|

市場調查報告書

商品編碼

1686571

自我調整安全:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Adaptive Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

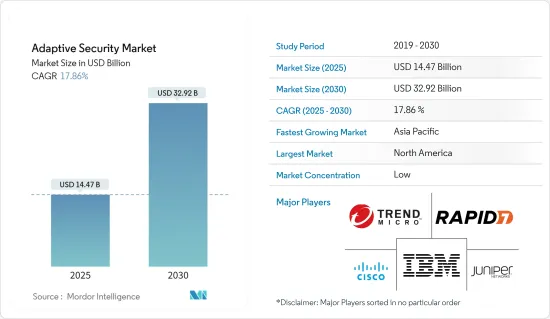

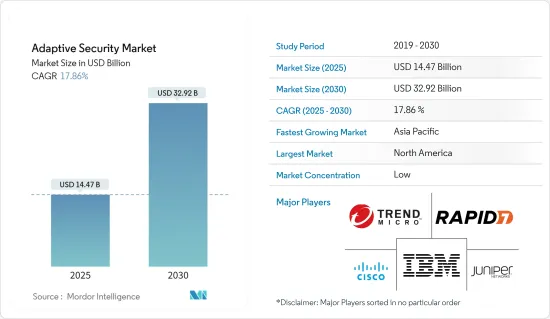

自我調整安全市場規模預計在 2025 年為 144.7 億美元,預計到 2030 年將達到 329.2 億美元,預測期內(2025-2030 年)的複合年成長率為 17.86%。

主要亮點

- 企業面臨不斷演變的威脅,包括進階持續性威脅、零時差惡意軟體和各種有針對性的攻擊。這些現代網路攻擊具有動態性和協調性,旨在利用組織傳統防禦中的弱點。

- 企業擴大採用預防策略來追蹤這些無法偵測的威脅,以保護其組織的資料、網路和應用程式。對安全合規性和法規的日益成長的需求以及保護 IT 資源免受先進和複雜的網路攻擊的需求是預計在預測期內推動自我調整安全市場發展的關鍵因素。

- 據律師事務所 DLA Piper 稱,自 2018 年 5 月《一般資料保護規範》(GDPR)在歐洲生效以來,截至 2023 年 1 月,荷蘭是報告個人資料外洩事件最多的國家,總數約為 117,434 起。德國位居第二,報告的個人資料外洩事件超過 76,000 起。此類資料外洩事件的激增正在推動市場需求。

- 此外,5G 的出現有望促進已邁向工業 4.0 的產業使用連網型設備。它正在透過物聯網的興起幫助實現各個行業的蜂窩連接。機器對機器的連接正在推動應用程式的安全性。

- 有效實施自我調整安全解決方案主要需要專業知識。由於缺乏熟練的網路安全專業人員,組織難以正確配置和部署這些解決方案,從而限制了它們減輕威脅和漏洞的有效性。

- 由於封鎖和保持社交距離措施,COVID-19 疫情迫使大多數組織轉向在家工作模式,從而對遠端管理和監控應用程式產生了巨大的需求。隨著組織對其應用服務的要求越來越高,對自我調整安全性的需求也隨之增加。

自我調整安全市場趨勢

雲端部署模式顯著成長

- 雲端服務的日益普及要求出現自適應雲端安全解決方案,該解決方案可以動態適應並響應不斷演變的威脅以提供安全性。

- 雲端基礎的自我調整安全解決方案有助於與任何雲端服務供應商的無縫整合,使企業能夠利用其現有的雲端基礎設施,同時增強安全功能,加速所有垂直行業採用雲端基礎的自我調整安全解決方案。

- 隨著企業為了實現可擴展性和成本效益而擴大將工作負載和資料遷移到雲端,對旨在保護雲端環境的安全解決方案的需求也日益增加。傳統的內部部署解決方案不適合雲端基礎架構的動態和分散式特性,這推動了對雲端基礎的自我調整安全解決方案和服務的需求。

- 例如,Flexera Software 對來自世界各地組織的 627 名技術專業人士進行的一項調查發現,截至 2023 年,50% 的企業已經在公共雲端中部署了工作負載,7% 的企業計劃在未來一年內將更多工作負載遷移到雲端。此外,48% 的受訪者表示他們將資料儲存在公共雲端上。

