|

市場調查報告書

商品編碼

1685929

光電感測器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Photonic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

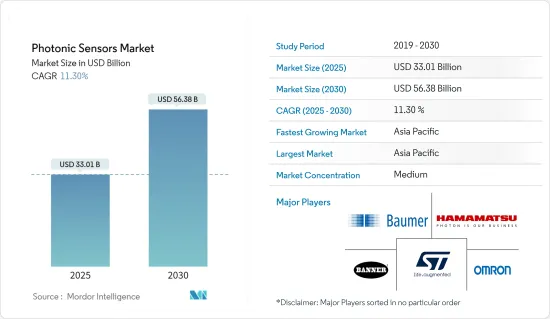

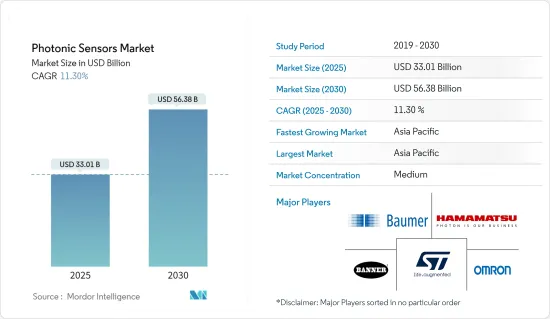

光電感測器市場規模在 2025 年估計為 330.1 億美元,預計到 2030 年將達到 563.8 億美元,在市場估計和預測期(2025-2030 年)內以 11.3% 的複合年成長率成長。

光電感測器對工業製程至關重要,用於光纖通訊系統、基於雷射的醫療設備、環境感測器和檢測器等設備。

主要亮點

- 光電感測器具有靈敏度高、響應快、抗電磁干擾等優點。此外,其非接觸式測量和寬動態範圍使其適用於從通訊到醫學影像和環境監測的各種應用。此外,光電感測器功耗低,通常在惡劣環境下工作,使其用途廣泛且高效,可用於廣泛的領域。

- 隨著自動駕駛汽車的興起以及依賴精確計時的全球定位系統 (GPS) 的進步,精確測量變得越來越重要。光電感測器被視為 GPS 的首選技術,同時也能為新興的自動駕駛汽車產業做出貢獻,從而在預測期內產生巨大的需求。

- 對安全和保障的需求不斷成長,推動了對光電感測器的需求,光子感測器可在航太和國防、運輸、製造、醫療保健、能源和電力等各種應用領域實現高精度、高速偵測和非侵入式監控。

- 光電感測器正在逐漸獲得商業性認可。然而,對於光子感測器的操作卻很少有既定的標準。光電感測器使用多種技術,包括雷射、光纖和生醫光電。這些技術各不相同且不相容。低認知度、低接受度以及感測器提供的影像品質不合理也可能阻礙市場成長。影像品質和價格之間的不平衡導致了競爭加劇和製定最優價格的壓力。

- 美國衝突促使投資轉移,印度和一些東南亞國家正成為製造業和工業企業的投資目的地。這種轉變主要是由於中國企業尋求擴大其製造足跡。這些不斷發展的動態將在研究市場中開闢新的道路。此外,終端用戶產業支出的增加將在未來幾年推動光電感測器的成長。 IHME 預測全球醫療支出將大幅增加,預計到 2050 年人均醫療支出將達到 1,515 美元(購買力平價 2,050 美元)。

光電感測器市場趨勢

最大的終端用戶產業是消費性電子產品

- 光電感測器在消費性電子產業中發揮著至關重要的作用,提供廣泛的應用,以增強使用者體驗和改善設備功能。這些感測器支援智慧型手機、平板電腦和筆記型電腦中的觸控螢幕、環境光感應器和接近感測器,從而改善用戶互動和顯示性能。它們在數位相機、智慧型手機和無人機中發揮著至關重要的作用,實現高解析度影像處理、自動對焦和低照度攝影。

- 智慧型手機、穿戴式裝置和其他消費性電子設備使用虹膜掃描和指紋認證來實現安全、便利的認證。智慧型手機普及率的提高可能會推動市場成長。例如,根據愛立信預測,2022年全球智慧型手機行動網路用戶數量將達到近64億,預計到2028年將超過77億,其中中國、印度和美國的智慧型手機行動網路用戶數量最多。

