|

市場調查報告書

商品編碼

1686173

水自動化和儀器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Water Automation and Instrumentation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

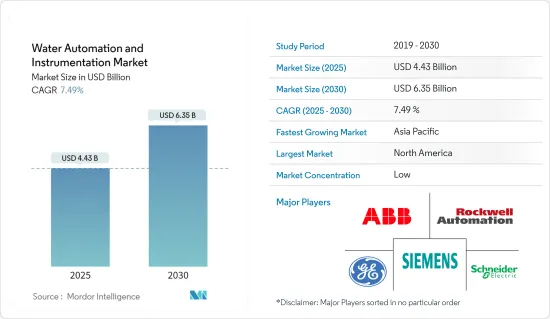

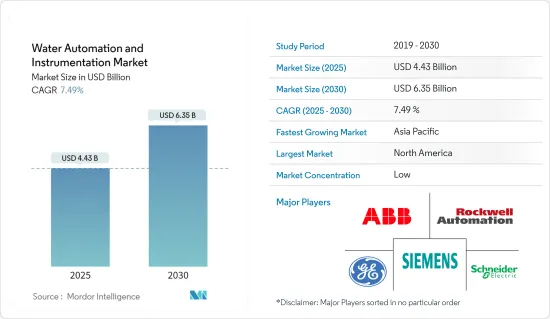

預計 2025 年水自動化和儀器市場規模將達到 44.3 億美元,到 2030 年將達到 63.5 億美元,預測期內(2025-2030 年)的複合年成長率為 7.49%。

2020 年初,COVID-19 疫情嚴重阻礙了水自動化設備的生產。這是因為多個國家為遏制 COVID-19 病毒傳播而實施的封鎖措施,嚴重擾亂了用水和污水景觀儀器所用零件的全球供應鏈。

主要亮點

- 隨著飲用水資源的減少和政府實施監管,控制營運成本已成為水產業相關人員面臨的最大挑戰之一。人事費用和能源成本佔營業單位營運成本的最大部分。

- 消費者對預防水傳播疾病的健康關注度日益提高,導致瓶裝水消費量增加。此外,這一趨勢導致對基礎設施開發的投資增加,以支持水自動化市場。

- 隨著當地供水站數量的增加和水質的多樣性,分散式控制系統的使用越來越多。 PLC 等自動化解決方案有助於控制馬達接觸器、攪拌馬達、泵站中的分散閥門以及測量水壓變送器。

- 儀器解決方案,包括液體分析儀和液位傳送器,有助於維持化學和製藥業的精確度。由於某些感測器的價格較高,此類設備的成本可能很高。然而,用戶營運成本的降低預計會降低整體擁有成本。

- 創新包括改進海水淡化技術以利用以前無法獲得的供應,並透過新的水回收技術提高工業效率。特別是,將基於物聯網 (IoT) 的控制和監控系統與用於水資源管理的 SCADA 軟體相結合的新型水技術自動化解決方案可以幫助開始解決特定問題。

水自動化和儀器市場趨勢

食品飲料產業需求呈現明顯成長率

- 食品和飲料生產需要大量的水,水是食品和飲料加工行業的關鍵原料之一,因此水質對產品品質和運作可靠性至關重要。在食品和飲料行業實施供水和廢水自動化可以透過消除錯誤和浪費、提高效率和生產力以及擴大利潤率來為公司節省大量收益。

- 此外,食品和飲料行業的不同公司實施不同的自動化和儀器方法。例如,秘魯的一家食品加工廠面臨的天然地下水過於混濁且受到砷污染,無法用於食品加工。 AMI 的客製化解決方案結合了超過濾濾膜和凝聚劑預處理、深度過濾和過濾氯化,以生產符合客戶食品加工高品質標準的水。該系統是 AMI PLC 自動化系統,具有中央控制櫃和觸控螢幕 HMI 操作員介面。

- 此外,液體分析儀、壓力測量系統和流量測量系統等儀器技術正在食品和飲料行業中實施,以便在從生產線排放產品時使用上述儀器技術來減少過程中產生的污水量。

- 此外,可以使用模組化、節省空間的分析面板有效監測原水、製程水和污水。這簡化了食品和飲料行業的日常流程整合和操作。

美國佔有較大的市場佔有率

- 工廠經理通常沒有時間研究規格和供應商來尋找滿足其特定應用需求的解決方案。為了滿足這些需求,供應商提供完整的水應用產品系列以及設備顧問的專業知識。

- 最初,該地區的供應商為該行業領域提供了一系列位准計和壓力計,但最近,水分析設備已擴大工具範圍,涵蓋了水生產和淨化中的所有技術。

- 美國人已經習慣打開水龍頭,看到乾淨的水流出來,廢棄物順著管道消失。然而,並沒有多少人了解提供這些服務所需的複雜且昂貴的系統。例如,美國有26英里長的自來水管道,每英里州際公路就有120萬英里的自來水管道。這只是一個飲用水系統。污水管的數量也大致相同。

