|

市場調查報告書

商品編碼

1685865

內容傳輸網路(CDN):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Content Delivery Network (CDN) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

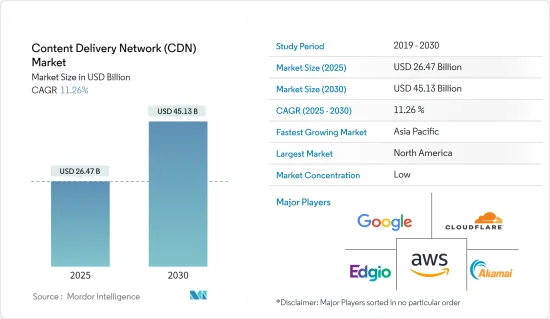

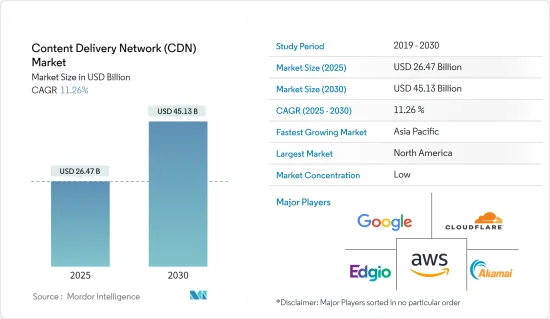

內容傳輸網路(CDN) 市場規模預計在 2025 年為 264.7 億美元,預計到 2030 年將達到 451.3 億美元,預測期內(2025-2030 年)的複合年成長率為 11.26%。

網路使用者數量的增加以及用戶在行動裝置上玩遊戲的傾向(其中許多裝置有儲存問題)是該研究市場的主要促進因素。雲端基礎的遊戲的一大優點是,您可以隨時從幾乎任何裝置(包括智慧型手機或平板電腦)玩遊戲。此外,內容傳輸網路(CDN) 是遊戲分發的一個有前途的範例,允許用戶無論使用什麼作業系統或裝置都可以玩遊戲。

主要亮點

- 隨著 4K 和超高清等新技術的推出,線上遊戲變得越來越流行。雖然這些新技術可以讓遊戲變得更有趣,但它們也會對遊戲前的體驗產生負面影響,例如讓你等待數小時才能完成下載。在開放平台上,遊戲玩家可能會對此做出負面反應,這可能導致提供者遭受損失。

- 此外,遊戲下載的漫長等待時間也會打擊玩家的積極性,並阻礙遊戲公司吸引更廣泛的受眾。因此,為了避免效能滯後,企業正在投資 CDN 解決方案來在全球範圍內提供高品質的內容。隨著低成本資料通訊服務的出現,網路速度不斷提高,刺激了雲端遊戲平台的採用,進而推動了基於影片串流的雲端遊戲訂閱。

- 隨著智慧型手機的廣泛普及,對原創高品質內容的需求以及內容消費的持續成長需要有效的 CDN 解決方案來提高內容交付和網路效能。由於確保透過高速資料網路持續傳輸內容的Over-The-Top (OTT)和隨選視訊(VOD)服務的需求不斷增加,預計整個預測期內市場將快速發展。

- 一些最具影響力的組織正在放棄第三方 CDN 服務,轉而採用根據其需求量身定做的內容交付網路。隨著越來越多的人轉向影片串流服務觀看電影和廣告,病毒和網路攻擊也隨之增加。缺乏足夠的標準和程序來發現和管理影片內容可能會阻礙市場擴張。

內容傳輸網路(CDN) 市場趨勢

媒體和娛樂(M&E)產業將經歷顯著成長

- 由於媒體播放器對高品質線上內容廣播的需求不斷增加、全球 OTT 平台的發展以及對 CDN 解決方案的需求不斷增加,預計媒體和娛樂領域將在預測期內為市場成長做出重大貢獻。據Netflix稱,截至2023年第四季度,Netflix全球付費用戶數量約為2.6億。

- 媒體和娛樂領域對內容傳輸網路的需求表現為串流媒體和富媒體服務的需求不斷成長、線上遊戲的普及以及對影片串流和內容交付的效率、可靠性和品質的需求不斷增加。此外,不斷發展的線上遊戲產業需要改善用戶體驗、無縫的遊戲效能和減少延遲,這為 CDN 市場提供了豐厚的成長機會。

