|

市場調查報告書

商品編碼

1685946

土壤處理:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Soil Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

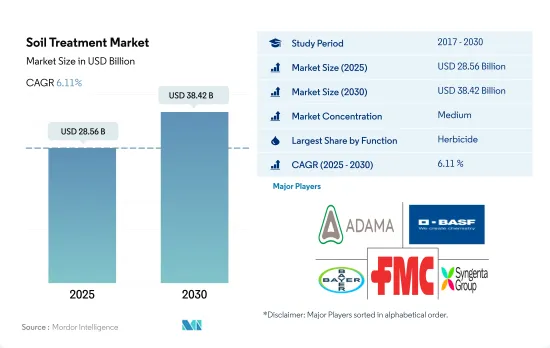

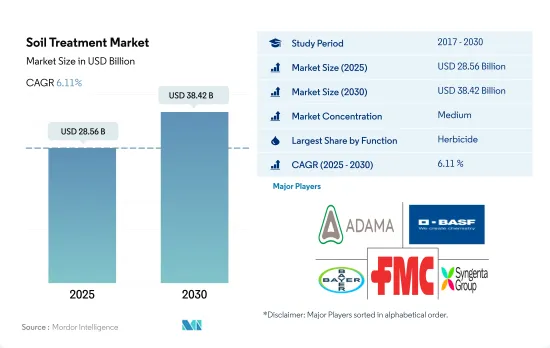

土壤處理市場規模預計在 2025 年為 285.6 億美元,預計到 2030 年將達到 384.2 億美元,預測期內(2025-2030 年)的複合年成長率為 6.11%。

除草劑憑藉其土壤處理功效佔據市場主導地位

- 2022年土壤處理方法使用情況方面,除草劑所佔比例最高,為72.8%。這些除草劑專門針對雜草種子,甚至在作物播種之前就抑制其發芽。該方法因其能夠主動管理雜草種群、確保作物更好地生長和整體雜草控制而廣受歡迎。

- 採用犁地和少犁地等現代農業技術正日益成為趨勢。使用土壤處理方法,可以精確地將除草劑施用於田地中雜草壓力較大的特定位置,從而最佳化除草劑的使用並降低成本。這些因素推動了採用土壤處理方法來施用除草劑。

- 2022 年,殺蟲劑佔全球土壤處理市場的 12.8%。土壤中的蛹和卵不會受到正常劑量殺蟲劑的影響,但幼蟲和成蟲階段可以透過土壤處理來控制。透過土壤處理可以有效控制甲蟲、黏蟲、斑蝥、船蟲和土壤螞蟻等害蟲。

- 土壤施用殺菌劑的使用主要集中在農作物和穀類,佔市場的最大價值佔有率,為45.4%。這種偏好是由於殺菌劑能夠有效保護穀物和穀類的質量,並有助於預防或減少真菌感染。

- 使用涕滅威、苯線磷和草線威等殺線蟲劑進行土壤處理,可以有效控制南方根結線蟲和短尾短體線蟲等微線蟲,這些線蟲會對各種作物造成嚴重損失。

- 由於上述因素,土壤處理市場預計將成長。

主要國家因病蟲害造成的產量損失不斷增加,促使人們採用土壤處理方法。

- 土壤害蟲會對全球農業和生態系統產生重大影響。這些害蟲包括土壤線蟲、真菌、細菌和昆蟲,它們會破壞作物、降低產量並破壞生態系統。有效的病蟲害管理對於確保糧食安全和維持穩定的糧食供應至關重要。

- 2022 年,南美土壤處理領域佔據全球市場的 34.2% 佔有率。 2017 年至 2022 年,該地區的市場價值將顯著成長,2022 年將達到 85.689 億美元。種植者通常採用土壤浸灌、撒播和溝施技術進行土壤處理。這些方法將加強對土傳疾病和害蟲的控制,從而提高作物產量。對保持土壤健康的日益重視促使農民採用這些土壤處理方法。

- 北美是第二大國家,佔全球市場佔有率的29.6%。土傳疾病被認為是作物生產的主要限制因素。土壤傳播的植物病原體,如立枯絲核菌、鐮刀菌、黃萎病、核盤菌、腐霉菌和疫黴菌,可導致許多作物(包括小麥、棉花、玉米、蔬菜、水果和觀賞植物)產量損失 50% 至 75%。

- 因此,預計全球土壤處理市場價值在 2023 年至 2029 年期間的複合年成長率將達到 5.0%,並且由於氣候變遷和病蟲害入侵導致的作物損失增加,預計所有作物類型都將呈現顯著成長。

