|

市場調查報告書

商品編碼

1683208

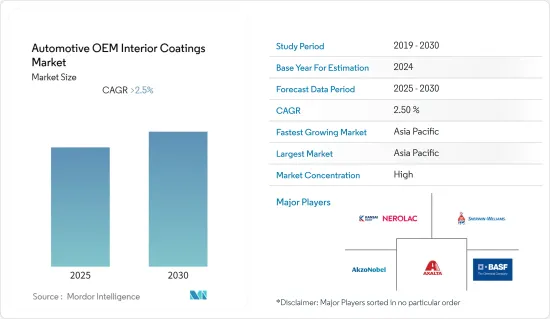

汽車OEM內裝塗料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Automotive OEM Interior Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預測期內,汽車OEM內裝塗料市場預計將以超過 2.5% 的複合年成長率成長。

COVID-19 疫情將對汽車產業產生一些短期和長期影響,並可能影響OEM內裝塗料市場。來自中國的許多零件供應出現延遲。因此,汽車產業面臨全球生產材料短缺的局面。根據OICA統計,2020年全球汽車產量較2019年下降約16%。許多OEM已停止了在歐洲的大部分生產,其中一家德國大型廠商已關閉了在歐洲的大部分製造工廠,其他OEM也長時間停產。隨著汽車生產放緩和 COVID-19 疫情進一步加劇了行業形勢, OEM汽車內裝塗料市場將在短期至中期內受到負面影響,預測期後半段的復甦速度將放緩。

主要亮點

- 從長遠來看,疫情危機引發的對個人出行的偏好是推動市場發展的主要因素。最近的趨勢是,由於道路和基礎設施的不斷完善、汽車租賃行業新創新興企業的創新以及中產階級可以負擔得起的低成本汽車的普及,消費者對個人交通的偏好有所增加。

- 中東和非洲不斷增加的投資機會以及即將到來的電動車需求可能會在未來提供機會。

- 亞太地區佔據全球市場主導地位,消費量最高的國家是中國、印度、日本和韓國。

汽車OEM內裝塗料市場趨勢

乘用車市場帶來龐大需求

- 在所研究的市場中,乘用車市場的需求最高。

- 在乘用車內裝中,各種類型的單組分、多組分、溶劑型和水性塗料用於塗覆各種基材,例如 ABS 和聚碳酸酯。雷射蝕刻塗層也用於這些目的。

- 它用於塗覆各種內部區域,包括中央叢集、儀表叢集、儀表板、揚聲器格柵、扶手和扶手邊框、方向盤、門飾和把手。這些塗層的主要特性是其高光澤度和光滑的表面。

- 全球乘用車產量自2017年起持續下降。 2020年,新冠疫情加劇了產量下滑趨勢,2020年全球乘用車總合為5583萬輛,較2019年的6715萬輛和2018年的7175萬輛持續下降。

- 根據OICA統計,2021年上半年(1月至6月)全球乘用車產量較2020年同期成長逾26%。 2021年上半年產量約28,148,900輛,高於2020年的22,314,111輛。不過,產量為33,248,444輛,仍比2019年低15%。

- 然而,由於社交距離措施導致個人交通偏好發生變化,預計復甦後乘用車領域對汽車OEM內裝塗料的需求成長率將高於商用車和其他汽車領域。

亞太地區佔市場主導地位

- 亞太地區是汽車OEM內裝塗料最大的市場。該區域市場的成長得益於龐大的汽車製造基地和亞太地區不斷增加的投資,主要來自中國、印度和東南亞國協等主要經濟體。

- 根據OICA統計,2020年,中國、日本、韓國和印度的汽車產量分別約為2523萬輛、807萬輛、351萬輛和339萬輛,佔全球汽車產量的50%以上。

- 中國是世界上最大的汽車製造業國家。 2018年,產業成長放緩,產銷量均出現下降。同樣的趨勢仍在持續,2019年產量下降了7.5%。汽車產業的表現受到經濟轉型和美國貿易戰的影響。

- 中國政府計劃在 2025 年讓至少 5,000 輛燃料電池電動車上路,到 2030 年讓至少 100 萬輛上路。隨著政府推動使用電動、混合動力汽車和燃料電池電動車,預計未來市場將會成長。

- 印度經濟正在成長,未來市場機會潛力大。預計未來幾年該國經濟將進一步成長。儘管貨幣貶值和商品及服務稅改革對國內產出產生了影響,但這些改革的影響正在逐漸消退。此外,政府正在採取措施吸引製造業的外國直接投資(FDI),將印度打造為製造業中心。

