|

市場調查報告書

商品編碼

1686231

汽車預束式安全帶:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Automotive Seat Belt Pretensioner - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

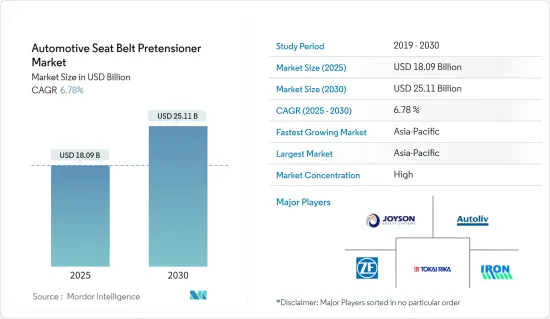

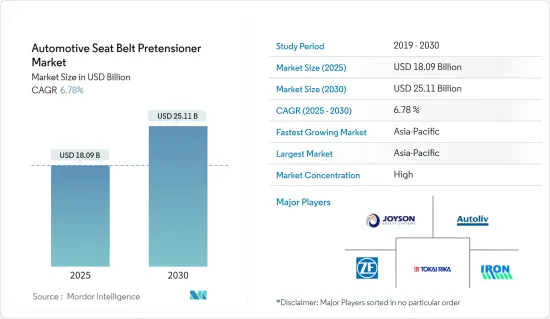

汽車預束式安全帶市場規模預計在 2025 年為 180.9 億美元,預計到 2030 年將達到 251.1 億美元,預測期內(2025-2030 年)的複合年成長率為 6.78%。

主要亮點

- 由於乘員安全的重要性日益增加以及政府對汽車安全標準的嚴格監管,汽車預束式安全帶市場多年來取得了顯著成長。預緊器是一種在碰撞過程中收緊安全帶以繃緊座位乘員身體的裝置,可最大限度地降低受傷風險。該裝置已成為現代車輛的重要組成部分,有助於保障乘客的整體安全。

- 然而,新冠疫情對汽車產業產生了重大影響,包括預束式安全帶市場。由於對經濟的擔憂和旅行限制降低了消費者需求,全球疫情導致製造工廠暫時關閉,汽車產銷量下降。因此,在疫情初期,汽車預束式安全帶的需求大幅下降。

- 此外,封鎖措施和旅行限制導致的供應鏈中斷影響了包括預束式安全帶在內的汽車零件的生產和銷售。邊境關閉和國際貿易限制進一步影響了原料和零件的供應,加劇了製造商的挑戰。

- 然而,隨著各國開始放鬆限制以及汽車產業恢復營運,預束式安全帶市場開始出現復甦跡象。製造業活動的恢復、需求的停滯以及消費者信心的逐步恢復支撐了市場復甦。此外,後疫情時代人們對乘客安全的日益關注以及汽車先進安全功能的日益普及,進一步推動了對預束式安全帶的需求。汽車製造商正在採用煙火和電動預束式安全帶等先進技術預束式安全帶提高乘員保護並滿足嚴格的安全法規。

- 此外,旨在提高預束式安全帶性能和效率的持續研究和開發預計將推動市場成長。製造商專注於開發輕量、經濟高效的安全帶張緊系統,以提供更高的安全性和乘客舒適度。

汽車預束式安全帶的市場趨勢

預計乘用車市場將佔據大部分市場佔有率

- 多年來,預緊器在提高乘客安全方面發揮了至關重要的作用。該裝置整合在安全帶系統中,用於在碰撞或突然減速時立即收回並收緊安全帶,減少乘員的向前移動並最大限度地減少衝擊。受傷風險增加。

- 全球範圍內乘客安全意識的不斷增強和道路交通事故的增加推動了對汽車先進安全功能的需求。政府和監管機構也實施了嚴格的安全標準,強制要求乘用車安裝預束式安全帶。為了遵守安全法規並滿足消費者對更安全車輛的需求,汽車製造商正在積極將預束式安全帶作為標準或選用配備安裝到他們的車輛中。

- 此外,技術的進步也促進了更複雜的安全帶張緊系統的發展。例如,煙火預緊器使用小型炸藥來啟動預緊器機構,由於其有效性和可靠性而變得越來越受歡迎。

- 此外,汽車製造商也致力於透過其他安全功能(如預束式安全帶、安全帶力限制器、可調式頂部錨固件和安全帶高度調節器)來提高乘客的整體舒適度和便利性。這些整合系統提供了全面的安全套件,並有助於提供更好的駕駛體驗。從地區來看,乘用車預束式安全帶市場在各個地區均實現了顯著成長。例如