- 光電感測器可以支援穿戴式裝置中的心率監測、脈搏血氧計和血糖值測量,為使用者提供有價值的健康資料。消費性電子產品支出的增加也刺激了穿戴式裝置的成長。此外,由於人口成長和生活方式的改變而導致的都市化不斷加快,人們的健康和安全意識也不斷增強。這是刺激健身追蹤器、耳戴式裝置和智慧型手錶等穿戴式裝置成長的主要因素。近年來,穿戴式裝置的銷量大幅成長。

- 智慧家庭設備等消費性電子產品正在使用光電感測器來偵測環境光、溫度和濕度,實現自適應顯示亮度和智慧氣候控制。這些感測器也用於遊戲機、智慧電視和智慧家居系統中的非接觸式手勢姿態辨識。

亞太地區佔主要市場佔有率

- 預計亞太地區將在預測期內實現顯著成長,這主要歸因於中國和印度國防和軍事開支的增加,以及這些國家的工業自動化趨勢的上升。例如,由於中國共產黨實施了改革,中國政府撥出了大量軍事預算來採用現代技術。

- 政府消息人士透露,國防部已設定目標,到 2025 年實現航太和國防製造業的銷售額達到 260 億美元,其中包括 50 億美元的出口。印度國防工業的擴張以及對本土生產和現代化的日益重視,推動了對此類感測器的需求,以滿足該國不斷變化的安全和技術需求。預計上述因素將在未來幾年推動全部區域市場的成熟。

- 該地區擁有重要的製造地,並且正在經歷工業自動化的蓬勃發展。光電感測器,包括光學編碼器、視覺系統和雷射感測器,對於精密製造、品管和機器人自動化至關重要。根據中國國家統計局的數據,到2025年中國製造業銷售額將達到8,856.8億美元。

- 據 IBEF 稱,到 2030 年,印度有潛力出口價值 1 兆美元的商品,並有望成為世界領先的製造業中心之一。製造業在印度經濟中發揮著至關重要的作用,佔GDP的17%,僱用了超過2,730萬人。印度政府透過實施各種計畫和政策,預計2025年製造業將佔該國經濟產出的25%。

光電感測器市場概覽

光電感測器市場處於半固體狀態,主要參與者正在採用合資、新產品推出和合作等各種策略,以擴大其在該市場的影響力並長期維持這種影響力。主要市場參與者包括 Banner Engineering Corp.、Baumer Holding AG、STMicroelectronics NV、Hamamatsu Photonics K.K. 和Omron Corporation。

- 2024 年 2 月-Schick 推出「世界上第一款」帶觸控螢幕的光電感測器。 Sick W10 是世界上第一款內建觸控螢幕顯示器的光電感應器。 W10 專為「通用和易於部署」而設計,為數百種食品和飲料 (F&B) 應用提供「無與倫比的高精度檢測技術」和「無可比擬的多功能性」。光電 W10 使用根據從行業最常見應用中獲得的知識構建的智慧板載演算法,以實現「全面的高重複性」。

- 2024 年 1 月——意法半導體 (ST) 與 Sphere Entertainment Co. 合作,為 Sphere 的 Big Sky 系統開發了世界上最大的影像感測器——3.16 億像素的 Big Sky 相機感測器。 ST 與 Sphere Studios 合作開發了首款 18K 感測器,能夠產生 Sphere 顯示器所需的解析度和保真度的影像。 Big Sky 的 316 萬像素解析度約為全片幅感光元件的 7 倍、全片幅商用相機解析度的 40 倍。晶粒尺寸為 9.92cm x 8.31cm2,是皮夾大小照片的兩倍。 300 毫米晶圓上只能容納四個晶粒。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 新冠肺炎疫情及其他宏觀經濟因素對市場的影響

第5章 市場動態

- 市場促進因素

- 製造業對自動化的需求不斷增加

- 對安保和安全的需求日益增加

- 增加對光纖通訊的投資

- 市場限制

- 缺乏業界標準

- 初期成本高

第6章 市場細分

- 依產品類型

- 光纖感測器

- 影像感測器

- 生物光學感測器

- 其他產品類型

- 按最終用戶產業

- 航太和國防

- 車

- 產業

- 衛生保健

- 能源和電力

- 消費性電子產品

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 供應商定位分析

- 公司簡介

- Banner Engineering Corp.