- 基於最終用戶垂直領域,BFSI 產業預計將推動對雲端基礎的自我調整安全解決方案和服務的需求。隨著 BFSI 行業擴大採用雲端平台,對自我調整安全解決方案的需求也日益成長,該解決方案可以透過存取與安全性和合規性要求相關的特定產業屬性來提供安全性。因此,將複雜的業務和多方面的監管需求與行業中正確的雲端平台業務相結合的需求正在推動對雲端安全等應用中自我調整安全解決方案和服務的需求。

- 市場上的供應商正在推出雲端基礎的自我調整安全解決方案,以提供自動化、客製化的保護。例如,Egress 於 2023 年 7 月開始提供應用自我調整安全模式的雲端電子郵件安全平台。隨著該解決方案的推出,該公司提供針對高級入境和出站威脅的動態、自動化防護,從而改變組織透過電子郵件管理人員風險的方式。

- 雲端基礎的自我調整安全的需求是由雲端運算的日益普及、混合和多重雲端環境日益複雜以及與雲端原生技術的整合所推動的。預計各行各業採用雲端技術將在預測期內推動雲端基礎的自我調整安全的需求。

北美佔據主要市場佔有率

- 對網路、端點、應用程式和雲端安全等一系列安全解決方案的需求日益成長,推動了北美採用自我調整安全。該地區致力於提高網路安全以應對不斷變化的網路威脅,並需要先進的安全技術來保護關鍵資料和系統,這是推動自我調整安全解決方案市場發展的關鍵因素。此外,對數位技術的依賴性增加、網路攻擊激增以及遵守法規的需要等因素都促使北美擴大採用自我調整安全。

- 美國在網路安全研發方面投入了大量資金。例如,2023年8月,美國能源局(DOE)向小型和農村電力公司開放了900萬美元的競爭性聯邦資金,以改善網路安全。這將允許電力行業的小型和地方公用事業公司和合作社申請一筆資金,在其基礎設施中建立網路彈性,以防範網路攻擊、勒索軟體和其他數位威脅。

- 此外,加拿大的網路犯罪正在迅速成長,其影響也不斷增加。 2023年8月,加拿大通訊安全局(CSE)發布報告,詳細記錄了加拿大發生的70,878起網路詐騙,導致超過3.9億美元被盜。在加拿大,勒索軟體攻擊和資料外洩等網路威脅變得越來越頻繁和複雜,刺激了對網路安全解決方案的投資,以防範新的威脅。

- 2024年1月,提供自適應和自主身分安全解決方案的公司Oleria在A輪資金籌措中籌集了3,300萬美元。此次投資使該公司的總資金籌措超過 4,000 萬美元,由 Evolution Equity Partners主導,Salesforce Ventures、Tapestry VC 和 Zscaler 參投。這筆資金籌措將使 Oleria 能夠擴大招聘,以加強整體產品創新,包括其人工智慧能力和打入市場策略。

- 整體而言,社會對網路安全風險和網路威脅潛在後果的認知不斷提高,更加重視實施有效的網路安全措施。這些因素共同凸顯了網路安全在北美的重要性,推動了各行各業對先進解決方案和主動網路安全策略的需求,從而極大地推動了市場的成長機會。

自我調整安全產業概覽

自我調整安全市場高度分散,既有全球參與者,也有中小型企業。市場的主要參與者包括思科系統公司、趨勢科技公司、Rapid7 公司、IBM 公司和瞻博網路公司。市場參與者正在採用合作和收購等方式來加強其解決方案產品並獲得永續的競爭優勢。

2023 年 11 月,Trellix 宣布了其生成人工智慧 (GenAI) 功能,該功能基於 Amazon Bedrock 構建,主要由 Trellix 高級研究中心提供支援。透過擴大與 AWS 的夥伴關係,Trellix 繼續投資 GenAI,以提供增強的威脅補救和改進的客戶支援。

2023 年 11 月,趨勢科技推出了 Trend Companion,這是一款新型生成式 AI 工具,主要旨在透過推動高效的工作流程和提高生產力來增強安全分析師的能力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 宏觀經濟因素如何影響市場

第5章市場動態

- 市場促進因素

- 需要保護 IT 資源免受進階網路攻擊

- 安全合規和法規的必要性

- 市場限制

- 缺乏熟練的網路安全專業人員

第6章市場區隔

- 按應用

- 應用程式安全

- 網路安全

- 端點安全

- 雲端安全

- 透過提供

- 服務

- 解決方案

- 按實施模型

- 本地

- 雲

- 按最終用戶

- BFSI

- 政府和國防

- 製造業

- 衛生保健

- 能源與公共產業

- 資訊科技/通訊

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Cisco Systems Inc.