- 媒體和娛樂 (M&E) 公司面臨著巨大的壓力,需要不斷提供高品質的內容和體驗來吸引和留住觀眾。這推動了媒體和娛樂領域對 CDN 解決方案和服務的需求增加,以擴展實況活動和串流媒體頻道,並保護內容、網站和應用程式免受攻擊。

- 在我們快速變化的數位環境中,內容傳輸網路的效率和速度對於向全世界交付影片內容至關重要。市場上的供應商已經認知到這種需求,並正在與串流媒體公司夥伴關係提供領先的視訊串流服務。

- 隨著越來越多的用戶對線上內容的需求,媒體和娛樂公司將面臨對內容傳輸網路解決方案和服務日益成長的需求,以便向大量受眾持續可靠地提供優質內容。此外,預計未來幾年視訊串流和即時網路通訊協定語音 (VoIP) 將在遊戲中變得越來越流行。 CDN 可以透過提供低延遲、高品質的串流媒體體驗來促進這一趨勢。

亞太地區成長迅速

- 中國對 CDN 的需求正在不斷成長,這反映出數位經濟的成長、上網人口的增加以及各行業的數位內容消費增加。

- 此外,中國是世界上成長最快的電子商務市場之一。隨著數百萬的線上消費者和不斷成長的數位經濟,企業依靠 CDN 快速可靠地向全國各地的用戶提供產品圖片、影片和網頁等數位內容。 CDN 幫助電子商務平台最佳化網站效能、減少延遲並改善整體用戶體驗,從而提高客戶滿意度和轉換率。因此,大多數電子商務公司都在採用內容分發網路,這增加了中國對CDN的需求。

- 此外,Netflix、Amazon Prime Video 和 Hulu 等 OTT 平台在日本也正在迅速普及。這些平台提供廣泛的視訊內容,包括電影、電視節目和原創劇集,需要可靠且擴充性的內容交付基礎設施。使用 CDN,OTT 供應商可以向日本各地的觀眾提供串流影片內容,即使在高峰尖峰時段也能保持最小的延遲和緩衝。

- 此外,為了滿足不斷變化的數位期望並保持競爭力,媒體和娛樂公司優先考慮專為日本終端用戶以及內容傳輸網路設計的解決方案。此外,為了加強日本的科技基礎設施,日本政府正在積極支持媒體和娛樂領域的數位革命。

內容傳輸網路(CDN) 市場概覽

內容傳輸網路(CDN) 市場較為分散,主要企業包括 Amazon Web Services Inc.(Amazon.com Inc.)、Akamai Technologies Inc.、Google LLC(Alphabet Inc.)、Cloudflare Inc. 和 Edgio Inc.。市場參與者正在採用聯盟、合併、投資和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024 年 2 月,非上市的雲端處理平台 Vultr 宣布推出最新產品:Vultr CDN。此內容傳送服務優先考慮接近用戶,同時保持強大的安全措施。透過此公告,Vultr 擴大了其影響範圍,提供全球內容和媒體快取功能。這為 Vultr 超過 225,000 名開發者的龐大社群提供了簡化的服務,使他們能夠輕鬆擴展網站和應用程式。與傳統網路不同,Vultr CDN 以其簡單性而脫穎而出,提供無與倫比的性價比,並擁有業界最具競爭力的頻寬成本。

- 2024 年 4 月:專門從事行動、視訊和人工智慧技術研究的公司 InterDigital Inc. 與康考迪亞大學的 IN2GM 實驗室合作。此次多年的合作旨在探索有助於透過 5G 網路實現人工智慧主導的身臨其境型媒體傳輸的工具。此次夥伴關係將專注於開拓媒體交付模式、開發原型工具和分析結果。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 微觀經濟因素對產業的影響

第5章 市場動態

- 市場促進因素

- 上網用戶數、人均上網消費、高畫質影片內容需求增加

- 線上遊戲產業的需求不斷成長

- 市場限制

- 大公司自建CDNS的趨勢

- 頻寬問題,尤其是在新興和低度開發經濟體

第6章 市場細分

- 按服務

- 解決方案

- 媒體交付

- 雲端安全

- Web 效能

- 服務

- 解決方案

- 按最終用戶

- 媒體與娛樂

- 廣告

- 電子商務

- 衛生保健

- 商業和金融服務

- 研究與教育

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲國家

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 北美洲

第7章 競爭格局

- 公司簡介

- Amazon Web Services Inc.(Amazon.com Inc.)

