|

市場調查報告書

商品編碼

1686254

汽車 HVAC:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Automotive HVAC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

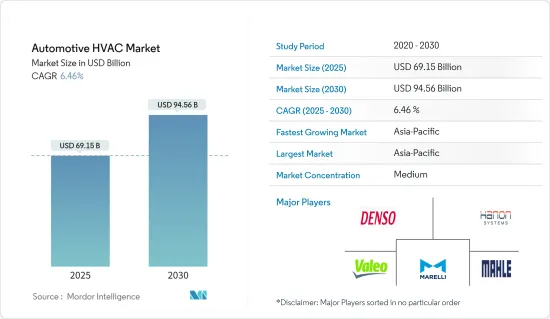

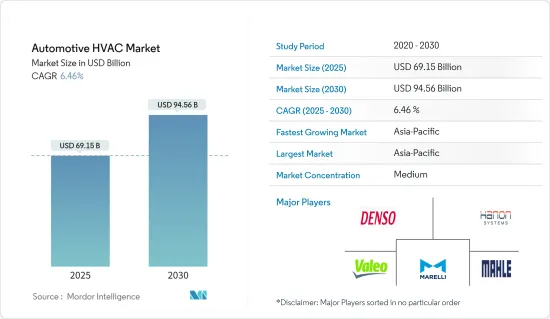

預計 2025 年汽車 HVAC 市場規模為 691.5 億美元,到 2030 年將達到 945.6 億美元,預測期內(2025-2030 年)的複合年成長率為 6.46%。

汽車用品和供應鏈市場受到了COVID-19的嚴重影響。汽車暖通空調系統市場因疫情爆發而受到影響。 2020年乘用車和商用車銷量的下降以及車輛和零件生產設施的暫時關閉,主要是由於地方政府實施的嚴格封鎖措施。

區域市場在供應鏈和原料來源方面面臨一些挑戰,這些挑戰在同一時期成為焦點。 2021年被譽為汽車產業生產部門改組轉型之年,但隨著案例的減少、生產設施恢復營運以及全部區域暖通空調零件的製造和銷售帶來了光明的前景。

從長遠來看,由於採用 HVAC 系統而對熱舒適性和安全性提高的需求不斷增加,預計將推動汽車 HVAC 市場的成長。更小的系統和更輕的重量可能會在未來幾年支持市場成長。以較低的成本整合電子設備、感測器和自動氣候控制功能,正在推動 HVAC 裝置在乘用車中的廣泛應用。汽車電氣化的不斷提高有望進一步促進先進舒適性和安全性功能的整合。

對創新和研發措施的大量投資有望增強參與者的產品和技術力。此外,採用環保冷媒和生產廉價的 HVAC 系統為汽車 HVAC 市場參與者提供了豐厚的成長機會。主要企業正在將先進的 HVAC 系統引入汽車,以幫助對抗車廂內的顆粒物。

由於中國、印度和日本等國家的汽車產量高,亞太地區預計將成為汽車 HVAC 市場最大的細分市場。預計未來幾年北美將為製造商創造新的成長前景。歐洲市場正呈現緩慢但穩定的成長,預計未來五年將達到危機前的水平。

汽車暖通空調市場趨勢

乘用車將成為長期驅動力

乘用車銷售一直深度推動各類車型的 HVAC 市場的發展。 2021 年全球汽車銷量約 6,670 萬輛,而 2020 年約為 6,380 萬輛。全球疫情影響了全球的經濟活動,包括全球汽車銷售,多個國家實施了嚴格的封鎖措施以遏制病毒傳播。因此,2020年的汽車銷量與2019年相比下降了14.8%。然而,隨著生活恢復正常,預計全球汽車銷量將增加,這將在預測期內推動汽車轉向感測器市場的成長。為了適應這些汽車的銷售, OEM目前正在將先進的 HVAC 和氣候控制系統納入其產品中。例如:

