|

市場調查報告書

商品編碼

1683856

危險場所設備:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Hazardous Area Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

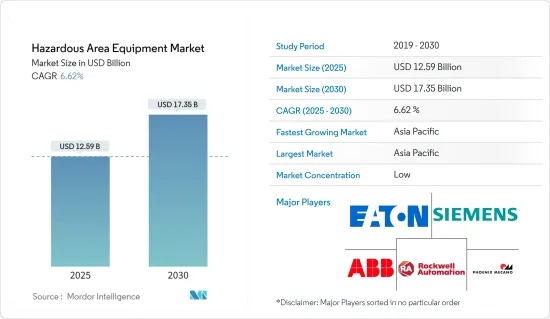

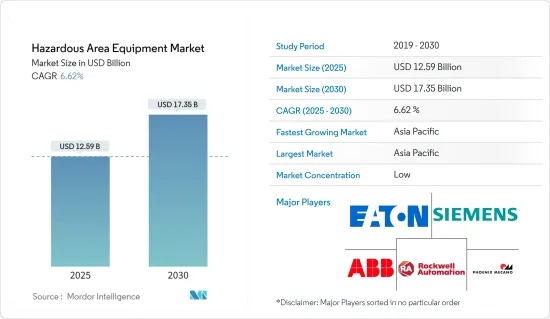

危險區域設備市場規模預計在 2025 年為 125.9 億美元,預計到 2030 年將達到 173.5 億美元,預測期內(2025-2030 年)的複合年成長率為 6.62%。

危險場所設備專門設計用於因存在可燃空氣、可燃性氣體或粒狀物而可能爆炸的環境。有幾種制度概述了此類設備的安全設計、功能和管理的標準。用於描述危險和保護措施的術語也各不相同。值得注意的是,在許多工業、商業和科學環境中,這種大氣的存在很常見,或至少是可能的。確保防火防爆對於員工安全和操作的可靠性至關重要。

主要亮點

- 危險區域設備的需求是由各種政府安全法規以及防止危險環境中發生事故和爆炸的需要所驅動的。設備設計的技術進步和對能源效率的日益重視也推動了市場的成長。

- 儘管危險區域設備產業正在成長,但仍有幾個因素阻礙其進一步發展。與設備相關的高費用以及需要合格的專業人員來操作設備是影響市場擴張的主要障礙。

- 危險區域設備缺乏統一的標準和認證以及偏遠地區對這些產品的取得有限也對市場的成長構成了重大挑戰。

- 此外,加工和冷凍行業等部門對安全措施的日益重視,也推動了對防火防爆危險區域設備(如工業控制器、電纜固定頭、馬達、感測器、頻閃燈、照明和其他相關設備)的需求。此外,各行各業,尤其是加工和冷凍產業,越來越重視加強安全措施,導致對危險區域設備的需求增加,預計在預測期內將大幅成長。

- 在危險區域使用的設備被嚴格封閉,以防止潛在的危險。這些設備通常由堅固的材料製成,例如壓鑄鋼,有時也由塑膠製成。此密封可有效防止因設備故障產生熱或火花而引發爆炸。

- 此外,各國在確保危險區域所使用的設備的安全方面也存在差異。雖然這些設備有其優點,但它們的實施成本相當高,而且相當笨重。因此,安裝危險區域設備的高初始成本阻礙了市場的成長。

危險區域設備市場趨勢

石油和天然氣終端用戶產業預計將佔據相當大的市場佔有率

- 在石油和天然氣行業,防爆有兩個要求:這意味著設備必須按照適當的標準製造,並按照附加標準安裝和維護。此外,石油和天然氣員工經常需要在危險的環境中工作。當有大量易燃液體、氣體、蒸氣或可燃粉塵時,安全非常重要。這些要求將在未來幾年增加對危險區域設備的需求。

- 市場正在經歷一系列技術創新,以幫助客戶進行日常建設、營運、最佳化和資產增值,並在更危險的情況下提供替代電氣解決方案。此外,預計即將到來的石油蘊藏量發現和探勘過程的投資將推動對危險區域設備的需求。例如,根據國際能源總署(IEA)預測,到2040年,全球石油需求將增加21%,石油占總能源的35%,而天然氣需求將成長31%,天然氣佔總能源的17%。

