|

市場調查報告書

商品編碼

1683228

厚規格和薄規格熱成型塑膠:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Heavy Gauge and Thin Gauge Thermoformed Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

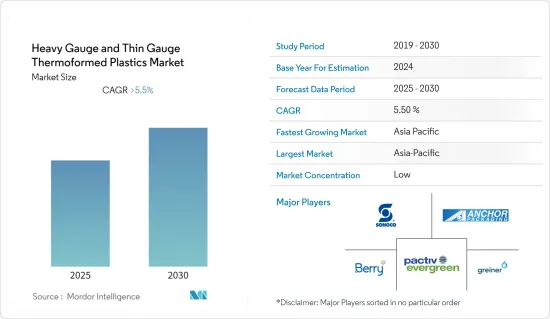

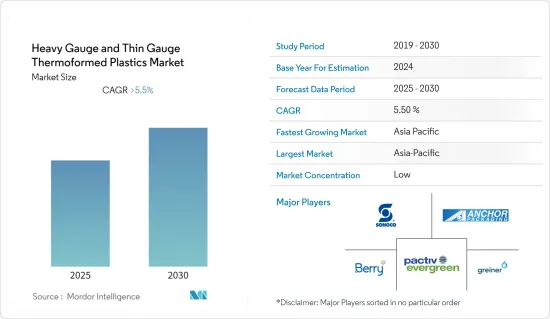

預測期內,厚薄規格熱成型塑膠市場預計將以超過 5.5% 的複合年成長率成長。

2020 年,市場受到了 COVID-19 的負面影響。 2020 年,疫情導致世界各國實施封鎖。受此影響,許多行業正在進行的建設計劃、生產活動和水處理廠都暫停了。這對一系列應用的市場需求產生了負面影響。此外,印度、義大利、法國、波蘭、英國和南非等大多數國家在 2020 年都進入停工狀態,影響了各行業的生產,從而對所研究的市場產生了影響。即使到了 2021 年,新變種病毒的傳播仍有可能造成混亂。在全球範圍內,汽車、電氣電子、工業和機械等厚薄規格熱成型塑膠消費產業受到了COVID-19疫情的嚴重打擊。

主要亮點

- 中期推動市場發展的關鍵因素是輕型和電動車的需求不斷增加、食品包裝行業的需求不斷成長以及製藥和醫療領域的使用加速。

- 另一方面,預計 COVID-19 疫情造成的不利環境以及對塑膠廢棄物的擔憂將阻礙市場成長。

- 預計預測期內亞太地區將主導全球市場。

- 標牌佔有最大的市場佔有率。預計在預測期內,其複合年成長率也將最快。在合成氣應用方面,食品包裝領域佔最大的市場佔有率。

厚薄規格熱成型塑膠的市場趨勢

食品包裝應用主導合成橡膠市場

- 薄規格熱成型塑膠用於滿足食品工業的包裝要求。由於人口成長、購買力增強、冷凍食品市場擴大以及人們生活方式繁忙等各種因素,全球市場正朝著擴大加工和包裝食品文化的方向發展,合成熱成型塑膠市場受到食品包裝產業成長的廣泛推動。

- 食品包裝佔據全球熱成型塑膠市場的主導地位,預計在整個預測期內仍將保持這一地位。

- 一項研究表明,用塑膠包裹的黃瓜比未包裹的黃瓜保存期限長 11 天。同樣,用塑膠包裝的香蕉比未包裝的香蕉保存期限長 21 天,用隔氧膜真空密封塑膠包裝包裹的牛肉保存期限長 26 天。因此,這些因素導致食品工業中包裝的使用量增加,進一步促進食品包裝產業的成長。

- 因此,隨著食品包裝需求的增加(由於這些因素),薄規格熱成型塑膠市場的需求也同步成長。人口不斷成長、生活方式繁忙以及飲食文化可能會進一步增加對加工食品、冷凍食品和農業包裝的需求,預計這將繼續推動薄規格熱成型塑膠市場的成長。

- 然而,食品包裝材料的使用類型受到世界各國食品和環境機構的廣泛監管,這可能成為包裝材料的限制因素。

亞太地區將達到最高成長率

- 預計亞太地區將在預測期內出現最高成長率。

- 可支配收入的增加和消費者生活方式的改變正在推動中國和印度等國家的食品包裝產品市場的發展,這反過來又擴大了厚規格和薄規格熱成型塑膠市場。

- 由於其強度和其他特性,厚規格和薄規格熱成型塑膠在各個行業中都受到高度青睞,包括電氣和電子行業、汽車行業、醫療和醫藥包裝行業等。此外,熱成型塑膠可以根據所需的剛度和硬度進行客製化。中國擁有最廣泛的電子產品製造基礎,為韓國、新加坡和台灣等上游生產商帶來了激烈的競爭。智慧型手機、OLED 電視和平板電腦等電子產品在市場家用電子電器領域呈現最高的成長。