全球土壤處理市場趨勢

從全球來看,由於土壤傳播的害蟲、疾病和雜草日益猖獗,預計每公頃土壤施用的作物保護產品的農藥消費量將會增加。

- 2022年全球透過土壤施用方式的作物保護化學品平均消費量為每公頃農業用地2,345.0克,較2017年的2,065.0克成長13.6%。

- 隨著人們越來越傾向於採用犁地和少犁地等現代農業技術,這導致土壤中害蟲增多,因此必須使用殺蟲劑來控制害蟲、雜草和土壤傳播的疾病。

- 除草劑,尤其是出苗前除草劑,通常施用於土壤中,專門針對雜草種子,甚至在作物播種之前就抑制其發芽。該方法因其能夠主動管理雜草種群、確保作物更好地生長和整體雜草控制而廣受歡迎。

- 蠐螬侵染導致大豆根系減少約 25%,玉米根系減少約 64%。研究發現,Phyllophaga capillata 和 Aegopsis bolboceridus 對所有評估變數都造成了損害,並導致巴西等南美國家的大豆產量降低了 58.62%,玉米產量降低了 59.76%。所有這些土壤傳播的害蟲都可以透過土壤施用殺蟲劑來有效控制。

- 同樣,南方根結線蟲(Meloidogyne incognita)和最短尾根線蟲(Pratylenchus brachyurus)等線蟲也會對果樹作物造成重大損失。例如胡蘿蔔容易出現較大的損失,平均損失為20.0%。由於這些寄生線蟲是土壤生物,因此用殺線蟲劑處理土壤以殺死這些生物非常重要。

控制土傳疾病的需要導致了土壤施用農藥的增加。

- 在農藥市場的動態格局中,土壤處理農藥脫穎而出,成為關鍵組成部分。這些專用化學物質在促進作物健康生長、有效控制病蟲害以及永續農業方面發揮著至關重要的作用。

- Cypermethrin是一種擬除蟲菊酯殺蟲劑,有時用作土壤處理殺蟲劑。當施用於土壤時,它可以有效控制多種土壤害蟲,包括白蟻和根蛆。Cypermethrin的作用方式是針對害蟲接觸時的神經系統,導致其癱瘓並最終死亡。 2022 年的價格為每噸 21,000 美元。

- Atrazine是一種常用於土壤處理的除草劑,用於控制農業和非農業領域的多種闊葉雜草和草類雜草。它對於控制與作物爭奪養分、水分和陽光的雜草族群特別有效。 2022 年的價格為每噸 13,800 美元。

- Malathion是一種有機磷殺蟲劑,用於土壤處理以控制農業和非農業地區的多種害蟲。它對造成作物和其他植物損害的飛行和爬行昆蟲均有效。Malathion的價格為每噸12,500美元。

- 代森錳鋅是一種殺菌劑和土壤處理劑,用於控制多種真菌疾病,包括白粉病、晚疫病和霜霉病。它屬於二硫代氨基甲酸家族,已知可有效對抗多種植物病原體。 2022 年的價格為每噸 7,800 美元。

土壤處理行業概況

土壤處理市場適度整合,前五大公司佔44.67%的市佔率。該市場的主要企業有:ADAMA Agricultural Solutions Ltd、 BASF SE、Bayer AG、FMC Corporation 和 Syngenta Group(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 活性成分價格分析

- 法律規範

- 阿根廷

- 澳洲

- 巴西

- 加拿大

- 智利

- 中國

- 法國

- 德國

- 印度

- 印尼

- 義大利

- 日本

- 墨西哥

- 緬甸

- 荷蘭

- 巴基斯坦

- 菲律賓

- 俄羅斯

- 南非

- 西班牙

- 泰國

- 烏克蘭

- 英國

- 美國

- 越南

- 價值鍊和通路分析

第5章市場區隔

- 功能

- 殺菌劑

- 除草劑

- 殺蟲劑

- 殺軟體動物劑

- 殺線蟲劑

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

- 地區

- 非洲

- 按國家

- 南非

- 其他非洲國家

- 亞太地區

- 按國家

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 緬甸

- 巴基斯坦

- 菲律賓

- 泰國

- 越南

- 其他亞太地區

- 歐洲

- 按國家

- 法國

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 西班牙

- 烏克蘭

- 英國

- 其他歐洲國家

- 北美洲

- 按國家

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

- 南美洲

- 按國家

- 阿根廷

- 巴西

- 智利

- 其他南美國家

- 非洲

第6章競爭格局

- 重大策略舉措

- 市場佔有率分析

- 商業狀況

- 公司簡介

- ADAMA Agricultural Solutions Ltd

- American Vanguard Corporation

- BASF SE

- Bayer AG

- FMC Corporation

- Nufarm Ltd

- PI Industries

- Rallis India Ltd

- Syngenta Group

- UPL Limited

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 49722

The Soil Treatment Market size is estimated at 28.56 billion USD in 2025, and is expected to reach 38.42 billion USD by 2030, growing at a CAGR of 6.11% during the forecast period (2025-2030).

