|

市場調查報告書

商品編碼

1686293

X-by-wire 系統:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)X-by-wire System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

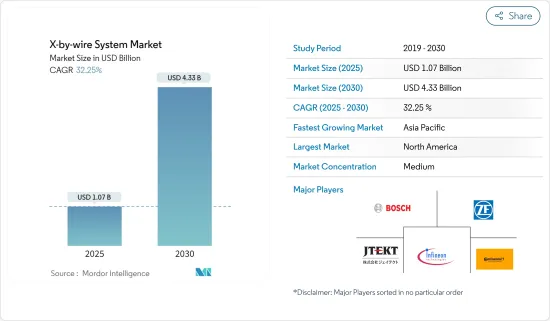

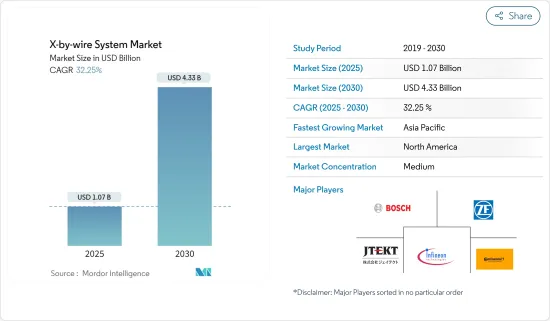

預計 2025 年 X-by-wire 系統市場規模為 10.7 億美元,到 2030 年將達到 43.3 億美元,預測期內(2025-2030 年)的複合年成長率為 32.25%。

受新冠疫情影響,約95%的汽車相關企業暫停營運。在全球範圍內,由於製造業活動陷入停滯,封鎖的影響是巨大的、前所未有的。然而,隨著經濟活動重新開放和全球汽車產量增加,市場在 2021 年開始恢復動力。

從長遠來看,ADAS(高級駕駛輔助系統)的出現和車輛自動化程度的提高預計將增加對汽車線控系統的需求。但目前這些系統在汽車市場的普及率仍較低。汽車製造商專注於提高燃油效率和降低車輛排放氣體水平,這可能會在未來推動線控系統市場的發展。

此外,汽車系統與車輛的整合度不斷提高,加上汽車產業電氣化的不斷提高,也有望推動市場的發展。此外,汽車中擴大使用自動駕駛、巡航控制、自動變速箱、車道偏離警報系統和其他監控系統等先進功能,預計也將推動汽車市場對油門、懸吊、煞車、換檔等線控系統的需求。

X-by-wire 系統在歐洲和北美已經很成熟並且被廣泛應用。由於消費者消費能力的不斷提高、對改進安全措施的需求以及對更省油的汽車的需求,這些系統在亞太地區的使用也在迅速成長。

中國、德國、美國和日本是線控系統的主要市場。隨著墨西哥等新興國家線控系統製造業的增加,汽車製造商對這些技術的需求預計將大幅增加。

線控系統的市場趨勢

預計在預測期內,線控線傳系統將佔據市場主導地位。

全球範圍內電動車的普及率正在不斷增加。隨著人們對 ADAS 功能認知的不斷提高,企業發展於豪華車的各大製造商現在也開始進入入門級市場來吸引客戶。預計此類案例將推動汽車線控線傳系統的需求。

線傳越來越受歡迎,因為它比傳統機械系統具有多種優勢,包括消除機械連桿中的約束問題、提高燃油經濟性、允許模組化系統部署,以及允許 ECU 將扭矩管理與巡航、牽引力控制和穩定性控制相結合。

包括奧迪、大陸、福特和博世在內的許多汽車製造商都致力於自動駕駛汽車的實用化,其中線傳系統通過檢測油門踏板輸入並向電源逆變器模組發送命令來控制馬達發揮關鍵作用。

2021年11月,中國長城汽車發表了基於GEEP 4.0的智慧底盤線傳智慧咖啡系統2.0。這是一個全新的電子電氣架構,整合了線傳轉向、線控刹車、線傳、線控油門、線控懸吊五大核心底盤系統。汽車的運動採用六自由度原理控制。