- 此外,印度包裝產業在出口和進口方面有著良好的業績記錄,從而推動了該國技術和創新的發展,同時為各個製造業部門增加了價值。包裝產業是印度所研究市場成長的催化劑。此外,過去幾年印度對包裝食品的需求龐大。預計這種情況將在預測期內持續下去,從而推動厚規格和薄規格熱成型塑膠市場的需求。

- 此外,預計其他各種應用的需求激增也將進一步推動該地區厚規格和薄規格熱成型塑膠的消費。

- 過去十年,日本的食品包裝產業經歷了強勁成長,推動了對厚薄規格熱成型塑膠的需求。日本食品業創造的收益從2010年的1,316.16億美元成長到2019年的1,384.88億美元。此外,日本是繼美國和中國之後的世界第三大包裝食品市場。預計2020年日本包裝食品市場的零售額將達到1,981億美元,較2016年成長5.9%或110億美元。

- 由於上述因素,預計在研究期間亞太地區的厚規格和薄規格熱成型塑膠市場將大幅成長。

厚規格和薄規格熱成型塑膠產業概況

市場高度分散,沒有一家企業能夠佔據較大的市場佔有率。所研究市場的關鍵參與者包括 Pactiv Evergreen、Berry Global Inc.、Sonoco Products Company、Greiner AG、Anchor Packaging 和 Silgan Plastics。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 輕型車輛和電動車的需求增加。

- 食品包裝產業的需求不斷增加

- 加速製藥和醫療領域的應用

- 限制因素

- 新冠肺炎疫情造成的不利狀況

- 塑膠廢棄物的環境問題

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 按應用

- 厚規

- 汽車及交通運輸零件

- 消費品

- 電氣和電子設備

- 工業/機械

- 包裝

- 醫療設備

- 其他用途

- 薄規格

- 醫療包裝

- 食品包裝

- 零售包裝

- 其他用途

- 厚規

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 其他歐洲國家

- 世界其他地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)分析**/排名分析

- 主要企業策略

- 公司簡介

- Anchor Packaging Inc.

- Berry Global Inc.

- Brentwood Industries, Inc.

- D&W Fine Pack

- Genpak, LLC

- Greiner Ag

- Pactiv Evergreen

- Peninsula Plastics Company Inc.

- Placon

- Silgan Plastics

- Sonoco Products Company

- SPENCER INDUSTRIES INCORPORATED

- Fabri-Kal

第7章 市場機會與未來趨勢

- 創新產品應用

The Heavy Gauge and Thin Gauge Thermoformed Plastics Market is expected to register a CAGR of greater than 5.5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Owing to the pandemic, various countries across the world imposed lockdown in 2020. Due to this, the ongoing construction projects, production activities, water treatment plants in many industries were halted. This had negatively affected the market demand in various applications. Additionally, most of the countries, like India, Italy, France, Poland, the United Kingdom, and South Africa, went into lockdown in 2020 affecting the production in various industries, thereby affecting the market studied. The spread of new variants may lead to disruptions in 2021 too. Globally, the heavy gauge and thin gauge thermoformed plastics consuming industries, like automotive, electrical and electronics, Industrial and machinery have been severely hit by the COVID-19 pandemic.

Key Highlights

- Over the medium term, major factors driving the market studied are increasing demand from lightweight vehicles and electric vehicles, growing demand from food packaging industry, and accelerating usage in the pharmaceutical and medical sector.

- On the flipside, unfavorable conditions arising due to the COVID-19 outbreak and environmental problems related to plastic waste expected to hinder the growth of the market studied.

- Asia-Pacific is expected to dominate the global market during the forecast period.

- The thin gauge accounted for the largest market share. It is also expected to register the fastest CAGR over the forecast period. In the thin gauge applications, the food packaging segment accounted for the largest market share.

Heavy Gauge & Thin Gauge Thermoformed Plastics Market Trends

Food Packaging Application to Dominate the Thin Gauge Market

- Thin gauge thermoformed plastics are used in the food industry for meeting their packaging requirements. As the global market is inching towards a growing culture of processed and packaged food due to various factors, such as growing population, increasing purchasing power, growing market for frozen food, and hectic life of the people, the market for thin gauge thermoformed plastics market is widely driven by the growth of food packaging industry.

- Food packaging dominates the overall market for thermoformed plastics in the world and is expected to do so through to the forecast period.

- There have been studies that indicated cucumbers when wrapped in plastic can last 11 days longer than unwrapped cucumbers. Similarly, bananas wrapped in plastic last 21 days longer than their unwrapped counterparts, and beef wrapped in vacuum plastic packaging with an oxygen barrier film lasts 26 days longer. Thus, such factors have led to an increased usage of packaging in the food industry, which is further driving the growth of the food packaging industry.

