|

市場調查報告書

商品編碼

1683417

脂肪族烴溶劑和稀釋劑:市場佔有率分析、產業趨勢和統計、成長預測(2025-2030 年)Aliphatic Hydrocarbon Solvents and Thinners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

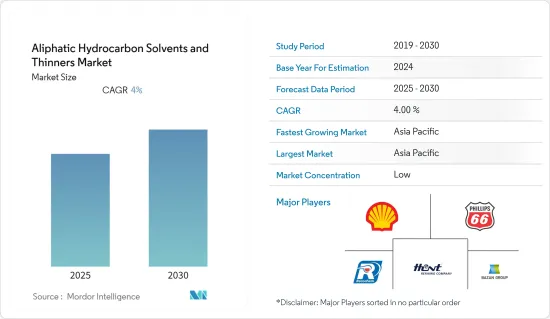

預測期內,脂肪族烴溶劑和稀釋劑市場預計複合年成長率為 4%。

由於全球被覆劑的使用越來越多,預計預測期內脂肪族烴溶劑和稀釋劑市場將會成長。

亞太地區佔據全球市場主導地位,其中消費量最高的國家是中國、印度、日本和東南亞國協。

脂肪族烴溶劑和稀釋劑市場趨勢

擴大油漆和塗料的應用

- 脂肪族溶劑屬於脂肪族化合物的範疇。脂肪族溶劑不含苯環。它們是飽和長直鏈(正構烷烴)、支鏈(異烷烴)或環狀烷烴的混合物。這些溶劑是透過蒸餾原油以獲得適當沸騰範圍的餾分,然後進行處理以改善顏色和氣味而生產的。

- 建築業的興起推動了脂肪族溶劑作為油漆和被覆劑中稀釋劑和稀釋劑的使用範圍擴大,從而擴大了市場。

- 除了針對建築業最佳化的建築膠粘劑、油漆和被覆劑外,加工商還使用這些溶劑作為清洗和脫脂劑。

- 據估計,自2018年與前一年同期比較英國將建造27,000至50,000套住宅,將推動市場成長。

- 汽車和其他行業對油漆和被覆劑的需求不斷增加,擴大了脂肪族烴溶劑和稀釋劑的使用。

- 因此,由於油漆和塗料在建築領域的應用日益廣泛,中國、英國、美國、印度和日本等國家在這一市場中發揮重要作用。

亞太地區佔市場主導地位

- 預計預測期內亞太地區將主導脂肪族烴溶劑和稀釋劑市場。由於中國、印度和日本等國家的需求旺盛,脂肪族烴溶劑和稀釋劑市場正在成長。

- 最大的脂肪族烴溶劑和稀釋劑生產商位於亞太地區。脂肪族烴溶劑和稀釋劑生產的主要企業包括荷蘭皇家殼牌公司、Recochem Inc、Phillips 66、mg organics pvt。有限公司

- 2018年,印度政府宣布投資31.65兆美元,根據「智慧城市計畫」建設100座城市。未來五年,100 個智慧城市和 500 個城市可以吸引價值 2 兆印度盧比(約 281.8 億美元)的投資,為油漆和被覆劑中使用脂肪族烴溶劑和稀釋劑創造空間。

- 隨著中國政府啟動大規模建設計畫,包括未來十年將2.5億人遷移到新的特大城市,建設活動有足夠的空間,因此未來幾年脂肪族烴溶劑和稀釋劑市場將會擴大。

- 除了油漆和被覆劑之外,這些脂肪族烴溶劑和稀釋劑還用於黏合劑、密封劑、橡膠製造以及包括汽車工業在內的各種最終用途。

- 除了油漆和被覆劑外,脂肪族烴溶劑和稀釋劑也被用作汽車工業的清潔劑和脫脂劑。

- 上述因素和政府支持正在推動預測期內(2020-2025 年)脂肪族烴溶劑和稀釋劑市場需求的增加。

脂肪族烴溶劑和稀釋劑產業概況

全球脂肪族烴溶劑和稀釋劑市場部分分散,只有少數幾家公司佔主導市場佔有率。主要參與者包括荷蘭皇家殼牌、亨特煉油公司、Recochem Inc、Phillips 66 和 Gadiv Petrochemical Industries Ltd.。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 擴大使用油漆和塗料作為稀釋劑和稀釋劑

- 由於用途廣泛而需求不斷增加

- 限制因素

- 嚴格的環境法規

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 脂肪族烴溶劑型

- 己烷

- 庚烷

- 礦物油精

- 汽油

- 其他

- 應用

- 畫

- 膠水

- 清洗和脫脂

- 橡膠製造

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率/排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- Brenntag Canada, Inc.

