|

市場調查報告書

商品編碼

1686575

英國作物保護化學品:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)UK Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

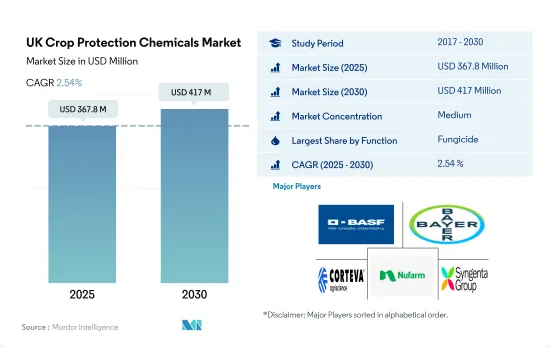

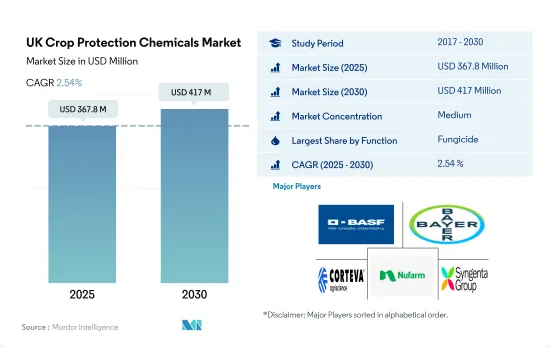

英國作物保護化學品市場規模預計在 2025 年為 3.678 億美元,預計到 2030 年將達到 4.17 億美元,預測期內(2025-2030 年)的複合年成長率為 2.54%。

該國的病蟲害侵擾日益嚴重,導致嚴重的產量損失,並推動了各種作物保護化學品市場的需求。

- 2022 年英國殺菌劑市值為 1.829 億美元,同年市場佔有率為 53.2%,成為消費量最大的作物保護化學品。

- 英國使用最廣泛的殺菌劑包括Chlorothalonil、Epoxiconazole、Prothioconazole和Tebuconazole。小麥葉枯病是英國最具破壞性的小麥葉部病害,在高壓時期會造成 30-50% 的產量損失。許多小麥種植者正在增加殺菌劑的使用以減少產量損失。

- 這種雜草影響英國的棉花和冬小麥等作物。對於主要纖維作物棉花而言,這已造成30%的產量損失。黑草(Alopecurus myosuroides)是一種本土雜草,在英國農場中猖獗生長。嚴重的蟲害迫使農民放棄主要糧食作物冬小麥。雜草爭奪資源,阻礙作物生長,降低產量,造成經濟損失,並導致使用除草劑。 2022 年,除草劑佔英國作物保護化學品市場的 38.2%。

- 氣候變遷和氣溫升高導致害蟲數量增加,攝食習慣也隨之改變。一項研究預測,隨著作物受到的熱應力加劇,英國氣溫上升 2°C 可能會導致糧食產量減少約 10%。結果,該國農民被迫使用殺蟲劑來應對蟲害壓力。

- 該國病蟲害的侵擾日益嚴重,導致嚴重的產量損失,因此市場需要一系列基於農民需求的作物保護劑。預計預測期內(2023-2029 年)市場複合年成長率為 2.4%。

英國作物保護化學品市場趨勢

在英國,農藥消費量正在下降,原因有很多,包括農民採用非化學替代品。

- 英國的殺蟲劑消費量正在下降。 2017年至2022年間,由於種植面積轉向畜牧業生產、某些活性物質的撤出、天氣對病蟲害水平的影響以及農民採用非化學替代品,每公頃消費量減少了243,800噸。

- 英國減少農藥使用的壓力越來越大,可能會影響未來幾年的農藥消費。政府已採取多項舉措減少農藥的使用。例如,2018年1月,英國政府發布了《綠色未來:我們的25年計畫》,旨在改善環境並增加綜合蟲害管理(IPM)和永續作物保護的採用。

