|

市場調查報告書

商品編碼

1685812

鈹:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Beryllium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

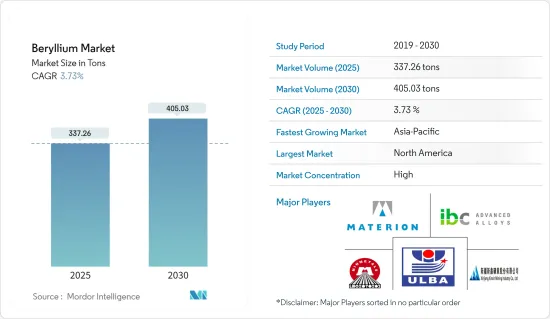

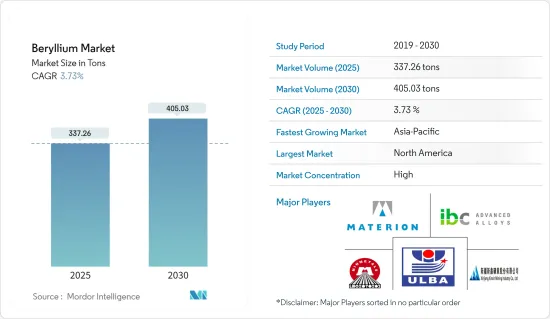

預計 2025 年鈹市場規模為 337.26 噸,到 2030 年將達到 405.03 噸,預測期間(2025-2030 年)的複合年成長率為 3.73%。

受新冠疫情影響,鈹市場遭遇挫折。全球停工和嚴格的政府監管已導致大面積生產關閉。不過,預計市場將在 2021 年復甦,並在未來幾年內實現顯著成長。

主要亮點

- 短期內,電子和通訊基礎設施需求的不斷成長以及鈹合金在航太和軍事應用中的廣泛使用將推動市場需求。

- 然而,預計潛在替代品的競爭將阻礙市場成長。

- 然而,未來核能發電對氧化鈹的需求和鈹鏡的新興應用預計將為研究市場創造新的機會。

- 預計北美將主導全球市場,大部分需求來自美國和加拿大。

鈹市場趨勢

電子和通訊領域佔據市場主導地位

- 消費性電子和通訊是鈹的主要終端用戶產業。鈹主要與銅形成合金,形成銅鈹合金。這些合金用於各種產品,包括電纜、高清晰度電視(HDTV)、電觸點、行動電話和電腦中的連接器、電腦晶片的散熱器、水下光纜、插座、恆溫器和波紋管。

- 鈹的優異導熱性可增加散熱能力,降低過熱風險並增強電子元件的可靠性。

- 隨著感測器、天線、電容器和電阻器等電子元件變得越來越小、功能越來越強大,鈹在這一不斷發展的領域中的重要性變得更加突出。

- 電子產業是世界上規模最大、成長最快的產業之一。在當今數位時代,電子設備對人們的生活產生著巨大的影響。預計電子產品的需求將持續成長,並繼續成為全球重要的經濟驅動力。

- 根據電子情報技術產業協會(JEITA)的資料,2023年全球電子及IT產業規模預計為3.3826兆美元,與前一年同期比較下降3%。不過,預計市場將出現復甦,到 2024 年將成長 9%,達到 36,868 億美元。

- 印度是繼中國之後的第二大智慧型手機製造國。據印度投資局稱,印度的目標是到 2025-26 年生產價值 1,260 億美元的行動電話。全球範圍內,智慧型手機的需求正在大幅成長。據 Telefonaktiebolaget LM Ericsson 稱,到 2027 年,智慧型手機用戶數量預計將達到 76.9 億部,從電子應用角度研究的市場利用率將不斷提高。

- 在美國,快速的技術進步和強勁的研發活動正在推動對尖端電子產品的需求。該行業正在經歷持續而顯著的發展。根據美國消費科技協會的報告,2023年美國消費性電子產品銷售的零售收入將達到4,850億美元,預計2024年將達到5,120億美元。

- 德國擁有歐洲最大的電子產業。根據德國電氣電子工業協會(ZVEI)的資料,該產業的總銷售收入預計將在2023年達到2,381億歐元(約2,580.6億美元)。全球消費性電器產品市場的主要驅動力包括技術進步、快速的都市化、蓬勃發展的住宅行業、人均收入的增加、生活水準的提高、對居家舒適度的日益重視、消費者生活方式的演變以及小型家庭數量的增加。

- 這些趨勢預計將增加對電子設備和通訊的需求,進而推動對鈹的需求。

北美佔據市場主導地位

- 預計北美將引領鈹市場,並將成為預測期內成長最快的地區。這種快速成長主要歸因於汽車、醫療保健、航太和國防、石油和天然氣、電子和通訊等領域的需求不斷成長,尤其是在美國和加拿大。

