|

市場調查報告書

商品編碼

1686578

金屬矽:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Silicon Metal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

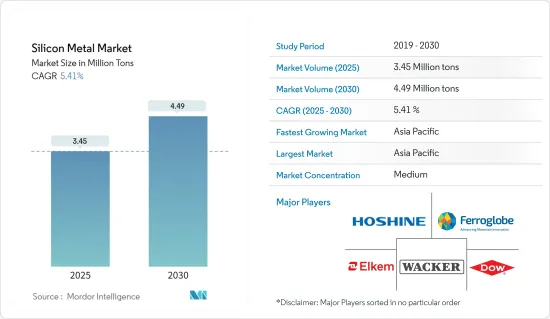

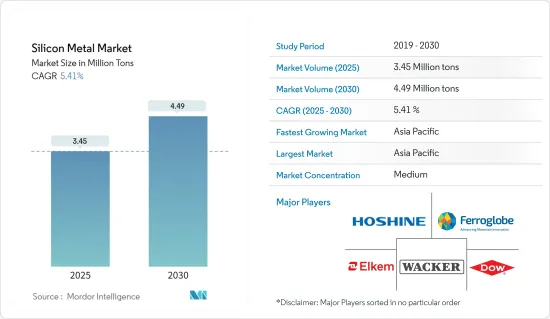

預計2025年矽金屬市場規模為345萬噸,2030年將達449萬噸,預測期間(2025-2030年)的複合年成長率為5.41%。

新冠疫情阻礙了金屬矽市場的發展。疫情期間,由於景氣衰退、消費支出減少以及生產和供應鏈中斷,汽車、建築和電子等許多使用金屬矽的行業的需求都下降。然而,隨著停工和限制的放鬆,使用金屬矽的行業開始復甦,基礎設施計劃、汽車生產、半導體製造和可再生能源設施的需求增加,推動了對金屬矽的需求。

主要亮點

- 汽車行業需求的激增、太陽能電池行業使用量的增加以及其他各種終端用戶需求的增加預計將導致全球矽金屬市場的擴張。

- 然而,能源成本波動阻礙了金屬矽市場的成長。

- 透過改善現有技術和增加可再生能源領域的需求來降低生產成本的多項措施預計將在未來幾年為市場相關人員提供成長機會。

- 亞太地區擁有最高的市場佔有率,並可能在預測期內主導矽金屬市場。

金屬矽市場趨勢

太陽能板領域佔市場主導地位

- 矽是太陽能發電領域使用最廣泛的半導體材料,目前銷售的太陽能模組中約有 95% 是由矽製成的。冶金矽經過精製過程可以轉化為高純度矽,高純度矽是用於半導體和太陽能電池的材料。這使得它適合生產太陽能電池。

- 太陽能是世界上規模最大、成長最快的產業之一。根據國際能源總署(IEA)的數據,該產業佔世界淨能源容量的近三分之二。

- 根據國際能源總署(IEA)發布的資料,2022年太陽能發電量將創紀錄增加270TWh,達到約1300TWh,增幅為26%。 2022年,太陽能發電將成為所有可再生能源技術中絕對發電量成長最強勁的能源,歷史上首次超越風能。

- 美國在《2022年通膨削減法案》(IRA)中為太陽能發電提供了慷慨的新資金。投資稅額扣抵和生產稅額扣抵可能會顯著促進太陽能產能和供應鏈的成長。

- 根據國際能源總署(IEA)發布的資料,巴西2022年將新增約11吉瓦的太陽能發電量,成長率2021年的兩倍。鑑於工業和電力零售商對可再生能源的持續需求,預計中期內安裝量將維持在這個水準。

- 根據印度新和可再生能源部(MNRE)發布的資料,截至2022年底,印度太陽能發電裝置容量排名世界第四。截至2022年11月,太陽能發電累積設備容量將達到約720萬千瓦。目前,印度太陽能電價非常有競爭力,並已實現市電平價。

