|

市場調查報告書

商品編碼

1683425

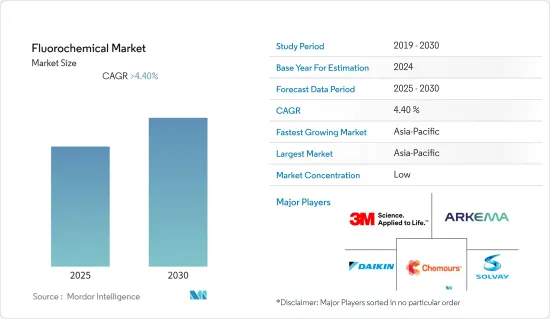

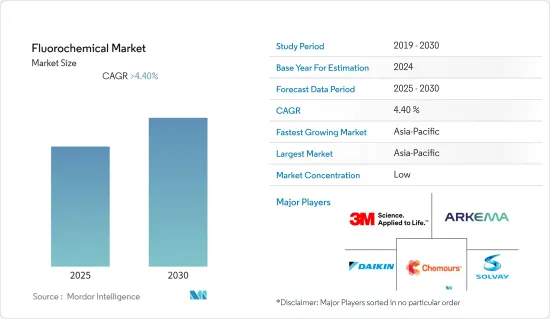

氟化學品市場 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Fluorochemical - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預測期內,氟化合物市場預計將以超過 4.4% 的複合年成長率成長。

受 COVID-19 的影響,氟化合物市場受到負面影響,全國實施封鎖、保持社交距離等措施,導致供應鏈中斷。但疫情過後,在政府的支持下,市場預計將迅速復甦,恢復疫情前的狀態。

關鍵亮點

- 短期內,HVAC 系統需求的增加預計將推動市場成長。

- 然而,與氟化合物相關的環境問題可能會阻礙市場成長。

- 未來五年,氟化合物市場可能會受益於增強服裝防水性能的氟化合物的研究和開發。

- 預計亞太地區將佔據最大的市場佔有率,並在未來五年內實現最高的複合年成長率。

氟化學市場趨勢

氟碳化合物佔據市場主導地位

- 由於旨在保護臭氧層和抑制全球暖化的新法規,氟碳化合物部分可能成為最大的部分。

- 氟碳化合物用於推進劑、發泡發泡劑、冷媒和溶劑,隨著主要製造商開發出危害較小的氟化學替代品,對氟化合物的需求預計將激增。例如,2021年全球冰箱市場收入為1,266億美元,而2020年的1,188億美元則成長了7.8%。預計這將創造對氟化學產品的需求。

- 由於人們對臭氧層的擔憂日益加劇,未來幾年對氟碳化合物的需求可能會下降。

- 氟碳化合物充當冷媒,由於潔淨空氣系統在製造業中的重要性日益增加,以及配備 HVAC 系統的汽車數量不斷增加,預計市場將會成長。例如,根據OICA的數據,2021年美國汽車產量為9,167,214輛,比2020年增加4%。這意味著隨著汽車產量的增加,對氟化學產品的需求也會增加。

- 所有上述因素都可能在預測期內推動氟化合物市場的發展。

亞太地區佔市場主導地位

- 預計未來幾年亞太地區將成為最大且成長最快的地區。這是由於汽車和基礎設施領域的暖通空調系統中冷媒的使用越來越多。

- 氟技術產品廣泛用於建築和建築業。其中包括填縫材料、電線電纜、建築膜和塗料,以及防銹、高強度、抗紫外線的材料,如電線電纜。

- 包裝和冷凍食品消費量的增加增加了商務用冷凍系統的市場需求,預計這將推動氟化學產業的成長。例如,根據經濟產業省的數據,2021年日本產電冰箱的金額將為2,293.9億日圓,較2020年成長2.64%。

- AHF 等氟化學品因其成本效益而被廣泛應用於鋁生產。例如,根據中國工業和資訊化部的數據,2021年中國原生鋁產量為3,850萬噸,較2020年成長3.8%。因此,預計該國通用化學產品市場的需求將呈現上升趨勢。

- 此外,鋁的重量輕、維護成本低的特性也可能推動鋁在電子和汽車應用領域的使用,從而增加對氟化合物的需求。例如,根據 OICA 的數據,印度的汽車產量為 4,399,112 輛,比 2020 年成長 30%。因此,汽車產量的增加可能會增加氟化合物市場的需求。

- 該地區的鋁使用量可能會更大,因為中國和印度的鋁儲量龐大,而且政府希望鼓勵外國對金屬產業進行直接投資。

- 預計這些市場趨勢將在未來幾年推動該地區對氟化合物的需求。

氟化學產業概況

全球氟化合物市場本質上是分散的。市場的主要企業(不分先後順序)包括索爾維、3M、阿科瑪、大金工業有限公司和科慕公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 暖通空調系統需求不斷成長

- 限制因素

- 與氟化學相關的環境問題

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(市場規模(基於數量))

- 產品

- 氟碳

- 氟樹脂

- 特殊/無機

- 其他

- 應用

- 冷凍和空調

- 車

- 電氣和電子(包括半導體)

- 藥品

- 紡織品和化學品

- 軍事和國防

- 宇宙

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率分析(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- AGC Chemicals Americas

- Anupam Rasayan India Ltd(Tanfac Industries Ltd.)

- Arkema

- DAIKIN INDUSTRIES, Ltd.

- Derivados del Fluor, SAU(MINERSA GROUP)

- DIC CORPORATION

- Dongyue Group

- Dynax Corporation

- Gujarat Fluorochemicals Limited

- HaloPolymer

- Honeywell International Inc.

