|

市場調查報告書

商品編碼

1686209

綠色 IT 服務:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Green IT Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

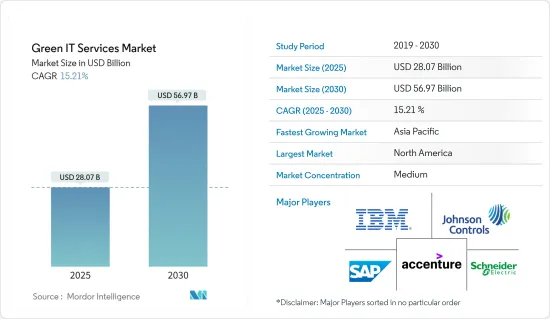

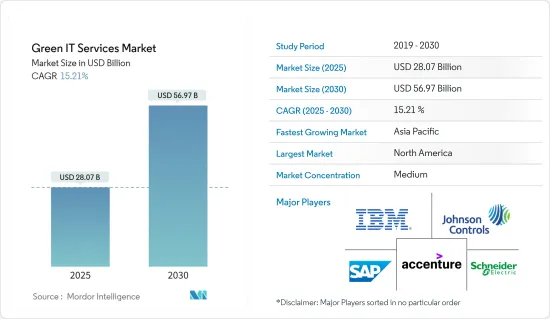

2025年綠色IT服務市場規模預估為280.7億美元,預估至2030年將達569.7億美元,預測期間(2025-2030年)複合年成長率為15.21%。

永續能源的使用正得到越來越廣泛的應用,因為巨大的成本節約和資源最佳化已被證明是該行業的有利因素。

主要亮點

- 人們對減少碳排放的興趣日益濃厚以及對環保服務的需求不斷成長,推動了綠色 IT 服務的成長。世界各地的公司都在尋求提高業務效率。消除浪費、有效利用資源和減少碳排放需要採用創新和永續的解決方案。

- 新冠肺炎疫情的出現暴露了供應鏈的脆弱性。對大多數 IT 組織而言,脆弱的生態系統還包括關鍵的 IT 服務提供者。此外,在家工作的規定也給服務提供者帶來了壓力,他們需要確保其關鍵任務企業客戶能夠獲得提供速度、安全性、品質和整體服務效率所必需的工具和技術。

- 因此,世界各國政府都推出了嚴格的工業法律法規,以抑制排放,減少環境破壞。這正在推動綠色IT服務的採用。公司也撥出資金來減少碳排放、遵守標準並提高品牌知名度。

- 印尼政府正在尋求加速國家資料中心的發展。 2022年6月,韓國政府簽署協議,在廖內群島的巴淡島開發價值1億美元的國家資料中心。

- 虛擬桌面虛擬化、雲端服務、綠色資料中心和 SaaS(軟體即服務)都是具有永續性特色的綠色 IT 解決方案。因此,產業和組織正在投資這些技術和服務,從而促進所研究市場的成長。

- 雲端處理預計將成為該市場的主要驅動力之一。據思科稱,到2021年,雲端資料中心預計將處理94%的工作負載。這有望促進雲端上提供的服務的發展並擴大市場。

綠色IT服務市場趨勢

IT 與電訊應用推動綠色 IT 服務市場

- 隨著新興企業和創投公司數量的快速成長,綠色IT服務的使用預計將在IT和通訊業中擴大。資訊科技和通訊業是近年來採用綠色IT服務的領先產業之一。

- 社群媒體平台的用戶數量龐大,導致網路流量大幅增加。儲存和雲端空間需要用功能強大、大容量的伺服器進行更新,以取代舊的、過時的伺服器。綠色IT服務將發揮其作用,像過去一樣處理電腦產品並以環保的方式使用它們。

- 過去幾十年來,由於開發中地區電信滲透率的不斷提高,電訊業實現了強勁成長。它們支援電話系統、佈線、安裝、維修、故障追蹤和調查服務。我們也確保佈線工程的品質持久並可取代舊工程。

- 2022年8月,GenCell Energy和Simtel宣佈在沃達豐營運的羅馬尼亞行動通訊站點部署GenCell FOX基於氨的離網電源解決方案的現場測試。該解決方案的開發符合嚴格的零排放永續性目標,確保即使在極端天氣條件下也能全天候供電,並透過使用經濟且廣泛使用的液氨燃料來最大限度地降低營運費用。

北美市場佔有率增加

- 快速成長的北美市場擁有各種各樣的綠色IT服務供應商,其中包括知名的軟體和服務公司。政府也推出了規範,推動綠色IT服務實踐。

- 江森自控於 1983 年推動建立了能源績效合約制度,光在北美就實施了 3,000 多份績效合約。江森自控透過管理設施審核來尋找提高建築圍護結構、照明、暖通空調、電源管理、水和其他系統效率的機會。