- 此外,汽車、能源、機械製造、電力、化學和冶金行業對原油和成品油(包括暖氣油和柴油)的需求不斷增加,進一步推動了石油和天然氣探勘過程,間接推動了對危險區域設備的需求。預計2022年全球原油(包括生質燃料)需求量將達到約9,957萬桶/日,2023年將增加至1.0189億桶/日。

- 危險場所主要分佈在石油和天然氣工業,這些場所在有限的區域內存在高濃度的可燃性氣體。根據GECF的數據,2022年12月中國天然氣消費量量達335億立方公尺。國際能源總署預計,到2040年,中國的天然氣需求將達到2,800億立方公尺。到2040年,中國還可能成為每天1,300萬桶的石油淨進口國,到2030年超過美國成為世界上最大的石油消費國。石油和天然氣行業的擴張可能會進一步推動市場成長。

- 印度石油部先前宣布,未來幾年將在印度的石油和天然氣探勘及天然氣基礎設施開發上投入約1,180億美元,其中2023年將投入580億美元用於石油和天然氣探勘和展示,2024年將投入600億美元用於開發管道、進口終端和城市燃氣發行網路等天然氣基礎設施。因此,預計市場將大幅成長。

預計亞太地區將佔據主要市場佔有率

- 中國是世界主要製造設備和工具機生產國和出口國之一。過去十年製造業活動的激增帶動了設備和工具產量的增加。因此,這種成長影響了防爆設備的採用率。根據國際半導體設備與材料協會的數據,2022年中國半導體設備銷售額將達到近1.38兆元(1,900億美元)。

- 製造過程中自動化程度的不斷提高預計將增加對防爆解決方案的需求。許多工業和製造工廠都有負責人定期進行現場檢查,沿著既定路線行駛並在特定地點檢查現場設備,以確保設施和設備的安全和良好的工作狀態。

- 在印度,採礦業的工業化和市場發展的不斷推進導致對所研究市場成長的投資頻繁。此外,由於新政府支持該行業,印度採礦業正在擴張。 MOSPI數據顯示,截至22會計年度末,印度全國礦業產量增加了約12%。

- 此外,據 IBEF 稱,政府計劃在 2022-25 年期間將採礦業價值 28,727 億印度盧比(36.8 億美元)的資產收益。此外,2023 年 2 月,JSW 集團宣布將在安得拉邦 YSR Kadapa 區建造一座鋼鐵廠,投資 880 億印度盧比(10 億美元)。此類金屬和採礦廠的開發可能會在研究市場中創造進一步的需求。

- 日本是領先的汽車和電子設備製造國之一,全球對這些產品的需求正在激增。這推動了製造設施的建設和升級,以滿足全球需求並提供新的創新產品。為了實現這一點,需要機械來進行活動,從而增加製造業中防爆設備的成長。

危險區域設備市場概況

危險場所設備市場競爭非常激烈,幾家老字型大小企業都在爭奪市場佔有率。該行業的一些知名公司包括 ABB 有限公司、伊頓公司、霍尼韋爾國際公司、西門子股份公司和羅克韋爾自動化公司。

這些公司擁有強大的國際影響力,提供各種危險區域設備,包括防爆照明、通訊工具、控制系統和感測器。為了維持市場地位,這些公司優先考慮技術創新、產品進步和策略夥伴關係。

除了這些老字型大小企業外,危險區域設備產業還有幾家新參與企業和新興企業。這些公司雄心勃勃,希望透過創新和先進的產品來提高安全性和效率,從而徹底改變市場。然而,他們面臨著來自已經擁有強大品牌聲譽和忠實基本客群的老字型大小企業的激烈競爭。