預測期內亞太地區將出現最快成長

- 由於該地區汽車銷量不斷成長,預計亞太地區將在銷售和價值方面佔據最大佔有率。中國、韓國、日本、印度等國家是汽車預束式安全帶的主要生產國。預計在預測期內,豪華車的興起和嚴格的道路安全規範將推動亞太地區汽車預束式安全帶市場的發展。

- 道路交通事故死亡人數的不斷增加迫使該地區各國政府採取預防措施,強制要求駕駛人和乘客繫上安全帶。

- 2018年,韓國推出了《通用安全帶法》,要求所有乘客在旅途中必須繫上安全帶。違反該法將被處以 3 萬韓元罰款,13 歲以下者將被處以兩倍罰款。由於上述因素,預計亞太地區的汽車預束式安全帶市場將出現成長。

汽車預束式安全帶產業概況

據稱,該市場相對集中,約有五家公司佔據了 50% 以上的市場佔有率。這些公司正在透過新產品擴大業務,以獲得競爭優勢。

為了滿足對預束式安全帶日益成長的需求,一些製造商已經與行業主要參與者合作,為即將推出的車型購買零件。例如,2021年12月,BMW在其慕尼黑總部舉行的BMW世界活動上發表了新款I4。新款 I4 配備了 Gedia Gebrueder Dingerkus 的座椅預張力系統。

除此之外,為了響應全球幾乎所有國家日益嚴格的安全標準,一些汽車製造商都推出了預束式安全帶。

例如,雷諾印度公司於 2021 年 6 月測試了一款具有最基本安全規格的簡易車型。例如,Triber 車型為後座乘客的胸部和頭部保護提供了顯著改善。該車輛透過中央安全帶的正確定位提供最佳的頭部和身體保護。

市場的主要參與者包括 Joyson Safety Systems、Autoliv Inc.、Tokai Rika 和 Iron Force Industrial。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 預計乘用車市場將佔據大部分市場佔有率

- 其他

- 市場限制

- 供應鏈中斷

- 其他

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場區隔

- 依技術

- 卷收器/預緊器

- 帶扣式預緊器

- 依座位類型

- 後部

- 正面

- 按車輛類型

- 搭乘用車

- 商用車

- 按最終用戶

- OEM

- 售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 北美洲

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- ZF Friedrichshafen AG

- Autoliv Inc.

- Ashimori Industry Co. Ltd

- Joyson Safety Systems

- ITW Automotive Products GmbH

- Continental AG

- Hyundai Mobis Co. Ltd

- Special Devices Inc.

- Iron Force Industrial Co. Ltd

- Tokai Rika Co. Ltd

- Hasco Co. Ltd

第7章 市場機會與未來趨勢

The Automotive Seat Belt Pretensioner Market size is estimated at USD 18.09 billion in 2025, and is expected to reach USD 25.11 billion by 2030, at a CAGR of 6.78% during the forecast period (2025-2030).

Key Highlights

- The automotive seat belt pre-tensioner market has experienced significant growth over the years due to the increasing importance of occupant safety and stringent government regulations on vehicle safety standards. A pre-tensioner is a device that rolls up the seat belt and tightens around the occupant in the event of a collision, minimizing the risk of injury. These devices have become an important part of modern vehicles and contribute to the overall safety of occupants.

- However, the COVID-19 pandemic had a major impact on the automotive industry, including the seat belt pre-tensioner market. The global pandemic led to temporary closures of manufacturing plants and reduced car production and sales as economic uncertainty and travel restrictions reduced consumer demand. This led to a significant drop in demand for automotive seatbelt pre-tensioners in the early stages of the pandemic.

- In addition, supply chain disruptions due to lockdown measures and travel restrictions have affected the production and sales of auto parts, including seat belt pre-tensioners. Border closures and international trade restrictions have further impacted the availability of raw materials and components, exacerbating the challenges for manufacturers.

- However, as countries began to ease regulations and the automotive industry resumed operations, the seat belt pre-tensioner market began to show signs of recovery. The resumption of manufacturing activity, stagnant demand, and a gradual recovery in consumer confidence supported the market recovery. In addition, increased focus on occupant safety in post-pandemic scenarios and increased adoption of advanced safety features in vehicles have further increased the demand for seat belt pretensioners. Automakers are integrating advanced technologies such as pyrotechnic seatbelt pre-tensioners and electric seatbelt pre-tensioners to improve occupant protection and meet stringent safety regulations.