隨著自動駕駛汽車的成長和技術的發展,政府也採取必要措施來維持市場需求。例如

從 2020 年開始,美國生產的所有新車都必須配備自動煞車、車道偏離警報系統和停車輔助系統。預計此因素將促進線控線傳系統市場的發展。

基於這樣的發展,預計預測期內線控線傳市場將實現良好的成長。

北美有望在市場發展中發揮關鍵作用

預計預測期內北美將佔據最大的市場佔有率。預計預測期內對電動車(尤其是高度自動駕駛汽車)的需求不斷成長將推動市場成長。北美線控系統市場已十分成熟,滲透率較高。

此外,一些公司正在採取聯盟、合作等策略來穩定其市場地位。

- 2021 年 3 月,Motional 宣布計劃使用全電動現代 IONIQ 5 作為下一代機器人計程車的汽車平臺。此次合作將使該公司能夠允許消費者從 2023 年開始在特定市場透過 Lyft 應用程式預訂 Motional Robo 計程車。 Motional 的 IONIQ 5 將具備 4 級自動駕駛功能,為線傳系統創造機會。

- 2021 年 6 月,豐田行動基金會 (TMF)、能源系統網路 (ESN) 和印第安納州經濟發展公司 (IEDC) 與 May Mobility 合作,在印第安納州中部推出免費自動駕駛接駁車服務。預計未來自動駕駛汽車將會產生對線控系統的需求。

這些因素可能會促進北美對線控系統的需求。由於消費者購買力的不斷增強、對更好安全措施的偏好以及對提高車輛燃油效率的需求,亞太地區線控駕駛系統的使用也呈現強勁成長。

線控系統產業概覽

市場相當集中,羅伯特·博世有限公司和大陸集團等主要企業佔據大部分市場佔有率。一些主要參與者正專注於透過收購參與企業、與其他市場參與企業建立策略聯盟以及推出先進的線控系統來擴大其影響力,而其他參與者則採用各種成長策略來獲得競爭優勢。

- 2020 年 10 月,採埃孚開始大量生產其新一代 AKC 主動後軸轉向系統。該系統可提供10度的後轉向角,線傳技術為較長的電動車提供了靈活性。

- 2020年4月,英飛凌科技股份公司宣布收購賽普拉斯半導體公司。此次收購使該公司能夠提供全面的產品組合,將現實世界的機器零件與數位世界連接起來,旨在為線控系統鋪平道路。

市場的主要企業包括羅伯特博世有限公司、ZF、JTEKT 公司、英飛凌科技和大陸汽車集團。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第 5 章市場細分(市場規模:十億美元)

- 按類型

- 線控油門系統

- 線傳煞車系統

- 線控轉向系統

- 線控停車系統

- 線傳換檔系統

- 按車型

- 搭乘用車

- 商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Nissan Motor Corp.

- Groupe PSA

- Nexteer Automotive

- Infineon Technologies AG

- JTEKT Corporation

- ZF Friedrichshafen AG

- Orscheln Products LLC

- Tesla Inc.

- Audi AG

- Torc Robotics

- Lokar Performance Products

- Robert Bosch GmBH

- Continental AG

第7章 市場機會與未來趨勢

The X-by-wire System Market size is estimated at USD 1.07 billion in 2025, and is expected to reach USD 4.33 billion by 2030, at a CAGR of 32.25% during the forecast period (2025-2030).

During the lockdowns, the COVID-19 pandemic compelled about 95% of all automotive-related companies to put their workforces on hold. Globally, the repercussions of the lockdown have been immense and unprecedented due to the halt of manufacturing activities. However, the market started to regain momentum in 2021 as economic activities resumed and vehicle production increased globally.

Over the long term, the emergence of advanced driver assistance systems and the increasing levels of vehicle automation is expected to increase the demand for automotive x-by-wire systems. However, currently, these systems have low penetration rates in the automotive market. The focus of automobile manufacturers on increasing fuel efficiency and reducing the emission level of the vehicle is likely to boost the x-by-wire system market in the future.

Increased integration of vehicular systems in vehicles is also expected to boost the market, coupled with an increase in vehicle electrification in the automotive sector. Increased use of advanced features in vehicles, such as self-driving, cruise control, automatic transmission, lane departure warning systems, and other monitoring systems, is also anticipated to boost the demand for x-by-wire systems in terms of throttle, suspension, braking, and gear shift in the automotive market.

X-by-wire systems are well-established and widely used in Europe and North America. The usage of these systems is also increasing rapidly in Asia-Pacific due to increased consumer spending power, demand for improved safety measures, and the requirement for increased vehicle fuel economy.

China, Germany, the United States, and Japan are major markets for these by-wire systems. Developing countries, such as Mexico, are projected to witness a rapid demand for these technologies from automotive manufacturers, as seen by the increased manufacturing of x-by-wire systems.

X-by-wire Systems Market Trends

Throttle-by-wire System is Expected to Dominate the Market During the Forecast Period

The adoption rate of electric vehicles is increasing globally. With growing awareness about the ADAS features, key manufacturers that operated only in high-end luxury cars are now entering the entry-level models market to attract customers. Such instances are expected to boost the requirements for throttle-by-wire systems in vehicles.

