|

市場調查報告書

商品編碼

1686249

低溫冷凍機:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Cryocooler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

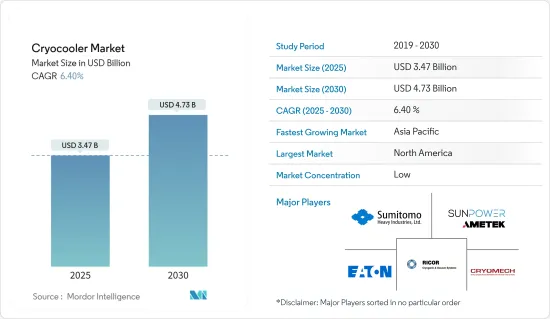

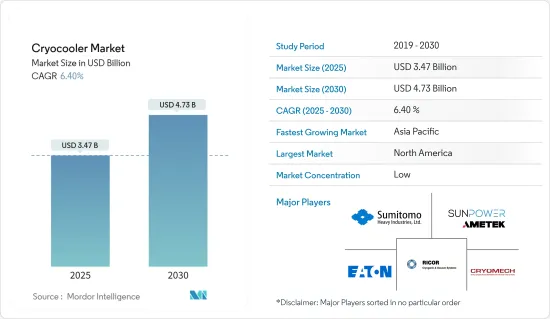

預計 2025 年低溫冷凍機市場規模為 34.7 億美元,到 2030 年將達到 47.3 億美元,預測期內(2025-2030 年)的複合年成長率為 6.4%。

主要亮點

- 低溫冷凍機是一種提供主動冷卻以達到極低溫度的設備。根據美國低溫學會的說法,低溫冷卻器或低溫冷凍機的設計目的是在約 -150°C 的溫度下提供主動冷卻。它利用密封管內的氣體流動吸收熱量並將其輻射到外部。該設備通常使用氦氣或混合氣體。這些設備可以在特定的低溫下產生冷凍,可以取代常規的低溫流體。低溫冷凍機有許多類型,包括斯特林製冷機、脈衝管製冷機、吉福德·麥克馬洪製冷機(GM製冷機)、焦耳-湯姆森等。

- 低溫冷凍機應用的主要促進因素之一是其在軍事和國防工業中的應用日益廣泛,用於為安裝在夜視系統中的紅外線感測器維持極低的溫度。近年來,隨著各國國防能力的加強,夜視設備的使用量顯著增加。此外,各國都在增加軍事開支以採用新技術。根據斯德哥爾摩國際和平研究所預測,2023年全球軍事開支將達到2.44兆美元,為數十年來最高水準。

- 此外,紅外線和可見光相機的冷卻繼續為微型低溫冷凍機提供機會。近年來,紅外線攝影機已從製冷型轉變為非製冷型轉變,但由小型斯特林循環冷凍冷卻的高性能紅外線成像儀仍然很重要。例如,2024 年 2 月,Prama India 與印度政府先進計算發展中心 (C-DAC) 合作,以加強本地製造業和創新。該夥伴關係由技術轉移(TOT)協議促成,旨在推進熱感像儀的製造、行銷和支援。這意味著 Prama India 正在利用技術來研發先進的熱感像儀。政府針對先進技術的此類舉措可能會進一步推動市場成長。

- 氣體液化和低溫儲存等工業製程以及超導體電磁儲能系統(SMES)系統等能源應用正在增加對低溫冷凍機的需求,進一步推動市場成長。另一個主要活動驅動力是太空探勘和衛星部署的擴展,其中使用低溫冷凍機來冷卻紅外線感測器和其他組件。例如,領先的低溫部件和系統開發商 Creare 已獲得美國太空總署的新合約。美國國家航空暨太空總署共享服務中心頒發的 SBIR 第二階段獎項預計將為超低振動 10K 多級低溫冷凍機的進一步擴建提供資金。

- 此外,傳統低溫冷凍機的技術問題對市場成長構成了許多挑戰。傳統的低溫冷凍機通常具有活塞和壓縮機等活動部件,這些部件會隨著時間的推移而磨損,導致頻繁維護和可靠性降低。對於那些需要為關鍵應用提供可靠冷卻解決方案的潛在用戶來說,這可能會是一種阻礙。此外,一些傳統的低溫冷凍機動態效率相對較低,功耗較高。在太空任務或可攜式醫療設備等對能源效率要求嚴格的應用中,這種低效率可能是一個重大缺點。

