|

市場調查報告書

商品編碼

1686235

空氣分離裝置-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Air Separation Unit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

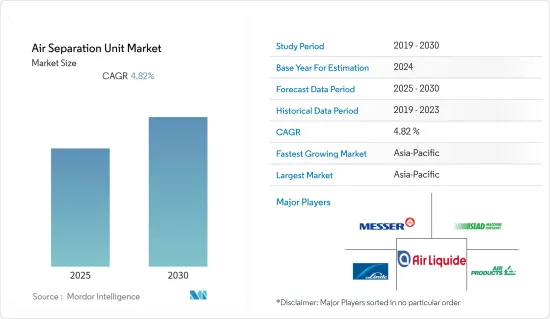

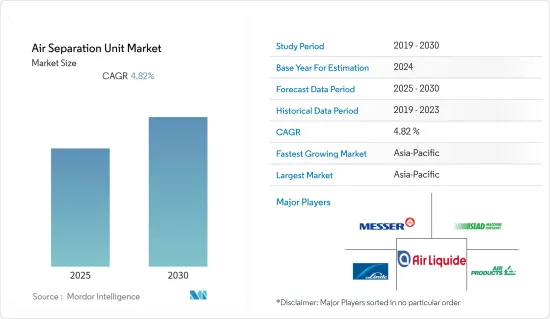

預計預測期內空氣分離裝置市場複合年成長率將達到 4.82%。

主要亮點

- 從中期來看,預計工業氣體需求增加、鋼鐵和加工工業成長等因素將在預測期內推動市場成長。

- 另一方面,供應高純度工業氣體的巨大成本迫使一些工業公司轉向替代空氣分離技術,如變壓式吸附(PSA)作為一種經濟有效的解決方案,這可能會抑制空氣分離裝置市場。

- 然而,沙烏地阿拉伯、阿拉伯聯合大公國和南非等國家的都市化和工業化活動正經歷高成長率。預計這些國家將為空氣分離裝置製造商提供成長機會。因此,中東和非洲地區市場開發活動的增加將為未來幾年空氣分離裝置市場參與者帶來有利機會。

- 預計亞太地區將在預測期內佔據市場主導地位,大部分需求來自印度和中國等國家。

空氣分離裝置市場趨勢

鋼鐵終端用戶市場需求旺盛

- 鋼鐵業是ASU的主要消費者之一。鋼鐵生產需要大量的氧氣,其中大部分是利用空分技術從空氣中獲得的。

- 據估計,全球超過一半的鋼鐵生產採用鹼性氧氣轉爐煉鋼製程(BOP),該製程利用純氧將液態高爐鐵水和廢鋼轉化為鋼。因此,大多數鋼廠都安裝大型空分裝置來滿足工廠運作中很重要的氧氣需求。

- 鋼鐵業是現代工業成長的驅動力之一,過去十年鋼鐵產量穩定成長。根據世界鋼鐵協會的數據,截至2022年12月,中國仍是全球最大的粗鋼生產國,產量為7,790萬噸,年減與前一年同期比較%。印度、日本、美國和俄羅斯則遠遠落後。

- 每個鋼廠都需要大型空分裝置,這些裝置是能源密集型的,因此最佳化能源消耗是一項重大挑戰。由於鋼鐵生產需要各種純度水平,因此保持氧氣純度也是一個重大挑戰。

- 預計中國、印度、非洲和東南亞國協正在快速工業化,並大力投資大型計劃。

- 2022 年 3 月,Inox Air Products 宣布已贏得在印度鋼鐵管理局有限公司 (SAIL) 位於賈坎德邦博卡羅工廠建設印度最大待開發區氧氣廠的合約。該工廠總投資為 75 億印度盧比,每天將生產 2,150 噸工業氣體,其中包括每天 2,000 噸氣態氧、每天 150 噸液態氧、每天 1,200 噸氣態氮和每天 100 噸氬。