- 汽車業是該國最大的製造業之一,僱用了超過 3,700 萬名工人,為該國的 GDP 貢獻了約 7.5%。 2018年,印度成為全球第四大汽車市場和第七大商用車製造國。

- 據印度工業和國內貿易促進部(DPIIT)稱,2000 年 4 月至 2020 年 6 月期間,印度汽車市場吸引了約 2,450 萬美元的外國直接投資。這些因素預計將對印度汽車OEM內裝塗料市場產生重大影響。

- 印度政府近期將電動車零件的進口關稅從 15-30% 下調至 10-15%,同時也為汽車產業提供稅收和財政激勵措施,以應對近期新冠疫情危機帶來的需求衝擊。

- 總體而言,儘管國內汽車行業將在未來幾年嘗試從這場危機中恢復,但預計預測期內對OEM汽車內飾塗料的需求將保持中等至低水平。

汽車OEM內裝塗料產業概況

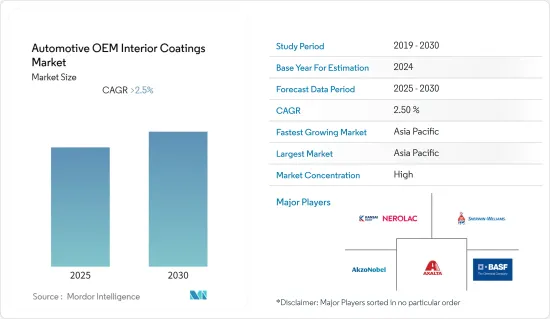

全球汽車OEM內裝塗料市場已部分整合,主要企業佔全球市場約50%的佔有率。主要企業包括 PPG Industries Inc、Akzo Nobel NV、Kansai Nerolac Paints Limited、 BASF SE 和 Axalta Coating Systems, LLC。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 個人出行偏好

- 對改進汽車內裝的需求不斷增加

- 限制因素

- 新冠肺炎疫情的負面影響

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 按樹脂

- 環氧樹脂

- 聚氨酯

- 丙烯酸纖維

- 其他樹脂

- 按圖層

- 底漆

- 底塗層

- 透明塗層

- 按車型

- 搭乘用車

- 輕型商用車

- 重型商用車

- 其他車型

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 伊朗

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率分析**/排名分析

- 主要企業策略

- 公司簡介

- Akzo Nobel NV

- Axalta Coating Systems

- BASF SE

- Fujikura Kasei Co. Ltd

- Kansai Nerolac Paints Limited

- NB Coatings

- PPG Industries

- The Sherwin-Williams Company

- KCC Corporation

第7章 市場機會與未來趨勢

- 增加中東和非洲的投資機會

- 未來電動車的需求

The Automotive OEM Interior Coatings Market is expected to register a CAGR of greater than 2.5% during the forecast period.

The outbreak of COVID-19 is likely to bring several short-term and long-term consequences in the automotive industry, which is likely to affect the OEM interior coatings market. The supply of many components from China has been delayed. This has resulted in the automotive industry, globally, running out of materials for production. According to OICA, the global production of automotive fell by around 16% in the year 2020, compared to 2019. Many OEMs shut down the majority of their European production, which includes leading German manufacturers shutting down the majority of their manufacturing units in Europe with other OEMs closing for a longer time. With automotive production slowing down and the COVID-19 pandemic further worsening the situation for the industry, the market for OEM automotive interior coatings is negatively affected in the short-/mid-term with a sluggish recovery rate during the latter part of the forecast period.

Key Highlights

- Over the long term, the major factor driving the market studied is the preference for personal transport owing to the pandemic crisis. The consumer preference for personal transport has grown over the recent years due to better development of roads and infrastructure, startup innovations in the car rental industry, and availability of low-cost cars that are affordable for the middle-class people.

- Rise in investment opportunities in the Middle East and Africa and upcoming demand for electric vehicles are likely to act as opportunities in the future.

- Asia-Pacific dominated the market across the world, with the largest consumption from countries, such as China, India, Japan, and South Korea.

Automotive OEM Interior Coatings Market Trends

Passenger Car Segment to Contribute Significant Demand to the Market

- The passenger cars segment has the largest demand in the market studied.

- In passenger car interiors, various types of single and multi-component and solvent-borne and waterborne coatings are used for coating various substrates, such as ABS and polycarbonate materials. Laser etchable coatings are also used for these purposes.

- They are used for coating various interiors, such as center clusters, meter clusters, instrument panels, speaker grills, armrest and armrest bezels, steering wheels, door trim, and handles. The important characteristics of these coatings are high gloss and a smooth finish.