- Koura

- MAFLONS.PA

- Navin Fluorine International Limited

- Solvay

- SRF Limited

- The Chemours Company

第7章 市場機會與未來趨勢

- 防水服飾用防雨氟化學品的研發

The Fluorochemical Market is expected to register a CAGR of greater than 4.4% during the forecast period.

Due to the impact of COVID-19, the fluorochemical market was negatively impacted because of nationwide lockdowns, social distancing mandates, etc., which caused supply chain disruptions. But after the pandemic, with help from the government, the market quickly recovered and is expected to get back to where it was before the pandemic.

Key Highlights

- Over the short term, the growing demand from HVAC systems is expected to drive market growth.

- However, the environmental problems associated with fluorochemicals are likely to hinder the market's growth.

- Over the next five years, the fluorochemical market is likely to benefit from the research and development of fluorochemicals that make clothing waterproof.

- The Asia-Pacific region is expected to have the biggest share of the market and the highest CAGR over the next five years.

Fluorochemicals Market Trends

Fluorocarbon to Dominate the Market

- Due to new rules meant to protect the ozone layer and slow down global warming, the fluorocarbon segment is likely to be the largest.

- Fluorocarbons are used in propellants, blowing agents, refrigerants, and solvents, and major manufacturers are formulating less harmful fluorochemical substitutes that are anticipated to surge the demand for fluorochemicals. For instance, in 2021, the global refrigerator market generated a revenue of USD 126.6 billion, which showed an increase of 7.8% compared with 2020, which amounted to USD 118.8 billion. Therefore, this is expected to create demand for fluorochemicals.

- Fluorocarbon demand may go down over the next few years because of growing worries about the ozone layer.

- Fluorocarbons serve as a refrigerant, and the growing importance of clean air systems in the manufacturing sector and the growing installation of HVAC systems in automobiles are expected to increase the growth of the market. For instance, according to OICA, in 2021, automobile production in the United States amounted to 91,67,214 units, which showed an increase of 4% compared to 2020. So, if the number of cars made goes up, there should be more demand for fluorochemicals on the market in the country.

- All of the aforementioned factors are likely to be the driving forces behind the fluorochemical market during the forecast period.

Asia-Pacific Region to Dominate the Market

- Over the next few years, the Asia-Pacific market is expected to be the biggest and grow the fastest. This is because more and more refrigerants are being used in HVAC systems in the automotive and infrastructure sectors.

- Fluor Technology's products are often used in the construction and building industries. These include anti-corrosion, high-strength, and UV-resistant materials like caulks, wire and cable, architectural membranes and coatings, and wire and cable.

- An increase in consumption of packaged and frozen food has led to a rise in market demand for commercial cooling systems, which is likely to drive the fluorochemical industry's growth. For example, the Ministry of Economy, Trade, and Industry (METI) says that the value of electric refrigerators made in Japan in 2021 will be JPY 229.39 billion yen ($2.09 billion), which is up 2.64 percent from 2020.

- Fluorine-based chemicals such as AHF are prominently used for aluminum production owing to their cost-effectiveness. For instance, according to the Ministry of Industry and Information Technology of the People's Republic of China, in 2021, the production volume of primary aluminum in China was 38.5 million tons, an increase of 3.8% compared to 2020. Therefore, this is expected to create upside demand for the flurochemical market in the country.

- Moreover, lightweight and low-maintenance characteristics also promoted the use of aluminum in electronic and automotive applications, which is likely to propel the demand for fluorochemicals. For instance, according to OICA, the total automotive production in India amounted to 43,99,112 units, which shows an increase of 30% compared to 2020. Because of this, a rise in the number of cars made is likely to increase demand in the fluorochemical market.

- Aluminum is likely to be used more in the region because China and India have a lot of it and their governments want to encourage foreign direct investment in their metal industries.

- So, all of these market trends are likely to boost the demand for fluorochemicals in the region over the next few years.

Fluorochemicals Industry Overview

The global fluorochemical market is fragmented by nature. Some of the major players (not in any particular order) in the market include Solvay, 3M, Arkema, Daikin Industries Ltd., and The Chemours Company, amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from HVAC Systems

- 4.2 Restraints

- 4.2.1 Environmental Problems Associated with Fluorochemical

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products or Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product

- 5.1.1 Fluorocarbon

- 5.1.2 Fluoropolymer

- 5.1.3 Specialty and Inorganic

- 5.1.4 Other Products

- 5.2 Application

- 5.2.1 Refrigeration and Air Conditioning

- 5.2.2 Automotive

- 5.2.3 Electrical and Electronics (incl. Semiconductors)

- 5.2.4 Pharmaceuticals

- 5.2.5 Textile and Chemicals

- 5.2.6 Military and Defense

- 5.2.7 Space

- 5.2.8 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)** /Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 AGC Chemicals Americas

- 6.4.3 Anupam Rasayan India Ltd (Tanfac Industries Ltd.)

- 6.4.4 Arkema

- 6.4.5 DAIKIN INDUSTRIES, Ltd.

- 6.4.6 Derivados del Fluor, S.A.U. (MINERSA GROUP)

- 6.4.7 DIC CORPORATION

- 6.4.8 Dongyue Group

- 6.4.9 Dynax Corporation

- 6.4.10 Gujarat Fluorochemicals Limited

- 6.4.11 HaloPolymer

- 6.4.12 Honeywell International Inc.

- 6.4.13 Koura

- 6.4.14 MAFLONS.P.A

- 6.4.15 Navin Fluorine International Limited

- 6.4.16 Solvay

- 6.4.17 SRF Limited

- 6.4.18 The Chemours Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Research and Development in Rain-Repelling Fluorochemicals Used in Waterproof Clothing