- 預計在預測期內,鋼鐵廠的此類大規模投資和新空分裝置建設計劃將推動全球空分裝置市場的鋼鐵部分的發展。

- 因此,基於上述因素,預計預測期內鋼鐵終端用戶部門將在全球空氣分離裝置市場中看到顯著的需求。

亞太地區可望主導市場

- 亞太地區佔據空氣分離裝置市場的最大佔有率,預計在預測期內將繼續佔據主導地位。

- 中國是世界第二大石油消費國,同時也是第六大石油生產國。儘管中國近50%的碳氫化合物需求依賴進口,但為了減少對能源進口的依賴,提高能源安全,中國正尋求透過開發四川盆地等各內陸頁岩盆地的國內蘊藏量,最大限度地發揮頁岩的潛力。

- 中國的頁岩革命帶來了前所未有的石化生產能力的創造和擴張。因此,中國大力投資精製和石化基礎設施,以滿足國內需求並減少國內工業的石化加工。隨著食品包裝、服飾、化妝品和化肥等行業對塑膠和其他石化產品的需求不斷成長,需要增加精製能力以滿足不斷成長的需求。

- 中國正在建造新的煉油廠,並升級和提高舊煉油廠的產能。沙烏地阿美計畫於2023年3月在中國東北地區啟動一座煉油廠和一個新的石化計劃,預計三年後啟動。這個位於遼寧省盤錦的投資額為100億美元的計劃將成為沙烏地阿美在中國的第二個大型精製和石化計畫。

- 由於國內電子製造業(如太陽能)的大幅成長、石油精製和石化產能的提高以及醫療保健成本的上升,中國對工業氣體的需求大幅增加,因此中國預計將引領亞太市場。

- 此外,印度的目標是在未來兩到七年內實現年產鋼3億噸的目標。印度鋼鐵產量的成長預計將增加對工業氣體(尤其是氧氣)的需求,這將在預測期內推動該國對空氣分離裝置的需求。

- 2022年2月,林德印度有限公司與ESL鋼鐵有限公司簽署了一份為期15年的協議,為該鋼廠每天供應約800噸氧氣和900噸氮氣。林德印度公司將在博卡羅的 ESL 鋼鐵廠建立一個現場空氣分離裝置。

- 2022 年 1 月,液化空氣集團宣布將在印度北方邦科西市投資約 35 億印度盧比建造一個供工業商業使用的新型空氣分離裝置。該裝置的日生產量為350噸氧氣,最大生產量為300噸。該工廠預計將於今年底運作。

- 因此,預計最終用戶領域(主要是中國和印度的鋼鐵、石油和天然氣以及化學品領域)對空分裝置的使用量增加將推動該地區對空氣分離裝置的需求。

空分裝置行業概況

ASU 市場相當分散。市場的主要企業(不分先後順序)包括林德股份公司、梅塞爾Group Limited、SIAD Macchine Impianti SpA、空氣產品和化學品公司以及液化空氣集團。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概述

- 介紹

- 2028 年市場規模與需求預測

- 近期趨勢和發展

- 市場動態

- 驅動程式

- 工業氣體需求不斷成長

- 鋼鐵和加工工業的成長

- 限制因素

- 供應高純度工業氣體的龐大成本

- 驅動程式

- 工業供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場區隔

- 過程

- 低溫蒸餾

- 非低溫蒸餾

- 氣體

- 氮

- 氧

- 氬氣

- 其他氣體

- 最終用戶

- 化工

- 石油和天然氣

- 鋼鐵業

- 其他最終用戶

- 區域市場分析(2028 年市場規模與需求預測)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 亞洲

- 中國

- 印度

- 韓國

- 日本

- 亞洲其他地區

- 歐洲

- 英國

- 德國

- 義大利

- 法國

- 其他歐洲國家

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Linde AG

- Messer Group GmbH

- Siad Macchine Impianti Spa

- Shanghai Chinllenge Gases Co. Ltd

- Taiyo Nippon Sanso Corporation

- Air Liquide SA

- Air Products and Chemicals Inc.