- 許多資料中心正在透過利用替代能源走向「綠色」。例如,微軟的資料中心使用風能、太陽能和水力發電。該公司的目標是,到 2020 年,將這一比例提高到 60%,並力爭此後持續保持這一高比例。

- 不同類型的夥伴關係正在塑造市場格局。例如,2021 年 6 月,微軟、Accenture和高盛宣布與 Linux 基金會和氣候變遷組織等非營利組織建立夥伴關係。此次夥伴關係的重點是擴大和共用軟體開發方法,以減少在資料中心運作時產生碳排放。

- 2022 年 6 月,IBM 宣布與 SL Green Realty Corp夥伴關係,利用 IBM 永續發展軟體幫助推動公司的環境、社會和管治(ESG) 策略。 SL Green 將使用 IBM 公司 Envizi 的軟體來更好地了解和報告公司的環境舉措。

- 在北美,環境法規、能源成本上升和資料中心擴張是推動節能和永續基礎設施發展的挑戰之一,創建綠色基礎設施為整體基礎設施提供了不同的方法。綠色 IT 服務可以幫助您降低系統成本、緩解營運問題並為快速出現的法規環境做好準備。

綠色IT服務業概況

綠色 IT 服務市場較為分散,主要參與者包括 IBM 公司、江森自控、Accenture公司、SAP SE 和Schneider ElectricSE。綠色技術和永續性供應商正在實施各種有機和無機成長策略,例如新產品發布、產品升級、合作夥伴關係/協議、業務擴展和併購,以加強其市場供應。市場競爭激烈,尚無一家企業主導。因此,市場集中度可能會處於中等水平。

- 2022 年 5 月-Schneider Electric在 2022 年漢諾威工業博覽會上推出了多項創新,旨在加速其客戶和合作夥伴實現二氧化碳淨零排放的進程。Schneider Electric技術和 AVEVA 洞察助力企業進入更有效率、更具彈性、更永續性的下一代工業企業。

- 2022年4月-江森自控宣布,歐洲能源公司Vattenfall委託安裝新型熱泵,以幫助該公司實現2050年實現供熱和發電資產零碳排放的目標。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 產業影響評估

- 市場動態

- 市場促進因素

- 增強環保意識並專注於減少碳足跡

- 加強政府監管

- 市場限制

- 管理不斷變化的能源和資源需求

第5章 市場區隔

- 按類型

- 軟體

- 服務

- 按行業

- 政府

- BFSI

- 資訊科技/通訊

- 產業

- 衛生保健

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- IBM Corporation

- Accenture PLC

- Johnson Controls

- SAP SE

- Schneider Electric SE

- Enablon Sa

- Accuvio Sustainability Software

- Dakota Software Corp

- Enviance Inc.

第7章投資分析

第 8 章:市場的未來

The Green IT Services Market size is estimated at USD 28.07 billion in 2025, and is expected to reach USD 56.97 billion by 2030, at a CAGR of 15.21% during the forecast period (2025-2030).

The use of sustainable sources has been a widely adopted trend as the enormous cost savings and optimization of the resources have proved to be a favoring factor for the industry.

Key Highlights

- The growingThe growing focus on reducing carbon footprints and the rising need for eco-friendly services propel the growth of green IT services. Companies around the world have started improving efficiencies of operations. The need to reduce waste, efficiently utilize resources and reduce carbon footprints warrants deploying innovative and sustainable solutions.

- With the emergence of COVID-19, the vulnerability of supply chains has been exposed. A fragile ecosystem for most IT organizations includes critical IT service providers. Moreover, work-from-home mandates have led the service providers to ensure that mission-critical enterprise customers have the essential tools and technologies to enable service speed, security, quality, and overall efficacy.

- Many governments worldwide have, thus, initiated strict laws and regulations for industries to control emissions and reduce environmental damage. This is driving the adoption of green IT services. The companies are also allocating funds to reduce carbon footprints adhere to the standards, and improve brand perception.

- The Government of Indonesia is trying to accelerate the development of National Data Centers. In June 2022, the government of South Korea signed an agreement to develop a 100 million USD National Data Centre in Batam, the Riau Islands.

- Desktop virtualization, cloud services, green data centers, and SaaS (software as a service) become green IT solutions by offering sustainability as a feature. Industries and organizations are, thus, investing in these technologies and services, aiding the growth of the market studied.

