|

市場調查報告書

商品編碼

1686573

包裝塗料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Packaging Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

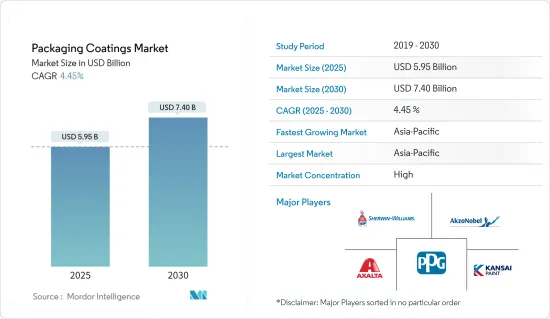

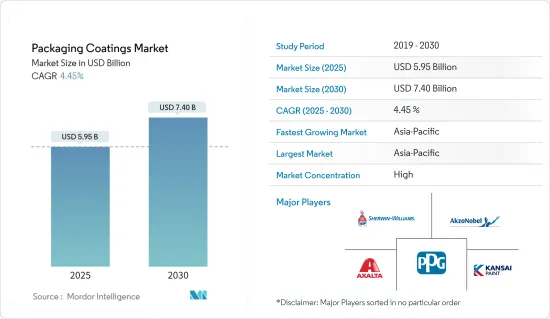

預計 2025 年包裝塗料市場規模為 59.5 億美元,到 2030 年將達到 74 億美元,預測期內(2025-2030 年)的複合年成長率為 4.45%。

COVID-19疫情對包裝塗料市場產生了不利影響。全球封鎖和嚴格的社交距離措施導致包裝設施關閉,進而影響了包裝塗料市場。然而,新冠疫情爆發後,限制措施被取消,市場恢復良好。由於各種包裝應用中包裝塗料的消費量增加,市場出現強勁復甦。

主要亮點

- 預計在預測期內,食品和飲料包裝需求的不斷成長以及個人護理行業氣霧罐包裝塗料的使用不斷增加將推動市場需求。

- 然而,有關包裝塗料排放的嚴格規定和環境問題預計將阻礙市場成長。

- 在預測期內,環保包裝塗料的日益成長的趨勢可能會為市場帶來機會。

- 亞太地區貢獻了最高的市場佔有率,預計在預測期內將佔據市場主導地位。

包裝塗料的市場趨勢

食品和飲料包裝佔據市場主導地位

- 在食品和飲料行業,包裝塗層可增強包裝的阻隔性、保存期限和整體美觀度,同時提供對可能影響包裝產品品質的防潮、防光和其他外部因素的保護。

- 環氧樹脂基底包裝塗料由於其乾燥速度快、韌性、附著力、耐水性和優異的固化性能,非常適合保護金屬表面。這些獨特的性能使丙烯酸成為塗層材料的絕佳選擇。

- 環氧塗料包括環氧酚醛、環氧酐、環氧胺基等多種共混物,其中以環氧酚醛應用最為廣泛。

- 2023 年 1 月,歐洲復興開發銀行 (EBRD) 宣布向土耳其 Akkim Kimya Sanayi ve Ticaret AS (Akkim) 提供 1,500 萬歐元貸款,資助該公司在亞洛瓦工廠建立第一家本地環氧樹脂製造廠。該貸款將使 Akkim 能夠生產液體環氧樹脂 (LER)、固態環氧樹脂 (SER) 和環氧氯丙烷 (ECH),每年生產能力為 68,000 噸。

- 隨著時代的發展,人們對罐頭食品和飲料的需求也日益增加。近年來,人們對罐裝果汁和啤酒的偏好日益成長,推動了對罐頭和其他金屬蓋的需求,這可能會在未來幾年進一步推動環氧基包裝塗料的應用。