- 根據美國地質調查局的數據,美國是世界上最大的鈹礦產生產國,到 2023 年產量將達到 190 噸,高於 2022 年的 175 噸。

- 約 60% 的鈹礦資源位於美國,主要分佈在猶他州斯帕爾山地區,該地區含有包括大型鈹石源在內的錶殼層礦床。猶他州已探明和可能的鈹石蘊藏量估計含有約蘊藏量噸鈹。

- 鈹被用於汽車工業,因為其優異的導熱性、強度和耐腐蝕性使其成為各種應用的理想材料,包括煞車盤、點火器開關、安全氣囊感知器、動力傳動系統總成部件和電氣部件。隨著該地區汽車產量的增加,對鈹的需求也預計將增加。

- 美國擁有僅次於中國的世界第二大汽車產業,在區域和全球市場中發揮著至關重要的作用。根據國際汽車製造商組織(OICA)的資料,預計2023年美國汽車產量將達到10,611,555輛,較2022年成長5.56%,這將推動對鈹的需求。

- 根據加拿大汽車工業協會的報告,汽車產業為加拿大的GDP貢獻了190多億美元。根據預測,到 2024 年,這項貢獻將增加到 401 億美元,為鈹市場創造成長機會。根據OICA資料,2023年加拿大汽車產量將為1,553,026輛,與前一年同期比較成長25.92%。

- 鈹的高熱導率和出色的強度重量比使其在航太和國防領域極為重要。它用於高速飛機、飛彈和火箭引擎的噴嘴。該地區不斷擴大的航太和國防部門預計將增加對鈹的需求。

- 美國擁有北美最大的航空市場,並擁有世界上最大的飛機持有之一。航太零件向法國、中國和德國等國家的強勁出口,正在促進該行業的製造活動,從而對鈹市場產生積極影響。

- 根據美國聯邦航空管理局(FAA)的數據,受航空旅行和貨運需求大幅復甦的推動,民航機隊在2022-23年成長了0.2%。此外,預計未來 20 年美國航空客運量每年將成長 2.4%,從 2023 年的 9,220 億美元達到 2044 年的 1.32 兆美元,而美國幹線噴射機持有將從 2023 年的 4,832 架成長到 20494 年的 6,84 架。

- 在電子領域,鈹的高熱導率和非磁性使其成為電接觸、半導體和通訊的必需材料。隨著該地區電子產業的發展,預計未來幾年對鈹的需求將會成長。

- 美國電子產業正處於溫和的成長軌跡,這得益於對先進技術產品的需求激增以及強勁的研發活動所推動的快速技術創新。

- 2024 年 4 月,根據拜登總統的兩黨基礎設施立法,能源部 (DOE) 宣布計劃投資高達 3.31 億美元建設新的輸電線路,優先考慮工會勞動力。此外,我的政府正在主導舉措,與公共和私營部門領導人合作,加強國家電網,目標是在未來五年內升級10萬英里的輸電線路。

- 鈹具有高強度和電導性,廣泛應用於石油和天然氣領域,從井下油管到壓縮機和發電機。隨著該地區石油和天然氣行業的擴張,未來幾年對鈹的需求預計會增加。

- 加拿大統計局稱,2023年加拿大原油產量將連續第三年增加,與前一年同期比較增加1.4%,達2.864億立方公尺。此外,加拿大能源承包商協會預測,2024 年將鑽探 6,229 口油井,比 2023 年增加 481 口,這表明油砂生產商正處於擴張階段。

- 鑑於這些發展,預測期內北美對鈹的需求將會激增。

鈹行業細分

鈹市場高度整合。主要企業有Materion公司、烏爾巴冶金廠(哈薩克原工業股份公司)、湖南水口山有色金屬集團、IBC先進合金、新疆新鑫礦業等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 電子和通訊基礎設施需求不斷成長

- 由於性能優異,在醫療設備中的應用日益廣泛

- 其他促進因素

- 限制因素

- 與替代品的競爭

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 產品類型

- 合金

- 金屬

- 陶瓷

- 其他產品類型

- 最終用戶產業

- 工業部件

- 車

- 衛生保健

- 航太和國防

- 石油和天然氣

- 電子和通訊

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率**/排名分析

- 主要企業策略

- 公司簡介

- American Beryllia Inc.

- American Elements

- Belmont Metals

- Hunan Shuikoushan Nonferrous Metals Group Co. Ltd

- IBC Advanced Alloys

- Materion Corporation

- NGK Metals

- Texas Mineral Resources Corp.