Throttle-by-wire is gaining popularity due to several benefits over traditional mechanical systems, such as eliminating binding problems in mechanical linkages, improving fuel economy, deploying a modular system, and allowing the ECU to integrate torque management with cruise, traction control, and stability control.

Many automakers, including Audi, Continental, Ford, and Bosch, are focusing on commercializing the autonomous car idea where throttle-by-wire systems play a crucial role in controlling electric motors by sensing the accelerator pedal input and sending commands to the power inverter modules.

In November 2021, China's Great Wall Motors unveiled its intelligent chassis-by-wire based on Smart Coffee System 2.0 based on GEEP 4.0, a completely new electronic and electrical architecture where five core chassis systems related steer-by-wire, brake-by-wire, shift-by-wire, throttle-by-wire, and suspension-by-wire are integrated. It controls automotive motions in the principle of six degrees of freedom.

In line with the growth in autonomous cars and technological developments, governments are also taking necessary steps to maintain the demand in the market. For instance,

From 2020 onward, all newly manufactured cars in the United States should be installed with an automatic braking system, a lane departure warning system, and a parking assistance system. This factor is expected to fuel the market for throttle-by-wire systems.

Based on such developments, the throttle-by-wire segment of the market is expected to witness decent growth over the forecast period.

North America Likely to Play a Significant Role in Market Development

North America is anticipated to hold the largest market share during the forecast period. The rising demand for electric vehicles, especially advanced self-driving cars, is anticipated to boost the market's growth over the forecast period. The market for x-by-wire systems in North America is already well-established, with a high penetration rate.

Several companies are also adopting partnerships, collaborations, and other strategies to stabilize their position in the market.

- In March 2021, Motional announced its plans to use the all-electric Hyundai IONIQ 5 as the vehicle platform for its next-generation Robo taxi. Through its partnership, the company could allow consumers in select markets to book a Motional Robo taxi through the Lyft app starting in 2023. Motional's IONIQ 5 would be equipped with Level 4 autonomous driving capabilities, thus creating opportunities for steer-by-wire systems.

- In June 2021, Toyota Mobility Foundation (TMF), Energy Systems Network (ESN), and the Indiana Economic Development Corporation (IEDC) partnered with May Mobility to launch a free autonomous shuttle service in Central Indiana. Autonomous vehicles are expected to create demand for the x-by-wire system in the future.

Such factors are likely to boost the demand for x-by-wire systems in North America. The use of x-by-wire systems is also growing significantly in the Asian-Pacific region due to increased consumer purchasing power, preference for better safety measures, and the need for higher fuel efficiency in the vehicle.

X-by-wire Systems Industry Overview

The market is fairly consolidated, with the key major players, such as Robert Bosch GmbH and Continental AG, holding the majority share in the market. While some key players focus on expanding their presence by acquiring other market participants, forming strategic alliances with other players in the market, and launching new and advanced x-by-wire systems, others are developing various growth strategies to gain a competitive edge over other players.

- In October 2020, ZF launched a new next-generation AKC active rear-axle steering system for mass production. This system could offer a rear steering angle of 10 degrees, and the steer-by-wire technology offers agility for longer electric vehicles.

- In April 2020, Infineon Technologies AG announced the acquisition of Cypress Semiconductor Corporation. With this acquisition, the company could aim to offer a comprehensive portfolio for linking real mechanical parts with the digital world, making way for x-by-wire systems.

Some of the key players in the market are Robert Bosch GmbH, ZF, JTEKT Corp., Infineon Technologies, and Continental AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION ( Market Size in USD Billion)

- 5.1 By Type

- 5.1.1 Throttle-by-wire System

- 5.1.2 Brake-by-wire System

- 5.1.3 Steer-by-wire System

- 5.1.4 Park-by-wire System

- 5.1.5 Shift-by-wire System

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Nissan Motor Corp.

- 6.2.2 Groupe PSA

- 6.2.3 Nexteer Automotive

- 6.2.4 Infineon Technologies AG

- 6.2.5 JTEKT Corporation

- 6.2.6 ZF Friedrichshafen AG

- 6.2.7 Orscheln Products LLC

- 6.2.8 Tesla Inc.

- 6.2.9 Audi AG

- 6.2.10 Torc Robotics

- 6.2.11 Lokar Performance Products

- 6.2.12 Robert Bosch GmBH

- 6.2.13 Continental AG