- Calumet Specialty Products Partners, LP

- Exxon Mobil Corporation

- Gadiv Petrochemical Industries Ltd

- Honeywell International Inc.

- Hunt Refining Company

- mg organics pvt. ltd

- Phillips 66

- Recochem Inc

- Royal Dutch Shell

第7章 市場機會與未來趨勢

The Aliphatic Hydrocarbon Solvents and Thinners Market is expected to register a CAGR of 4% during the forecast period.

Aliphatic Hydrocarbon Solvents and Thinners market is expected to grow during the forecast period owing to growing application in paints and coatings across the globe.

Asia-Pacific region dominated the market across the globe with the largest consumption from the countries such as China, India, Japan and ASEAN countries.

Aliphatic Hydrocarbon Solvents & Thinners Market Trends

Growing Application in Paints & Coatings

- Aliphatic solvents are in the category of aliphatic compounds. Aliphatic solvents do not contain a benzene ring. They are mixtures of saturated, long straight chain (normal-paraffin), branched chain (iso-paraffin) or cyclic paraffins. These solvents are produced by the distillation of crude oil by the appropriate boiling point range fraction, and then are treated to improve their color and odor.

- The increasing buildings & construction sector is attributing to the growing application ofaliphatic solvents as thinners and diluents in paints and coatings thereby increasing its market.

- In addition to the construction adhesives, paints and coatings optimized for the construction industry, processors also use these solvents as cleaning and degreasing agents

- It is estimated that in United Kingdom around 27,000 - 50,000 new homes are built year-over-year from 2018 which in turn increases scope for this market

- Growing demand for paints and coatings from automotive sector and other industries are in turn increasing the application ofaliphatic hydrocarbon solvents and thinners

- Hence, growing application of paints & coatings in buildings & construction sector in countries like China, United Kingdom, United States, India, Japan are playing a major role in this market.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market foraliphatic hydrocarbon solvents and thinnersduring the forecast period. Due to the high demand application from countries like China, India and Japan the market foraliphatic hydrocarbon solvents and thinnershas been increasing.

- The largest producers of aliphatic hydrocarbon solvents and thinners are located in Asia-Pacific region. Some of the leading companies in the production of aliphatic hydrocarbon solvents and thinner are Royal Dutch Shell, Recochem Inc, Phillips 66, mg organics pvt. ltd

- In 2018, the Indian government has announced an investment worth USD 31,650 billion for the construction of 100 cities, under the smart cities plan. 100 smart cities and 500 cities are likely to invite investments worth INR 2 trillion (~USD 28.18 billion), over the coming five years creating scope for the application ofaliphatic hydrocarbon solvents and thinnersin paints andcoatings.

- The Chinese government has rolled out massive construction plans, including making provisions for the movement of 250 million people to its new megacities, over the next ten years creating a major scope for construction activity thereby increasing the market foraliphatic hydrocarbon solvents and thinnersover the coming years.

- Apart from paints & coatings these aliphatic hydrocarbon solvents and thinners are also used in adhesives & sealants, in rubber manufacturing and others which have multiple application in various end-user industries like automotive and others

- In automotive industry apart from paints and coatings thesealiphatic hydrocarbon solventsand thinners are used as cleansers and degreasing agents

- The aforementioned factors coupled with government support are contributing to the increasing demand for aliphatic hydrocarbon solvents and thinners market during the forecast period (2020-2025).

Aliphatic Hydrocarbon Solvents & Thinners Industry Overview

The global aliphatic hydrocarbon solvents and thinners market is partially fragmented with players accounting for a marginal share of the market. Few companies include are Royal Dutch Shell, Hunt Refining Company, Recochem Inc, Phillips 66, Gadiv Petrochemical Industries Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application in Paints & Coatings as Diluents and Thinners

- 4.1.2 Growing Demand Owing to their Wide Range of Applications

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Aliphatic Hydrocarbon Solvent Type

- 5.1.1 Hexane

- 5.1.2 Heptane

- 5.1.3 Mineral Spirits

- 5.1.4 Gasoline

- 5.1.5 Others

- 5.2 Application

- 5.2.1 Paints & Coatings

- 5.2.2 Adhesives

- 5.2.3 Cleaning & Degreasing

- 5.2.4 Rubber Manufacturing

- 5.2.5 Others

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Brenntag Canada, Inc.

- 6.4.3 Calumet Specialty Products Partners, L.P

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 Gadiv Petrochemical Industries Ltd

- 6.4.6 Honeywell International Inc.

- 6.4.7 Hunt Refining Company

- 6.4.8 mg organics pvt. ltd

- 6.4.9 Phillips 66

- 6.4.10 Recochem Inc

- 6.4.11 Royal Dutch Shell