|

市場調查報告書

商品編碼

1685950

燃料添加劑-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Fuel Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

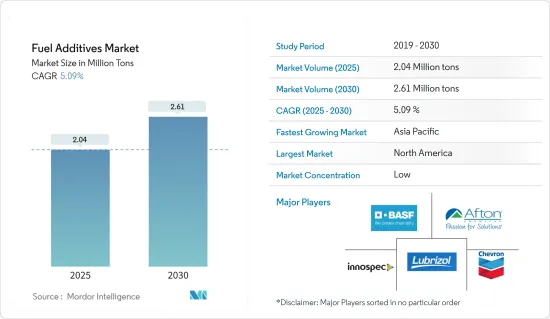

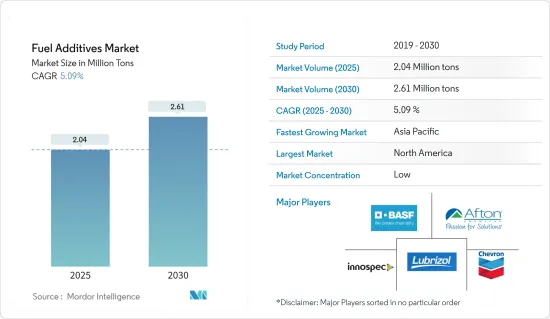

預計 2025 年燃料添加劑市場規模為 204 萬噸,2030 年將達到 261 萬噸,預測期間(2025-2030 年)的複合年成長率為 5.09%。

COVID-19疫情對市場產生了負面影響。這是因為製造設施和工廠因封鎖和限制而關閉。供應鏈和運輸中斷進一步擾亂了市場。不過,2021年產業復甦,市場需求回歸。

主要亮點

- 從中期來看,嚴格的環境法規的建立和原油品質的下降是推動市場成長的因素之一。

- 另一方面,美國、中國和德國等國家對電池電動車 (BEV) 的需求不斷增加,以及研發活動的高成本可能會在預測期內阻礙市場成長。

- 然而,對超低硫柴油(ULSD)的需求加速可能會為未來的市場成長提供機會。

燃料添加劑市場趨勢

汽油佔市場主導地位

- 汽油是石油提煉的主要產品。汽車和飛機使用的汽油大部分是由重油餾分透過熱解或催化裂解得到的裂解汽油。

- 增加辛烷值的汽油添加劑也被視為抗爆添加劑,因為它們可以提高燃料的抗爆能力。此類添加劑主要有醚類、醇類、酯類、有機金屬化合物等。

- 在小型汽車中,汽油引擎是主要的動力來源。汽油添加劑包括混合化合物、含氧酸鹽、抗氧化劑、抗爆劑、鉛清除劑、燃料染料等。

- 根據美國能源資訊署的數據,2023 年 8 月美國汽油總產量從上個月的 13 萬桶增加至 29 萬桶。

- 零售加油站出售的汽油主要有三種等級:普通汽油、中級汽油和高級汽油。 2022年,美國消耗了約1,345.5億加侖成品汽油,平均每天約3.69億加侖(約878萬桶)。

- 根據美國能源資訊署的數據,預計 2022 年全球石油和其他石油液體產量平均為 1.001 億桶/天,2023 年將增至 1.018 億桶/天。

- 2022年五大石油生產國分別為美國、沙烏地阿拉伯、俄羅斯、加拿大和中國。美國排名第一,日產量為 18,875,000 桶。沙烏地阿拉伯則位居第二,產量為1,083.5萬桶/天,持有全球已探明石油蘊藏量的17%。

- 因此,由於上述因素,預計預測期內與汽油相關的燃料添加劑應用將佔據最高的市場佔有率。

北美佔據市場主導地位

- 北美的燃料添加劑市場以美國為主。美國是成長最快的經濟體之一,目前是世界上最大的製造業基地之一。該國的製造業對該國的經濟貢獻巨大。

- 在美國,由於航空業的需求增加,噴射燃料/煤油燃料的消費量也正在增加。預計2022年消費量為每天156.2萬桶,較上年的137.6萬桶成長13.5%。

- 此外,2022 年燃料油消費量為 34.3 萬桶/日,較 2021 年的 31.4 萬桶/日成長 9.2%。

- 根據OICA統計,美國是僅次於中國的第二大汽車生產國,預計2022年汽車產量將達到1,006萬輛,較2021年成長10%。 2022年,美國生產了175萬輛轎車和830萬輛商用車。