- Trend Micro Incorporated.

- Rapid7 Inc.

- IBM Corporation

- Juniper Networks Inc.

- Trellix(STG Partners LLC)

- Panda Security Inc.(Watchguard Technologies Inc.)

- Illumio Inc.

- Lumen Technologies Inc.

- Aruba Networks Inc.(Hewlett Packard Enterprise Development LP)

第8章投資分析

第9章 市場機會與未來趨勢

The Adaptive Security Market size is estimated at USD 14.47 billion in 2025, and is expected to reach USD 32.92 billion by 2030, at a CAGR of 17.86% during the forecast period (2025-2030).

Key Highlights

- A significant factor driving the demand growth is that firms are constantly being attacked by progressive threats such as advanced persistent threats, zero-day malware, and different targeted attacks. Dynamic and orchestrated, these modern cyberattacks seek to exploit weaknesses in an organization's traditional defenses.

- Enterprises have been adopting prevention strategies to increasingly keep track of such undetectable threats to protect the organizations' data, networks, and applications. The growing need for security compliances and regulations and the need to secure IT resources from sophisticated and complex cyberattacks are major factors expected to drive the adaptive security market over the forecast period.

- Law firm DLA Piper states that since the Europe-wide implementation of the General Data Protection Regulation (GDPR) in May 2018, the highest number of personal data breaches as of January 2023 were reported in the Netherlands, a total of around 117,434. Germany ranked second, with more than 76,000 private data breach notifications. Such a massive rise in data breaches is propelling the demand for the market.

- In addition, the advent of 5G is expected to expedite the use of connected devices in industries already pushing toward Industrial Revolution 4.0. This revolution has aided cellular connectivity throughout the industry through the rise of loT. Machine-to-machine connections are driving the traction of application security.

- Adaptive security solutions primarily need specialized expertise to be implemented effectively. Due to the lack of skilled cybersecurity professionals, organizations struggle to configure and deploy these solutions properly, limiting their effectiveness in mitigating threats and vulnerabilities.

- With the outbreak of COVID-19, most of the organization shifted to the work-from-home model due to the lockdown and social distancing measures that created a significant demand to manage and monitor applications remotely. As a result of the rising demand from organizations for adaptive security for their application services, the need for them increased.

Adaptive Security Market Trends

Cloud Deployment Model to Witness Major Growth

- The growing adoption of cloud services has necessitated the emergence of adaptive cloud security solutions, which dynamically adjust and respond to evolving threats and offer security.

- Cloud-based adaptive security solutions help seamlessly integrate with any cloud service providers, enabling organizations to leverage their existing cloud infrastructure while enhancing security capabilities and driving the adoption of cloud-based adaptive security solutions by organizations across industries.

- The increasing migration of workloads and data by businesses to the cloud for scalability and cost-effectiveness creates a growing need for security solutions designed to protect cloud environments. As traditional on-premises solutions are not suited to the dynamic and distributed nature of cloud infrastructure, the demand for cloud-based adaptive security solutions and services is increasing.

- For instance, according to a survey of 627 technical professionals across a cross-section of organizations globally by Flexera Software, as of 2023, 50% of enterprises already had workloads in the public cloud, with 7% planning to move additional workloads to the cloud in the next 12 months. In addition, 48% of the respondents reported having data stored on the public cloud.

- By end-user industry, the BFSI segment is expected to drive demand for cloud-based adaptive security solutions and services. As the BFSI industry is increasingly adopting cloud platforms, accessing industry-specific attributes related to security and compliance requirements is driving the need for adaptive security solutions to enable security. Thus, the need to match the complexities of operations and multi-faceted regulatory demands with the right cloud platform businesses in the industry is driving the need for adaptive security solutions and services in applications such as cloud security.

- The market vendors are introducing cloud-based adaptive security solutions and offering automated and tailored protection. For instance, in July 2023, Egress started offering a cloud email security platform to apply an adaptive security model. With the launch of this solution, the company would offer dynamic and automated protection against advanced inbound and outbound threats, transforming how organizations manage human risk via email.

