|

市場調查報告書

商品編碼

1683522

安全存取服務邊際(SASE) -市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Secure Access Service Edge (SASE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

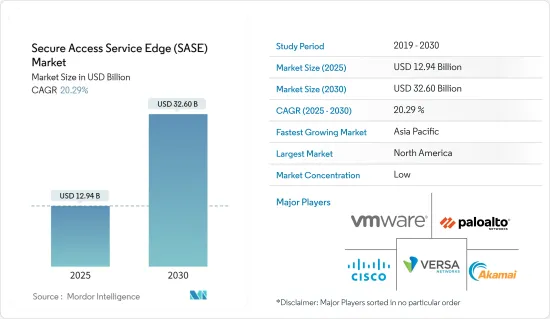

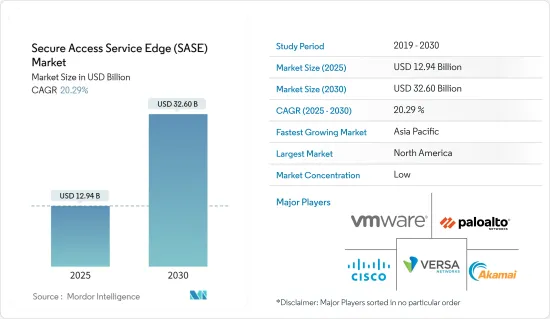

安全存取服務邊際市場規模預計在 2025 年為 129.4 億美元,預計到 2030 年將達到 326 億美元,預測期內(2025-2030 年)的複合年成長率為 20.29%。

SASE 代表了網路存取安全的模式轉移。它將網路和安全功能(如防火牆即服務 (FWaaS)、SD-WAN 甚至網路即服務 (NaaS))整合到單一雲端原生服務中。這種整合以可擴展、靈活和安全的方式保護和連接您分散式的勞動力和雲端基礎的應用程式。

主要亮點

- SASE 提高了 SDN 環境的安全性並完善了軟體定義網路 (SDN) 系統。 SDN 支援動態網路配置,SASE 確保網路在變更以滿足不斷變化的需求時能夠得到安全保障。隨著物聯網 (IoT) 的發展,SASE 保護著物聯網設備及其產生的資料。在物聯網背景下,安全通訊和資料保護至關重要。

- 此外,雲端基礎的SASE 的採用可能會激增。例如,2024年2月,華為在IP Club Carnival上推出了全新的HiSec SASE解決方案。新發布的解決方案具有從雲端到網路到邊緣到端點的整合式智慧保護功能,為企業總部和分公司提供一致的安全保障。

- 隨著公有雲使用量的成長,各種類型的企業都在增加雲端運算支出。雲端運算支出已成為 IT 預算的重要組成部分,約有 77% 的公司報告年度雲端運算支出超過 1,200 萬美元,80% 的公司報告年度雲端運算支出超過 120 萬美元。小型企業的工作量較少、規模較小,這意味著整體雲端成本較低。

- 市場相關人員關心的是,在為客戶提供 SASE 服務的同時,保持適當的監管合規性和管理成本。供應商可能難以保證其技術的安全、平穩運作並遵守所有適用的法律法規。供應商未能遵守規則和標準可能會對其服務產生負面影響並危及其客戶的業務運作。供應商提供的計劃和服務優先考慮並遵守普遍接受的標準和服務交付最佳實踐。供應商需要幫助來跟上不斷發展的技術和政府法規。

- 在全球範圍內更多企業中擴大投資策略可能會加速採用安全存取服務邊緣來支援業務成長。在後 COVID-19 時代,我們預計提供單一供應商 SASE 的供應商數量將顯著增加。後 COVID-19 時代的新 SD-WAN 購買很可能是單一供應商 SASE 產品的一部分。

安全存取服務邊際(SASE) 市場趨勢

大公司佔有較大的市場佔有率

- 邊緣運算的日益普及、向雲端基礎設施的轉變以及遠端工作的快速擴展正在顯著改變傳統的網路架構和安全模型。擁有大量 IT 預算和技術熟練的員工的大型企業正在迅速適應這個市場現實。

- 採用分散式勞動力模式的大型企業發現,傳統的 WAN 架構由於其 VPN 聚合容量嚴重有限,無法適應大多數隨處辦公 (WFA) 工作流程。現有的安全模型和靜態的數位轉型投資在過去幾年減緩了大型企業對 SASE 的採用。