- 2022年10月,Polestar將向全球市場推出三款電動SUV車型。這款 SUV 配備了先進的氣候控制系統,即使在長途旅行中也能為乘客提供舒適的感覺。

全球汽車領域研發活動的活性化將增強市場參與者的技術力。這些市場參與者正在引入汽車暖通空調領域的先進技術來開發新產品,為其帶來市場競爭優勢。市場上的競爭對手正在開發環保產品,以遵守政府有關排放的嚴格規定。能源效率是推動 HVAC 系統成長的另一個參數。製造商擴大採用綠色技術來開發環保、節能的汽車 HVAC 系統。例如

- 2021年11月,馬瑞利公司開發了一種室內空氣品質(IAQ)淨化系統,可殺死車輛和室內環境中的細菌和病毒。該系統結合使用 UV-A 和 UV-C 光以及二氧化鈦 (TiO2) 過濾器來消滅空氣中的細菌和病毒,包括 COVID-19,15 分鐘內的有效性超過 99%。

市場參與者正在進行併購,以擴大其市場影響力。例如,Denso與豐田合作開發普銳斯混合動力技術,以提高汽車安全性、燃油效率和綠色技術。此外,人們對全球暖化的日益擔憂對汽車暖通空調市場產生了一定影響。因此,世界許多國家已開始採取措施減少二氧化碳排放,這可能會導致該領域對暖通空調的需求下降。

亞太地區可望實現高成長

由於主要汽車製造商的接近性、汽車產量巨大以及印度、韓國和中國等生產國對汽車的需求激增,亞太市場可能會出現顯著的發展。政府振興汽車業的努力預計將在下一個財政年度推動汽車市場的發展。例如,印度政府正在透過汽車產業的專案和課程鼓勵外國投資,為市場帶來新的創新。

2022年4月,中國乘用車產銷分別完成99.6萬輛和96.5萬輛。與前一年同期比較,產量下降了41.9%,銷量下降了43.4%。 2022年1-4月乘用車產量也較去年同期下降2.6%至64.94億輛。

中國是最大的市場之一,對這些汽車 HVAC 系統的需求做出了巨大貢獻。印度、中國和亞太地區其他地區對乘用車的需求不斷增加,這是人們對舒適性和安全性的偏好不斷增加的結果。預計這些因素將促進該地區的市場成長。消費者正在尋找能夠提供同等舒適功能的高規格車輛。此外,泰國、馬來西亞等國的外資汽車生產也蓬勃發展。

根據中國汽車流通協會(CADA)統計,2021年8月中國豪華車經銷商銷售量為27.8萬輛,較去年同期下降9.4%。還有獅子塔。 2021年,BMW銷量達815,691輛,支撐了中國豪華汽車市場的銷售量。這使得寶馬成為中國最暢銷的豪華汽車製造商。梅賽德斯·奔馳和奧迪的高階汽車銷量下滑。

考慮到這些因素和持續的需求,預計預測期內市場將以高速成長。

汽車暖通空調產業概況

汽車暖通空調市場正在整合,主要企業佔大部分市場佔有率。空調市場的主要企業包括 Mahle GmbH、 Denso Corporation、三菱重工有限公司和 Hanon Systems。併購、與區域空調設備製造商的合作、以及與汽車製造商建立和鞏固聯盟是塑造市場競爭格局的一些動態。例如

- 2021 年 11 月,Hanon Systems 在匈牙利啟用了兩家新工廠:位於佩奇的新工廠和位於萊薩格的擴建大樓。該工廠擁有 22,464平方公尺的製造空間,包括用於汽車空調(A/C) 管路的成型、硬焊、焊接、折彎、組裝和測試的設備。

- 2021 年 8 月,法雷奧推出了一款新型法雷奧熱泵,採用天然冷媒,可從外部空氣中滿足三分之二的能源需求,從而減少了從車載電池中獲取能源的需要。與配備傳統加熱系統的電動車相比,配備此熱泵的電動車在低至 -15°C 的溫度下可行駛距離增加 30%。

- 2021年2月,海立國際(香港)有限公司與Marelli Corporation KK的合資公司Highly Marelli Holdings成立。 Highly Marelli 將專注於為客戶和供應商提供壓縮機電氣化、熱泵系統、暖氣、通風和空調(「HVAC」)以及電動壓縮機(「EDC」)系統領域的世界一流解決方案。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 依技術類型

- 手排/半自動 HVAC

- 自動暖通空調系統

- 按車型

- 搭乘用車

- 商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Valeo Group

- Denso Corporation

- Mahle GmbH

- Marelli Corporation

- Sanden Corporation

- Keihin Corporation

- Japan Climate Systems Corporation

- Mitsubishi Heavy Industries Ltd

- Hanon Systems Corp.