- 2020 年,儘管草甘膦可能與癌症有關,但英國農業中Glyphosate的使用量在四年內增加了 16%,包括重量、處理面積和每公頃施用率。政府計劃透過增加收穫前乾燥(使用Glyphosate人工乾燥作物)或增加犁地農業來減少對傳統化學物質的依賴,免耕農業傾向於依靠Glyphosate和其他除草劑來處理雜草,而不會透過耕作從土壤中釋放碳。同樣,殺菌劑IMAZALIL)的使用量增加了53%,而同期用該化學品處理的土地面積增加了63%,達到81,000多公頃。

- 植物病蟲害對農業生產有重大影響,因此氣候變遷、病蟲害和產量損失可能會增加農藥消耗,以保護作物,減少因病蟲害造成的產量損失。

監管變化和政府對減少農藥的關注可能會影響作物保護化學品的價格。

- Cypermethrin和Emamectin benzoate是目前大規模使用的重要殺蟲劑成分。 2022年,這些零件的價格分別為每噸21,100美元和每噸17,300美元。

- Metalaxyl2022 年的價格為每噸 8,700 美元,是一種系統性苯醯胺殺菌劑,以其保護和治療作用而聞名。它透過抑制孢子囊的形成、菌絲的生長和新感染的建立來發揮作用。它抑制真菌核酸合成(RNA聚合酵素1)。該殺菌劑建議用作熱帶和亞熱帶作物的葉面噴布、用於控制土壤傳播病原體的土壤處理劑以及用於管理霜霉病的種子處理劑。

- Glyphosate被農民廣泛用作除草劑來控制雜草並作為耕作的替代品,但據觀察,它會破壞土壤生態系統並釋放碳。在英國,由於再生農業實踐鼓勵減少耕作,截至 2020 年的四年間,Glyphosate在農業中的使用量增加了 16%。農藥噴灑面積增加9%(23萬公頃)。小麥種植者主要使用Glyphosate在收穫前乾燥作物。 2022年Glyphosate價格與前一年同期比較去年同期上漲2.2%。

- 選擇性除草劑二甲戊靈屬於Dinitroanilines除草劑。它用於控制各種園藝作物、草坪和林業中的多種雜草,包括一年生植物、多年生植物、闊葉樹和木本植物。 2022年,二甲戊靈的價格為每噸3,300美元。

英國作物保護化學品產業概況

英國作物保護化學品市場適度整合,前五大公司佔 63.61% 的市場。市場的主要企業包括BASF公司、拜耳公司、科迪華農業科技、紐髮姆有限公司和先正達集團(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告發布

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 活性成分價格分析

- 法律規範

- 英國

- 價值鍊和通路分析

第5章市場區隔

- 按功能

- 殺菌劑

- 除草劑

- 殺蟲劑

- 殺軟體動物劑

- 殺線蟲劑

- 按應用

- 化學處理

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 按作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- ADAMA Agricultural Solutions Ltd.

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 52786

The UK Crop Protection Chemicals Market size is estimated at 367.8 million USD in 2025, and is expected to reach 417 million USD by 2030, growing at a CAGR of 2.54% during the forecast period (2025-2030).

Increasing pests and disease infestations in the country are leading to severe yield losses and driving the market for different crop protection chemicals

- The UK fungicide market was valued at USD 182.9 million in 2022. It was the most consumed among crop protection chemicals, with a market share of 53.2% in the same year.

- The most extensively used fungicide formulations in the United Kingdom include chlorothalonil, epoxiconazole, prothioconazole, and tebuconazole. Septoria tritici is UK wheat's most damaging foliar disease, causing yield losses that range from 30% to 50% in high-pressure seasons. Many wheat growers have increased the use of fungicides in their crops to mitigate yield loss.

- Weeds impact UK crops like cotton and winter wheat. They cause a 30% yield loss in cotton, the main fiber crop. Black grass (Alopecurus myosuroides), a native weed, frequently infests UK farms. Severe infestations force farmers to abandon winter wheat, the main cereal crop. Weeds compete for resources, hinder crop growth, and reduce yields, causing economic losses and leading to the adoption of herbicides. Herbicides accounted for 38.2% of the UK crop protection chemicals market in 2022.