- 新IT基礎設施正在全球市場擴張。越來越多的大型企業正在將安全性和網路整合到單一雲端平台上。因此,惡意軟體即服務正在針對暴露的物聯網和OT環境(例如醫院、油氣天然氣田、電網、運輸服務和企業網路)大規模運作。威脅行為者需要付出大量調查努力才能發現並利用嵌入式物聯網和營運技術設備的操作環境和配置。

- 根據微軟《2023年數位防禦報告》,全球的攻擊呈現增加趨勢,其中以身分攻擊最為常見,佔所有攻擊的42%。此外,網路攻擊逐年增多,全球勒索軟體相關損失的成本不斷上升。根據微軟 2024 年的報告,密碼攻擊嘗試次數從每月約 30 億次飆升至每月 300 億多億次。

- 在我們互聯的數位世界中,設備上線並與更大的系統通訊,收集大量資料並創造可視性,從而為大型企業創造商機。這種情況也為網路威脅打開了大門,並使網路犯罪成為價值數十億美元的產業。電腦、路由器、印表機、網路攝影機和遠端系統管理設備等物聯網設備都面臨安全風險。由於這些設備對於許多組織的業務至關重要,因此它們很快就會成為負擔和安全風險。各行各業迅速採用物聯網解決方案增加了攻擊媒介機會組織面臨風險。針對遠端管理設備的攻擊、基於網路的攻擊和資料庫攻擊在大型企業中最為普遍。

- 上述事件可能會促進大型企業採用網路即即服務(NaaS),因為它具有區別於其他安全網路策略的功能。 SASE 不依賴資料中心的安全性,而是採取直接的方法,因為來自使用者裝置的所有流量在發送到最終目的地之前會在更靠近使用者的點進行檢查。這使其成為保護雲端中的分散式勞動力和資料的理想選擇。在當今以雲端為中心的大型企業中,使用者、裝置和應用程式需要從任何地方安全地存取工作。舊有系統無法承受提供這種靈活性所需的頻寬。然而,SASE 透過允許任何使用者或裝置(無論位於何處)進行訪問,同時保持企業級安全性,從而增強了該領域的需求。

北美佔很大佔有率

- 美國是一個發達的經濟體,其先進技術的採用和接受、網路自動化的發展以及雲端基礎的服務的普及為安全接入服務邊際市場做出了重大貢獻。終端用戶產業數位化,以及Cisco、 VMware、Palo Alto Networks、Versa Networks 和 Akamai Technologies 等知名供應商的出現,促進了市場的成長。

- 隨著企業數位化轉型快速加速,安全正轉向雲端運算。隨著多個終端用戶產業廣泛採用雲端服務,需要保護網路基礎架構、降低複雜性並提高速度和靈活性。預計這將為未來幾年的市場供應商提供巨大的成長機會。

- 美國有三大雲端服務供應商:Amazon Web Services,Microsoft Azure和Google Cloud。它也被認為是 5G、自動駕駛、物聯網、區塊鏈、人工智慧和遊戲等重大技術創新的中心。整合 SASE 功能可以將零信任安全功能整合到企業架構中,這對於實現可信任的網路安全態勢至關重要。透過這種方式,SASE 解決方案正在改變最終用戶網路和安全架構,降低網路風險、成本和複雜性。

- Orange Business、Palo Alto Networks 和 Orange Cyberdefense 於 2023 年 8 月建立合作夥伴關係,為全球企業提供雲端原生、託管的安全存取服務邊際(SASE) 解決方案。隨著企業加速採用雲端來支援混合業務並向客戶提供現代產品和服務,數位攻擊面正在擴大。該夥伴關係將提供業界最完整的人工智慧 SASE 解決方案、諮詢和顧問服務以及全球託管網路、安全和數位服務。這項服務使組織能夠最大限度地提高其 SASE 轉型的投資收益(ROI)。

- 加拿大在雲端運算應用方面處於領先地位。許多組織正在部署公有雲、私有雲和邊緣雲端的組合。混合工作和雲端轉型的興起增加了對超越網路邊界的保全服務的需求,對加拿大市場的成長產生了積極影響。此外,該國擁有嚴格的資料保護和監管法律,進一步推動了終端用戶產業對 SASE 解決方案的需求。

- 預計自動化程度的提高和連網設備的引入將推動市場需求的大幅成長。網路即服務 (NaaS) 模式使中小型企業受益,因為它減輕了日常設備維護的負擔,使他們能夠專注於客戶服務等任務。由於加拿大擁有大量小型企業,預計 NaaS 將成為未來幾年的一大趨勢。

