|

市場調查報告書

商品編碼

1686570

汽車降雨感應器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Automotive Rain Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

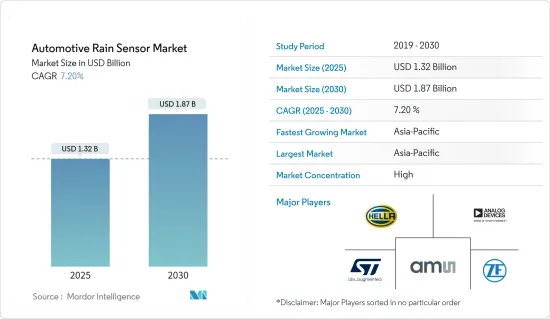

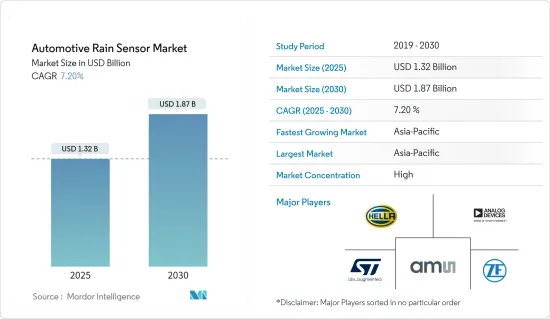

預計 2025 年汽車降雨感應器市場規模為 13.2 億美元,預計到 2030 年將達到 18.7 億美元,預測期內(2025-2030 年)的複合年成長率為 7.2%。

2020 年,市場受到了 COVID-19 疫情的衝擊,導致汽車產量下降、供應鏈中斷,影響了汽車降雨感應器的商業性可行性。然而,2021 年上半年市場勢頭強勁,全球主要地區的電動車銷售正在復甦。

預計在預測期內,車輛電氣系統的使用不斷增加、對車輛駕駛員舒適性和安全性的需求不斷成長以及汽車行業的大幅擴張將成為市場成長的主要促進因素。此外,電動車和自動駕駛汽車技術的發展預計將進一步促進汽車降雨感應器市場的大幅成長。此外,經濟狀況的改善、客戶需求和興趣的不斷成長、技術創新以及政府監管的加強都是推動市場擴張的一些有利因素。此外,各大豪華汽車製造商紛紛推出電動車,以應對日益成長的環境問題和不斷上漲的燃油價格。這也可能促進該領域的擴張。由於汽車降雨感應器成本較低,預計經濟型和中檔汽車採用此類感測器將推動市場發展。

由於普遍降雨量較大,一些國家建議在汽車上安裝降雨感應器。然而,有些地區不需要降雨感應器。中東和北非是降雨稀少的地區。卡達、沙烏地阿拉伯、阿拉伯聯合大公國、科威特和埃及等一些國家的降雨量極少,因此自動降雨感應器的必要性不大。例如,中東地區幾乎完全是沙漠,因此任何季節的降雨量都很少。中東地區唯一真正出現冬季的地方是沙烏地阿拉伯的山區,那裡的氣溫可能會降至冰點以下。這種典型的氣候條件可能會阻礙主要OEM在新興市場推出具有此類自動雨量感測器技術功能的車型,從而限制預測期內的整體市場發展。

在北美大部分地區,自動雨刷已經是汽車的常見配置,並在大多數車型中廣泛普及。降雨感應器可以控制雨刷的速度和頻率,不僅是一個方便的功能,而且被認為可以使駕駛更安全。合適的雨刷速度可確保任何天氣下都有最佳的可見度。根據汽車製造商介紹,降雨感應器位於後視鏡後面,非常適合安裝各種感測器,包括攝影機、太陽感測器和環境光感測器。

汽車降雨感應器市場趨勢

安全和舒適意識的提高預計將推動需求

降雨感應器是一種駕駛輔助系統,透過在雨天自動啟動擋風玻璃雨刷系統來減輕駕駛者的負擔,大大提高車內的安全性和舒適性。自動駕駛和連網汽車已經吸引了消費者的興趣,預計將在預測期內獲得廣泛認可。 ADAS(先進駕駛輔助系統)有望縮小傳統車輛和未來車輛之間的採用差距。例如,

一些政府專注於強制其管轄範圍內行駛的車輛配備某些 ADAS 功能,而其他政府則專注於設計和實施 ADAS 功能及其相關規範以提高車輛性能。例如

- 鑑於現代車輛中 ADAS(高級駕駛輔助系統)的普及率越來越高,中國政府最近宣布了三項專門涵蓋 ADAS 的新標準:其中第一項新標準是 GB/T 39263-2020,有關高級駕駛輔助系統(ADAS)的術語和定義。標準對各類系統進行了定義,分為資訊支援系統和控制支援系統兩大類。

