 SEBS消費量增加。

- 預計未來幾年中國黏合劑和密封劑市場將在包裝、汽車、建築和電子行業等終端用戶領域實現健康成長。 SEBS 在國內的主要企業和潛在客戶包括 3M、HB Fuller Company、Henkel AG & Co. KGaA、Arkema Group、Sika AG、回天新材料和皖維高科。

- 根據中國膠黏劑和壓敏膠工業協會統計,2021年至2022年全國膠黏劑產量逐年增加,2022年總合達到788萬噸。預計2025年膠合劑產量將達855萬噸,預計SEBS需求將增加。

- 印度是世界第二大鞋類生產國,佔全球年產量220億雙的9%。所生產的鞋類近 90% 供國內使用,其餘則出口。鞋類消費量量約21億雙,位居中國和美國之後,位居第三。

- 印度有潛力成為鞋類和皮革產業的全球領導者。與阿拉伯聯合大公國的自由貿易協定(FTA)預計將有助於促進皮革產業的發展。據聯邦貿易和工業、消費者事務、食品、公共分配和紡織品部長稱,2022 年 11 月出口增加了 64%。

- 根據電子情報技術產業協會(JEITA)預測,2023年12月工業電子設備產值將達2,935.77億日圓(約20.8085億美元),年增率接近100%。此外,2023年12月家用電子電器產值達357.75億日圓(2.5357億美元),較上年同期成長約112.2%。

- 由於這些因素,該地區的苯乙烯-乙烯-丁烯-苯乙烯 (SEBS) 市場預計在預測期內將呈現穩定成長。

苯乙烯、乙烯、丁烯、苯乙烯產業概況

苯乙烯-乙烯-丁烯-苯乙烯 (SEBS) 市場本質上是綜合性的,主要企業貢獻了大部分市場佔有率。市場的主要企業包括科騰公司、中國石油化學股份有限公司(中石化)、塞拉尼斯公司、台橡株式會社和旭化成株式會社(排名不分先後)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 加大對膠黏劑產業的投資

- 汽車產業需求增加

- 其他促進因素

- 限制因素

- 苯乙烯的危險特性及管理規定

- 其他阻礙因素

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 形式

- 顆粒

- 粉末

- 最終用戶產業

- 鞋類

- 黏合劑和密封劑

- 塑膠

- 公路和鐵路

- 車

- 運動與玩具

- 電氣和電子

- 其他終端用戶產業(醫療、3D列印、潤滑劑、黏合劑等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Asahi Kasei Corporation

- Celanese Corporation

- China Petrochemical & Chemical Corporation(Sinopec Corp.)

- Dynasol Group

- General Industrial Polymers

- ENEOS Corporation

- Kraton Corporation

- Kuraray Co. Ltd

- LCY GROUP

- Ningbo Changhong Polymer Scientific and Technical Inc.

- Ravago

- RTP Company

- Trinseo

- TSRC

- Versalis SpA

第7章 市場機會與未來趨勢

- 在各種應用中作為 PVC 的替代品出現

The Styrene Ethylene Butylene Styrene Market size is estimated at 328.20 kilotons in 2025, and is expected to reach 420.87 kilotons by 2030, at a CAGR of 5.1% during the forecast period (2025-2030).

The COVID-19 pandemic hampered the styrene ethylene butylene styrene (SEBS) market as nationwide lockdowns in several countries and strict social distancing measures affected applications such as adhesives and sealants, automotive, and plastics. However, the market registered a significant growth rate well after the restrictions were lifted due to the increasing demand for ethylene butylene styrene from adhesives and sealants, automotive, and plastics industries.

Key Highlights

- The increasing investments in the adhesives industry and the growing demand from the automotive industry are expected to drive the market for styrene ethylene butylene styrene.

- On the flip side, the hazardous nature and regulations of styrene are expected to hinder the growth of the market.

- The emergence as a replacement for PVC across various applications is expected to create opportunities for the market during the forecast period.

- Asia-Pacific is expected to dominate the market. It is also expected to register the highest CAGR during the forecast period. This is due to the rising demand for styrene ethylene butylene styrene from adhesives and sealants, automotive, and plastics industries.

Styrene Ethylene Butylene Styrene (SEBS) Market Trends

The Automotive Industry is Expected to Dominate the Market

- Styrene-ethylene-butylene-styrene (SEBS), owing to its high strength, excellent UV and heat stability, and other physical properties, is used in automotive weather seals, window encapsulation, glass run channels, static seals, automotive interior trim, and instrument panel preparation.

- Global automobile manufacturing is expected to surpass 100 million units in the near future due to increasing population levels and rising affluence in emerging markets. According to the Organization Internationale des Constructeurs d'Automobiles (OICA), in 2023, around 93.55 million vehicles were produced worldwide, witnessing a growth rate of 10% compared to 85.02 million vehicles in 2022. This indicated an increased demand for SEBS from the automotive industry. In 2023, around 68 million passenger cars were manufactured worldwide, up by nearly 11% compared to 2022.