- Akamai Technologies Inc.

- Google LLC(Alphabet Inc.)

- Cloudflare Inc.

- Edgio Inc.

- CDNetworks Inc.

- Fastly Inc.

- Microsoft Corporation

- AT&T Inc.

- Tata Communications Limited

第8章投資分析

第9章:未來市場展望

The Content Delivery Network Market size is estimated at USD 26.47 billion in 2025, and is expected to reach USD 45.13 billion by 2030, at a CAGR of 11.26% during the forecast period (2025-2030).

The growing number of internet users and the tendency of users to play games on mobile devices, with storage issues in many devices, is one of the major drivers for the market studied. A significant advantage of cloud-based gaming is that games are available anytime from almost any device, such as smartphones and tablets. Moreover, a content delivery network (CDN) is a promising paradigm for gaming delivery, as users can play games on any OS or device.

Key Highlights

- The popularity of online gaming is increasing along with the introduction of new technology, such as 4K and Ultra HD. While these new technologies make gaming more enjoyable, they can negatively impact the pre-gaming experience by making players wait hours for the download to finish. Gamers may respond negatively to this on open platforms, which could cost the providers money.

- Moreover, gamers may be discouraged, and gaming companies may be unable to reach a wider audience due to long wait times for downloads of games. Therefore, to avoid any lag in performance, companies are investing in CDNs to deliver high-quality content globally for CDN solutions. The increasing internet speed supported by the emergence of low-cost data-based telecom services is fueling the adoption of cloud gaming platforms, which is driving the subscription of video streaming-based cloud gaming.

- With the growing smartphone adoption, the demand for original, high-quality content and the ongoing growth of content consumption has made effective CDN solutions necessary to boost content delivery and network performance. The market is anticipated to develop faster throughout the forecast period due to the increased demand for over-the-top (OTT) and video-on-demand (VOD) services, guaranteeing continuous content delivery over a high-speed data network.

- Some of the most influential organizations are moving away from third-party CDN services and toward deploying a content delivery network tailored to their needs. As more people use video streaming services to watch movies and advertise, viruses and cyber-attacks are rising. The lack of appropriate standards and procedures for discovering and regulating video content could hinder the market's expansion.

Content Delivery Network (CDN) Market Trends

Media and Entertainment (M&E) Segment to Witness Major Growth

- The media and entertainment segment is expected to contribute significantly to the market's growth during the forecast period, supported by the demand for high-quality online content broadcasting among the media players and the development of OTT platforms worldwide, increasing the demand for CDN solutions. According to Netflix, Netflix had around 260 million paid subscribers worldwide as of the fourth quarter of 2023.

- The content delivery network demand in the media and entertainment sector is characterized by the growing demand for streaming and rich media services, the proliferation of online gaming, and the ever-increasing demand for efficiency, reliability, and quality in video streaming and content delivery. Furthermore, the ever-evolving online gaming industry necessitates enhanced user experience, seamless game performance, and reduced latency, thus further offering lucrative growth opportunities for the CDN market.

- Media and entertainment (M&E) companies face significant pressure to continuously deliver high-quality content and experiences that attract and retain viewers. This further drives the demand for CDN solutions and services in the media and entertainment sector to scale live events and streaming channels and secure content, websites, and applications from attacks.

- In the fast-paced digital landscape, the efficiency and speed of content delivery networks are crucial for distributing video content globally. Market vendors are recognizing the need and entering into partnerships with streaming companies for advanced video streaming services.

- As increasing numbers of users demand online content, the demand for content delivery network solutions and services in the media and entertainment companies is expected to grow to deliver top-tier content consistently and reliably to large audiences. Moreover, in the coming years, video streaming and real-time voice-over-internet protocol (VoIP) are anticipated to become increasingly popular in gaming. CDNs are well-positioned to facilitate these trends by delivering low-latency, high-quality streaming experiences.

