|

市場調查報告書

商品編碼

1683977

非洲除草劑:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Africa Herbicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

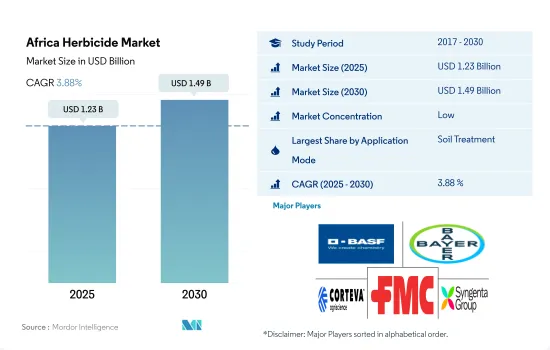

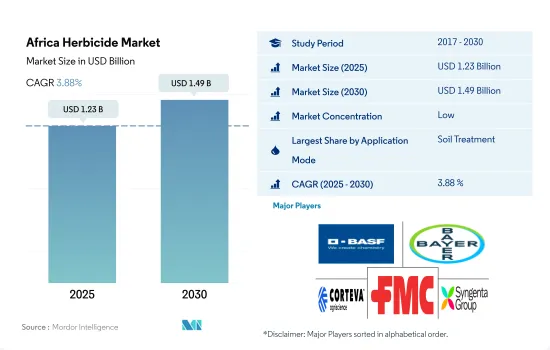

預計 2025 年非洲除草劑市場規模將達到 12.3 億美元,到 2030 年將達到 14.9 億美元,預測期內(2025-2030 年)的複合年成長率為 3.88%。

不同施用方式的採用在很大程度上取決於作物的生長階段和雜草種類。

- 非洲農業部門面臨許多挑戰,其中雜草是主要威脅。該地區的集約化農業實踐、犁地和主要作物的單一栽培導致各種雜草種類的繁殖並阻礙了作物的生長。由於各種社會經濟因素,農民使用不同的施用方法施用除草劑,以更好地控制雜草並促進作物生長。

- 除草劑的土壤處理施用方式大多被農民採用作為預防措施,在雜草生長初期進行控制,從而進一步減少除草劑的使用量和生產成本。預計預測期內該應用模式的市值將成長1.531億美元。

- 葉面施用除草劑是第二常用的施用方式,也是控制各種作物闊葉雜草的常用傳統做法。預計預測期內葉面噴布的使用量將會成長,市場成長額將達到 1.004 億美元。

- 日益嚴重的水資源短缺和微灌系統的進步為化學灌溉模式的興起提供了立足點,這種模式統一使用化學除草劑來更好地控制雜草。預計2023年至2029年間化學灌溉模式市場將成長5,440萬美元。

- 由於存在噴霧漂移和對人體潛在危害等相關風險,除草劑的燻蒸採用受到限制。另一方面,它已被證明能夠滲透到土壤中並有效控制雜草。

- 由於雜草侵染日益嚴重,該地區除草劑市場規模預計在預測期內將增加 3.123 億美元。

傳統除草方法帶來的風險增加了該地區對除草劑的需求。

- 非洲的農業部門集中在南非、衣索比亞、奈及利亞、埃及和肯亞等國家。農業是最重要的部門之一,大多數人口從事農業。該產業對撒哈拉以南非洲地區 GDP 的貢獻率為 14% 左右。在各種生物挑戰中,雜草對農業部門構成了重大威脅。傳統的雜草管理方法費時、昂貴、費力,導致農民採用除草劑作為主要的雜草控制方法。

- 歷史時期,除草劑的消費量大幅增加。 2017 年為 162,000 噸,到 2022 年將增加至 198,100 噸。消費量的成長主要是由於雜草侵染的增加和除草劑使用量的增加。平均而言,雜草每年在非洲造成高達25%的產量損失。產量損失的增加將進一步推動除草劑消費量在 2023 年至 2029 年間增加 9,611 噸。

- 穀物和穀類作物生產者在種植過程中主要使用化學除草劑,2022 年佔 45.1%。這些作物占主導地位的主要原因是種植面積大,單一栽培有利於各種雜草的生長。這種雜草可能導致該地區穀類作物產量高達 34%。因此,這些作物中除草劑的使用量很高。

- 該地區除草劑市場預計在預測期內實現 4.1% 的複合年成長率,解決與其他除草方法相關的問題。

非洲除草劑市場趨勢

該地區對糧食和高作物產量的需求不斷成長,將推動除草劑市場的發展

- 近年來,非洲除草劑的使用量明顯增加。除草劑消費量大幅增加,反映出農業實踐和雜草控制對除草劑的需求不斷成長。 2017年至2022年間,非洲每公頃除草劑消費量將大幅增加89.3%。這種激增可以歸因於農民對除草劑益處的認知不斷提高,以及他們提高單位土地農業生產率的願望。市場上各種除草劑的廣泛供應在鼓勵增加除草劑的使用方面發揮關鍵作用。