- 2023 年 5 月-ABB 宣布將在田納西州孟菲斯開設價值 300 萬美元的羅伯特·M·托馬斯創新中心,以加速開發下一代電氣化解決方案。

- 2023 年 8 月 - 伊頓公司 PLC 宣布將在 2023 年自動化博覽會上展示針對危險區域的新型工業解決方案。我們將展示乙太網路同軸電纜 (EoC) CCTV解決方案、用於 2、21 和 22 區危險區域的 nHLL 線性 LED 燈具,以及用於石油和天然氣、化學加工和污水處理等行業的智慧通用編組 (MTL SUM5)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

- 評估宏觀趨勢對你所在產業的影響

第5章 市場動態

- 市場促進因素

- 加強有關危險區域和材料處理的規定

- 能源需求增加,推動新礦探勘需求

- 市場挑戰/限制

- 設備投資及安裝成本高

第6章 市場細分

- 按設備

- 供電系統

- 馬達

- 監控系統

- 電纜固定頭和連接器

- 自動化和控制產品

- 外殼

- 照明產品

- 按鈕和訊號裝置

- 按最終用戶產業

- 石油和天然氣

- 能源與發電

- 化學

- 食品和飲料

- 藥品

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 按產品類型和最終用戶產業分類的佔有率

- 危險設備製造商名單

- 法國

- 西班牙

- 義大利

- 比荷盧

- 亞洲

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 拉丁美洲

- 墨西哥

- 巴西

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章 區域評級-市場狀況

- 0/20 區,I/II/III 級 1 分區

- 1/21 區,I/II/III 級 2 分區

- 2/22 區,I/II/III 級 2 分區

第8章競爭格局

- 公司簡介

- ABB Ltd

- Eaton Corporation PLC

- Siemens AG

- Rockwell Automation Inc.

- Phoenix Mecano

- R. Stahl AG

- CZ Electric Co. Ltd

- Pepperl+Fuchs GmbH

- Cordex Instruments Ltd

- Marechal Electric Group

- Adalet Inc.(Scott Fetzer Company)

- Bartec GmbH

- Alloy Industry Co. Ltd

- GM International Srl

- Spina Group SRL

- Supermec Pte. Ltd

- Wago GmbH & Co. KG

- Warom Technology Inc. Co.

- Honeywell HBT

- Hangzhou Hikvision Digital Technology Co. Ltd

第9章 市場展望

The Hazardous Area Equipment Market size is estimated at USD 12.59 billion in 2025, and is expected to reach USD 17.35 billion by 2030, at a CAGR of 6.62% during the forecast period (2025-2030).

Equipment for hazardous areas is specifically designed for use in environments that are highly explosive due to the presence of combustible air-flammable gases or particulate combinations. There are multiple schemes that outline the standards for the safe design, functioning, and management of such equipment. The terminology used to describe hazards and protective measures can also vary. It is important to note that the presence of such an atmosphere is common or at least possible in numerous industrial, commercial, and scientific settings. Ensuring fire and explosion protection is crucial for the safety of employees and the reliability of operations.

Key Highlights

- The demand for hazardous area equipment is being driven by the implementation of safety regulations by various governments and the need to prevent accidents and explosions in hazardous environments. The market growth is also being propelled by technological advancements in equipment design and the growing emphasis on energy efficiency.

- Although the hazardous area equipment industry has experienced growth, there are several factors that impede its further development. The significant expenses associated with the equipment and the necessity for qualified professionals to operate them are the primary obstacles affecting market expansion.

- The absence of uniform standards and certification for hazardous area equipment, along with the limited accessibility of these products in remote areas, pose substantial challenges to the market's growth.

- There is also a growing demand for flame- and explosion-proof hazardous area equipment, such as industrial controllers, cable glands, motors, sensors, strobe beacons, lighting, and other related items, due to the heightened emphasis on safety measures in sectors like process and cooling industries. Also, the increasing focus on enhancing safety measures in various industries, specifically in process and cooling sectors, is leading to a rise in demand for hazardous area equipment and is expected to experience substantial growth in the forecast period.

- The equipment used in the hazardous area is securely enclosed to prevent any potential hazards. These equipment are typically made of sturdy materials such as die-cast steel and sometimes plastic. The enclosure effectively prevents explosions in case of faulty equipment generating heat or sparks.