- Universal Industrial Plants Mfg Co. Pvt Ltd

- Bhoruka Gases Limited

- Sichuan Air Separation Plant Group

第7章 市場機會與未來趨勢

- 中東和非洲的工業發展活動活性化

簡介目錄

Product Code: 50922

The Air Separation Unit Market is expected to register a CAGR of 4.82% during the forecast period.

Key Highlights

- Over the medium term, factors such as increasing demand for industrial gases, spurred by the growth in steel and process industries, are likely to drive the market growth during the forecast period.

- On the other hand, since the cost to supply high-purity industrial gases is huge, several operating companies are shifting toward alternate air separation techniques, such as pressure swing adsorption (PSA), as a cost-effective solution that may restrain the market for air separation units.

- Nevertheless, countries such as Saudi Arabia, the United Arab Emirates, and South Africa have been witnessing a high growth rate of urbanization and industrialization activities. They are expected to offer growth opportunities for air separation unit players. Therefore, the increase in industrial development activities in the Middle East and African region presents a good market opportunity for air separation unit market players in the coming years.

- Asia-Pacific is expected to dominate the market during the forecast period, with most of the demand coming from countries like India, China, etc.

Air Separation Unit Market Trends

Iron and Steel End-user Segment to Witness Significant Demand

- The iron and steel industry is one of the major consumers of ASUs, as steel production requires massive amounts of oxygen, most of which is sourced from the air using ASU technology.

- It is estimated that more than half of the global steel production uses the basic oxygen process (BOP), which uses pure oxygen to convert a charge of liquid blast-furnace iron and scrap into steel. Hence, most steel plants install large ASUs to cater to the oxygen demand, which forms a critical part of plant operations.

- The iron and steel industry is one of the drivers of modern industrial growth, and steel production has been growing steadily over the past decade. According to the World Steel Association, as of December 2022, China upholds the world leader in crude steel production, with 77.9 million metric tonnes produced, a 10% decrease from the previous year. India, Japan, the United States, and Russia trail far behind.

- As all steel plants require large-scale ASUs, and these units are highly energy-intensive, optimising energy consumption is a major challenge. Maintaining oxygen purity is also a major challenge, as different purities are required for steel production.

- The steel demand is expected to be highest among developing economies, such as China, India, Africa and the ASEAN countries, which are industrialising fast and investing heavily in large-scale infrastructure projects.

- In March 2022, INOX Air Products Ltd announced that it had won a contract to construct India's largest Greenfield Oxygen Plant in India at the Steel Authority of India's (SAIL) Bokaro plant in Jharkhand. Being built at a total investment of INR 750 crore, the plant will generate 2150 tonnes per day (TPD) of Industrial Gases, including 2000 TPD of Gaseous Oxygen, 150 TPD of Liquid Oxygen, 1200 TPD of Gaseous Nitrogen & 100 TPD of argon.

- Such large investments and projects for the construction of new ASUs in steel plants are expected to drive the iron and steel segment of the Global ASU market during the forecast period.

- Therefore, based on the abovementioned factors, the iron and steel end-user segment is expected to witness significant demand for the global air separation unit market during the forecast period.

Asia-Pacific Expected to Dominate the Market

- Asia-Pacific accounted for the largest air separation unit market share and is expected to continue its dominance during the forecast period.

- China is the world's second-largest oil consumer but the sixth-largest oil producer. It imports nearly 50% of its hydrocarbon demand, and to reduce dependence on energy imports and improve energy security, China has been trying to maximise its shale potential by exploiting its domestic reserves across various inland shale basins, such as the Sichuan basin.

- The shale revolution in China has resulted in unprecedented petrochemical capacity creation and expansion. As a result, China has made significant investments in its refining and petrochemical infrastructure to appease domestic demand and reduce the petrochemical process for domestic industries. Due to an ever-rising demand for plastics and other petrochemicals from sectors such as food packaging, clothing, cosmetics and fertilisers, refining capacity has to be increased to handle the growing demand.