安全存取服務邊際(SASE) 市場概覽

安全接入服務邊際市場中的供應商提供各種服務,並且適度整合。然而,VMware、Palo Alto Networks、Versa Networks Inc. 和 Cisco Systems Inc. 等主要供應商是不同地區各類終端使用者高度青睞的網路服務供應商。

- 2024 年 1 月-Kindrill 宣布將與思科合作推出兩項新的 Security Edge 服務,以協助客戶改善安全管理並主動解決和應對網路事件。新推出的安全邊緣服務,以及 Kyndryl 和思科可用的 SD-WAN 服務,使企業能夠為向安全存取服務邊際(SASE) 架構的過渡奠定堅實的基礎。

- 2024 年 1 月 - Vertha Networks 是領先的基於 AI/ML 的整合安全存取服務邊際(SASE) 解決方案供應商,宣布推出一系列新的整合 SASE 閘道。這些閘道器提供超過 100Gbps 的驚人吞吐量,旨在滿足對增強運算能力日益成長的需求。這項需求是由產業內網路和安全功能日益融合所推動的。 Versa 的新閘道器將高效能硬體與 Versa 作業系統 (VOS)(該公司的整合 SASE 軟體堆疊)結合,具有單一途徑架構。這種效能的提升使企業首次能夠將安全功能和多種網路功能整合到單一閘道器上。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 評估影響市場的宏觀經濟因素

第5章 市場動態

- 市場促進因素

- 越來越需要結合 SD-WAN、FWaaS、SWG、CASB 和 ZTNA 功能的單一網路架構

- 缺乏安全程序和工具

- 強制遵守資料保護和監管法律

- 市場限制

- 缺乏有關雲端資源、雲端安全架構和 SD-WAN 策略的知識

- 前期成本高,且 SASE 架構及其組件缺乏標準化

第6章 市場細分

- 依產品類型

- 網路即服務

- 安全即服務

- 按組織規模

- 大型企業

- 中小型企業

- 按最終用戶產業

- BFSI

- 資訊科技/通訊

- 零售

- 衛生保健

- 政府

- 製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 比利時

- 荷蘭

- 盧森堡

- 丹麥

- 芬蘭

- 挪威

- 瑞典

- 冰島

- 亞洲

- 印度

- 中國

- 日本

- 台灣

- 韓國

- 馬來西亞

- 香港

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Cisco Systems Inc.

- VMWare Inc.

- Palo Alto Networks.

- Versa Networks Inc.

- Akamai Technologies Inc.

- Cato Networks

- Fortinet Inc.

- Check Point Software Technologies Ltd

- Cloudflare Inc.

- Forcepoint

第8章投資分析

第9章:未來市場展望

The Secure Access Service Edge Market size is estimated at USD 12.94 billion in 2025, and is expected to reach USD 32.60 billion by 2030, at a CAGR of 20.29% during the forecast period (2025-2030).

SASE signifies a paradigm shift in network access security. It combines network and security features, like Firewall-as-a-service (FWaaS) and SD-WAN, further combining network-as-a-service (NaaS) into a single cloud-native service. With this convergence, distributed workforces and cloud-based applications will be protected and connected in a scalable, flexible, and secure manner.

Key Highlights

- SASE improves security in SDN environments, thereby completing software-defined networking (SDN) systems. Dynamic network configuration is made possible by SDN, and SASE guarantees that these networks are secure as they change in order to meet the changing requirements. SASE protects IoT devices and the data they generate as the Internet of Things (IoT) develops. In the context of the IoT, secure communications and data protection are essential.

- Furthermore, cloud-based SASE may witness a surge in adoption. For instance, in February 2024, Huawei announced the new HiSec SASE Solution launch at the IP Club Carnival. This newly launched solution comes with cloud-network-edge-endpoint integrated intelligent protection, providing consistent security assurance for the enterprise headquarters and branches.

- The increasing usage of the public cloud is boosting cloud spending for businesses of all kinds. Cloud spending is already a significant aspect of IT budgets, wherein about 77% of companies stated that their annual cloud spending value surpasses USD 12 million, and 80% of them stated that the value exceeds USD 1.2 million. As SMBs have fewer and smaller workloads, their overall cloud costs are cheaper.