- 到2022年終,歐盟市場上的所有新車可能都必須配備先進的安全系統。歐盟理事會於 2021 年 3 月與歐洲議會達成協議後,通過了有關機動車輛總體安全以及乘員和弱勢道路使用者保護的法規,旨在大幅減少道路交通事故死亡和傷害。此外,受政府支持的汽車安全評級機構歐洲新車安全評估協會 (Euro NCAP) 可能要求駕駛員監控系統從 2023 年或 2024 年開始獲得五星安全評級。

亞太地區預計將佔據汽車降雨感應器市場的較大佔有率

預計預測期內亞太地區將佔據最高複合年成長率。中國、印度等新興國家的經濟成長可能會在未來增加對乘用車的需求。這可能促使全球汽車製造商對技術和現代化大規模生產系統進行大量投資,從而刺激對汽車降雨感應器雨刷系統的需求。此外,基礎建設和工業化投資的增加推動了商用車的需求,也可能提振該地區的市場成長前景。根據這份市場研究報告,預計亞太地區將在整個預測期內繼續主導降雨感應器雨刷市場。預計中國、印度、印尼、日本和韓國等國家將成為該市場的主要貢獻者。例如

- 2021 年 3 月,斯柯達汽車印度公司宣布推出首款量產車——全新中型 SUV Kushaq,該系列共有四款車型,是其 INDIA 2.0計劃的一部分。它配備了降雨感應器,可以在需要時自動打開近光燈和雨刷。

歐洲將成為未來成長最快的地區。由於主要汽車製造商的存在,德國引領了區域市場。此外,汽車產量的增加和先進技術的採用可能會促進該地區的市場成長。此外,政府為振興受到 COVID-19 嚴重打擊的汽車產業而實施的多項有利措施預計將促進這些地區的市場成長。

另外,歐洲地區的主要特徵是豪華車產量大、技術力高。消費者對高性能汽車的偏好是汽車降雨感應器市場成長的主要原因。

汽車降雨感應器產業概況

隨著國內外企業的參與,汽車降雨感應器市場正在不斷鞏固。主要企業正在採取產品創新、併購等策略來擴大其地理範圍並維持其市場地位。市場的主要企業包括Denso Corporation、HELLA GmbH &Co.KGaA、ZF Friedrichshafen AG、Analog Devices Inc.、Valeo group、ams-OSRAM International GmbH 等。

- 2021年3月,海拉開始與汽車資料供應商Wejo合作。海拉全面的感測器專業知識有望幫助 Wejo 發現其高性能雷達、電池和雨量光學氣候感測器的新使用案例。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 波特五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按車型

- 搭乘用車

- 商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 巴西

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 世界其他地區

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- HELLA GmbH & Co. KGaA

- Denso Corporation

- ZF Friedrichshafen AG

- Analog Devices Inc

- STMicroelectronics

- Valeo group

- Semiconductor Components Industries LLC

- ams-OSRAM International GmbH

- HAMAMATSU PHOTONICS KK

第7章 市場機會與未來趨勢

The Automotive Rain Sensor Market size is estimated at USD 1.32 billion in 2025, and is expected to reach USD 1.87 billion by 2030, at a CAGR of 7.2% during the forecast period (2025-2030).

The market was negatively affected by the COVID-19 pandemic in 2020 due to low-reported vehicle sales impacting the commercial potential for automotive rain sensors in the wake of a decline in vehicle production and supply chain disruptions. However, by the first half of 2021, the market had gained momentum as electric vehicle sales picked up across major regions globally.

The increasing use of electrical systems in cars and the expanding need for driver comfort and safety in vehicles, coupled with significant expansion of the automotive sector, are anticipated to act as major driving factors for market growth during the forecast period. In addition, the development of electric mobility and autonomous vehicle technology is expected to further contribute to the remarkable growth of the automotive rain sensors market. Moreover, improving economic conditions, increasing customer demand and interest, technical innovation, and stricter government restrictions are all favorable drivers for the market's expansion. Furthermore, leading luxury vehicle manufacturers are introducing electric variants of their vehicles in response to growing environmental concerns and rising fuel prices. It will also aid in the expansion of the sector. Due to the lower cost of automotive rain sensors, adopting such sensors in the economy and mid-range automobiles is expected to enhance market growth.

In general, several nations advise putting a rain sensor on cars because of excessive rain. However, there are some places where it might not even be necessary. The Middle East & North Africa are two places with very little rainfall. Some nations, such as Qatar, Saudi Arabia, the United Arab Emirates, Kuwait, and Egypt, have extremely low levels of precipitation, which lessens the need for automatic rain sensors. For example, rainfall is negligible in all seasons of the Middle East, as the region is nearly all desert. The only real winters in the Middle East happen in the mountainous regions of Saudi Arabia, where temperatures can reach freezing. Such typical climatic conditions discourage key OEMs from launching their models with such automatic rain-sensing technology features and hence are anticipated to limit the overall market development over the forecast period.