- Tropag Oscar H. Ritter Nachf GmbH

- Ulba Metallurgical Plant(kazatomprom)

- Xiamen Beryllium Copper Technologies Co. Ltd

- Xinjiang Xinxin Mining Industry Co. Ltd

第7章 市場機會與未來趨勢

- 未來核能發電。

- 鈹鏡的新應用

- 其他機會

The Beryllium Market size is estimated at 337.26 tons in 2025, and is expected to reach 405.03 tons by 2030, at a CAGR of 3.73% during the forecast period (2025-2030).

The beryllium market faced setbacks due to COVID-19. Global lockdowns and stringent government regulations led to widespread shutdowns of production hubs. However, the market rebounded in 2021, and it is estimated to witness significant growth in the upcoming years.

Key Highlights

- Over the short term, the growing demand from electronics and telecommunication infrastructure and extensive usage of beryllium alloys in aerospace and military applications drive the market's demand.

- However, competition from potential alternatives is expected to hinder the market's growth.

- Nevertheless, future demand for beryllium oxide in nuclear power generation and emerging applications of beryllium mirrors are expected to create new opportunities for the market studied.

- North America is expected to dominate the global market, with the majority of demand coming from the United States and Canada.

Beryllium Market Trends

Electronics and Telecommunications Segment to Dominate the Market

- Consumer electronics and telecommunications stand out as key end-user industries for beryllium. Beryllium is predominantly alloyed with copper in these applications, forming copper-beryllium alloys. These alloys find their way into various products, including cables, high-definition televisions, electrical contacts, cell phone and computer connectors, computer chip heat sinks, underwater fiber optic cables, sockets, thermostats, and bellows.

- Beryllium's excellent thermal conductivity enhances heat dissipation, mitigating overheating risks and bolstering the reliability of electronic components.

- As electronic components like sensors, antennas, capacitors, and resistors shrink and gain capabilities, beryllium's significance in this evolving landscape becomes even more pronounced.

- The electronics industry is one of the world's largest and fastest growing. In the current digital era, electronic items significantly impact people's lives. The demand for electronic gadgets is projected to rise continuously and remain a significant economic driver globally.

- As per data from the Japan Electronics and Information Technology Industries Association (JEITA), the global electronics and IT industry saw a 3% year-over-year decline in 2023, totaling USD 3,382.6 billion. However, a rebound is anticipated, with projections of a 9% growth in 2024, reaching USD 3,686.8 billion.

- India is the second largest smartphone producer after China. As per Invest India, the country aims to manufacture cell phones worth USD 126 billion by 2025-26. Globally, the demand for smartphones is increasing at a significant rate. According to the Telefonaktiebolaget LM Ericsson, the subscription is likely to reach 7,690 million by 2027, enhancing the usage of the market studied from electronics applications.

- In the United States, swift technological advancements and robust R&D activities fuel a demand for cutting-edge electronic products. The industry is witnessing continuous and significant progress. The Consumer Technology Association reports that retail revenue from US consumer electronics sales reached an impressive USD 485 billion in 2023, with projections for 2024 set at USD 512 billion.

- Germany boasts the largest electronics industry in Europe. Data from the Germany Electrical and Electronics Association (ZVEI) indicates that the sector achieved an aggregated turnover of EUR 238.1 billion (approximately USD 258.06 billion) in 2023. Key drivers for the global household appliances market include technological advancements, rapid urbanization, a booming housing sector, rising per capita income, enhanced living standards, a growing emphasis on comfort in household chores, evolving consumer lifestyles, and an increasing number of smaller households.

- Given these dynamics, the demand for electronics and telecommunications is set to rise, subsequently fueling the demand for beryllium.

North America to Dominate the Market

- North America is poised to lead the beryllium market, emerging as the region with the fastest growth during the forecast period. This surge is primarily fueled by increasing demands across various sectors, including automotive, healthcare, aerospace and defense, oil and gas, and electronics and telecommunications, particularly in the United States and Canada.

- As per the US Geological Survey, the United States was the world's largest beryllium mine producer, with production amounting to 190 metric tons in 2023, growing from 175 tons in 2022.

- About 60% of beryllium resources are in the United States, mainly in the Spor Mountain area in Utah, where the epithermal deposit contains a large bertrandite source. Proven and probable bertrandite reserves in Utah are estimated at about 20,000 tons of contained beryllium.

- Beryllium is used in the automotive industry due to its high thermal conductivity, strength, and resistance to corrosion, making it an ideal material for various applications, including brake discs, ignition switches, airbag sensors, powertrain components, and electrical components. As vehicle production rises in the region, the demand for beryllium is expected to bolster.