- The demand for cloud-based adaptive security is growing due to the increasing adoption of cloud computing, the complexity of hybrid and multi-cloud environments, and the integration with cloud-native technologies. Implementing cloud technology across industries is anticipated to create demand for cloud-based adaptive security over the forecast period.

North America to Hold Significant Market Share

- The rising need for various security solutions, including network, endpoint, application, and cloud security, drives adaptive security adoption in North America. The region's focus on improving cybersecurity to address changing cyber threats and the requirement for advanced security technologies to safeguard critical data and systems are key factors driving the adaptive security solutions market. Furthermore, factors such as the growing reliance on digital technologies, the surge in cyberattacks, and the necessity for regulatory compliance all contribute to the rising implementation of adaptive security in North America.

- The United States has invested significantly in cybersecurity research and development. For instance, in August 2023, the United States Department of Energy (DOE) opened USD 9 million in competitive federal funding for small and rural electric utilities to improve cybersecurity. This will allow smaller and rural utilities and cooperatives in the electric sector to apply for chunks of funding to build more cyber resilience in their infrastructure that could defend against cyberattacks, ransomware, and other digital threats.

- Moreover, cybercrime is rapidly gaining traction in Canada, and its impact is increasing. In August 2023, the Communications Security Establishment (CSE) released a report detailing 70,878 cyber fraud cases in Canada, resulting in over USD 390 million being stolen. Organizations in Canada are investing in cybersecurity solutions to guard against emerging threats due to the mounting frequency and sophistication of cyber threats, such as ransomware attacks and data breaches.

- In January 2024, Oleria, a company providing adaptive and autonomous identity security solutions, raised USD 33 million in a Series A funding round. This latest investment, which brings the company's total funding to more than USD 40 million, is led by Evolution Equity Partners with participation from Salesforce Ventures, Tapestry VC, and Zscaler. This funding round allows Oleria to ramp up hiring to enhance its overall product innovation, involving AI capabilities and its go-to-market strategy.

- Overall, increased public awareness of cybersecurity risks and the potential consequences of cyber threats has contributed to a greater emphasis on implementing effective cybersecurity measures. The combination of these factors underscores the critical importance of cybersecurity in North America, leading to a growing demand for advanced solutions and proactive cybersecurity strategies across industries, driving the market's growth opportunities significantly.

Adaptive Security Industry Overview

The adaptive security market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Cisco Systems Inc., Trend Micro Incorporated., Rapid7 Inc., IBM Corporation, and Juniper Networks Inc. Players in the market are adopting approaches such as partnerships and acquisitions to enhance their solutions offerings and gain sustainable competitive advantage.

In November 2023, Trellix launched its generative Artificial Intelligence (GenAI) capabilities, built on Amazon Bedrock and mainly supported by Trellix Advanced Research Center. By expanding its partnership with AWS, Trellix continues investing in GenAI to deliver enhanced threat remediation and improved customer support.

In November 2023, Trend Micro launched its new generative AI tool, Trend Companion, mainly built to empower security analysts by driving efficient workflows and enhanced productivity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need to Secure IT Resources from Advanced Cyberattacks

- 5.1.2 Need for Security Compliances and Regulations

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Cyber Security Professionals

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Application Security

- 6.1.2 Network Security

- 6.1.3 End Point Security

- 6.1.4 Cloud Security

- 6.2 By Offering

- 6.2.1 Service

- 6.2.2 Solution

- 6.3 By Deployment Model

- 6.3.1 On-premise

- 6.3.2 Cloud

- 6.4 By End User

- 6.4.1 BFSI

- 6.4.2 Government and Defense

- 6.4.3 Manufacturing

- 6.4.4 Healthcare

- 6.4.5 Energy and Utilities

- 6.4.6 IT and Telecom

- 6.4.7 Other End Users

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Trend Micro Incorporated.

- 7.1.3 Rapid7 Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Juniper Networks Inc.

- 7.1.6 Trellix (STG Partners LLC)

- 7.1.7 Panda Security Inc. (Watchguard Technologies Inc.)

- 7.1.8 Illumio Inc.

- 7.1.9 Lumen Technologies Inc.

- 7.1.10 Aruba Networks Inc.(Hewlett Packard Enterprise Development LP)