- 此外,高通膨和原料及製造成本的上升可能會影響低溫冷凍機的製造成本。這可能會影響定價和利潤率,進而影響市場成長。此外,對環境永續性和與能源效率相關的法規的日益關注可能會推動對更高效、功耗更低、對環境影響更小的低溫冷凍機的需求。

低溫冷凍機市場趨勢

最大的終端用戶領域是醫療保健

- 由於低溫冷凍機在 MRI 系統、果凍和質子治療中已廣泛應用,因此在醫療保健領域的需求量很大。它用於冷卻該醫療設備中的超導性磁體。低溫冷凍機的研究和開發已使其在醫療保健行業的各種應用領域中得到越來越廣泛的認可。

- 據稱,低溫冷凍機的高輸入電力消耗是一個限制因素。然而,在醫療保健領域使用低溫冷凍機的好處大於壞處。在醫療領域,低溫冷凍機擴大應用於磁振造影(MRI)和核磁共振(NMR)設備。例如,2023 年 12 月,生命與材料研究核磁共振 (NMR) 波譜解決方案的重要供應商布魯克公司 (Bruker Corporation) 宣布將在俄亥俄州立大學的國家門戶超高場 NMR 中心安裝 1.2吉赫(GHz) NMR 系統。此類舉措可能會進一步推動醫療保健領域對低溫冷凍機的需求。

- 此外,醫療設備的興起也有望為市場成長創造機會。印度醫學研究理事會 (ICMR) 和印度理工學院 (IIT) 合作成立了“IIT 的 ICMR”,並在醫療設備領域設立了印度製造產品開發和商業化的卓越中心 (CoE)。據 IBEF 稱,2000 年 4 月至 2023 年 12 月期間,流入醫療和外科器械行業的 FDI 為 32.6 億美元。此外,2024-25 年臨時預算為製藥和醫療保健產業撥款 98,461 億印度盧比(118.5 億美元)。

- 此外,我們正在擴大我們的 Ayushman Bharat舉措,目標是到 2025 年擴大 Jan Ausadhi 計劃和對抗結核病宣傳活動的規模。這也推動了低溫冷凍機市場的成長。預算撥款的增加可能會促進醫療保健產業乃至市場的成長。醫療保健產業對這份預算的期望是強大的基礎設施、診斷服務、全面的醫療保健政策、稅收優惠等。

- 此外,低溫冷凍機在冷凍保存中發揮關鍵作用,透過將生物實體(從細胞到組織)冷卻到極低的溫度來保存它們。低溫生物學領域取得了重大進展,特別是在細胞和組織的保存方面。這項進展使得低溫生物學被廣泛應用於生殖醫學、癌症造血幹細胞治療、CAR-T 細胞等尖端免疫細胞療法以及動植物性因庫的建立等各個領域。

- 根據國際癌症研究機構《世界癌症報告》,儘管在癌症預防和治療方面不斷取得進展,但全球癌症負擔仍在穩步增加,預計2018年至2040年間新患者數將增加50%。此外,根據世界衛生組織的數據,預計2040年全球新發癌症病例將達2,988萬例,到2050年將達到3,528萬例。預計這些因素將推動對低溫冷凍機的需求。

預計北美將佔最大佔有率

- 由於國防和醫療保健產業的投資不斷增加,北美成為低溫冷卻器市場應用的主要動力。根據斯德哥爾摩國際和平研究所統計,2023年美國軍費開支達9,160億美元,位居世界最高。

- 此外,美國政府航太機構已投入大量研發資金來實施創新的低溫冷卻技術。這可能會促進該國未來幾年太空產業的發展。美國預算辦公室表示,2023會計年度預算及支持文件中列出的美國核子武力計畫預計在2023-2032年期間耗資7,560億美元,比2021-2030年期間增加1,220億美元。

- 由於低溫冷卻器廣泛應用於質子治療、果凍、核磁共振成像系統、醫院的氧氣液化等領域,該地區醫療保健產業對低溫冷卻器的需求正在上升。該地區是新型癌症治療方法和低溫冷凍機設備等快速發展技術的關鍵發展區域,其中最突出的是針對固態腫瘤、肺癌和白血病的治療。