- The market players are concerned about maintaining proper regulatory compliance while offering clients SASE services and executing expenses. Sometimes, vendors find it difficult to safeguard their technology, keep running smoothly, and comply with all applicable laws and regulations. Vendors' non-compliance with rules and standards can adversely affect their services and jeopardize clients' business operations. By adhering to the accepted standards and best service-delivery practices, they offer programs and services to prioritize them. Vendors need help keeping up with evolving technologies and government regulations.

- The growth in investment strategies in a larger share of businesses globally will accelerate the adoption of secure access service edge in supporting business growth. In the post-COVID-19 era, there will be a significant increase in the number of vendors with single-vendor SASE offerings. New SD-WAN purchases in the post-COVID-19 era will be part of a single-vendor SASE offering.

Secure Access Service Edge (SASE) Market Trends

Large Enterprises will Hold Major Market Shares

- Increased adoption of edge computing, the shift to cloud infrastructure, and a surge in remote work have challenged many traditional network architectures and security models. Large enterprises with access to larger IT budgets and skilled employees are rapidly adapting to this market reality.

- Large enterprises with a distributed workforce model find the traditional WAN architectures with rigidly limited VPN aggregation capacity inadequate for most work-from-anywhere (WFA) workflows. Existing security models and fixed digital transformation investments have slowed down the adoption of SASE among large enterprises over the last few years.

- The global market is witnessing an expansion in new IT infrastructure. Large enterprises that combine security and networks into a single cloud platform are proliferating. As a result, Malware-as-a-service has moved to large-scale operations against exposed IoT and OT in hospitals, oil and gas fields, electrical grids, transportation services, and corporate networks. Threat actors require significant research efforts to uncover and exploit the configuration of operating environments and embedded IoT and OT devices.

- According to the Microsoft Digital Defense Report 2023, Microsoft said that globally, there has been a growing number of attacks, of which identity attacks are the most common, and 42% of the total attacks are only identity attacks. Also, every year, there has been an increasing number of cyberattacks, and the cost of ransomware-related damage increases globally. As per the report published by Microsoft in 2024, attempted password attacks have soared to over 30 billion from around 3 billion per month.

- In a connected digital world, devices communicate online with larger systems, collecting voluminous data and creating visibility to bring business opportunities to large enterprises. This situation also opens the doors for cyber threats, making the cybercrime business worth multi-billion dollars. IoT devices such as computers, routers, printers, web cameras, and remote management devices are at a security risk. These devices are critical to many organizations' operations; hence, they can quickly become a liability and security risk. The rapid adoption of IoT solutions close to every industry has increased the number of attack vectors and organizations' risk exposure. Attacks against remote management devices, attacks via the web, and attacks on databases are most prevalent among large enterprises.

- The aforementioned incidents are likely to boost the adoption of the network-as-a-service (NaaS) in large enterprises due to its ability to stand out from other secure networking strategies. Rather than relying on data center security, SASE has a direct approach as the overall traffic from the users' devices is inspected at a nearby point of presence before being sent to its final destination. This makes it an ideal option for protecting distributed workforces and data in the cloud. In modern cloud-centric large enterprises, users, devices, and applications require secure access while working from anywhere. Legacy systems cannot tolerate the bandwidth needed to provide this flexibility. However, SASE can do so while maintaining enterprise-level security for users and devices at any location, which bolsters this segment's demand.

North America will Hold a Significant Share

- The United States is a developed economy with a significant inclination toward implementing and accepting advanced technology, development in network automation, and surge in cloud-based services, thereby contributing to the secure access service edge market. The growing digitization among end-user industries and the presence of prominent market vendors, like Cisco Systems Inc., Vmware Inc., Palo Alto Networks, Versa Networks Inc., and Akamai Technologies, are contributing to the market's growth.

- Security is moving toward cloud computation due to the fast acceleration of the digital transformation of businesses. The significant adoption of cloud services in several end-user industries necessitates securing the network infrastructure and reducing complexity to improve speed and agility. This is anticipated to create substantial growth opportunities for market vendors in the coming years.

- The United States is home to three major cloud service providers: Amazon Web Services, Microsoft's Azure, and Google Cloud. It is also considered to be the hub for major technological innovations such as 5G, autonomous driving, IoT, Blockchain, artificial intelligence, and gaming. Integrating SASE capabilities converges zero trust security capabilities into enterprise architectures, which is paramount in achieving a trusted network security posture. Thus, SASE solutions are analyzed to transform the end-users networks and security architectures to reduce cyber risks, costs, and complexities.