- The growth in the automotive industry can also be seen due to the rising demand for electric vehicles. In terms of EV volume, the total number of electric vehicle sales is expected to reach 31 million in 2027 and 74.5 million by 2035. Therefore, the demand for SEBS is expected to grow in the coming years.

- China's passenger electric vehicle (EV) market continues to grow at an impressive rate. EV sales rose by 87% Y-o-Y in 2022. BYD, Wuling, Chery, Changan, and GAC are some of the top Chinese brands that dominate the EV market, with local brands commanding 81%. Additionally, in 2022, BYD increased its market share by over 11% Y-o-Y, with six out of the top 10 EV models in the Chinese market coming from the brand.

- The Chinese government estimates a 20% penetration rate of electric vehicle production by 2025. This is anticipated to increase the production and consumption of vehicle batteries, thus increasing SEBS demand in the market.

- According to the China Association of Automobile Manufacturers (CAAM), China has the largest automotive production base in the world, with a total vehicle production of 30.16 million units in 2023, registering an increase of 11.7% compared to 27 million units produced last year.

- Owing to all these factors, the market for styrene-ethylene-butylene-styrene (SEBS) is likely to grow globally during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific dominated the global SEBS market. With growing construction activities in countries like India, China, Japan, and South Korea, the demand for adhesives, sealants, and electrical products has been increasing in the region, further leading to an increase in the consumption of SEBS.

- The Chinese adhesives and sealants market is estimated to witness healthy growth over the coming years in end-user segments such as packaging, automotive, construction, and electronic industries. Some of the major players and potential customers for SEBS in the country are 3M, HB Fuller Company, Henkel AG & Co. KGaA, Arkema Group, Sika AG, Huitian New Materials, Wanwei High-tech, and others.

- According to statistics from the China Adhesive and Adhesive Tape Industry Association, adhesive production in the country increased year on year from 2021 to 2022, reaching a total of 7.88 million metric tons in 2022. The production of adhesives is expected to reach 8.55 million metric tons in 2025, which is expected to increase the demand for SEBS.

- India is the second-largest footwear manufacturer in the world, accounting for 9% of the annual global production of 22 billion pairs. Nearly 90% of the manufactured footwear is utilized in the country, and the rest is exported. The consumption of footwear stood at around 2.1 billion pairs, and it ranks third after China and the United States.

- India has the potential to become a world leader in the footwear and leather industry. The leather industry is expected to grow due to the country's free trade agreement (FTA) with the United Arab Emirates. Exports increased by 64% in November 2022, according to the Union Minister for Trade Industries, Consumer Affairs, Food, and Public Distribution and Textiles.

- According to the Japan Electronics and Information Technology Industries (JEITA), the production value of industrial electronic devices stood at JPY 293,577 million (USD 2,080.85 million) in December 2023, increasing by almost 100% annually. Furthermore, the production value of consumer electronic equipment in the country stood at JPY 35,775 million (USD 253.57 million) in December 2023, increasing by around 112.2% during the same period the previous year.

- Due to all such factors, the market for styrene-ethylene-butylene-styrene (SEBS) in the region is expected to show steady growth during the forecast period.

Styrene Ethylene Butylene Styrene Industry Overview

The styrene-ethylene-butylene-styrene (SEBS) market is consolidated in nature, with top players contributing to the major share of the market. Some of the major players in the market include (not in any particular order) Kraton Corporation, China Petrochemical Corporation (Sinopec Corp.), Celanese Corporation, TSRC, and Asahi Kasei Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Investments in the Adhesives Industry

- 4.1.2 Growing Demand From the Automotive Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Hazardous Nature and Regulations of Styrene

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Form

- 5.1.1 Pellets

- 5.1.2 Powder

- 5.2 End-User Industry

- 5.2.1 Footwear

- 5.2.2 Adhesives and Sealants

- 5.2.3 Plastics

- 5.2.4 Roads and Railways

- 5.2.5 Automotive

- 5.2.6 Sporting and Toys

- 5.2.7 Electrical and Electronics

- 5.2.8 Other-end User Industries (Medical, 3D Printing, Lubricant Tackifiers, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Asahi Kasei Corporation

- 6.4.2 Celanese Corporation

- 6.4.3 China Petrochemical & Chemical Corporation (Sinopec Corp.)

- 6.4.4 Dynasol Group

- 6.4.5 General Industrial Polymers

- 6.4.6 ENEOS Corporation

- 6.4.7 Kraton Corporation

- 6.4.8 Kuraray Co. Ltd

- 6.4.9 LCY GROUP

- 6.4.10 Ningbo Changhong Polymer Scientific and Technical Inc.

- 6.4.11 Ravago

- 6.4.12 RTP Company

- 6.4.13 Trinseo

- 6.4.14 TSRC

- 6.4.15 Versalis SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emergence as a Replacement For PVC Across Various Applications