- In addition, ongoing research and development activities aimed at improving the performance and efficiency of seat belt pre-tensioners are expected to drive market growth. Manufacturers are focused on developing lightweight, cost-effective belt tensioner systems that provide greater safety and passenger comfort.

Automotive Seat Belt Pretensioner Market Trends

Passenger Car Segment Expected to Hold Majority Share in the Market

- Over the years, pre-tensioners played a key role in improving the safety of passenger car occupants. Integrated into the seatbelt system, these devices are designed to instantly retract and tighten the seatbelt in the event of a crash or sudden deceleration, reducing the forward movement of the occupant and minimizing impact. Increased risk of injury.

- The growing awareness of passenger safety and the increase in traffic accidents worldwide are increasing the demand for advanced safety functions in vehicles. Governments and regulators have also introduced stringent safety standards, mandating the installation of seat belt pre-tensioners in passenger vehicles. To comply with safety regulations and meet consumer demand for safer vehicles, automakers are aggressively incorporating seatbelt pretensioners as standard or optional equipment into their vehicle models.

- Additionally, advances in technology have led to the development of more sophisticated seat belt tensioner systems. For instance, pyrotechnic pretensioners, which use small gunpowder to activate the pre-tensioner mechanism, are growing in popularity due to their effectiveness and reliability.

- In addition, automakers are focusing on improving overall occupant comfort and convenience with other safety features such as seatbelt pre-tensioners and seatbelt force limiters, adjustable top anchors, and seatbelt height adjusters. Leading to the integration of These integrated systems offering a comprehensive safety package and contributing to a better driving experience. Regionally, the passenger car seat belt pre-tensioner market recorded significant growth in various regions. For instance,

Asia-Pacific to Witness Fastest Growth over the Forecast Period

- Asia-Pacific is expected to occupy the largest share by volume and value due to the growing vehicle sales in the region. Countries such as China, South Korea, Japan, and India are the major manufacturers of automotive seatbelt pretensioners. The increasing number of premium vehicles and strict road safety norms are expected to drive the Asia-Pacific automotive seatbelt pretensioner market during the forecast period.

- Increasing fatalities due to road accidents have forced governments across the region to take preventive measures and make seatbelts mandatory for both drivers and passengers.

- In 2018, South Korea introduced Universal Seatbelt Law, according to which every passenger traveling will have to wear a seatbelt. Violation of the law will attract a penalty of KRW 30,000, and those younger than 13 will be fined twice as high. Owing to the above-mentioned factors, the automotive seatbelt pretensioner market is expected to experience a boost in the Asia-Pacific region.

Automotive Seat Belt Pretensioner Industry Overview

The market is said to be relatively consolidated, with about five players accounting for more than 50% of the market share. These companies have been expanding their businesses with new products to have an edge over their competitors.

Owing to increased demand for seatbelt pretensioners, several manufacturers are partnering with major players in the industry to source components for their upcoming vehicle models. For instance, in December 2021, BMW launched its new I4 at the BMW World event at corporate HQ in Munich. The new I4 equips a seat pretensioner system from Gedia Gebrueder Dingerkus.

Apart from these, several automobile manufacturers have been introducing seatbelt pretensioners in the wake of increased safety standards in virtually every country of the world.

For instance, Renault India, in June 2021, tested its most basic safety specifications in models that were offered with bare minimum features. The Triber model, for instance, showed significant improvements with improved chest and head protection for rear-seat passengers. The vehicle offers optimum head and body protection with the help of the proper positioning of center seat belts.

Some of the key players in the market are Joyson Safety Systems, Autoliv Inc., Tokai Rika Co. Ltd, and Iron Force Industrial Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Passenger Car Segment Expected to Hold Majority Share in the Market

- 4.1.2 Others

- 4.2 Market Restraints

- 4.2.1 Disturbances in Supply Chain

- 4.2.2 Others

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Technology

- 5.1.1 Retractor Pretensioner

- 5.1.2 Buckle Pretensioner

- 5.2 By Seat Type

- 5.2.1 Rear

- 5.2.2 Front

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By End-user Type

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 ZF Friedrichshafen AG

- 6.2.2 Autoliv Inc.

- 6.2.3 Ashimori Industry Co. Ltd

- 6.2.4 Joyson Safety Systems

- 6.2.5 ITW Automotive Products GmbH

- 6.2.6 Continental AG

- 6.2.7 Hyundai Mobis Co. Ltd

- 6.2.8 Special Devices Inc.

- 6.2.9 Iron Force Industrial Co. Ltd

- 6.2.10 Tokai Rika Co. Ltd

- 6.2.11 Hasco Co. Ltd