- Additionally, different countries have their own methods of ensuring the safety of equipment used in hazardous areas. While these equipment offers benefits, their deployment can be quite costly, and they can become quite heavy. As a result, the high initial cost of implementing hazardous area equipment is hindering market growth.

Hazardous Area Equipment Market Trends

Oil and Gas End-user Industry Segment is Expected to Hold Significant Market Share

- In the oil and gas industry, explosion proofing has two requirements: equipment must be manufactured to the appropriate standards and installed and maintained in accordance with additional standards. Also, oil and gas employees are frequently required to work in dangerous environments. Safety is significant when flammable liquids, gases, vapors, or combustible dust are present in substantial amounts. Such requirements are creating increasing demand for hazardous area equipment in the coming years.

- The market is witnessing various innovations to assist customers in the daily construction, operation, optimization, and enhancement of their assets and provide alternative electrical solutions in more hazardous situations. Moreover, the discovery of oil reserves and upcoming investments in the exploration processes is expected to drive the demand for hazardous area equipment. For instance, the International Energy Agency said that by 2040, the world's demand for oil will go up by 21%, making it the source of 35% of all energy, and the demand for natural gas will go up by 31%, making it the source of 17% of all energy.

- Additionally, the increasing demand for crude oil and finished oils, including heating oil and diesel fuel in the automobile, energy, machinery manufacturing, electricity, chemicals, and metallurgy sectors has further boosted the need for more oil and gas exploration processes, indirectly driving the demand for hazardous area equipment. The demand for crude oil (including biofuels) in 2022 globally amounted to approximately 99.57 million barrels per day, and it is forecasted to increase to 101.89 million barrels per day in 2023.

- Hazardous locations are primarily found in the oil and gas industry, as areas with limited presence of combustible gas are high. According to GECF, in December 2022, natural gas consumption in China amounted to 33.5 billion cubic meters (bcm). In addition, according to the IEA, the country is expected to account for 280 billion cubic meters of global natural gas demand by 2040. It also has the potential to overtake the United States as the ultimate oil consumer by 2030, with 13 million barrels per day net imports by 2040. Such expansion in the oil and gas industries may further propel the market's growth.

- The government's Oil Ministry's earlier announcement related to the spending of around USD 118 billion in the oil and gas exploration and setting up of natural gas infrastructure in India over the next few years, which USD 58 billion would be funded in oil and gas exploration and exhibition, by 2023 while USD 60 billion will be put in the development of natural gas infrastructure, such as pipelines, import terminals, and city gas distribution networks by 2024. Thus, the market is anticipated to witness significant growth.

Asia-Pacific is Expected to Hold Significant Market Share

- China is one of the significant producers and exporters of manufacturing equipment and machine tools worldwide. The surge in manufacturing activities over the last decade has increased the production of equipment and tools. Therefore, this growth is impacting the rate of adoption of explosion-proof equipment. According to Semiconductor Equipment and Materials International, in 2022, the sales revenue from semiconductor equipment in China reached almost CNY 1.38 trillion (USD 0.19 trillion).

- The increasing adoption of automation in manufacturing procedures is expected to propel the demand for explosion-proof solutions. At many industrial and manufacturing plants, personnel periodically perform field inspections by patrolling along defined routes and checking field devices at specific points to keep facilities and equipment safe and in good working order.

- India is frequently investing in the studied market growth due to the increase of industrialization and the development of Mining industries in the country. Additionally, India's mining sector has expanded due to a new government that is pro-industry. According to MOSPI, at the end of fiscal year 2022, production of the mining industry across India increased by about 12%.

- Further, according to IBEF, the government plans to monetize assets worth INR 28,727 crore (USD 3.68 billion) in the mining sector over 2022-25. Additionally, in February 2023, JSW Group announced the construction of a steel plant in Andhra Pradesh's YSR Kadapa district with an investment of INR 8,800 crore (USD 1 billion). Such developments in the metals and mines plants may further create demand in the studied market.