In most parts of North America, automatic wipers are already commonplace in vehicles and have advanced across most car segments. Rain sensors that manage the speed and frequency of wipers are not only a convenience feature, but they are also thought to make driving safer. In all weather situations, the proper wiper speed ensures optimal visibility. According to automakers, the rain sensor's location behind the rearview mirror is also perfect for a cluster of sensors, such as a camera, sun sensor, and ambient light sensor.

Automotive Rain Sensors Market Trends

RISING AWARENESS TOWARDS SAFETY AND COMFORT EXPECTED TO DRIVE DEMAND

The rain sensor is a driver assistance system that takes the strain off the driver by automatically activating the windshield wiper system when it rains, thereby significantly improving in-vehicle safety and comfort. Autonomous cars and connected vehicles are gaining consumers' interest and are anticipated to gain wider acceptance over the forecast period. The advanced driver assistance systems (ADAS) featured are expected to diminish the penetration gap between traditional cars and tomorrow's cars. For instance,

While some governments are focusing on mandating certain ADAS features across vehicles operating in their region, others are focusing on designing and implementing standards for ADAS features and their associated specifications to improve the vehicle's performance. For instance,

- Reflecting the increasing availability of advanced driver assistance systems (ADAS) on modern vehicles, the Chinese government has recently published three new standards that specifically cover advanced driver assistance systems. The first of these new standards is GB/T 39263-2020 on terms and definitions for advanced driver assistance systems (ADAS). The standard specifies definitions for various systems, which are split into two categories; information assistance systems and control assistance systems.

- By the end of 2022, all new cars on the EU market may have to be equipped with advanced safety systems. Following an agreement with the European Parliament in March 2021, the council adopted a regulation on the general safety of motor vehicles and the protection of vehicle occupants and vulnerable road users to reduce road casualties significantly. Additionally, Euro NCAP, a government-backed group that rates cars for safety, may require a driver-monitoring system to earn a five-star safety rating starting in 2023 or 2024.

ASIA-PACIFIC REGION IS EXPECTED TO HOLD THE HIGH MARKET SHARE IN THE AUTOMOTIVE RAIN SENSOR MARKET

During the forecast period, Asia-Pacific is expected to dominate with the highest CAGR. The economic growth of emerging countries such as China and India may increase the demand for passenger cars in the future; this is expected to induce global automobile manufacturers to invest heavily in technology and modern mass production systems, fueling the demand for automotive rain-sensing wiper systems. Moreover, increased investments in infrastructure development and industrialization that fuel the demand for commercial vehicles may also boost the market's growth prospects in this region. According to this market study report, APAC is expected to continue dominating the rain-sensing windshield wipers market throughout the forecast period. Countries like China, India, Indonesia, Japan, and South Korea will be the major market contributors. For instance,

- In March 2021, Skoda Auto India announced the launch of the all-new midsize SUV Kushaq, its first production car of four models, as part of the INDIA 2.0 project. The car features rain sensors that automatically switch on the low beam or windscreen wipers when required.

Europe is to be the fastest-growing region in the future. Germany leads this regional market due to the presence of major automakers in the country. Additionally, increased vehicle production and the adoption of advanced technologies may boost the market growth in this region. Furthermore, several favorable government initiatives implemented to revitalize the automobile industry, which was hit hard by COVID-19, are expected to drive market growth in these regions.

Additionally, the European region's higher production of luxury cars and high technological capabilities are key characteristics. Consumer's prefer high-performance vehicles, which is the major reason for the growth of the automotive rain sensor market.

Automotive Rain Sensors Industry Overview

The automotive rain sensors market is consolidated, with the presence of national and international players in the market. The major players follow strategies like product innovation, mergers, and acquisitions to expand their reach and hold their market position. The major players in the market are Denso Corporation, HELLA GmbH & Co. KGaA, ZF Friedrichshafen AG, Analog Devices Inc., Valeo group, ams-OSRAM International GmbH, etc.

- In March 2021, HELLA entered a collaboration with vehicle data provider Wejo. HELLA's comprehensive sensor expertise is expected to enable Wejo to identify new use cases for high-performance radar, battery, and rain-light-climate sensors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Rest of World

- 5.2.4.1 Brazil

- 5.2.4.2 Saudi Arabia

- 5.2.4.3 United Arab Emirates

- 5.2.4.4 South Africa

- 5.2.4.5 Rest of World

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 HELLA GmbH & Co. KGaA

- 6.2.2 Denso Corporation

- 6.2.3 ZF Friedrichshafen AG

- 6.2.4 Analog Devices Inc

- 6.2.5 STMicroelectronics

- 6.2.6 Valeo group

- 6.2.7 Semiconductor Components Industries LLC

- 6.2.8 ams-OSRAM International GmbH

- 6.2.9 HAMAMATSU PHOTONICS KK