- 根據PAC Global報告的資料,受製造業和快速消費品產業包裝需求不斷成長的推動,美國包裝市場規模預計到2025年將達到約310億美元。

- 根據飲料行銷公司預測,2022 年美國軟性飲料銷售量將達到 363 億加侖,較 2021 年的 360.4 億加侖有所成長。

- 據加拿大政府稱,受製造業和快速消費品行業對軟包裝需求不斷成長的推動,加拿大包裝行業規模預計到 2025 年將達到約 312 億美元。

- 因此,隨著食品和飲料包裝行業需求的不斷增加,預計預測期內全球對包裝塗料的需求將會增加。

中國主導亞太地區

- 中國擁有世界上最大的製造業和最大的消費群。中國是世界第一人口大國,也是各類商品最大的消費國。由於多種原因,包裝塗料市場是中國經濟中成長最快的領域之一。

- 近年來,塗層在各種產品上的應用顯著擴大。對裝飾性和吸引力包裝的需求不斷增加,導致對包裝塗料的需求增加。

- 中國佔據電子商務市場的最大佔有率。中國的銷售額佔電子商務總銷售額的30%以上。中國是全球成長最快的電子商務市場之一,也是電子商務巨頭阿里巴巴的所在地。

- 電子商務市場的成長導致包裝產業的需求大幅增加,進而帶動了包裝塗料產業的需求大幅增加。食品和飲料包裝是一個成長特別快速的行業。

- 在中國,人們對環境和污染的認知不斷增強,導致了有關揮發性有機化合物(VOC)等危險化學品的法規的製定。這些因素可能會對包裝塗料市場產生負面影響。這些因素被證明是因禍得福,因為公司很快就適應了各種環保替代品。

- 此外,佛山市池田空氣清新劑等公司專門生產罐裝汽車空氣清新劑。公司在中國擁有四家工廠,總面積超過10萬平方公尺,擁有30多條不同的生產線。該公司的願景是到 2026 年將產值提高到 10 億美元。預計此類發展將對研究市場產生影響。

- 上述因素將導致預測期內該國對包裝塗料的消費需求增加。

包裝塗料產業概況

包裝塗料市場正在整合。市場的主要企業(不分先後順序)包括阿克蘇諾貝爾公司、PPG工業公司、宣偉公司、艾仕得塗料系統公司和關西塗料公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 食品和飲料包裝需求不斷成長

- 擴大個人護理品氣霧罐包裝塗料的應用

- 限制因素

- VOC排放的嚴格法規與環境問題

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按樹脂

- 環氧樹脂

- 丙烯酸纖維

- 聚氨酯

- 聚烯

- 聚酯纖維

- 其他樹脂

- 按應用

- 食品罐

- 飲料罐

- 氣霧管

- 蓋子與封口裝置

- 工業和特殊包裝

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Akzo Nobel NV

- ALTANA

- Axalta Coating Systems, LLC

- BASF SE

- FGN Fujikura Kasei Global Network

- Hempel A/S

- Henkel Corporation.

- Jamestown Coating Technologies

- Kangnam Jevisco Co. Ltd

- Kansai Paint Co.,Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- Weilburger

第7章 市場機會與未來趨勢

- 環保包裝塗料的趨勢日益成長

The Packaging Coatings Market size is estimated at USD 5.95 billion in 2025, and is expected to reach USD 7.40 billion by 2030, at a CAGR of 4.45% during the forecast period (2025-2030).

The COVID-19 pandemic had a negative impact on the market for packaging coatings. Nationwide lockdowns and strict social distancing measures led to the closure of packaging facilities, consequently affecting the packaging coatings market. However, after the COVID-19 pandemic, the market recovered well following the lifting of restrictions. It rebounded significantly due to the increased consumption of packaging coatings in various packaging applications.

Key Highlights

- Increasing demand for food and beverage packaging and the growing utilization of packaging coatings in aerosol cans for the personal care industry are expected to drive market demand during the forecast period.

- On the flip side, stringent regulations and environmental concerns regarding VOC emission from packaging coatings are expected to hinder the growth of the market studied.

- The growing inclination for eco-friendly packaging coatings is likely to act as an opportunity for the market studied over the forecast period.

- The Asia Pacific region accounts for the highest market share and is expected to dominate the market during the forecast period.

Packaging Coatings Market Trends

Food and Beverage Packaging to Dominate the Market

- In the food and beverage industry, packaging coatings enhance the barrier properties, shelf-life, and overall aesthetics of the packaging, while also protecting against moisture, light, and other external factors that can potentially impact the quality of the packaged products.

- Epoxies resin-based packaging coatings, due to their features, such as fast-drying properties, toughness, adhesion properties, resistance to water, and good curing, are suitable for protecting metal surfaces. These unique characteristics make acrylic resins a noble choice as a coating material.

- Different blends of epoxy-based coatings are available, which include epoxy-phenolic, epoxy-anhydride, and epoxy-amino coatings, among which epoxy-phenolic is mainly used.