Herbicides dominate the market due to their effectiveness through soil treatment methods

- Herbicides accounted for the highest share of 72.8% in the utilization of soil treatment methods in 2022. These herbicides specifically target weed seeds, impeding their germination even prior to crop sowing. This approach has gained popularity due to its ability to proactively manage weed populations proactively, ensuring better crop establishment and overall weed control.

- There is a growing trend toward adopting modern farming practices, including no-till and minimum-till farming. Herbicides may be applied through the soil treatment method with precision, targeting specific areas in the field where weed pressure is high, thereby optimizing herbicide use and reducing costs. These factors are driving the adoption of soil treatment for herbicide applications.

- Insecticides accounted for a share of 12.8% of the global soil treatment market in 2022. Although the pupae and eggs in the soil are not affected by the normal doses of pesticides, larval and adult stages may be controlled by soil treatment. Pests like white grubs, wireworms, fungus gnats, and soil mealybugs may effectively be managed by soil application.

- The utilization of soil treatment fungicides was predominantly focused on grains and cereals, representing the largest value share of 45.4% in the market. This preference is driven by the effectiveness of fungicides in protecting the quality of grains and cereals, as they help prevent or reduce fungal infections.

- The soil treatment of nematicides like aldicarb, fenamiphos, and oxamyl may effectively be employed in controlling microscopic nematodes like Meloidogyne incognita and Pratylenchus brachyurus that are known to cause significant losses in various crops.

- Owing to the aforementioned factors, the market for soil treatment is anticipated to grow.

The rise in yield losses in major countries due to pests is driving the use of soil treatment

- Soil-borne pests may have a significant global impact on agriculture and ecosystems. These pests include nematodes, fungi, bacteria, and insects that live in the soil and can damage crops, reduce yields, and disrupt ecosystems. Managing pests effectively is essential for ensuring food security and maintaining a stable food supply.

- In 2022, the soil treatment segment in South America held a substantial 34.2% share of the global market. From 2017 to 2022, the region witnessed a noteworthy increase in market value, accounting for USD 8,568.9 million in 2022. Growers commonly employ soil drenching, broadcast, and furrow application techniques for soil treatment. Enhancing the control of soil-borne diseases and pests through these methods improves crop yields. The growing emphasis on preserving soil health has prompted farmers to embrace these soil treatment approaches.

- North America is the second leading country, holding a substantial 29.6% global market share. Soil-borne diseases are considered a major limitation of crop production. Soil-borne plant pathogens such as Rhizoctonia spp., Fusarium spp., Verticillium spp., Sclerotinia spp., Pythium spp., and Phytophthora spp. can cause 50% to 75% yield loss for many crops such as wheat, cotton, maize, vegetables, fruits, and ornamentals.

- Therefore, the global soil treatment market value is expected to register a CAGR of 5.0% during 2023-2029 and is anticipated to witness significant growth in all crop types due to the changing climate and rising crop losses due to pest infestation.

Global Soil Treatment Market Trends

The increasing infestation of soil borne pest, diseases, and weeds, the per hectare consumption of soil treatment of pesticides is likely to increase globally

- The global average consumption of crop protection chemicals through soil application mode was recorded as 2,345.0 g per ha of agricultural land in 2022, which increased by 13.6% compared to 2017, which was 2,065.0 g per ha.

- The growing trend toward the adoption of modern farming practices, including no-till and minimum-till farming, is increasing the pest population in the soil, necessitating the soil application of pesticides to control pests, weeds, and soil-borne diseases.

- Herbicides, specifically pre-emergent herbicides, are generally applied to soil as they specifically target weed seeds, impeding their germination even prior to crop sowing. This approach has gained popularity due to its ability to proactively manage weed populations proactively, ensuring better crop establishment and overall weed control.

- The white grub infestation reduced the root system by approximately 25% in soybeans and 64% in maize. It was observed that Phyllophaga capillata and Aegopsis bolboceridus damaged all evaluated variables, reducing overall soybean productivity by 58.62% and maize productivity by 59.76% in South American countries like Brazil. All these soil-borne pests may effectively be controlled by soil application of insecticides.