- 此外,由於低溫冷凍機主要用於癌症治療的質子束治療,該地區的低溫冷凍機市場正在不斷擴大。事實證明,肺癌和腦癌的質子治療是適合局部癌症患者的治療方法。腦瘤是0至14歲兒童癌症死亡的重要原因。該地區癌症患者數量的快速增加可能會刺激對質子治療的需求並推動市場成長。根據美國質子治療協會的數據,美國有 42 個質子治療中心為患者提供治療。

- 癌症是美國第二大死因。根據美國癌症協會估計,2024年美國女性將新增972,000例癌症病例,同年還將有125,070人死於肺癌和支氣管癌。

- 低溫冷凍機可為夜視系統、衛星監視系統、飛彈導引系統等中的紅外線感測器維持極低的溫度。北美軍事和監控行業對低溫冷凍機的需求不斷成長,推動了該地區低溫冷凍機市場的發展。

- 美國太空總署已開始使用體育場大小的氣球進行太空研究。該任務名為 ASTHROS,將於 2023 年 12 月從南極洲發射。搭載 ASTHROS 的氣球將配備觀測設備和輕型望遠鏡。 ASTHROS 觀測地球上不可見的光波長。美國太空總署將使用動力低溫冷凍機來冷卻儀器,使其超導性檢測器的溫度保持在接近-268.5°C。

低溫冷凍機市場概覽

低溫冷凍機市場有幾家主要企業,包括住友公司和巴里自動化公司,以及其他競爭對手,爭奪這個中等分散的市場空間的主導地位。這些公司採取了強力的競爭策略,如產品創新、投資、收購和策略夥伴關係,以維持其在市場上的地位和競爭優勢。在研究期間,市場競爭對手之間的敵意處於中等偏高的水平。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 技術簡介

- 主要宏觀經濟趨勢的市場影響

第5章市場動態

- 市場促進因素

- 新興經濟體醫療保健服務的成長

- 液化天然氣產量增加

- 市場限制

- 低溫冷凍機性能限制

第6章市場區隔

- 按最終用戶產業

- 宇宙

- 衛生保健

- 軍隊

- 商業

- 運輸

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章競爭格局

- 公司簡介

- Sumitomo Heavy Industries Limited

- Sunpower Inc.(AMETEK Inc.)

- Ricor Systems

- Eaton Corporation PLC

- Cryomech Inc.(Bluefors OY)

- Chart Industries Inc.

- Janis Research Company LLC

- Advanced Research Systems Inc.

- Air Liquide Advanced Technologies

- Stirling Cryogenics BV

- Northrop Grumman Corporation

- Thales Group

第8章投資分析

第9章:市場的未來

The Cryocooler Market size is estimated at USD 3.47 billion in 2025, and is expected to reach USD 4.73 billion by 2030, at a CAGR of 6.4% during the forecast period (2025-2030).

Key Highlights

- A cryocooler is a device that provides active cooling to reach cryogenic temperatures. According to the Cryogenic Society of America Inc., a cryogenic cooler or a cryocooler is designed to allow active cooling at about -150 °C. It uses the flow of gas inside closed tubes, which absorbs the temperature and radiates it outside. The device generally uses helium or a mixture of gases. These devices produce refrigeration at a specific low temperature that can replace normal cryogenic fluids. There are many types of cryocoolers, including Stirling, pulse tube, Gifford-McMahon (GM), and Joule-Thomson.

- One of the major factors driving the adoption of cryocoolers is its growing adoption across the military and defense industries to maintain cryogenic temperatures for IR sensors installed in night-vision-based systems. The use of night vision devices has significantly increased in the last few years as countries advance their defense capabilities. Moreover, countries are increasing their military spending to adopt new technologies. According to SIPRI, military spending worldwide amounted to USD 2.44 trillion in 2023, the highest amount in several decades.