- Cloud computing is expected to be one of the major drivers of this market. According to Cisco, Cloud data centers are expected to process 94% of the workloads in 2021. This is predicted to fuel the development of services offered on the cloud, thereby expanding this market.

Green IT Services Market Trends

Application in IT and Telecom to Drive the Green IT Service Market

- The use of green IT services is anticipated to grow in the IT and telecom industry as the number of start-ups and companies is increasing rapidly. Information technology and the telecom industry are among the foremost sectors utilizing green IT services in the recent past.

- Since there is a considerable presence of users on social media platforms, internet traffic has significantly increased. Storage and cloud space must be updated by installing powerful high-capacity servers to replace old, outdated ones. Green IT services come into the role by utilizing the same old disposing of computers products and using them in an environmentally friendly manner.

- The telecom industry has witnessed robust growth over the last few decades, aided by the growing adoption in developing regions. They support telephone systems, cabling, installation and repair, fault tracing, and survey services. Also, they ensure that the wiring installation's quality will be long-lasting and replace the old ones.

- In August 2022, GenCell Energy and Simtel announced the deployment of GenCell FOX ammonia-based off-grid power solution field test at a mobile telecom tower site in Romania, operated by Vodafone. The solution has been developed to comply with strict zero-emission sustainability objectives, ensure resilient 24/7 constant power even in extreme weather conditions, and minimize operating expenses by using economical and widely available liquid ammonia fuel.

North America to Have the Higher Market Share

- The rapidly growing market in the North American region has a diverse group of providers for green IT services, led by prominent software and service players. The government has also issued norms that promote the practice of green IT services.

- Johnson Controls helped establish energy performance contracting in 1983 and has enforced more than 3,000 performance contracts in North America alone. It controls facility audits to identify opportunities to improve the building envelope efficiency, lighting, HVAC, power management, water, and other systems.

- Many data centers are "going green" by leveraging alternative energy sources. For instance, Microsoft's data centers utilize wind, solar, or hydroelectricity. They have set goals of growing this to 60% by this decade and to an ongoing and higher percentage in years beyond that.

- Various kinds of partnerships are shaping the market landscape. For instance, in June 2021, Microsoft, Accenture, and Goldman Sachs announced a partnership with nonprofits, like the Linux Foundation and climate groups. The partnership focuses on expanding and sharing ways to build software that produces fewer carbon emissions when run in data centers.

- In June 2022, IBM announced its partnership with SL Green Realty Corp to leverage IBM sustainability software to help advance the company's environmental, social, and governance (ESG) strategy. SL Green will use software from Envizi, an IBM Company, to better understand and report on its environmental initiatives.

- In North America, the environmental regulations, rising energy costs, and expanding data centers are some of the challenges that drive the energy efficient and sustainable infrastructure to build green infrastructure, which gives different approaches to the entire infrastructure. Green IT services help the systems to reduce costs, alleviate operational issues, and prepare for the rapidly emerging regulatory environment.

Green IT Services Industry Overview

The Green IT services market is moderately fragmented as some of the leading players operating in the market are IBM Corporation, Johnson Controls, Accenture PLC, SAP SE, and Schneider Electric SE. To strengthen their market offerings, green technology and sustainability vendors have implemented a variety of organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions. The market is highly competitive, without any dominating players. Hence, the market concentration will be medium.

- May 2022 - Schneider Electric announced several innovations at Hannover Messe 2022, aiming toward accelerating the path to net zero CO2 emissions for customers and partners. The company's technology and AVEVA insights allow firms to reach the next industrial generation with enhanced efficiency, resiliency, and sustainability.

- April 2022 - Johnson Controls announced that it had commissioned a new heat pump installation that will support Vattenfall, a European energy company, in attaining its goal to eliminate carbon emissions from its heating and power generation facilities by 2050.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 impact on the industry

- 4.5 MARKET DYNAMICS

- 4.6 Market Drivers

- 4.6.1 Increasing Environmental Concerns and Growing Focus on Reducing Carbon Footprints

- 4.6.2 Strengthening Government Regulations

- 4.7 Market Restraints

- 4.7.1 Managing Variable Energy and Resource Demands

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By End-user Vertical

- 5.2.1 Government

- 5.2.2 BFSI

- 5.2.3 IT and Telecom

- 5.2.4 Industrial

- 5.2.5 Healthcare

- 5.2.6 Other End-user Verticals

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Accenture PLC

- 6.1.3 Johnson Controls

- 6.1.4 SAP SE

- 6.1.5 Schneider Electric SE

- 6.1.6 Enablon Sa

- 6.1.7 Accuvio Sustainability Software

- 6.1.8 Dakota Software Corp

- 6.1.9 Enviance Inc.