- The world passenger car production has been in a steady decline since 2017. The COVID-19 has further aggravated this decline in 2020, as a total of 55.83 million cars were produced in 2020, a steady decline from 67.15 million units and 71.75 million units in 2019 and 2018, respectively, was registered.

- According to OICA, in the first half of 2021 (January-June), the global passenger vehicle production has increased by more than 26% when compared to the same period in 2020. In the first six months, the production has increased from 2,23,14,111 units in 2020, to reach about 2,81,48,90 in 2021. However, the production is still less by 15% compared to 2019, which is 3,32,48,444 units.

- However, the demand for automotive OEM interior coatings from the passenger cars segment is expected to increase with a higher rate relative to the commercial and other vehicles segments post-recovery, owing to the change in mobility preferences for personal mode of transport in the wake of social distancing measures.

Asia-Pacific Region to dominate the Market

- Asia-Pacific is the largest market for automotive OEM interior coatings. Growth in the regional market is driven by the huge automotive production base coupled with increased investments in the Asia-Pacific region, primarily from major economies, such as China, India, and ASEAN countries.

- According to OICA, around 25.23 million, 8.07 million, 3.51 million, and 3.39 million units of vehicles were produced in China, Japan, South Korea, and India, respectively, contributing to over 50% of the global automobile production in the year 2020.

- The Chinese automotive manufacturing industry is the largest in the world. The industry witnessed a slowdown in 2018, wherein the production and sales declined. A similar trend continued, with the production witnessing a 7.5% decline during 2019. The performance of the automotive industry was affected by the economic shifts and China's trade war with the United States.

- The Chinese government is planning to have a minimum of 5,000 fuel cell electric vehicles by 2025 and 1 million by 2030. With government promoting the use of electric, hybrid, and fuel cell electric vehicles, the market is expected to grow in the future.

- India is a growing economy and holds great potential for future market opportunities. The country's economy is expected to further grow in the coming years. Despite demonetization and GST reforms affecting the national production volume, the impact of these reforms is slowly waning. Moreover, the country's government has been taking initiatives to attract Foreign Direct Investments (FDIs) in the manufacturing sector, to make India a manufacturing hub.

- The automotive industry is one of the largest manufacturing sectors in the country and contributes about 7.5% to the nation's GDP, by employing more than 37 million workers. In 2018, India became the fourth-largest automobile market in the world and the seventh-largest commercial vehicle manufacturer.

- According to the Department of Promotion Industry and Internal Trade (DPIIT) around USD 24.5 million worth FDIs were attracted by the Indian automobiles market between the period of April 2000 to June 2020. Factors such as these will show a significant impact on the automotive OEM interior coatings market in the country.

- The Indian government has recently reduced customs duty on the import of components for electric vehicles from a range of 15-30% to 10-15%, along with tax breaks and fiscal packages for the automotive industry, to fight the recent demand shocks amid COVID-19 crisis.

- Overall, the demand for the automotive OEM interior coatings is expected to be moderate to low during the forecast period, while the automotive industry in the country will try to recover from this crisis in the coming years.

Automotive OEM Interior Coatings Industry Overview

The global automotive OEM interior coatings market is partially consolidated in nature, with the top players accounting for around 50% of the global market. The major companies include PPG Industries Inc, Akzo Nobel N.V., Kansai Nerolac Paints Limited, BASF SE, and Axalta Coating Systems, LLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Mobility Preference for Personal Transport

- 4.1.2 Growing Demand for Better Interiors in Vehicles

- 4.2 Restraints

- 4.2.1 Detrimental Impact of COVID-19

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Resin

- 5.1.1 Epoxy

- 5.1.2 Polyurethane

- 5.1.3 Acrylic

- 5.1.4 Other Resins

- 5.2 Layer

- 5.2.1 Primer

- 5.2.2 Base Coat

- 5.2.3 Clear Coat

- 5.3 Vehicle Type

- 5.3.1 Passenger Car

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Heavy Commercial Vehicles

- 5.3.4 Other Vehicle Types

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Iran

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems

- 6.4.3 BASF SE

- 6.4.4 Fujikura Kasei Co. Ltd

- 6.4.5 Kansai Nerolac Paints Limited

- 6.4.6 NB Coatings

- 6.4.7 PPG Industries

- 6.4.8 The Sherwin-Williams Company

- 6.4.9 KCC Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rise in Investment Opportunities in the Middle-East and Africa

- 7.2 Upcoming Demand for Electric Vehicles