- Furthermore, the cooling of infrared and visible cameras continues to provide opportunities for small cryocoolers. While recent years have witnessed a shift from cooled to uncooled IR cameras, there is still significance for high-performance infrared imagers cooled by small Stirling cycle cryocoolers. For instance, in February 2024, Prama India partnered with the Indian government's Centre for Development of Advanced Computing (C-DAC) to bolster local production and innovation. This partnership, facilitated by a transfer of technology (TOT) agreement, centers on advancing thermal camera manufacturing, marketing, and support. It signifies Prama India's stride in leveraging technology for advanced thermal camera R&D. Such government initiatives in advanced technology may further propel the market's growth.

- The need for cryocoolers in industrial processes, such as liquefaction of gases and cryogenic preservation, as well as in energy applications like superconducting magnetic energy storage (SMES) systems, is expanding, further propelling the market's growth. Also, the expanding activities in space exploration and the deployment of satellites, which rely on cryocoolers for cooling infrared sensors and other components, are significant drivers. For instance, Creare, a significant developer of cryogenic components and systems, received a new contract from NASA. The SBIR Phase II award from NASA Shared Services Center is expected to fund further expansion of a 10 K multi-stage cryocooler with very low vibration.

- Moreover, technical problems with traditional cryocoolers present several challenges to the market's growth. Traditional cryocoolers often have moving parts, such as pistons and compressors, which can wear out over time, leading to frequent maintenance and reduced reliability. This can deter potential users who require highly reliable cooling solutions for critical applications. Also, some traditional cryocoolers have relatively low thermodynamic efficiency, resulting in higher power consumption. This inefficiency can be a significant drawback in applications where energy efficiency is essential, such as in space missions or portable medical devices.

- Additionally, high inflation and rising costs of raw materials and manufacturing can impact the production costs of cryocoolers. This may affect pricing and profit margins, potentially influencing the market's growth. Furthermore, increasing focus on environmental sustainability and regulations related to energy efficiency can drive demand for more efficient cryocoolers that consume less power and have a lower environmental impact.

Cryocooler Market Trends

Healthcare to be the Largest End-user Vertical

- Cryocoolers are in significant demand in healthcare due to their widespread application in MRI systems, cryosurgery, and proton therapy. They are used to keep the superconducting magnets in this medical equipment cool. The studies and developments on cryocoolers have enhanced their acceptance in the healthcare industry for various applications.

- The high input power consumption of cryocoolers is claimed to be a limitation. However, the benefits of using cryocoolers in healthcare exceed the drawbacks. The use of cryocoolers in magnetic resonance image (MRI) and nuclear magnetic resonance (NMR) equipment is increasing in the medical field. For instance, in December 2023, Bruker Corporation, a significant provider of nuclear magnetic resonance (NMR) spectroscopy solutions for life and materials research, announced the installation of a 1.2 gigahertz (GHz) NMR system at the National Gateway Ultrahigh Field NMR Center at the Ohio State University. Such initiatives may further create demand for cryocoolers in the healthcare segment.

- In addition, the rise in medical machines would create an opportunity for the market's growth. The Indian Council of Medical Research (ICMR) and Indian Institutes of Technology (IITs) cooperated in establishing 'ICMR at IITs' by establishing centers of excellence (CoE) for Make in India product development and commercialization in the medical devices space. According to IBEF, FDI inflows into the medical and surgical appliances industry stood at USD 3.26 billion between April 2000 and December 2023. Furthermore, in the Interim Budget 2024-25, INR 98,461 crore (USD 11.85 billion) was allocated for the pharmaceutical and healthcare industry.

- Furthermore, the country is scaling up the Ayushman Bharat initiative, aiming to expand the Jan Ausadhi program and anti-TB campaign by 2025. This is also aiding in the growth of the cryocooler market. Such increased budget allocations may help in the growth of the healthcare industry and, thereby, the market. Robust infrastructure, access to diagnostics, comprehensive healthcare policy, and tax incentives are some expectations of the healthcare industry from this budget.

- In addition, cryocoolers play a crucial role in cryopreservation, a method that conserves biological entities, ranging from cells to tissues, by chilling them at extremely low temperatures. The field of cryobiology, especially in cell and tissue preservation, has seen significant advancements. This progress has led to cryobiology's extensive adoption, spanning diverse fields like reproductive medicine, hematopoietic stem cell treatments for cancer, cutting-edge immune cell therapies like CAR T-cells, and the establishment of gene banks for both animals and plants.