- Samvardhana Motherson Group

- Hella GmbH & KGaA

第7章 市場機會與未來趨勢

The Automotive HVAC Market size is estimated at USD 69.15 billion in 2025, and is expected to reach USD 94.56 billion by 2030, at a CAGR of 6.46% during the forecast period (2025-2030).

The automotive goods and supply chain market were drastically impacted by COVID-19. The automotive HVAC system market was affected due to the outbreak of the pandemic. The decline in passenger car and commercial vehicle sales in 2020 and the temporary shutdown of vehicle and component production facilities were primarily attributed to the stringent lockdown measures prevailed by regional governments.

The regional markets were exposed to several challenges in terms of supply chain and raw material sources which got highlighted during the same period. Although 2021 has marked itself as the year of transition where the auto sector revamped its production units, and with the decline in the cases, production facilities are back in operation, and vehicle sales have increased across major geographies creating a positive outlook for the HVAC component manufacturing and sales.

Over the long term, a rise in demand for thermal comfort and an increase in safety due to the adoption of HVAC systems are expected to boost the growth of the automotive HVAC market. A reduction in system size and weight of the system may support the growth of the market over the coming years. The integration of electronics, sensors, and automated climate control features at a lesser cost is translating into greater adoption of HVAC units in passenger vehicles. Rising vehicle electrification is likely to increase the integration of advanced comfort and safety features in vehicles.

Technological innovations and substantial investments in R&D initiatives are poised to enhance players' offerings and technological capabilities. Furthermore, the adoption of eco-friendly refrigerants and the production of cheaper HVAC systems provide lucrative growth opportunities for the players operating in the automotive HVAC market. Major players are introducing advanced HVAC system in vehicle which help to fight against fine particulates in vehicle cabin.

The Asia-Pacific region is expected to be the largest segment in the automotive HVAC market owing to the large vehicle production levels in countries such as China, India, and Japan. North America is forecasted to create new growth prospects for the manufacturers in the coming years. The European market is showing slow but steady growth and is expected to reach pre-meltdown levels over the period of the next five years.

Automotive HVAC Market Trends

Passenger Car to Provide Longer Term Momentum

Passenger car sales have deeply driven the market of HVAC across all car models. In 2021, global car sales were around 66.7 Million, which in 2020 were 63.8 Million. The global pandemic impacted economic activities all around the world including car sales across the globe, and strict lockdowns were enforced in several countries to contain the spread of the virus. Owing to this the number of cars sold in 2020 was 14.8% lower when compared to 2019. But with life returning to normalcy, the number of cars sold globally has increased which will aid the automotive steering sensor market growth in the forecast period. Owing to these vehicle sales, the present offering by OEM carries advanced HVAC and climate control systems integrated into their offered models. For instance:

- In October 2022, Polestar introduced its 3 electric SUV models in the global market. The SUV is equipped with an advanced climate control system to provide passenger comfort during long-duration journeys.

The augmenting research and developments in the automotive sector across the world are set to enhance the technological capabilities of the market players. These market players are introducing advanced technologies in automotive HVAC to develop new products that impart a competitive edge in the market. The competitors in the market are developing eco-friendly products to fall in line with the stringent government regulations regarding emissions. Energy efficacy is the other parameter driving growth in HVAC systems. Manufacturers are increasingly using green technologies to develop eco-friendly and energy-efficient automotive HVAC systems. For Instance,

- In November 2021, Marelli Corporation has developed an Indoor Air Quality (IAQ) Purification System, which kills bacteria and viruses in vehicles and indoor environments. The system utilizes UV-A and UV-C light combined with a titanium dioxide (TiO2) filter to destroy airborne bacteria and viruses, including COVID-19, with greater than 99% effectiveness within 15 minutes.

