|

市場調查報告書

商品編碼

1683418

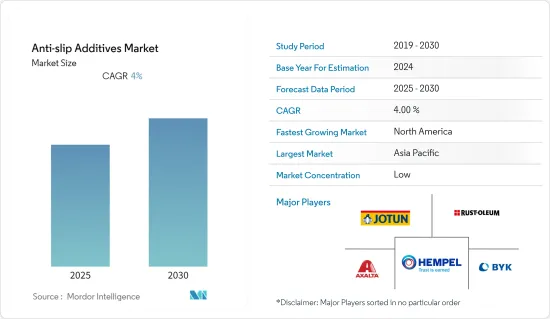

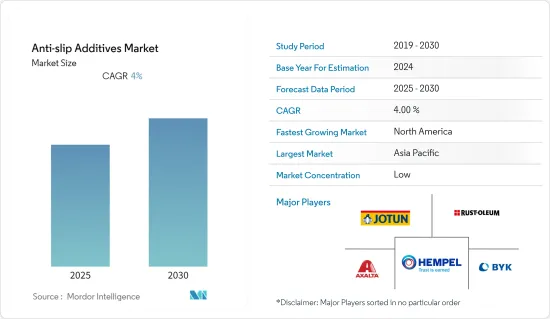

防滑添加劑市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Anti-slip Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

防滑添加劑市場預計在預測期內實現 4% 的複合年成長率

關鍵亮點

- 工業地板材料的廣泛應用和海洋產業的需求不斷成長正在推動市場成長

- 嚴格的環境法規和其他限制因素預計將阻礙市場成長

防滑添加劑的市場趨勢

擴大工業地板的用途

- 防滑添加劑添加到油漆中以提高油漆的防滑性,並可應用於各種基材,包括木材、金屬、玻璃纖維和混凝土表面。這種含有防滑添加劑的塗料適用於各個領域,其中工業地板材料的應用處於領先地位。

- 防滑添加劑不會改變所添加的油漆或塗料的顏色、性能或特性。它可以添加到水基或溶劑基系統中,對黏度的影響最小,同時還能提高塗層地板的防滑性。

- 政府為維護工業安全而訂定的嚴格法規導致工業塗料中防滑添加劑的應用增加。

- 截至2019年5月,印度已核准約296個食品加工低溫運輸計劃,為防滑添加劑在該行業的使用提供了巨大的潛力。

- 目前,中國醫藥產業價值約1,450億美元,是最大的新興市場,預計到2022年成長將達到約2,000億美元,從而未來幾年其市場範圍將持續擴大。

- 中國、英國、美國、印度和日本在該市場中扮演著重要角色,其中工業領域在防滑添加劑的使用方面處於領先地位。

亞太地區佔市場主導地位

- 預計預測期內亞太地區將主導防滑添加劑市場。在中國、印度和日本等國家,由於工業安全性的提高,對防滑添加劑的需求正在增加。

- 最大的防滑添加劑生產商位於亞太地區。防滑添加劑產業的主要企業包括 Hempel A/S、BYK(ALTANA)、Axalta Coating Systems、Jotun 和 Rust-Oleum。

- 防滑添加劑的使用在化學/製藥、汽車和包裝等製造業中更為普遍。

- 在船舶工業中,含有防滑劑的塗料被塗在船舶地板、甲板和船舶上,以使其更防滑。

- 根據日本船舶工業協會的數據,截至2019年6月底,船舶總噸位為14,354噸,而2018年12月底為15,097噸,從而帶動防滑添加劑市場成長。

- 中國政府正在推行大規模建設計畫,例如在未來十年內建造可容納2.5億人口的特大城市,這為未來幾年在建設活動中使用塗料防滑添加劑創造了空間。

- 這些防滑添加劑可用作潮濕區域、乾燥區域、無塵室和其他工作空間的工業安全預防措施。

- 上述因素加上政府支持,將推動預測期內防滑添加劑市場需求的增加。

防滑添加劑行業概況

防滑添加劑市場比較分散,每家公司的佔有率都很小。範例包括 Hempel A/S、BYK(ALTANA)、Axalta Coating Systems、Jotun 和 Rust-Oleum。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 擴大工業地板的用途

- 海洋產業需求不斷成長

- 限制因素

- 嚴格的環境法規

- 其他限制因素

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 添加劑類型

- 氧化鋁

- 二氧化矽

- 其他添加劑類型

- 添加劑特性

- 粉末

- 總計的

- 混合物

- 應用

- 建築學

- 工業地板材料

- 海洋

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率/排名分析

- 主要企業策略

- 公司簡介

- Akzo Nobel BV

- Associated Chemical

- Axalta Coating Systems

- BYK(ALTANA)

- Hempel A/S

- Jotun

- PPG Industries Inc.