- 因此,為了建立如此龐大的排水系統並維護有序的水道,許多公司正在進行策略性收購以獲得技術專長。例如,2021 年 5 月,TASI 集團公司收購了喬治亞諾克羅斯的 Mission Communication,以補充 TASI Flow 現有的資產管理和無線連接策略,使其在用水和污水市場中佔據更強的地位。

水自動化和儀器行業概況

主要參與者包括 ABB 集團、西門子股份公司、施耐德電氣 SE、通用電氣公司、羅克韋爾自動化公司、工業公司、艾默生電氣、橫河電機株式會社、Endress+Hauser Pvt。 Ltd、Eurotek India、Phoenix Contact、NALCO、MJK Automation、Blue Water Automation 等。市場分散,主要參與者之間的競爭非常激烈。因此,預計市場集中度較低。

- 2020 年 11 月 - 新加坡國家水務局 (PUB) 授予 ABB 一套完整的全廠監控和控制系統,用於其大士水回收廠,價值 3000 萬美元。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 政府制定節約水資源和能源的規定

- 智慧水技術的應用日益廣泛

- 市場限制

- 缺乏操作儀器設備的熟練人員

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場區隔

- 水自動化解決方案

- DCS

- SCADA

- PLC

- IAM

- HMI

- 其他水自動化解決方案

- 儀器解決方案

- 壓力變送器

- 液位傳送器

- 溫度變送器

- 液體分析儀

- 氣體分析儀

- 洩漏檢測系統

- 流量感測器/變送器

- 其他水測量解決方案

- 最終用戶產業

- 化學

- 製造業

- 食品飲料業

- 公共產業

- 紙和紙漿

- 其他最終用戶產業

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 澳洲

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 公司簡介

- ABB Group

- Siemens AG

- Schneider Electric SE

- GE Corporation

- Rockwell Automation Inc.

- Mitsubishi Motors Corporation

- Emerson Electric

- Yokogawa Electric Corporation

- Endress+Hauser Pvt. Ltd

- Eurotek India

- Phoenix Contact

- NALCO

- MJK Automation

- KROHNE LTD

第7章投資分析

第 8 章:市場的未來

The Water Automation and Instrumentation Market size is estimated at USD 4.43 billion in 2025, and is expected to reach USD 6.35 billion by 2030, at a CAGR of 7.49% during the forecast period (2025-2030).

The COVID-19 pandemic considerably hampered the production of water automation instrumentation at the beginning of 2020. This is because the lockdown imposed in several countries to curb the spread of the COVID-19 virus caused considerable disruptions in the global supply chain of the parts and components used in the water and wastewater landscape instruments.

Key Highlights

- Managing operational costs emerged as one of the biggest challenges posed by stakeholders of the water industry, as the governments are imposing regulations, along with depletion of potable water resources. Expenses relating to labor and energy constitute the largest share in OPEX for water utilities.

- The increasing health concerns for preventing water-borne diseases among consumers augmented the consumption of bottled drinking water. Furthermore, this trend led to an increase in infrastructure development investments that support the water automation market.

- There has been an increase in the use of decentralized control systems, with the rise in the number of outstations and varied qualities of water in a region. Automation solutions, such as PLC, help in controlling pump station motor contactors, stirrer motors, and distributed valves, as well as to measure the pressure transmitter of the water.

- Water instrumentation solutions, such as liquid analyzers and level transmitters, are helping chemical and pharmaceutical industries maintain precision. The high prices of specific sensors might increase the cost of such instruments. However, reduced operational costs due to the users are expected to decline the total cost of ownership.

- Technological innovations include taking advantage of previously unusable supplies through improved water desalination and increased industrial efficiency through new water reclaiming technologies. A new breed of water tech automation solutions, especially the Internet of Things (IoT)-based control and monitoring systems combined with SCADA software for water management, are solutions that can be explored to help begin to solve certain issues.

Water Automation And Instrumentation Market Trends

Demand from Food and Beverage Industry to Witness a Significant Growth Rate

- The production of food and beverages requires a large amount of water, and water quality is crucial to product quality and operational reliability as water is one of the important raw materials in the food and beverage processing industry. The implementation of water and wastewater automation in the food and beverage industry can save significant revenues for the company along with eliminating errors and waste, enhancing efficiency and productivity, and expanding profit margins.