- 2023年3月新車銷量為1,384,676輛,較上季成長19.2%,季增9.4%。

- 此外,根據加拿大汽車工業協會的數據,2023 年 1 月、2023 年 2 月和 2023 年 3 月的新車銷量分別為 103,380 輛、109,781 輛和 150,956 輛。 2023 年 4 月加拿大銷量預計為 144,069 輛,略低於 2023 年 3 月的總合,較 2022 年 4 月成長 2.3%。

- 此外,美國是世界上最大的航空市場之一。美國航空公司的載客量比其他國家都多,全球收入排名前 10 的航空公司中約有一半位於美國。此外,根據美國聯邦航空管理局 (FAA) 的數據,美國通用航空機隊將在 2022 年成長至 204,590 架飛機。此外,截至 2022 年,美國將擁有約 935 架民航機。預計這將增加航太產業多種應用的市場需求。

- 所有這些因素都會影響預測期內燃料添加劑的消耗。

燃料添加劑產業概況

燃料添加劑市場比較分散。主要公司包括(排名不分先後):雅富頓化學公司、路博潤公司、Innospec、雪佛龍公司和BASF公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 制定嚴格的環境法規

- 原油品質劣化

- 限制因素

- 純電動車(BEV)需求不斷成長

- 研發成本上升

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 產品類型

- 存款控制

- 十六烷改良劑

- 潤滑添加劑

- 抗氧化劑

- 防鏽劑

- 低溫操作改善劑

- 抗爆劑

- 其他產品類型

- 應用

- 柴油引擎

- 汽油

- 噴射機燃料

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 墨西哥

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 合併、收購、合資、合作和協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Afton Chemical

- Baker Hughes Company

- BASF SE

- Cargill Incorporated

- Chevron Corporation

- Clariant

- Dorf Ketal Chemicals

- Evonik Industries AG

- Exxon Mobil corporation

- Infineum International Limited

- Innospec

- Lanxess

- The Lubrizol Corporation

- TotalEnergies SE

第7章 市場機會與未來趨勢

- 超低硫柴油(ULSD)需求加速成長

The Fuel Additives Market size is estimated at 2.04 million tons in 2025, and is expected to reach 2.61 million tons by 2030, at a CAGR of 5.09% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market. This was because of the shutdown of manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the medium term, the enactment of stringent environmental regulations and the degrading quality of crude oil are some of the factors driving the growth of the market studied.

- On the flip side, increasing demand for battery electric vehicles (BEVs) in countries such as the United States, China, and Germany and high cost of R&D activities may hamper the market's growth during the forecast period.

- However, the accelerating demand for ultra-low-sulfur diesel (ULSD) is likely to act as an opportunity for market growth in the future.

Fuel Additives Market Trends

Gasoline to Dominate the Market Studied

- Gasoline is the primary product made from petroleum. The major portion of the gasoline used in automotive and aviation is cracked gasoline obtained through the thermal or catalytic cracking of the heavier oil fractions.

- Gasoline additives that increase octane number are also considered antiknock additives as they can increase the antiknock capability of the fuel. The additives in this category mainly include ethers, alcohols, esters, organometallic compounds, and others.

- For light-duty vehicles, gasoline engines play the role of major power source. Gasoline additives include hybrid compound blends, oxygenates, antioxidants, antiknock agents, lead scavengers, and fuel dyes, among others.

- According to the US Energy Information Administration, in August 2023, the total gasoline production in the United States increased to 290 thousand barrels from 130 thousand barrels reported in the previous month.

- Three main grades of gasoline are sold at retail gasoline refueling stations: Regular, Midgrade, and Premium. In 2022, about 134.55 billion gallons of finished motor gasoline were consumed in the United States, an average of about 369 million gallons per day (or about 8.78 million barrels per day).