- Japan is one of the significant manufacturers of automobiles and electronic equipment, and the demand for these products is increasing rapidly worldwide. This factor has led to the rise in construction and upgrading manufacturing facilities to meet global demand and provide new and innovative products. To facilitate this, machinery is required to carry out the activities, thus increasing the growth of explosion-proof equipment in the manufacturing sector.

Hazardous Area Equipment Market Overview

The hazardous area equipment market is quite competitive, with several well-established players competing for market share. Among the prominent companies in this industry are ABB Ltd, Eaton Corporation, Honeywell International Inc., Siemens AG, and Rockwell Automation Inc.

These companies possess a robust international influence and provide a diverse array of hazardous area equipment, including explosion-proof lighting, communication tools, control systems, and sensors. To uphold their standing within the market, these companies prioritize innovation, product advancement, and strategic partnerships.

In addition to these established players, there are several new entrants and startups emerging in the hazardous area equipment industry. These companies have the ambition to revolutionize the market with their innovative and advanced products, which bring enhanced safety and efficiency. Nevertheless, they encounter strong competition from well-established players who have already built a solid brand reputation and loyal customer base.

- May 2023 - ABB Ltd announced the opening of its USD 3 million Robert M. Thomas Innovation Center in Memphis, Tennessee, to accelerate the development of next-generation electrification solutions.

- August 2023 - Eaton Corporation PLC company announced to showcase its new industrial solutions for hazardous areas at Automation Expo 2023. It will introduce Ethernet over Coax (EoC) CCTV solution, nHLL linear LED fixture used in Zone 2 and 21 and 22 hazardous areas, and Smart Universal Marshalling (MTL SUM5) for industries such as oil & gas, chemical processing, and wastewater treatment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 An Assessment of Macro Trends Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stricter Regulations for Handling Hazardous Areas and Substances

- 5.1.2 Increasing Energy Requirements, Driving the Demand for Exploration of New Mines

- 5.2 Market Challenges/Restraints

- 5.2.1 High Investments and High Installation Cost of the Equipment

6 MARKET SEGMENTATION

- 6.1 By Equipment

- 6.1.1 Power Supply Systems

- 6.1.2 Electric Motors

- 6.1.3 Surveillance Systems

- 6.1.4 Cable Glands and Connectors

- 6.1.5 Automation and Control Products

- 6.1.6 Enclosures

- 6.1.7 Lighting Products

- 6.1.8 Push Buttons and Signaling Devices

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Energy and Power Generation

- 6.2.3 Chemical

- 6.2.4 Food and Beverage

- 6.2.5 Pharmaceuticals

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.2.1 Market Share by Product Category and End-user Industry

- 6.3.2.2.2 List of Manufacturers of Hazardous Equipment

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Italy

- 6.3.2.6 Benelux

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.4.1 Mexico

- 6.3.4.2 Brazil

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.1 North America

7 AREA RATING - MARKET SCENARIO

- 7.1 Zone 0 / 20, Class I / II / III Division 1

- 7.2 Zone 1 / 21, Class I / II / III Division 2

- 7.3 Zone 2 / 22, Class I / II / III Division 2

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 ABB Ltd

- 8.1.2 Eaton Corporation PLC

- 8.1.3 Siemens AG

- 8.1.4 Rockwell Automation Inc.

- 8.1.5 Phoenix Mecano

- 8.1.6 R. Stahl AG

- 8.1.7 CZ Electric Co. Ltd

- 8.1.8 Pepperl+Fuchs GmbH

- 8.1.9 Cordex Instruments Ltd

- 8.1.10 Marechal Electric Group

- 8.1.11 Adalet Inc. (Scott Fetzer Company)

- 8.1.12 Bartec GmbH

- 8.1.13 Alloy Industry Co. Ltd

- 8.1.14 G.M. International Srl

- 8.1.15 Spina Group SRL

- 8.1.16 Supermec Pte. Ltd

- 8.1.17 Wago GmbH & Co. KG

- 8.1.18 Warom Technology Inc. Co.

- 8.1.19 Honeywell HBT

- 8.1.20 Hangzhou Hikvision Digital Technology Co. Ltd