- Further, various companies in the Food and beverage industry are deploying various automation and instrumentation methods. For instance, a food processing plant in Peru was faced with natural groundwater contaminated with high turbidity and arsenic, making it unsuitable for use in food processing. AMI's custom-engineered solution incorporates ultrafiltration membranes with pretreatment by coagulant and depth filtration, as well as chlorination of the filtrate to produce water meeting the customer's high-quality standards for use in food product processing. The system is AMI PLC automated using a central control enclosure and touchscreen HMI operator interface.

- Moreover, instrumentation technology such as liquid analyzer, pressure measurement system, flow measurement system is being deployed in the food and beverage industry to reduce the volume of wastewater during the process by using the above-mentioned instrumentation technology when discharging products from the lines.

- Further, Raw water, process water or wastewater can be efficiently monitored with modular, space-saving analysis panels. This simplifies daily process integration and operation in the food and beverage industries.

United States to Account for Significant Market Share

- Plant managers generally do not have the time to study specifications and suppliers to find the solution to specific application requirements. To counter this requirement, vendors offer a complete product portfolio for water industry applications and instrument consultants' expertise.

- Originally vendors in the region offered a portfolio of level and pressure instruments for this industry segment, but recently, water analytical instruments have widened the range of tools to encompass all the technologies of water production and purification.

- Americans have become accustomed to receiving clean water when they turn on their taps and having waste disappear down their pipes. Yet, not many understand the complicated and expensive systems required to deliver those services. For instance, the United States has 26 miles of water mains, 1.2 million miles of water supply mains for every mile of interstate highway. That is just the drinking water system. There is nearly an equal number of sewer pipes.

- Thus, to maintain such a vast establishment and organized channel of the wastewater system, many companies are making strategic acquisitions to gain technical expertise. For instance, in May 2021, The TASI Group of Companies acquired Mission Communication, Norcross GA, to complement TASI Flow's existing Asset Management and Wireless Connectivity Strategy, bringing a strong presence in the Water and Wastewater market.

Water Automation And Instrumentation Industry Overview

The major players, include ABB Group, Siemens AG, Schneider Electric SE, GE Corporation, Rockwell Automation Inc., Mitsubishi Motors Corporation, Emerson Electric, Yokogawa Electric Corporation, Endress+ Hauser Pvt. Ltd, EurotekIndia, Phoenix Contact, NALCO, MJK Automation, and Blue Water Automation. As the market is fragmented, there is a major competition between the major players. Therefore, the market concentration is expected to be low.

- November 2020 - PUB, Singapore's National Water Agency, issued ABB a contract for a complete site-wide plant monitoring and control system for the Tuas Water Reclamation Plant valued at USD 30 million.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Regulation to Save Water Resources and Energy

- 4.2.2 Increase in Adoption of Smart Water Technologies

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Personnel to Operate Instrumentation

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the COVID-19 Impact on the Market

5 MARKET SEGMENTATION

- 5.1 Water Automation Solution

- 5.1.1 DCS

- 5.1.2 SCADA

- 5.1.3 PLC

- 5.1.4 IAM

- 5.1.5 HMI

- 5.1.6 Other Water Automation Solutions

- 5.2 Water Instrumentation Solution

- 5.2.1 Pressure Transmitter

- 5.2.2 Level Transmitter

- 5.2.3 Temperature Transmitter

- 5.2.4 Liquid Analyzers

- 5.2.5 Gas Analyzers

- 5.2.6 Leakage Detection Systems

- 5.2.7 Flow Sensors/Transmitters

- 5.2.8 Other Water Instrumentation Solutions

- 5.3 End-user Industry

- 5.3.1 Chemical

- 5.3.2 Manufacturing

- 5.3.3 Food and Beverages

- 5.3.4 Utilities

- 5.3.5 Paper and Pulp

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 Australia

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 India

- 5.4.3.5 Rest of Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Group

- 6.1.2 Siemens AG

- 6.1.3 Schneider Electric SE

- 6.1.4 GE Corporation

- 6.1.5 Rockwell Automation Inc.

- 6.1.6 Mitsubishi Motors Corporation

- 6.1.7 Emerson Electric

- 6.1.8 Yokogawa Electric Corporation

- 6.1.9 Endress + Hauser Pvt. Ltd

- 6.1.10 Eurotek India

- 6.1.11 Phoenix Contact

- 6.1.12 NALCO

- 6.1.13 MJK Automation

- 6.1.14 KROHNE LTD