- Baumer Holding AG

- STMicroelectronics NV

- Hamamatsu Photonics KK

- Omron Corporation

- Sick AG

- Keyence Corporation

- Pepperl+Fuchs GmbH

- Rockwell Automation Inc.

- Autonics Corporation

第8章投資分析

第 9 章:未來趨勢

The Photonic Sensors Market size is estimated at USD 33.01 billion in 2025, and is expected to reach USD 56.38 billion by 2030, at a CAGR of 11.3% during the forecast period (2025-2030).

Photonic sensors are crucial in industrial processes and are used in devices like fiber optic communication systems, laser-based medical instruments, environmental sensors, and optical detectors.

Key Highlights

- These sensors offer advantages, including high sensitivity, fast response times, and immunity to electromagnetic interference. They also enable non-contact measurements, have a wide dynamic range, and are suitable for various applications, from telecommunications to medical imaging and environmental monitoring. Additionally, photonics sensors often exhibit lower power consumption and can function in harsh environments, making them versatile and efficient in diverse fields.

- With the growing adoption of autonomous cars, precision metrology has gained significant importance with advancements in the global positioning system (GPS), which relies on precision timing. Photonic sensors are being viewed as a suitable technology for GPS and can benefit the budding autonomous car industry, thereby creating significant demand over the forecast period.

- Increasing requirements for security and safety drive the demand for photonics sensors primarily due to their ability to provide high precision, rapid detection, and non-intrusive monitoring in various applications, including aerospace and defense, transportation, manufacturing, healthcare, energy and power, and many others.

- Photonic sensors are slowly witnessing commercial acceptance. However, there are few established standards for their operation. Photonic sensors also use numerous technologies, such as laser, fiber optics, and biophotonic. These technologies are distinct from each other and lack compatibility. Lack of awareness, less acceptability, and the unjustifiable image quality offered by the sensors may also hinder market growth. The imbalance between image quality and price has led to increased competition and peer pressure regarding optimal pricing.

- The U.S. and China dispute has prompted a shift in investments, with countries like India and select Southeast Asian nations emerging as attractive destinations for manufacturing and industrial ventures. This shift is mainly due to Chinese companies seeking to broaden their manufacturing footprint. These evolving dynamics are poised to create new avenues within the studied market. Furthermore, heightened expenditures in end-user industries are set to bolster the growth of photonic sensors in the coming years. IHME projects a significant increase in global health spending, estimated to reach USD 1,515 (2.050 PPP dollars) per person by 2050.

Photonic Sensors Market Trends

Consumer Electronics to be the Largest End-user Industry

- Photonic sensors play a crucial role in the consumer electronics industry, offering a wide range of applications that enhance user experience and improve device functionality. These sensors enable touchscreens, ambient light sensors, and proximity sensors in smartphones, tablets, and laptops, enhancing user interaction and display performance. They play a key role in digital cameras, smartphones, and drones, enabling high-resolution imaging, autofocus, and low-light photography.

- In consumer electronics like smartphones and wearables, iris scanning and fingerprint sensing are used for secure and convenient authentication. The increasing adoption of smartphones is likely to aid the market's growth, which has been studied significantly. For instance, according to Ericsson, the number of smartphone mobile network subscriptions globally reached almost 6.4 billion in 2022. It is forecasted to exceed 7.7 billion by 2028. China, India, and the United States have the highest smartphone mobile network subscriptions.

- Photonic sensors support heart rate monitoring, pulse oximetry, and blood glucose measurement in wearable devices, providing valuable health data to users. Increasing spending on consumer electronic products is also stimulating the growth of wearable devices. Further, the growing population's increasing urbanization and changing lifestyle have raised its health and safety awareness. This has been a major factor in stimulating the growth of wearable devices, such as fitness trackers, earwear, and smartwatches. There has been a significant increase in the number of wearable devices sold over the past few years.