- In January 2023, the European Bank for Reconstruction and Development (EBRD) announced to provide a EUR 15 million loan to Akkim Kimya Sanayi ve Ticaret A.S. (Akkim) in Turkey to finance the establishment of the first local epoxy resin manufacturing plant at its premises in Yalova. The loan will enable Akkim to produce liquid epoxy resin (LER), solid epoxy resin (SER), and epichlorohydrin (ECH), with an annual production capacity of 68,000 tonnes.

- The demand for canned food and beverages has been increasing over time. The growing preference for canned fruit juice and beer among people in recent times has been boosting the demand for cans and other metal caps, which may further drive the applications of epoxy-based packaging coatings in the coming years.

- According to the data reported by PAC Global, the United States packaging market is expected to reach about USD 31 billion by 2025, owing to the increasing demand for packaging from the manufacturing and FMCG sectors.

- According to the Beverage Marketing Corporation, in the United States, the sales volume of liquid refreshment beverages reached 36,300 million gallons in 2022 and registered growth when compared to 36,040 million gallons in 2021.

- According to the government, the packaging industry in Canada is expected to reach about USD 31.2 billion by 2025, owing to the increasing demand for flexible packaging from the country's manufacturing and FMCG sectors.

- Hence, with the increasing demand from the food and beverage packaging industry, the demand for packaging coatings is projected to increase worldwide, during the forecast period.

China to Dominate the Asia-Pacific Region

- China has the biggest manufacturing sector in the world and the largest consumer base. Being the most populated country, China makes it the largest consumer of various goods. Owing to various reasons, the packaging coatings market is one of the fastest-growing markets in the Chinese economy.

- The applications of coatings on various products have grown significantly in recent times. The increasing need for decorative and attractive packaging has led to an increase in the demand for coatings for packaging.

- China has the largest share of the e-commerce market. Sales in China account for more than 30% of the total e-commerce sales. China is one of the fastest-growing e-commerce markets in the world, and it is home to the e-commerce giant Alibaba.

- The growth in the e-commerce market led to a huge increase in demand for the packaging industry and, consequently, the packaging coatings industry. Food and beverage packaging is the fastest-growing sector among them.

- In China, the awareness concerning the environment and pollution led to the formation of regulations related to harmful chemicals (such as volatile organic compounds (VOCs)). Such factors can adversely affect the market for packaging coatings. These factors have also been a blessing in disguise, as companies have quickly adapted to various eco-friendly alternatives.

- Moreover, companies such as Foshan Ikeda Air Freshener Co., Ltd. are focusing on specializing in the production of canned car fresheners. The company has 4 factories in China with a total area of more than 100,000 square meters, with over 30 different production lines. The company's vision is to increase the output value will reach 1 billion by 2026. Such developments are expected to affect the studied market.

- The factors above contribute to the increasing demand for packaging coatings consumption in the country during the forecast period.

Packaging Coatings Industry Overview

The packaging coatings market is consolidated. Some of the major players (not in any particular order) in the market include Akzo Nobel NV, PPG Industries Inc., The Sherwin-Williams Company, Axalta Coating Systems, and Kansai Paint Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Food and Beverage Packaging

- 4.1.2 Growing Utilization of Packaging Coatings in Aerosol Cans for Personal Care Industry

- 4.2 Restraints

- 4.2.1 Stringent Regulation and Environmental Concern Regarding VOC Emission

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Resin

- 5.1.1 Epoxies

- 5.1.2 Acrylics

- 5.1.3 Polyurethane

- 5.1.4 Polyolefins

- 5.1.5 Polyester

- 5.1.6 Other Resins

- 5.2 By Application

- 5.2.1 Food Cans

- 5.2.2 Beverage Cans

- 5.2.3 Aerosol and Tubes

- 5.2.4 Caps and Closures

- 5.2.5 Industrial and Specialty Packaging

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Qatar

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Nigeria

- 5.3.5.4 Egypt

- 5.3.5.5 South Africa

- 5.3.5.6 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 ALTANA

- 6.4.3 Axalta Coating Systems, LLC

- 6.4.4 BASF SE

- 6.4.5 FGN Fujikura Kasei Global Network

- 6.4.6 Hempel A/S

- 6.4.7 Henkel Corporation.

- 6.4.8 Jamestown Coating Technologies

- 6.4.9 Kangnam Jevisco Co. Ltd

- 6.4.10 Kansai Paint Co.,Ltd.

- 6.4.11 PPG Industries, Inc.

- 6.4.12 RPM International Inc.

- 6.4.13 The Sherwin-Williams Company

- 6.4.14 Weilburger

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Inclination for Eco-Friendly Packaging Coatings