- 持續廣泛地使用單一除草劑或有限數量的除草劑,而沒有進行適當的輪作和多樣化,可能會產生抗性雜草種群。隨著時間的推移,這些抗性雜草將佔據主導地位,降低除草劑控制的有效性。輪換使用不同作用方式的除草劑有助於防止抗性雜草佔據主導地位。 2022 年,在南非發現了最常見的莧菜(Amaranthus palmeri,俗稱帕爾默莧菜)Glyphosate抗性機制。Glyphosate是一種常用於多種作物除草的農藥。然而,Glyphosate抗性雜草的出現對成功控制雜草構成了重大障礙。

- 非洲不斷成長的糧食需求迫切需要提高農業生產力。除草劑透過減少作物損失對提高農業產量做出了巨大貢獻。為了滿足人口的糧食需求,人們對除草劑的依賴性不斷增加。

對除草劑產品的高度依賴以及除草劑進口關稅法規的變化導致該地區活性成分價格波動。

- 雜草對非洲的農業部門構成了重大威脅,造成穀物和主要作物產量損失高達 34%。為了解決這個問題,農民嚴重依賴化學除草劑來有效地控制雜草。由於勞動力短缺和工資上漲,手工和機械除草等替代方案變得昂貴。

- 甲草胺是一種除草劑,用於控制玉米、胡蘿蔔、番茄、甜菜、蘆筍、蕪菁、大豆、蕓薹屬植物、葫蘆科植物、洋蔥、豌豆、豆類、小麥、生菜、菸草和草莓等作物中的多種一年生闊葉植物和草類。 2022 年,甲草胺的價格為每噸 16,580.9 美元,較 2017 年上漲 31.3%。價格上漲主要是由於需求增加,以及由於從非洲以外的國家進口而導致供應不足。南非是主要進口國,從印度進口甲草胺。

- Atrazine是南非和奈及利亞等玉米生產國最常使用的除草劑,這些國家約 88% 的玉米種植面積依靠Atrazine來除草。Atrazine用途廣泛,包括陸地作物和非作物、森林、住宅草坪、高爾夫球場、休閒區和牧場,並且是農場廣泛使用的除草工具。由於Atrazine可用於多種作物,其價格多年來一直在上漲。 2022 年,與 2017 年的價格相比,每公噸上漲了 3,292.7 美元。

- Glyphosate是該地區第二大最受歡迎的除草劑,由於其成本效益而被廣泛採用。截至 2022 年,活性成分Glyphosate的價格為每噸 1,143.2 美元。

非洲除草劑行業概況

非洲除草劑市場較為分散,前五大公司佔了27.04%的市場。該市場的主要企業有:BASF公司、拜耳公司、科迪華農業科技公司、富美實公司和先正達集團(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 活性成分價格分析

- 法律規範

- 南非

- 價值鍊和通路分析

第5章 市場區隔

- 執行模式

- 化學灌溉

- 葉面噴布

- 燻蒸

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

- 原產地

- 南非

- 其他非洲國家

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001679

The Africa Herbicide Market size is estimated at 1.23 billion USD in 2025, and is expected to reach 1.49 billion USD by 2030, growing at a CAGR of 3.88% during the forecast period (2025-2030).

Adoption of various application modes majorly depends upon the crop growth stage and weed type

- Africa's agricultural sector is facing various challenges, among which weeds are becoming a major threat to the sector. The region's intensive agricultural practices, no-tillage, and monoculture practices in major crops help various weed species to grow and hamper crop growth. Due to various socio-economic factors, farmers implement herbicide application through different application modes for better weed management and enhanced crop growth.

- The herbicide soil treatment application mode is majorly adopted by farmers as a precaution to control weeds in their early growth stages, which reduces further herbicide use and production costs. The market value for this application mode is expected to increase by USD 153.1 million during the forecast period.

- Foliar herbicide application is the next most adopted application mode and common traditional practice for controlling broadleaf weeds in various crops, which is effective in rapid action by targeting the weed species. The use of the foliar method is expected to grow during the forecast period, accounting for a market value growth of USD 100.4 million.

- Increasing water shortages and advancements in micro-irrigation systems help in the rise of the chemigation mode, which provides the uniform distribution of chemical herbicide applications for better weed management. The market for the chemigation mode will grow by USD 54.4 million during 2023-2029.

- The adoption of herbicide fumigation is limited due to its associated risks, such as spray drift and potential harm to human health. On the other hand, it has been found to effectively control weeds by penetrating the soil and other areas.

- The herbicide market in the region is expected to grow by USD 312.3 million during the forecast period, driven by the increasing weed infestations.