- The United States boasts the world's second-largest automotive industry, trailing only China, and plays a pivotal role in regional and global markets. Data from the Organisation Internationale des Constructeurs Automobiles (OICA) indicates that the US automotive production reached 10,611,555 units in 2023, marking a 5.56% increase from 2022, bolstering the demand for beryllium.

- As reported by the Automotive Industries Association of Canada, the automotive sector contributes over USD 19 billion to Canada's GDP. Projections suggest this contribution will rise to USD 40.1 billion in 2024, presenting growth opportunities for the beryllium market. OICA data shows Canada produced 1,553,026 vehicles in 2023, a 25.92% increase from the prior year.

- Beryllium's high thermal conductivity and exceptional strength-to-weight ratio render it crucial in aerospace and defense. It is employed in high-speed aircraft, missiles, and rocket engine nozzles. With the aerospace and defense sector expanding in the region, the demand for beryllium is set to rise.

- The United States has the largest aviation market in North America and boasts one of the world's most extensive fleet sizes. Strong exports of aerospace components to nations like France, China, and Germany are propelling the industry's manufacturing activities, positively influencing the beryllium market.

- According to the Federal Aviation Administration (FAA), boosted by the sharp recovery in demand for air travel and cargo, the number of aircraft in the commercial fleet grew by 0.2% in 2022-23. Additionally, US airline enplanements are estimated to grow 2.4% per year over the next 20 years to USD 1.32 trillion in 2044 compared to USD 922 billion in 2023, and projects the US mainline jet fleet to grow from 4,832 in 2023 to 6,894 in 2044.

- In electronics, beryllium's high thermal conductivity and non-magnetic properties are essential for electrical contacts, semiconductors, and telecommunications. As the electronics sector grows in the region, the demand for beryllium is expected to grow in the coming years.

- The US electronics sector is on a moderate growth trajectory, driven by a surge in demand for advanced technological products and rapid innovation spurred by robust R&D activities.

- The Department of Energy (DOE), in April 2024, announced plans to invest up to USD 331 million in a new transmission line, prioritizing union labor, under President Biden's Bipartisan Infrastructure Law. Additionally, the administration is leading an initiative by collaborating with public and private sector leaders to enhance the nation's transmission network, aiming to upgrade 100,000 miles of transmission lines in the next five years.

- With its high strength and conductivity, beryllium finds applications in the oil and gas sector, from down-hole tubing to compressors and generators. With the expanding oil and gas sector in the region, the demand for beryllium is set to rise in the coming years.

- Statistique Canada reports that Canada's crude oil production rose for the third consecutive year in 2023, hitting 286.4 million cubic meters, a 1.4% increase from the previous year. Moreover, with projections from the Canadian Association of Energy Contractors anticipating 6,229 wells to be drilled in 2024, up 481 from 2023, it is evident that oil sand producers are in an expansion phase.

- Given these dynamics, North America is poised for a surge in beryllium demand during the forecast period.

Beryllium Industry Segmentation

The beryllium market is highly consolidated. The major players include Materion Corporation, Ulba Metallurgical Plant (Kazatomprom), Hunan Shuikoushan Nonferrous Metals Group Co. Ltd, IBC Advanced Alloys, and Xinjiang Xinxin Mining Industry Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Electronics and Telecommunication Infrastructure

- 4.1.2 Increasing Usage in Medical Equipment Owing to its Superior Properties

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Competition from Potential Alternatives

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Alloys

- 5.1.2 Metals

- 5.1.3 Ceramics

- 5.1.4 Other Product Types

- 5.2 End-user Industry

- 5.2.1 Industrial Components

- 5.2.2 Automotive

- 5.2.3 Healthcare

- 5.2.4 Aerospace and Defense

- 5.2.5 Oil and Gas

- 5.2.6 Electronics and Telecommunication

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 American Beryllia Inc.

- 6.4.2 American Elements

- 6.4.3 Belmont Metals

- 6.4.4 Hunan Shuikoushan Nonferrous Metals Group Co. Ltd

- 6.4.5 IBC Advanced Alloys

- 6.4.6 Materion Corporation

- 6.4.7 NGK Metals

- 6.4.8 Texas Mineral Resources Corp.

- 6.4.9 Tropag Oscar H. Ritter Nachf GmbH

- 6.4.10 Ulba Metallurgical Plant (kazatomprom)

- 6.4.11 Xiamen Beryllium Copper Technologies Co. Ltd

- 6.4.12 Xinjiang Xinxin Mining Industry Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Future Demand for Beryllium Oxide in Nuclear Power Generation

- 7.2 Emerging Applications of Beryllium Mirrors

- 7.3 Other Opportunities