- Pro Chem Inc.

- Rust-Oleum

- SAICOS COLOR GmbH

- Vexcon Chemicals

第7章 市場機會與未來趨勢

- 開發更有效的防滑添加劑

- 其他機會

簡介目錄

Product Code: 69155

The Anti-slip Additives Market is expected to register a CAGR of 4% during the forecast period.

Key Highlights

- Increasing applications in industrial flooring and increasing demand from the marine industry are driving the market growth.

- Stringent environmental regulations and other restraints are expected to hinder the growth of the market studied.

Anti-slip Additives Market Trends

Growing Applications in Industrial Flooring

- Anti-slip additives, when added to coatings, improve the skid resistance to the coatings and can be applied on different substrates, like wood, metal, fiberglass, and concrete surfaces. These anti-slip additives added coatings are applicable for different areas among which industrial flooring leads in the application.

- Anti-slip additives do not change the color, performance or properties of the paint or coatings to which they are added. They can be added to water or solvent-based system with minimal viscosity effects and also increases slip resistance to the coated floor.

- Stringent regulations from government to maintain industrial safety are increasing the application of anti-slip additives to coatings in industries.

- About 296 approved cold chain projects in food processing have been approved in India as on May 2019 creating a major scope for the usage of anti-slip additives in the industry.

- The Chinese pharmaceutical industry, which is valued at about USD 145 billion currently, represents the biggest emerging market with growth tipped to reach about ~USD 200 billion by 2022, thus, increasing the scope of the market over the coming years.

- Industrial sector leads in the utilization of anti-slip additives with China, the United Kingdom, the United States, India, and Japan, playing a major role in this market.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for anti-slip additives during the forecast period. In countries, like China, India, and Japan, because of growing industrial safety, the demand for anti-slip additives has been increasing in the region.

- The largest producers of anti-slip additives are located in the Asia-Pacific region. Some of the leading companies in the production of anti-slip additives are Hempel A/S, BYK(ALTANA), Axalta Coating Systems, Jotun, and Rust-Oleum.

- The usage of anti-slip additives is more dominant in manufacturing industries, like chemicals and pharmaceuticals, automotive, packaging, and other industries.

- In the marine industry these anti-slip additives added coatings are applied on floors, decks of ships, and boats to increase slip resistance.

- According to the Ship Builders Association of Japan, the gross tonnage of ship size covered 14,354 by end of June 2019, which was 15,097 tonnage by the end of December 2018 creating growth in the market of anti-slip additives.

- The Chinese government has rolled out massive construction plans, including making provisions for 250 million people in its new megacities, over the next ten years, creating scope for application of anti-slip additives to coatings in its construction activity over the coming years.

- These anti-slip additives added coatings can be used on wet areas, dry areas, clean room areas, and other workspaces as a safety measure in industries.

- The aforementioned factors, coupled with government support, are contributing to the increasing demand for anti-slip additives market during the forecast period.

Anti-slip Additives Industry Overview

The anti-slip additives market is fragmented with players accounting for a marginal share of the market. Few companies include are Hempel A/S, BYK(ALTANA), Axalta Coating Systems, Jotun, and Rust-Oleum, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application in Industrial Flooring

- 4.1.2 Increasing Demand from the Marine Industry

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Additive Type

- 5.1.1 Aluminum oxide

- 5.1.2 Silica

- 5.1.3 Other Additive Types

- 5.2 Additive Nature

- 5.2.1 Powder

- 5.2.2 Aggregate

- 5.2.3 Mix

- 5.3 Application

- 5.3.1 Buildings and Construction

- 5.3.2 Industrial Flooring

- 5.3.3 Marine

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel BV

- 6.4.2 Associated Chemical

- 6.4.3 Axalta Coating Systems

- 6.4.4 BYK (ALTANA)

- 6.4.5 Hempel A/S

- 6.4.6 Jotun

- 6.4.7 PPG Industries Inc.

- 6.4.8 Pro Chem Inc.

- 6.4.9 Rust-Oleum

- 6.4.10 SAICOS COLOR GmbH

- 6.4.11 Vexcon Chemicals

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of More Efficient Anti-slip Additives

- 7.2 Others Opportunities

02-2729-4219

+886-2-2729-4219