- 預計上述發展將在整個預測期內推動太陽能產業矽金屬市場的發展。

亞太地區佔市場主導地位

- 亞太地區,尤其是中國,是世界上最大的金屬矽生產國。該地區擁有豐富的石英、煤炭等原料蘊藏量以及低成本的勞動力,適合建立大規模的金屬矽生產設施。

- 金屬矽最重要的應用是矽膠黏合劑、密封劑、潤滑劑、化學品、其他材料和鋁合金。汽車、建築、工業和其他最終用戶領域是這些產品的主要應用。

- 中國新能源車產銷量大幅成長,預計2022年銷量將達722萬輛,佔全球電動車銷量的64%。

- 預計政府推動電動、混合動力汽車和燃料電池汽車普及的措施將在預測期內推動市場發展。中國對電動車的需求不斷成長,推動了對半導體、鋁合金和矽膠黏合劑的需求。

- 中國工業協會發布的報告顯示,2022年中國汽車出口311萬輛,其中乘用車253萬輛,商用車58萬輛,較去年同期成長54.4%。

- 全球頂級太陽能製造商的總部都設在中國,包括晶科能源、天合光能和晶澳太陽能。過去兩年,中國的太陽能電池製造業大幅成長。根據國際能源總署(IEA)發布的資料,中國在太陽能發電裝置容量新增方面持續領先,2022年將新增太陽能發電裝置容量100吉瓦,較2021年成長近60%。

- 投資行動電話、筆記型電腦等電器產品製造是中國重點投資領域。為了滿足即將到來的需求成長,全球各大製造商都在向中國市場投入大量資金。

- 由於這些因素,預計亞太地區的中國將主導金屬矽市場。

金屬矽產業概況

金屬矽市場部分盤整。主要參與者(不分先後順序)包括合盛矽業、Ferroglobe、Elkem ASA、陶氏和瓦克化學。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 汽車產業需求快速成長

- 太陽能電池產業的使用日益增多

- 各類終端用戶對矽的需求不斷增加

- 限制因素

- 能源成本波動

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 依產品類型

- 冶金級

- 化學級

- 按應用

- 鋁合金

- 半導體

- 太陽能板

- 矽衍生物

- 其他用途(建築和基礎設施)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 印尼

- 泰國

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 西班牙

- 法國

- 土耳其

- 俄羅斯

- 北歐的

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Anyang Huatuo Metallurgy Co., Ltd.

- Dow

- Elkem ASA

- Ferroglobe

- Hoshine Silicon Industry Co., Ltd.

- Liasa

- Minasligas

- Mississipi Silicon

- PCC SE

- RIMA INDUSTRIAL

- RusAL

- Shin-Etsu Chemical Co., Ltd.

- Wacker Chemie AG

- Zhejiang kaihua yuantong silicon industry co. LTD.

第7章 市場機會與未來趨勢

- 透過現有技術創新降低生產成本的舉措

- 可再生能源領域的需求不斷成長

The Silicon Metal Market size is estimated at 3.45 million tons in 2025, and is expected to reach 4.49 million tons by 2030, at a CAGR of 5.41% during the forecast period (2025-2030).

The COVID-19 hampered the silicone metal market. Many industries that utilize silicone metal, such as automotive, construction, and electronics, experienced decreased demand during the pandemic due to economic downturns, reduced consumer spending, and disruptions in production and supply chains. However, as lockdowns and restrictions eased, industries that utilize silicone metal recovered, and there was increased demand for silicone from infrastructure projects, automotive production, semiconductor manufacturing, and renewable energy installations, which boosted the demand for silicone metals.

Key Highlights

- Surging demand for silicone from the automotive industry, increasing use in the solar industry, and increasing demand for silicones from various other end users are expected to increase the market for silicone metal globally.

- However, volatility in energy costs is hindering the growth of the silicon metal market.

- Several measures to reduce production costs by improving current technologies and increasing demand from the renewable energy sector are expected to create growth opportunities for the market players in the upcoming period.

- The Asia-Pacific holds the highest market share and is likely to dominate the silicon metal market during the forecast period.

Silicon Metal Market Trends

Solar Panels Segment to Dominate the Market

- Silicon, which accounts for about 95% of the modules sold today, is the most extensively used semiconductor material in photovoltaics. In the process of purification, metallurgical silicon can be transformed into high-purity silicon that is used to make semiconductors and solar cells. Therefore, it is suitable for the manufacture of photovoltaic cells.

- Solar energy is one of the largest and fastest-growing sectors worldwide. The sector is responsible for nearly two-thirds of global net energy capacity, according to the International Energy Agency.

- According to the data published by the International Energy Agency (IEA), in 2022, solar PV production increased by a record 270 TWh, which increased by 26%, reaching almost 1300 TWh. It demonstrated the most considerable absolute generation growth of all renewable technologies in 2022, surpassing wind for the first time in history.