- Consumer electronics like smart home devices use photonic sensors to detect ambient light, temperature, and humidity, enabling adaptive display brightness and smart climate control. These sensors are also used in touchless gesture recognition in gaming consoles, smart TVs, and home automation systems.

Asia-Pacific to Hold Major Market Share

- Asia-Pacific is expected to witness a significant growth rate over the forecast period, primarily due to the increasing defense/military spending in China and India and the industrial automation trend in these nations. For instance, the Chinese government offers considerable military budgets for incorporating modern technology, owing to reforms by the Chinese Communist Party.

- According to the official source, the Ministry of Defence has set a target of achieving a turnover of USD 26 billion in aerospace and defense manufacturing by 2025, which includes USD 5 billion in exports. The expansion of India's defense industry and its emphasis on indigenization and modernization have driven the demand for these sensors to meet the country's evolving security and technological needs. The above factors will expand the market maturation across the region in the upcoming years.

- The region is home to significant manufacturing hubs and is witnessing a surge in industrial automation. Photonics sensors, including optical encoders, vision systems, and laser sensors, are crucial for precision manufacturing, quality control, and robotic automation. According to the National Bureau of Statistics of China, the manufacturing revenue in China will amount to USD 885.68 billion by 2025.

- According to IBEF, India may export goods worth USD 1 trillion by 2030 and is on the route to becoming a prominent global manufacturing hub. With 17% of the country's GDP and over 27.3 million workers, manufacturing plays a significant role in the Indian economy. By implementing different programs and policies, the Government of India expects 25% of the economy's output to come from manufacturing by 2025.

Photonic Sensors Market Overview

The photonic sensors market is semi-consolidated, and the major players have used various strategies, such as joint ventures, new product launches, partnerships, and others, to increase their footprints in this market to sustain in the long run. Some of the key market players are Banner Engineering Corp., Baumer Holding AG, STMicroelectronics NV, Hamamatsu Photonics KK, and Omron Corporation.

- February 2024 - Sick announced the "world's first" photoelectric sensor equipped with a touchscreen. The Sick W10 is a "world-first" photoelectronically powered sensor with an integrated touchscreen display. Designed for "universal use and ease of deployment," the W10 offers "unrivaled precision detection technology" and "unmatched versatility" for hundreds of food and beverage (F&B) applications. The photoelectronically-powered W10 uses smart onboard algorithms built on the knowledge gained from the industry's most common applications to deliver "high reproducibility across the board."

- January 2024 - STMicroelectronics (ST) collaborated with Sphere Entertainment Co. to develop the world's largest image sensor, the 316-megapixel Big Sky camera sensor for Sphere's Big Sky system. ST collaborated with Sphere Studios to develop an 18K sensor, the first of its kind, capable of producing images at the resolution and fidelity needed for Sphere's display. The 316-megapixel resolution of the Big Sky is nearly 7x larger than a full-frame sensor and 40x more resolution than full-frame commercial cameras. The die is 9.92 cm x.8.31 cm 2, which is twice the size of a wallet-size photograph. Only four full die fits on a 300 mm wafer.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Automation Demand in Manufacturing Industry

- 5.1.2 Increasing Requirement for Security and Safety

- 5.1.3 Increasing Investment in Fiber Optic Communications

- 5.2 Market Restraints

- 5.2.1 Lack of Industry Standards

- 5.2.2 High Initial Cost

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Fiber Optic Sensors

- 6.1.2 Image Sensors

- 6.1.3 Biophotonic Sensors

- 6.1.4 Other Product Types

- 6.2 By End-user Industry

- 6.2.1 Aerospace and Defense

- 6.2.2 Automotive

- 6.2.3 Industrial

- 6.2.4 Healthcare

- 6.2.5 Energy and Power

- 6.2.6 Consumer Electronics

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Positioning Analysis

- 7.2 Company Profiles

- 7.2.1 Banner Engineering Corp.

- 7.2.2 Baumer Holding AG

- 7.2.3 STMicroelectronics NV

- 7.2.4 Hamamatsu Photonics KK

- 7.2.5 Omron Corporation

- 7.2.6 Sick AG

- 7.2.7 Keyence Corporation

- 7.2.8 Pepperl+Fuchs GmbH

- 7.2.9 Rockwell Automation Inc.

- 7.2.10 Autonics Corporation