- Similarly, nematodes like Meloidogyne incognita and Pratylenchus brachyurus cause significant losses in fruit and vegetable crops. For instance, carrots are susceptible to considerable losses, averaging up to 20.0%. As these parasitic nematodes are soil-dwelling organisms, it is important to treat the soil with nematicides to kill these organisms.

Soil treatment pesticide usage is increasing with the need for controlling soil-borne diseases

- Amid the dynamic landscape of the pesticide market, soil treatment pesticides stand out as crucial components. These specialized chemicals play a pivotal role in fostering healthy crop growth, effective pest and disease control, and sustainable agricultural practices.

- Cypermethrin is a pyrethroid insecticide that may be used as a soil treatment pesticide. When applied to the soil, it provides effective control against a variety of soil-borne pests, including termites and root maggots. Cypermethrin's mode of action involves targeting the nervous system of the pests upon contact, leading to paralysis and eventual death. It was priced at USD 21.0 thousand per metric ton in 2022.

- Atrazine is an herbicide commonly used as a soil treatment to control various broadleaf and grassy weeds in agricultural fields and non-crop areas. It is particularly effective in managing weed populations that compete with crops for nutrients, water, and sunlight. In 2022, it was priced at USD 13.8 thousand per metric ton.

- Malathion is an organophosphate insecticide used as a soil treatment to control a variety of insect pests in agricultural fields and non-crop areas. It is effective in managing both flying and crawling insects that may cause damage to crops and other plants. Malathion was priced at USD 12.5 thousand per metric ton.

- Mancozeb is a fungicide and soil treatment used to control various fungal diseases such as damping-off, blight, and downy mildew. It belongs to the class of dithiocarbamates and is known for its broad-spectrum activity against a wide range of plant pathogens. In 2022, it was priced at USD 7.8 thousand per metric ton.

Soil Treatment Industry Overview

The Soil Treatment Market is moderately consolidated, with the top five companies occupying 44.67%. The major players in this market are ADAMA Agricultural Solutions Ltd, BASF SE, Bayer AG, FMC Corporation and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Australia

- 4.3.3 Brazil

- 4.3.4 Canada

- 4.3.5 Chile

- 4.3.6 China

- 4.3.7 France

- 4.3.8 Germany

- 4.3.9 India

- 4.3.10 Indonesia

- 4.3.11 Italy

- 4.3.12 Japan

- 4.3.13 Mexico

- 4.3.14 Myanmar

- 4.3.15 Netherlands

- 4.3.16 Pakistan

- 4.3.17 Philippines

- 4.3.18 Russia

- 4.3.19 South Africa

- 4.3.20 Spain

- 4.3.21 Thailand

- 4.3.22 Ukraine

- 4.3.23 United Kingdom

- 4.3.24 United States

- 4.3.25 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 By Country

- 5.3.1.1.1 South Africa

- 5.3.1.1.2 Rest of Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Country

- 5.3.2.1.1 Australia

- 5.3.2.1.2 China

- 5.3.2.1.3 India

- 5.3.2.1.4 Indonesia

- 5.3.2.1.5 Japan

- 5.3.2.1.6 Myanmar

- 5.3.2.1.7 Pakistan

- 5.3.2.1.8 Philippines

- 5.3.2.1.9 Thailand

- 5.3.2.1.10 Vietnam

- 5.3.2.1.11 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 By Country

- 5.3.3.1.1 France

- 5.3.3.1.2 Germany

- 5.3.3.1.3 Italy

- 5.3.3.1.4 Netherlands

- 5.3.3.1.5 Russia

- 5.3.3.1.6 Spain

- 5.3.3.1.7 Ukraine

- 5.3.3.1.8 United Kingdom

- 5.3.3.1.9 Rest of Europe

- 5.3.4 North America

- 5.3.4.1 By Country

- 5.3.4.1.1 Canada

- 5.3.4.1.2 Mexico

- 5.3.4.1.3 United States

- 5.3.4.1.4 Rest of North America

- 5.3.5 South America

- 5.3.5.1 By Country

- 5.3.5.1.1 Argentina

- 5.3.5.1.2 Brazil

- 5.3.5.1.3 Chile

- 5.3.5.1.4 Rest of South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 American Vanguard Corporation

- 6.4.3 BASF SE

- 6.4.4 Bayer AG

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 PI Industries

- 6.4.8 Rallis India Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219