The risk associated with the traditional weeding methods is increasing the need for herbicides in the region

- The African agricultural sector is majorly concentrated in countries like South Africa, Ethiopia, Nigeria, Egypt, and Kenya. Agriculture is one of the most important sectors, and the majority of the population works in it. The sector contributes around 14% to Sub-Saharan Africa's GDP. Among various biotic and abiotic challenges, weeds are becoming a major threat to the agricultural sector. Traditional weed management practices are associated with being time-consuming, becoming more expensive, and needing more labor, and these factors divert farmers to adopt herbicides as a primary method for weed control.

- There was a significant growth in herbicide consumption during the historical period. In 2017, it was 162.0 thousand metric ton, which increased to 198.1 thousand metric ton in 2022. The consumption growth is majorly attributed to the increasing weed infestations and rise in herbicide adoption. On average, every year, weeds are causing yield loss of up to 25% in Africa. The increasing yield losses further drive the herbicide consumption growth by 9,611 metric ton during 2023-2029.

- Grain and cereal crop growers are majorly utilizing chemical herbicides in their cultivation, which accounted for 45.1% in 2022. The dominance of these crops is mainly due to their higher cultivation area and monoculture agriculture practices favoring various weed species to grow. Weeds cause a potential yield loss of up to 34% to cereals crops in the region. This resulted in higher utilization of herbicides in these crops.

- The herbicide market in the region is projected to register a CAGR of 4.1% during the forecast period, which will solve the problems associated with other methods of weed management.

Africa Herbicide Market Trends

Rising food demand in the region coupled with need for high productivity of the crops will drive the herbicide market

- In recent years, the use of herbicides in Africa has experienced a notable surge. There has been a substantial increase in the consumption of herbicides, reflecting a growing demand for these products in agricultural practices and weed management. From 2017 to 2022, herbicide consumption per hectare in Africa witnessed a significant growth of 89.3%. This upsurge can be attributed to the increased awareness among farmers regarding the advantages of herbicides and their desire to enhance agricultural productivity per unit of land. The wide availability of diverse herbicides in the market has played a significant role in driving the upswing in herbicide usage.

- Continuous and extensive use of a single herbicide or a limited set of herbicides without proper rotation or diversification can lead to the selection of resistant weed populations. Over time, these resistant weeds dominate the landscape, making herbicides less effective in controlling them. Rotation of herbicides with different modes of action to prevent the dominance of resistant weed populations. The most prevalent glyphosate resistance mechanism in Amaranthus palmeri, commonly known as palmer amaranth, was seen in the Republic of South Africa in 2022. Glyphosate is a frequently used pesticide for weed management in a variety of crops. However, the rise of glyphosate-resistant weed populations offers a considerable obstacle to successful weed control.

- Africa's rising food demand has led to a determined push to boost agricultural productivity. Herbicides contribute significantly to increased agricultural yields by lowering crop losses. The necessity to fulfill the population's food requirements drives the reliance on herbicides.

Heavy reliance on herbicide products and changing regulations on import tariffs on herbicides are leading to fluctuating active ingredient prices in the region

- In the African agriculture sector, weeds have emerged as a substantial threat, leading to yield losses of up to 34% in cereals and staple food crops. To address this issue, farmers heavily rely on chemical herbicides for effective weed control, as alternative methods like hand weeding and mechanical weeding have become cost-prohibitive due to labor shortages and rising wages.

- Metribuzin is a herbicide for control of various annual broadleafs and grasses in crops like maize, carrots, tomatoes, beetroot, asparagus, turnip, soybeans, brassicas, cucurbits, onions, peas, beans, wheat, lettuce, tobacco, and strawberries. The price of metribuzin was recorded as USD 16,580.9 per metric ton in 2022, which was 31.3% more than in 2017. This price increase is majorly attributed to the rising demand and unavailability as it is imported from other non-African countries. South Africa is the major importing country, and it imports metribuzin from India.

- Atrazine is the predominant herbicide utilized in maize-producing nations such as South Africa and Nigeria, with approximately 88% of the maize area relying on atrazine for weed control. Its application extends to numerous terrestrial food crops, non-food crops, forests, residential turf, golf courses, recreational areas, and rangelands, making it a widely adopted weed control measure on farms. Due to its expanding usage across different crops, the price of atrazine has been consistently rising each year. In 2022, it experienced a growth of USD 3,292.7 per metric ton compared to the price recorded in 2017.

- Glyphosate is extensively adopted as the region's second most prevalent herbicide, mainly owing to its cost-effectiveness. As of 2022, the price of glyphosate's active ingredient was recorded at USD 1,143.2 per metric ton.

Africa Herbicide Industry Overview

The Africa Herbicide Market is fragmented, with the top five companies occupying 27.04%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, FMC Corporation and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 South Africa

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 South Africa

- 5.3.2 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 Sumitomo Chemical Co. Ltd

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219