- The changing climate and rising temperatures are causing an increase in the population and feeding habits of insect pests. A study reveals that as heat stress on crops intensifies, cereal yields in the United Kingdom are projected to decline by approximately 10% with a 2 °C increase in temperature. Consequently, these circumstances are prompting farmers in the country to rely on insecticides to manage pest pressures.

- Increasing pests and disease infestations in the country have led to severe yield losses, thus driving the market for different crop protection chemicals based on farmers' needs. The market is estimated to register a CAGR of 2.4% during the forecast period (2023-2029).

UK Crop Protection Chemicals Market Trends

The United Kingdom is experiencing a decline in the consumption of pesticides due to various factors, including the adoption of non-chemical alternatives by farmers

- The United Kingdom is experiencing a decline in the consumption of pesticides. From 2017 to 2022, the consumption per hectare decreased by 243.8 thousand metric ton due to changes in the area of cultivation to livestock farming, withdrawal of certain active substances, the impact of the weather on pest and disease levels, and the adoption of non-chemical alternatives by farmers.

- The rising pressure on the United Kingdom to reduce the use of pesticides could impact the consumption of pesticides in the coming years. The government is taking several initiatives to reduce the use of pesticides. For instance, in January 2018, the UK government launched "A Green Future: Our 25-Year Plan" to improve the environment and increase the uptake of integrated pest management (IPM) and sustainable crop protection.

- In 2020, the use of glyphosate in UK farming grew by 16% over four years in terms of weight, the area treated, and application rate per hectare despite being linked to causing cancer and the government plans to reduce reliance on conventional chemicals due to rising pre-harvest desiccation (where crops are artificially dried using glyphosate) and/or an increase in no-till agriculture, which tends to rely upon glyphosate and other herbicides to deal with weeds without releasing carbon from the soil via plowing. Similarly, the use of the fungicide imazalil increased by 53%, while the land area treated with the chemical rose by 63% to more than 81,000 ha during the same period.

- Changing climate, pests and diseases, and harvest losses could drive the consumption of pesticides to protect crops and reduce pest yield losses, as plant diseases and pests can have a significant impact on agriculture production.

Regulatory changes and the government's focus on reducing pesticides may influence the prices of crop protection chemicals

- Cypermethrin and emmamectin benzoate are significant insecticide ingredients used on a large scale. In 2022, these ingredients were priced at USD 21.1 thousand per metric ton and USD 17.3 thousand per metric ton, respectively.

- Metalaxyl, valued at USD 8.7 thousand per metric ton in 2022, is a systemic phenylamide fungicide known for its protective and curative mode of action. It works by suppressing sporangial formation, mycelial growth, and the establishment of new infections. It disrupts fungal nucleic acid synthesis - RNA polymerase 1. This fungicide is recommended for foliar spray on tropical and sub-tropical crops, as a soil treatment for controlling soil-borne pathogens, and as a seed treatment to manage downy mildew.

- Glyphosate, widely used by farmers as a herbicide for weed control and as an alternative to plowing, has been observed to disrupt the soil ecosystem and release carbon. In the United Kingdom, its usage in farming witnessed a growth of 16% over four years till 2020, with regenerative farming practices encouraging reduced plowing. The area of land sprayed with pesticides expanded by 9% (230,000 ha). Wheat farms are notable users of glyphosate for crop desiccation before harvest. In 2022, the price of glyphosate experienced a 2.2% increase compared to the previous year.

- Pendimethalin, a selective herbicide, belongs to the dinitroaniline herbicide family. It is used to control a broad range of weeds, including annual and perennial grasses, broadleaf species, and woody species in various horticultural crops, turf, and forestry. In 2022, pendimethalin was priced at USD 3.3 thousand per metric ton.

UK Crop Protection Chemicals Industry Overview

The UK Crop Protection Chemicals Market is moderately consolidated, with the top five companies occupying 63.61%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, Nufarm Ltd and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 United Kingdom

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits & Vegetables

- 5.3.3 Grains & Cereals

- 5.3.4 Pulses & Oilseeds

- 5.3.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 Sumitomo Chemical Co. Ltd

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219