- Orange Business, Palo Alto Networks, and Orange Cyberdefense partnered in August 2023 to deliver a cloud-native managed security access service edge (SASE) solution to enterprises globally. The digital attack surface has expanded as organizations expedite cloud adoption to accommodate hybrid work and deliver the latest products and services to their customers. The partnership provides the industry's most complete AI-powered SASE solutions, advisory and consultant services, and global managed network, security, and digital services. Organizations using this offering can maximize their SASE transformation's return on investments (ROI).

- Canada is at the forefront of cloud adoption. Many organizations are deploying a mix of public, private, and edge clouds. With the rise of hybrid work and cloud transformation, the demand for security services to expand beyond the network perimeter is increasing, positively impacting the growth of the country's market. In addition, stringent data protection and regulatory legislation in the country further drive the demand for SASE solutions in end-user industries.

- The market demand is anticipated to rise significantly due to increasing automation and deploying connected devices. The network-as-a-service (NaaS) model benefits small businesses by offloading day-to-day equipment maintenance and focusing on tasks such as customer service. With a large base of small businesses in Canada, NaaS is expected to become a significant trend in the coming years.

Secure Access Service Edge (SASE) Market Overview

The secure access service edge market vendors are moderately consolidated with an array of services. However, major vendors like VMware, Palo Alto Networks, Versa Networks Inc., and Cisco Systems Inc. are highly preferred network service providers for various end users in various regions.

- January 2024 - Kyndryl announced that the company partnered with Cisco to launch two of its new security edge services in order to help customers improvise their security controls and address and respond to cyber incidents proactively. The newly launched security edge services along with Kyndryl and Cisco's available SD-WAN services, enable organizations to build a solid foundation to transition into a secure access service edge (SASE) architecture.

- January 2024-Versa Networks, a leading provider of AI/ML-powered Unified Secure Access Service Edge (SASE) solutions, has announced the launch of a new series of Unified SASE gateways. These gateways offer an impressive throughput exceeding 100 Gbps, designed to address the rising demand for enhanced computing capabilities. This demand is driven by the industry's increasing integration of networking and security functions. Versa's new gateways integrate high-performance hardware with the Versa Operating System (VOS), the company's unified SASE software stack, which features a single-pass architecture. This improved performance allows organizations to consolidate security functions and multiple networking into a single gateway for the first time.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products and Services

- 4.3 Assessment of Macro Economic Factors Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need for a Single Network Architecture that Combines SD-WAN, FWaaS, SWG, CASB, and ZTNA Capabilities

- 5.1.2 Lack of Security Procedures and Tools

- 5.1.3 Mandatory Compliance with Data Protection and Regulatory Legislation

- 5.2 Market Restraints

- 5.2.1 Lack of Knowledge of Cloud Resources, Cloud Security Architecture, and SD-WAN Strategy

- 5.2.2 High Upfront Implementation Costs and Lack of Standardization Around SASE Architecture and Its Components

6 MARKET SEGMENTATION

- 6.1 By Offering Type

- 6.1.1 Network as a Service

- 6.1.2 Security as a Service

- 6.2 By Organization Size

- 6.2.1 Large Enterprises

- 6.2.2 Small and Medium Enterprises

- 6.3 By End-user Vertical

- 6.3.1 BFSI

- 6.3.2 IT and Telecom

- 6.3.3 Retail

- 6.3.4 Healthcare

- 6.3.5 Government

- 6.3.6 Manufacturing

- 6.3.7 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Italy

- 6.4.2.6 Belgium

- 6.4.2.7 Netherlands

- 6.4.2.8 Luxembourg

- 6.4.2.9 Denmark

- 6.4.2.10 Finland

- 6.4.2.11 Norway

- 6.4.2.12 Sweden

- 6.4.2.13 Iceland

- 6.4.3 Asia

- 6.4.3.1 India

- 6.4.3.2 China

- 6.4.3.3 Japan

- 6.4.3.4 Taiwan

- 6.4.3.5 South Korea

- 6.4.3.6 Malaysia

- 6.4.3.7 Hong Kong

- 6.4.3.8 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 VMWare Inc.

- 7.1.3 Palo Alto Networks.

- 7.1.4 Versa Networks Inc.

- 7.1.5 Akamai Technologies Inc.

- 7.1.6 Cato Networks

- 7.1.7 Fortinet Inc.

- 7.1.8 Check Point Software Technologies Ltd

- 7.1.9 Cloudflare Inc.

- 7.1.10 Forcepoint