|

市場調查報告書

商品編碼

1685904

德國工業塗料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Germany Industrial Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

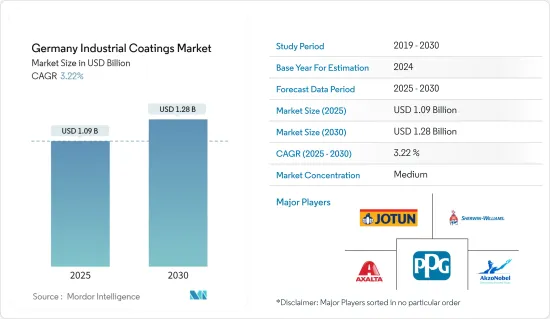

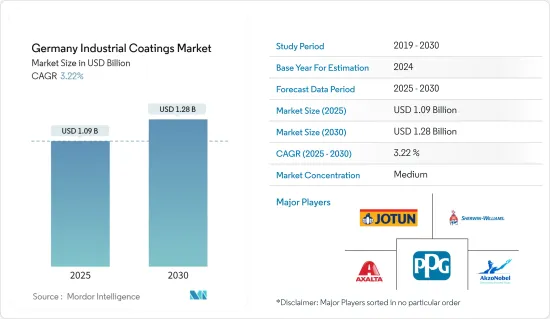

預計 2025 年德國工業塗料市場規模為 10.9 億美元,到 2030 年將達到 12.8 億美元,預測期內(2025-2030 年)的複合年成長率為 3.22%。

COVID-19疫情對工業塗料產業產生了負面影響。銷售額受到 GDP 波動的影響。由於停工和人力短缺,大多數生產設施都已停產。這導致各生產者感到焦慮。此外,供應鏈限制嚴重阻礙了該行業的擴張。 2019-2020年,汽車業銷售低迷、結構性放緩、經濟疲軟。然而,放鬆封鎖措施以及促進經濟復甦的獎勵措施使該地區的汽車產業受益。預計市場將在 2021 年復甦,並在未來幾年經歷顯著成長。

主要亮點

- 短期內,工業基礎設施建設的增加以及石油天然氣和石化行業的需求成長預計將推動市場成長。

- 然而,有關揮發性有機化合物(VOC)排放的嚴格規定預計會阻礙市場成長。

- 然而,對環保塗料產品日益成長的需求可能為所研究的市場提供豐厚的成長機會。

德國工業塗料市場趨勢

蓬勃發展的石油和天然氣產業推動了對防護塗料的需求

- 石油和天然氣產業是防護塗料的主要終端使用者之一。由於該行業在高溫環境下運行,因此需要耐熱塗層。它還用於保護暴露在潮濕環境中的金屬和鋼骨免受腐蝕。在石油和天然氣工業中,它們用於儲槽、管道、閥門、泵浦等。

- 石油和天然氣產業在上游和下游都使用保護塗層來防止石油和天然氣在輸送到精製的過程中發生腐蝕。該行業正在努力尋找降低資本成本的方法。遵守嚴格的環境法規的需要,加上對有效、持久的塗層系統以保護資產的需求,正在推動需求的成長。

- 海上石油和天然氣生產是最苛刻的生產之一。因此,所使用的塗層系統必須能夠承受這些條件。長時間暴露在穿透性的紫外線下以及不斷接觸波濤洶湧的海水增加了對工業塗料的需求。

- 然而,在俄烏戰爭爆發後,德國採取多項制裁措施,包括暫停俄羅斯對北溪2號天然氣管道的認證程序,以支持烏克蘭。暫停從俄羅斯進口石油及相關產品可能會影響國內市場研究。