- China has been constructing new refineries and upgrading and adding capacity to older refineries. In March 2023, Saudi Aramco aims to start operation at the refinery and its new petrochemical project in northeast China after three years. The USD 10 billion project at Panjin, Liaoning Province, will be Aramco's second large refining-petrochemical venture in China.

- China is expected to lead the market in Asia-Pacific due to its significant growth in electronics manufacturing (like solar PV etc.) domestically, increasing refining and petrochemical capacity, and increasing healthcare expenditure, which has significantly increased the demand for industrial gases.

- Moreover, India aims to achieve 300 million metric tons of steel annually by over next two to seven years. The increasing steel production in India is expected to increase the demand for industrial gasses, particularly oxygen, which will likely drive the demand for air separation units in the country during the forecast period.

- In February 2022, Linde India Limited entered into a 15-year agreement with ESL Steel Limited to supply about 800 mt per day of oxygen and 900 mt per day of nitrogen to the steel mill. Linde India will set up an on-site air separation unit at ESL Limited's steel mill at Bokaro.

- In January 2022, Air Liquide announced an investment of about INR 350 crore in a new air separation unit dedicated to industrial merchant activities in Kosi, Uttar Pradesh, India. This unit will have a production capacity of 350 tons per day with a maximum of 300 tons of oxygen. The plant is likely to be operational by the end of this year.

- As a result, the increasing uptake of ASUs from the iron and steel, oil and gas, and chemical end user segments, majorly from China and India, is expected to increase the demand for air separation units in the region.

Air Separation Unit Industry Overview

The ASU market is moderately fragmented. Some of the major players in the market (in no particular order) include Linde AG, Messer Group GmbH, SIAD Macchine Impianti SpA, Air Products and Chemicals Inc., and Air Liquide SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.1.1 Increasing Demand for Industrial Gases

- 4.4.1.2 Growth in Steel and Process Industries

- 4.4.2 Restraints

- 4.4.2.1 The Huge Cost to Supply High-Purity Industrial Gases

- 4.4.1 Drivers

- 4.5 Industry Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Process

- 5.1.1 Cryogenic Distillation

- 5.1.2 Non-cryogenic Distillation

- 5.2 Gas

- 5.2.1 Nitrogen

- 5.2.2 Oxygen

- 5.2.3 Argon

- 5.2.4 Other Gases

- 5.3 End User

- 5.3.1 Chemical Industry

- 5.3.2 Oil and Gas Industry

- 5.3.3 Iron and Steel Industry

- 5.3.4 Other End Users

- 5.4 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.4.1 North America

- 5.4.1.1 United States of America

- 5.4.1.2 Canada

- 5.4.1.3 Rest of the North America

- 5.4.2 Asia

- 5.4.2.1 China

- 5.4.2.2 India

- 5.4.2.3 South Korea

- 5.4.2.4 Japan

- 5.4.2.5 Rest of the Asia

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of the Europe

- 5.4.4 Middle-East and Africa

- 5.4.4.1 Saudi Arabia

- 5.4.4.2 United Arab Emirates

- 5.4.4.3 South Africa

- 5.4.4.4 Rest of the Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of the South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Linde AG

- 6.3.2 Messer Group GmbH

- 6.3.3 Siad Macchine Impianti Spa

- 6.3.4 Shanghai Chinllenge Gases Co. Ltd

- 6.3.5 Taiyo Nippon Sanso Corporation

- 6.3.6 Air Liquide SA

- 6.3.7 Air Products and Chemicals Inc.

- 6.3.8 Universal Industrial Plants Mfg Co. Pvt Ltd

- 6.3.9 Bhoruka Gases Limited

- 6.3.10 Sichuan Air Separation Plant Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increase in Industrial Development Activities in the Middle-East and African Region

02-2729-4219

+886-2-2729-4219