Asia-Pacific to Register Significant Growth

- There has been a mounting demand for CDNs in China, reflecting the country's growing digital economy, expanding online population, and increasing digital content consumption across various industries.

- Moreover, China is among the fastest-growing e-commerce markets globally. With millions of online shoppers and a growing digital economy, businesses rely on CDNs to ensure fast and reliable delivery of digital content to users across the country, including product images, videos, and web pages. CDNs help e-commerce platforms optimize website performance, reduce latency, and enhance the overall user experience, increasing customer satisfaction and higher conversion rates. Hence, most e-commerce companies are adopting content delivery networks, which has led to a growing demand for CDNs in China.

- Furthermore, OTT platforms like Netflix, Amazon Prime Video, and Hulu are witnessing rapid adoption in Japan. These platforms offer a wide range of video content, including movies, TV shows, and original series, which require reliable and scalable content delivery infrastructure. CDNs enable OTT providers to deliver streaming video content to viewers across Japan with minimal latency and buffering, even during peak traffic.

- In addition, the media and entertainment companies give the solutions designed for the content delivery network the highest precedence, in addition to end users in Japan, to meet shifting digital expectations and continue to be competitive. Moreover, to reinforce the country's technology infrastructure, the Government of Japan is aggressively supporting the digital revolution in the media and entertainment segment.

Content Delivery Network (CDN) Market Overview

The content delivery network (CDN) market is fragmented, with the presence of major players like Amazon Web Services Inc. (Amazon.com Inc.), Akamai Technologies Inc., Google LLC (Alphabet Inc.), Cloudflare Inc., and Edgio Inc. Players in the market are adopting strategies such as partnerships, mergers, investments, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- February 2024: Vultr, a privately-held cloud computing platform, unveiled its latest offering, Vultr CDN. The content delivery service prioritizes proximity to users while maintaining robust security measures. With this launch, Vultr extends its reach, providing global content and media caching capabilities. This move equips Vultr's extensive community of over 225,000 developers with streamlined services, facilitating the scaling of their websites and applications. Unlike traditional networks, Vultr CDN stands out for its simplicity, offering unmatched price-to-performance ratios and boasting the industry's most competitive bandwidth costs.

- April 2024: InterDigital Inc., a company specializing in mobile, video, and AI technology research, partnered with Concordia University's IN2GM Lab. The collaboration, spanning multiple years, aims to delve into tools that facilitate AI-driven delivery of immersive media over 5G networks. This partnership focuses on pioneering media delivery paradigms, developing prototype tools, and analyzing their outcomes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Microeconomic Factors on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Online Users, Per Capita Online Consumption, and Demand for High -quality Video Content

- 5.1.2 Growing Demand from Online Gaming Industries

- 5.2 Market Restraints

- 5.2.1 Larger Organizations Tending to Build their Own CDNS

- 5.2.2 Bandwidth Concerns, Particularly in Developing and Undeveloped Economies

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Solutions

- 6.1.1.1 Media Delivery

- 6.1.1.2 Cloud Security

- 6.1.1.3 Web Performance

- 6.1.2 Services

- 6.1.1 Solutions

- 6.2 By End User

- 6.2.1 Media and Entertainment

- 6.2.2 Advertising

- 6.2.3 E-commerce

- 6.2.4 Healthcare

- 6.2.5 Business and Financial Services

- 6.2.6 Research and Education

- 6.2.7 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 South Africa

- 6.3.5.3 Saudi Arabia

- 6.3.5.4 Rest of Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services Inc. (Amazon.com Inc.)

- 7.1.2 Akamai Technologies Inc.

- 7.1.3 Google LLC (Alphabet Inc.)

- 7.1.4 Cloudflare Inc.

- 7.1.5 Edgio Inc.

- 7.1.6 CDNetworks Inc.

- 7.1.7 Fastly Inc.

- 7.1.8 Microsoft Corporation

- 7.1.9 AT&T Inc.

- 7.1.10 Tata Communications Limited