- According to the IARC's World Cancer Report, despite constant progress in cancer prevention and treatment, the global cancer burden kept growing, as the number of new cases is anticipated to increase by 50% between 2018 and 2040. Furthermore, according to the WHO, new global cases of cancer are anticipated to be recorded at 29.88 million by 2040 and 35.28 million by 2050. Such factors are expected to drive the demand for cryocoolers.

North America is Expected to Hold the Largest Share

- North America is significantly driving the adoption of cryocoolers in the market due to rising investment in the military and healthcare industries. According to SIPRI, the United States led the ranking of the countries with the highest military spending in 2023, with USD 916 billion dedicated to the military.

- Furthermore, government space organizations in the United States invested significant research and development funds in introducing innovative cryogenic cooling technology. This will help the country's space industry grow in the coming years. According to the US Congressional Budget Office, the plans for US nuclear forces, as outlined in the FY 2023 budget and supporting documents, are projected to cost USD 756 billion over the 2023-2032 period, which is USD 122 billion more than the 2021-2030 period.

- In the healthcare industry, the rising need for cryocoolers in the region is attributed to their extensive utilization in proton therapy, cryosurgery, MRI systems, and the liquefaction of oxygen in hospitals. The area is a significant developer of new cancer drugs and rapidly evolving technologies, such as cryocooler devices, with the most prominent groups aimed at treating solid tumors, lung cancer, and leukemia.

- Additionally, the cryocooler market in the region has been escalating as cryocoolers are primarily used for proton therapy in cancer treatment. Proton therapy for lung and brain cancers has proven to be a suitable treatment for patients whose cancer is limited to the local area. Brain tumors are the significant cause of cancer-related death among children aged 0-14. The upsurge in the cases of the cancers noted above in the region may drive the demand for proton therapy, thereby driving the market's growth. According to the National Association of Proton Therapy, 42 proton therapy centers treat patients in the United States.

- Cancer is the second leading cause of death in the United States. According to the American Cancer Society, in 2024, it was estimated that there would be over 972 thousand new cancer cases among women in the United States. The source also estimated that there will be around 125,070 deaths from lung and bronchus cancers in the same year.

- Cryocoolers maintain cryogenic temperatures for IRIR sensors installed in night vision-based systems, satellite-based surveillance, and missile guidance. The growing demand for cryocoolers across North America's military and surveillance industries has been boosting the cryocooler market in the region.

- NASA has started working on studying the cosmos using a stadium-sized balloon. The mission, ASTHROS, was launched in December 2023 from Antarctica. The balloon carrying ASTHROS will carry the instrument and a lightweight telescope. ASTHROS will observe wavelengths of light invisible from Earth. NASA will use a cryocooler supplied with electricity to cool the tools and keep superconducting detectors near -268.5 °C.

Cryocooler Market Overview

The cryocooler market is home to multiple key players, including Sumitomo and Barry Automation Inc., alongside other contenders, all striving for prominence within this moderately fragmented market space. These companies have embraced potent competitive strategies, such as product innovations, investments, acquisitions, and strategic partnerships, to maintain their relevance and competitive edge in the market. During the study period, the competitive rivalry within the market exhibited a moderately high level of intensity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.5 Impact of Key Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Medical and Healthcare Services in Developing Economies

- 5.1.2 Increasing Production of Liquefied Natural Gas

- 5.2 Market Restraints

- 5.2.1 Performance Constraint of Cryocoolers

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Space

- 6.1.2 Healthcare

- 6.1.3 Military

- 6.1.4 Commercial

- 6.1.5 Transportation

- 6.1.6 Other End-user Verticals

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sumitomo Heavy Industries Limited

- 7.1.2 Sunpower Inc. (AMETEK Inc.)

- 7.1.3 Ricor Systems

- 7.1.4 Eaton Corporation PLC

- 7.1.5 Cryomech Inc. (Bluefors OY)

- 7.1.6 Chart Industries Inc.

- 7.1.7 Janis Research Company LLC

- 7.1.8 Advanced Research Systems Inc.

- 7.1.9 Air Liquide Advanced Technologies

- 7.1.10 Stirling Cryogenics BV

- 7.1.11 Northrop Grumman Corporation

- 7.1.12 Thales Group