- 根據BP統計,德國2021年石油總消費量為204.5萬桶/日,較2020年的204.9萬桶/日下降0.2%。

- 據同一消息來源稱,2021年天然氣總消費量為905億立方米,比2020年的871億立方米增加4.2%。

- 由於上述發展,預計預測期內石油和天然氣產業對防護塗料的需求將會增加。

增加環氧樹脂的使用

- 環氧樹脂是一種石油衍生的增強聚合物複合材料。它是環氧單元參與的反應過程的結果。這些樹脂用作塗料應用中的黏合劑,以增加地板和金屬應用塗料的耐久性。

- 環氧塗料具有優異的耐腐蝕、耐磨和耐候性能,適合在惡劣環境下的鋼應用。它還能耐高溫,適合用於儲存熱產品和暴露在極端高溫下的罐中。

- 工業環氧塗料通常採用三層。首先,塗上底漆,例如鋅底漆。然後噴灑環氧樹脂。使用環氧黏合劑或聚氨酯面漆完成塗層。

- 環氧聚醯胺塗層具有優異的防潮性,環氧膠泥塗層具有優異的構造厚度,酚醛環氧塗層具有優異的耐化學性。根據應用情況,環氧樹脂可用作底漆、中間漆或面漆。

- 環氧樹脂經常用作工業塗料的黏合劑。這些塗層具有高附著力、高耐化學性(腐蝕性)和耐物理性,適用於船舶和化學儲存槽。

- 環氧塗料因其易得性而廣泛應用於眾多工業領域。環氧粉末塗料用途廣泛,可用於洗衣機、烘乾機、白色家電、石油和天然氣工業使用的鋼管和配件、水管道以及混凝土加固混凝土。

- 環氧塗料有幾個優點:

- 環氧塗料持久耐用、經濟實惠、防水且抗衝擊。

- 它可以用來提高工作安全性,因為它不像拋光混凝土那麼滑。

- 環氧樹脂因其光澤而具有高度可見度,並能反射光源,從而創造安全的工作環境。

- 在預測期內,上述因素可能會增加所研究市場對環氧樹脂的需求。

德國工業塗料產業概況

德國工業塗料市場本質上是部分整合的。市場的主要企業包括 PPG Industries、 剪切機-Williams、AkzoNobel NV、Axalta Coating Systems 和 Jotun。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 加大工業基礎建設

- 石油、天然氣和石化產業的需求不斷成長

- 限制因素

- 嚴格控制VOC排放

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 樹脂類型

- 環氧樹脂

- 丙烯酸纖維

- 醇酸

- 聚氨酯

- 其他樹脂類型

- 塗層技術

- 水性塗料

- 溶劑型塗料

- 輻射固化塗料

- 粉末塗料

- 類型

- 一般工業用途

- 保護

- 石油和天然氣

- 礦業

- 力量

- 基礎設施

- 其他保護措施

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- AkzoNobel NV

- Axalta Coating Systems

- Beckers group

- Hempel AS

- Jotun

- MIPA SE

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Williams Company

第7章 市場機會與未來趨勢

- 對環保塗料的需求不斷增加

The Germany Industrial Coatings Market size is estimated at USD 1.09 billion in 2025, and is expected to reach USD 1.28 billion by 2030, at a CAGR of 3.22% during the forecast period (2025-2030).

Due to the outbreak of COVID-19, the industrial coatings sector was negatively impacted. Sales were affected due to GDP movement. Most production units were shut down due to the lockdowns and shortage of human resources. This resulted in uncertainty among various producers. Furthermore, supply chain constraints significantly obstructed the expansion of the industry. The automotive industry showed sluggish sales, a structural slowdown, and a sputtering economy in 2019-2020. However, the easing of lockdowns, along with incentive packages to support economic revival, benefited the regional automotive industry. The market recovered in 2021 and is expected to grow at a significant rate in the coming years.

Key Highlights

- Over the short term, the increasing construction of industrial infrastructure and the growing demand from oil and gas and petrochemical industries are expected to boost the market growth.

- However, the stringent regulations for volatile organic compound (VOC) emissions are expected to hinder the market's growth.

- Nevertheless, the rising demand for eco-friendly coating products is likely to create lucrative growth opportunities for the studied market.

German Industrial Coatings Market Trends

Flourishing Oil and Gas Sector to Rise the Demand for Protective Coatings

- The oil and gas sector is one of the major end users of protective coatings. The industry requires heat-resistant coatings due to the high-temperature environment of its business operations. The coatings are also used to protect metal and steel structures from corrosion when exposed to moist and damp conditions. They are used in the oil and gas industry for tanks, pipes, valves, pumps, etc.

- The oil and gas industry uses protective coatings for both upstream and downstream segments to prevent corrosion during oil and gas transportation toward refineries. The industry has been trying to find ways to cut capital charges. Along with the need to adhere to strict environmental regulations, this has led to the demand for a coating system with a long life, which may be effective in protecting assets.