- Therefore, with increasing demand for food packaging (due to such factors) the demand for thin gauge thermoformed plastics market is also witnessing a growth simultaneously. The demand for processed and frozen food and packaging demand for the agriculture industry is further likely to increase with population growth, hectic life, and food culture, which, in turn, is expected to continue driving the growth of the thin gauge thermoformed plastic market.

- However, the type of food packaging material used is widely regulated by various national food and environmental agencies around the globe, which may serve as a restraint in terms of packaging material.

Asia-Pacific Region to Witness the Highest Growth Rate

- Asia-Pacific region is expected to witness the highest growth rate during the forecast period.

- The rise in disposable incomes and changing consumer's lifestyle is fostering the market for food packaged products in countries, such as China and India, which is augmenting the heavy gauge & thin gauge thermoformed plastics market.

- Due to its strength and other properties, heavy and thin gauge thermoformed plastics are highly preferred in various industries, including the electrical and electronics industry, automotive industry, medical and pharma packaging industry, etc. Additionally, thermoformed plastics are customized to desired levels of stiffness and hardness. China has the most extensive electronics production base, offering tough competition to upstream producers like South Korea, Singapore, and Taiwan. Electronic products, such as smartphones, OLED TVs, and tablets, among others, witnessed the highest growth in the consumer electronics segment of the market.

- Furthermore, the Indian packaging industry has made a mark with its exports and imports, thereby driving the technology and innovation growth in the country while adding value to various manufacturing sectors. The packaging industry plays the role of a catalyst in the growth of the market studied in India. Furthermore, the country has been exhibiting significant demand for packed food for the past few years. This scenario is expected to continue during the forecast period, thus, boosting the demand in the heavy gauge and thin gauge thermoformed plastics market.

- Moreover, the surging demand from various other applications is also likely to further add to the consumption of heavy gauge and thin gauge thermoformed plastics in the region.

- The Japanese food packaging industry witnessed major growth over the past decade, boosting the demand for heavy gauge and thin gauge thermoformed plastics. The revenue generated by the food industry in Japan increased from USD 131,616 million in 2010 to USD 138,488 million in 2019. Moreover, Japan is the third-largest package food market in the world after the United States and China. Retail sales in the Japanese packaged food market was estimated at USD 198.1 billion in 2020, representing a growth of 5.9% or USD 11 billion since 2016.

- Owing to the above-mentioned factors, the market for heavy and thin gauge thermoformed plastics in the Asia-Pacific region is projected to grow significantly during the study period.

Heavy Gauge & Thin Gauge Thermoformed Plastics Industry Overview

The market studied is highly fragmented with no single player holding a significant share. The key players in the market studied include Pactiv Evergreen, Berry Global Inc., Sonoco Products Company, Greiner AG, Anchor Packaging, and Silgan Plastics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Lightweight Vehicles and Electric Vehicles.

- 4.1.2 Growing Demand from Food Packaging Industry

- 4.1.3 Accelerating Usage in the Pharmaceutical and Medical Sector

- 4.2 Restraints

- 4.2.1 Unfavorable Conditions Arising Due to the COVID-19 Outbreak

- 4.2.2 Environmental Problems Related to Plastic Waste

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Heavy Guage

- 5.1.1.1 Automotive and Transportation Parts

- 5.1.1.2 Consumer Goods

- 5.1.1.3 Electrical and Electronics

- 5.1.1.4 Industrial and Machinery

- 5.1.1.5 Packaging

- 5.1.1.6 Medical Equipment and Devices

- 5.1.1.7 Other Applications

- 5.1.2 Thin Guage

- 5.1.2.1 Medical Packaging

- 5.1.2.2 Food Packaging

- 5.1.2.3 Retail Packaging

- 5.1.2.4 Other Applications

- 5.1.1 Heavy Guage

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 ASEAN Countries

- 5.2.1.6 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 United Kingdom

- 5.2.3.2 France

- 5.2.3.3 Germany

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 Rest of the World

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anchor Packaging Inc.

- 6.4.2 Berry Global Inc.

- 6.4.3 Brentwood Industries, Inc.

- 6.4.4 D&W Fine Pack

- 6.4.5 Genpak, LLC

- 6.4.6 Greiner Ag

- 6.4.7 Pactiv Evergreen

- 6.4.8 Peninsula Plastics Company Inc.

- 6.4.9 Placon

- 6.4.10 Silgan Plastics

- 6.4.11 Sonoco Products Company

- 6.4.12 SPENCER INDUSTRIES INCORPORATED

- 6.4.13 Fabri-Kal

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovative Product Applications