Market players are involved in mergers and acquisitions to expand their market presence. For instance, Denso collaborated with Toyota to develop Prius, a hybrid technology promoting safety, fuel efficiency, and green technology in vehicles. Furthermore, growing concerns about global warming have slightly impacted the automotive HVAC market. Consequently, many nations worldwide have started taking measures to reduce their carbon footprints which might reduce the HVAC deman in the segment.

High Growth Anticipated in the Asia-Pacific Region

The Asia-Pacific market is probably going to observe huge development attributable to the nearness of key automotive makers, vast scale generation of vehicles, and spiraling vehicle requests in the manufacturing countries, like India, South Korea, and China. Government activities to restore the automotive business are required to drive the market during the forthcoming year. For example, the Government of India is encouraging foreign investments through programmed courses in the automotive area to bring new innovations to market.

In April 2022, Chinese passenger car production reached 996,000 units with sales registering 965,000 units. This accounts the downfall of 41.9% and 43.4% respectively in production and sales compared to previous year. In 2022, January to April, passenger car production also decreased with 2.6% year-on-year registering 6,494 million units.

China is one of the largest markets and contributes significantly to the demand for these automotive HVAC systems. The increasing demand for passenger vehicles from India, China, and their other counterparts in the Asia-Pacific region is a result of the growing preferences of people for comfort and safety. These factors are expected to contribute to the market growth in the region. Consumers are aligning toward high-specification vehicles that offer par comfort features. In addition, there is an upsurge in vehicle production by foreign companies in countries, including Thailand and Malaysia.

According to the China Automobile Dealers Association (CADA), the luxury car dealers in the country sold 278,000 vehicles in August 2021, an 9.4% decrease year-on-year. In addition, llion units. In 2021, BMW backed up China's premium segment car sales registering 815, 691 units. This made BMW to become China's top selling luxury car maker. On similar lines Mercedes Benz and Audi witnessed decline in their premium car sales.

Considering these factors and ongoing demand, market is anticpated to witness high growth rate during the forecast period.

Automotive HVAC Industry Overview

The automotive HVAC market is consolidated, with the top global players accounting for most of the market share. The major companies in the air-conditioning market include MAHLE GmbH, DENSO Corporation, Mitsubishi Heavy Industries Ltd, and Hanon Systems. Mergers and acquisitions, partnerships with regional HVAC equipment manufacturers, and establishing and ensuring tie-ups with car manufacturers are some of the dynamics shaping the market's competitive landscape. For instance:

- In November 2021, Hanon System inaugurated its two new establishments in Hungary - a new greenfield production facility in Pecs and a building expansion in Retsag. The facility provides 22,464 square meters of manufacturing space and accommodates equipment including forming, brazing, welding and bending, assembly lines and testing for automotive air conditioning (A/C) lines.

- In August 2021, Valeo announced New Valeo heat pump that procures two-thirds of its energy demand from the ambient air, thereby limiting the need to draw energy from the onboard batteries, and uses a natural refrigerant. EVs equipped with the device can travel up to 30% further at -15°C than those fitted with more conventional heating systems.

- In February 2021, Highly Marelli Holdings Co., Ltd., a previously announced joint venture between Highly International (Hong Kong) Limited and Marelli Corporation K.K., has been formed. Highly Marelli will concentrate on providing world-class solutions for clients and suppliers in the areas of compressor electrification, heat pump systems, heating, ventilation, and air conditioning ("HVAC") and electric driven compressor ("EDC") systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 By Technology Type

- 5.1.1 Manual/Semi-automatic HVAC

- 5.1.2 Automatic HVAC

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Saudi Arabia

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Valeo Group

- 6.2.2 Denso Corporation

- 6.2.3 Mahle GmbH

- 6.2.4 Marelli Corporation

- 6.2.5 Sanden Corporation

- 6.2.6 Keihin Corporation

- 6.2.7 Japan Climate Systems Corporation

- 6.2.8 Mitsubishi Heavy Industries Ltd

- 6.2.9 Hanon Systems Corp.

- 6.2.10 Samvardhana Motherson Group

- 6.2.11 Hella GmbH & KGaA