- Offshore oil and gas production has some of the most demanding conditions. Therefore, the coating systems used must be equipped for these conditions. Prolonged exposure to penetrating UV rays and constant contact with rough seawater increases the need for industrial coatings.

- However, with the Russia-Ukraine war, Germany has taken steps to halt the process of certifying the Nord Stream Two gas pipeline from Russia, besides other sanctions, in support of Ukraine. The temporary halts on the imports of petroleum and allied products from Russia are likely to affect the market studied in the country.

- According to BP Stats, the total oil consumption in Germany was 2,045 thousand barrels per day in 2021, registering a decline rate of 0.2% compared to 2,049 thousand barrels per day in 2020.

- As per the same source, the total natural gas consumption in the country was 90.5 billion cubic meters in 2021, registering a growth rate of 4.2% from 87.1 billion cubic meters in 2020.

- All the above-motioned factors are expected to augment the demand for protective coatings for the oil and gas industry during the forecast period.

Rising Usage of Epoxy Resins

- Epoxy resins are reinforced polymer composites derived from petroleum sources. They are the result of a reactive process involving epoxide units. These resins are used as binders for coating applications to enhance the durability of coatings for floor and metal applications.

- Epoxy coatings are suitable for steel applications in harsh operating environments because of their resistance to corrosion, abrasion, and weathering. These coatings are also resistant to extremely high temperatures, making them suitable for use on tanks that store hot products and are exposed to extreme heat.

- Industrial epoxy coatings are commonly used in three layers. Firstly, a primer, such as zinc primer, is applied. The epoxy is then sprayed on. An epoxy binder or polyurethane topcoat is applied to complete the coating process.

- Epoxy polyamide coatings are ideal for moisture resistance, epoxy mastic coatings are used for film thickness, and phenolic epoxy coatings are excellent for chemical resistance. Depending on the application, epoxies can be used as a priming, intermediate coat, or even a topcoat.

- Epoxy resins are frequently used as binders in industrial coatings. Those coatings provide high adhesion and high chemical (corrosion) and physical resistance for use on ships and chemical storage tanks.

- Due to their availability, epoxy coatings find numerous industrial applications. Epoxy powder coatings are used on washers, dryers, white goods, steel pipes, and fittings used in the oil and gas industry, water transmission pipelines, and concrete reinforcing rebar due to their flexible applicability.

- Several advantages of epoxy coatings are:

- Epoxy coatings are long-lasting, cost-effective, waterproof, and shock-resistant.

- They are used to improve operational safety since they are not slippery like polished concrete.

- Epoxy increases visibility with its high sheen, reflecting light sources and improving visibility making for a safer working environment.

- All the above-mentioned factors may augment the demand for epoxy resins for the market studied during the forecast period.

German Industrial Coatings Industry Overview

The Germany industrial coatings market is partially consolidated in nature. Some of the major key playersin the market include PPG Industries Inc., The Sherwin-Williams Company, AkzoNobel NV, Axalta Coating Systems and Jotun.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Industrial Infrastructure Construction

- 4.1.2 Growing Demand from Oil and Gas and Petrochemical Industries

- 4.2 Restraints

- 4.2.1 Stringent Regulations for VOC Emissions

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Resin Type

- 5.1.1 Epoxy

- 5.1.2 Acrylic

- 5.1.3 Alkyd

- 5.1.4 Polyurethane

- 5.1.5 Other Resin Types

- 5.2 Technology

- 5.2.1 Water-borne Coatings

- 5.2.2 Solvent-borne Coatings

- 5.2.3 Radiation-cured Coatings

- 5.2.4 Powder Coatings

- 5.3 Type

- 5.3.1 General Industrial

- 5.3.2 Protective

- 5.3.2.1 Oil and Gas

- 5.3.2.2 Mining

- 5.3.2.3 Power

- 5.3.2.4 Infrastructure

- 5.3.2.5 Other Protectives

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AkzoNobel NV

- 6.4.2 Axalta Coating Systems

- 6.4.3 Beckers group

- 6.4.4 Hempel AS

- 6.4.5 Jotun

- 6.4.6 MIPA SE

- 6.4.7 PPG Industries Inc.

- 6.4.8 RPM International Inc.

- 6.4.9 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for Eco-friendly Coatings