- As per the US Energy Information Administration, in 2022, the global production of oil and other petroleum liquids averaged 100.1 million barrels per day (b/d) and is expected to rise to 101.8 million barrels per day in 2023.

- The top five oil-producing nations in 2022 were the United States, Saudi Arabia, Russia, Canada, and China. The United States topped the list with a production of 18,875,000 barrels per day (bpd). Saudi Arabia came in second with an output of 10,835,000 BPD and possesses 17% of the total proven petroleum reserves on a global scale.

- Thus, owing to the aforementioned factors, gasoline-related applications of fuel additives are likely to account for the highest market share during the forecast period.

North America to Dominate the Market

- The United States dominated the fuel additive market in the North American region. The United States is one of the fastest-emerging economies and has become one of the biggest production houses in the world today. The country's manufacturing sector is one of the major contributors to the country's economy.

- In the United States, jet/kerosene fuel witnessed a hike in consumption owing to the rising demand in the aviation industry. In 2022, the country consumed 1562 thousand barrels per day, which increased by 13.5% compared to 1376 thousand barrels per day in the previous year.

- Moreover, fuel oil experienced a hike in consumption by 9.2% to 343 thousand barrels per day in 2022 compared to 314 thousand barrels per day in 2021.

- According to OICA, the United States is the second-largest automotive manufacturer after China and produced 10.06 million vehicles in 2022, registering a growth of 10% compared to the production in 2021. The country produced 1.75 million cars and 8.3 million commercial vehicles in 2022.

- In March 2023, new vehicle sales totaled 1,384,676 units, a 19.2% increase from February 2023 and a 9.4% increase from March 2022.

- Further, according to the Automotive Industries Association of Canada, new motor vehicle sales for the months of January 2023, February 2023, and March 2023 are 103,380; 109,781, and 150,956 units, respectively. In April 2023, an estimated 144,069 units were sold in Canada, slightly less than the March 2023 total and a 2.3% increase over April 2022.

- Moreover, the United States has one of the biggest aviation markets in the entire world. More people are transported by US airplanes than by airlines from any other nation, and around half of the top 10 revenue-generating airlines in the world are based in the United States. Further, according to the Federal Aviation Administration (FAA), the general aviation fleet in the United States had expanded to 204,590 aircraft in 2022. Also, the US commercial aviation fleet had roughly 935 of these aircraft as of 2022. This is expected to increase the market demand from multiple applications in the aerospace industry.

- All these factors, in turn, have an impact on the consumption of fuel additives during the forecast period.

Fuel Additives Industry Overview

The fuel additives market is fragmented in nature. The major players (not in any particular order) include Afton Chemicals, The Lubrizol Corporation, Innospec, Chevron Corporation, and BASF SE, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Enactment of Stringent Environmental Regulations

- 4.1.2 Degrading Quality of Crude Oil

- 4.2 Restraints

- 4.2.1 Increasing Demand for Battery Electric Vehicles (BEVs)

- 4.2.2 High Costs of R&D Activities

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Volume)

- 5.1 Product Type

- 5.1.1 Deposit Control

- 5.1.2 Cetane Improvers

- 5.1.3 Lubricity Additives

- 5.1.4 Antioxidants

- 5.1.5 Anticorrosion

- 5.1.6 Cold Flow Improvers

- 5.1.7 Antiknock Agents

- 5.1.8 Other Product Types

- 5.2 Application

- 5.2.1 Diesel

- 5.2.2 Gasoline

- 5.2.3 Jet Fuel

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Argentina

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Afton Chemical

- 6.4.2 Baker Hughes Company

- 6.4.3 BASF SE

- 6.4.4 Cargill Incorporated

- 6.4.5 Chevron Corporation

- 6.4.6 Clariant

- 6.4.7 Dorf Ketal Chemicals

- 6.4.8 Evonik Industries AG

- 6.4.9 Exxon Mobil corporation

- 6.4.10 Infineum International Limited

- 6.4.11 Innospec

- 6.4.12 Lanxess

- 6.4.13 The Lubrizol Corporation

- 6.4.14 TotalEnergies SE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Accelerating Demand for Ultra-low-sulfur Diesel (ULSD)