- The United States included generous new funding for solar PV in the Inflation Reduction Act (IRA) introduced in 2022. Investment and production tax credits will likely significantly boost the growth of PV capacity and supply chains.

- According to the data published by the International Energy Agency (IEA), in 2022, Brazil added almost 11 gigawatts of solar PV capacity, doubling its growth rate for 2021. In view of the continued demand for renewable energy from industry and power retailers, deployment is projected to be maintained at this level over the medium term.

- According to the data published by the Ministry of New and Renewable Energy (MNRE), India held the fourth position in solar PV deployment worldwide as of the end of 2022. The Cumulative installed capacity of solar power reached around 7.2 GW as of November 2022. Today, India's solar tariffs are very competitive, and grid parity has been achieved.

- The developments mentioned above are expected to drive the market for silicone metal in the solar industry through the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific, particularly China, is the largest producer of silicone metal globally. The region benefits from abundant reserves of raw materials like quartz and coal, as well as access to low-cost labor, which supports the establishment of large-scale silicon metal production facilities.

- The most critical applications of silicon metal are silicone adhesives, sealants, lubricants, chemicals, and other substances, as well as aluminum alloys. The automotive, building and construction, industrial, and other end-user sectors are the primary uses of these products.

- The production and sales of new energy vehicles increased significantly in China, with the number of units sold reaching 7.22 million by 2022, representing 64 % of all EV sales worldwide.

- The market is projected to be driven by the government's promotion of EVs, hybrids, and fuel-cell vehicles in the forecast period. The rising demand for electric vehicles in this country increases the need for semiconductors, aluminum alloys, and silicon adhesives.

- According to the report released by the China Association of Automobile Manufacturers (CAAM), in 2022, China exported 3.11 million vehicles, including 2.53 million passenger cars and 580,000 commercial vehicles, an increase of 54.4 % compared to 2021.

- The top global solar PV manufacturing companies, such as JinkoSolar, Trina Solar, and JA Solar, are headquartered in China. Solar cell manufacturing in China has been increasing significantly in the past two years. According to the data published by the International Energy Agency (IEA), with 100 GW capacity of solar PV added in 2022, almost 60% more than in 2021, China continues to lead in terms of solar PV capacity additions.

- Investment in the manufacture of mobile phones, laptops, and other electrical appliances is a significant area for investment in China. In order to meet the upcoming increase in demand, large manufacturers from around the world have invested substantial capital into China's market.

- Due to these factors, Asia-Pacific region China is expected to dominate the silicon metal market.

Silicon Metal Industry Overview

The silicon metal market is partially consolidated. The major players (not in any particular order) include Hoshine Silicon Industry Co., Ltd, Ferroglobe, Elkem ASA, Dow, and Wacker Chemie AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surging Demand from the Automotive Industry

- 4.1.2 Increasing Use in the Solar Industry

- 4.1.3 Increasing Demand for Silicones from Different End Users

- 4.2 Restraints

- 4.2.1 Volatility in Energy Costs

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Metallurgy Grade

- 5.1.2 Chemical Grade

- 5.2 Application

- 5.2.1 Aluminum Alloys

- 5.2.2 Semiconductors

- 5.2.3 Solar Panels

- 5.2.4 Silicone Derivatives

- 5.2.5 Other Applications (Construction and Infrastructure)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Indonesia

- 5.3.1.7 Thailand

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 Spain

- 5.3.3.5 France

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anyang Huatuo Metallurgy Co., Ltd.

- 6.4.2 Dow

- 6.4.3 Elkem ASA

- 6.4.4 Ferroglobe

- 6.4.5 Hoshine Silicon Industry Co., Ltd.

- 6.4.6 Liasa

- 6.4.7 Minasligas

- 6.4.8 Mississipi Silicon

- 6.4.9 PCC SE

- 6.4.10 RIMA INDUSTRIAL

- 6.4.11 RusAL

- 6.4.12 Shin-Etsu Chemical Co., Ltd.

- 6.4.13 Wacker Chemie AG

- 6.4.14 Zhejiang kaihua yuantong silicon industry co. LTD.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Efforts to Reduce the Cost of Production by Innovating the Existing Technology

- 7.2 Increasing Demand from Renewable Energy Sector